- United States

- /

- Biotech

- /

- NYSE:ABBV

AbbVie (NYSE:ABBV) Announces Positive Phase 3 Results for Migraine Drug Atogepant

Reviewed by Simply Wall St

AbbVie (NYSE:ABBV) recently announced positive results from its Phase 3 TEMPLE study, marking significant progress in migraine treatment. Over the last month, AbbVie’s stock price remained relatively flat, mirroring broader market trends. While the positive study results for Atogepant might have added slight upward pressure, this was tempered by overall market volatility influenced by geopolitical tensions and interest rate speculations. Additionally, other developments, such as the promising FDA label expansion for MAVYRET, might have reinforced investor confidence, but these factors were balanced by an overall stable market performance during the period.

AbbVie has 5 possible red flags we think you should know about.

The recent positive results from the Phase 3 TEMPLE study on Atogepant indicate potential revenue growth for AbbVie, as the company advances its pipeline in migraine treatment. This aligns with the company's strategic focus on expanding into areas like obesity and oncology. These therapeutic expansions, alongside promising developments like the FDA label expansion for MAVYRET, are designed to strengthen future earnings. While the stock price remained relatively flat in the short term, largely due to market volatility, these advances could positively influence future revenue and earnings forecasts.

Over the past five years, AbbVie’s total shareholder return, including dividends, reached 133.93%, demonstrating substantial long-term value for investors. Despite this strong growth, AbbVie's recent one-year performance underperformed the US market's return of 9.8%. Within the biotech sector specifically, AbbVie surpassed the industry average, which experienced a decline of 9.8% over the same period.

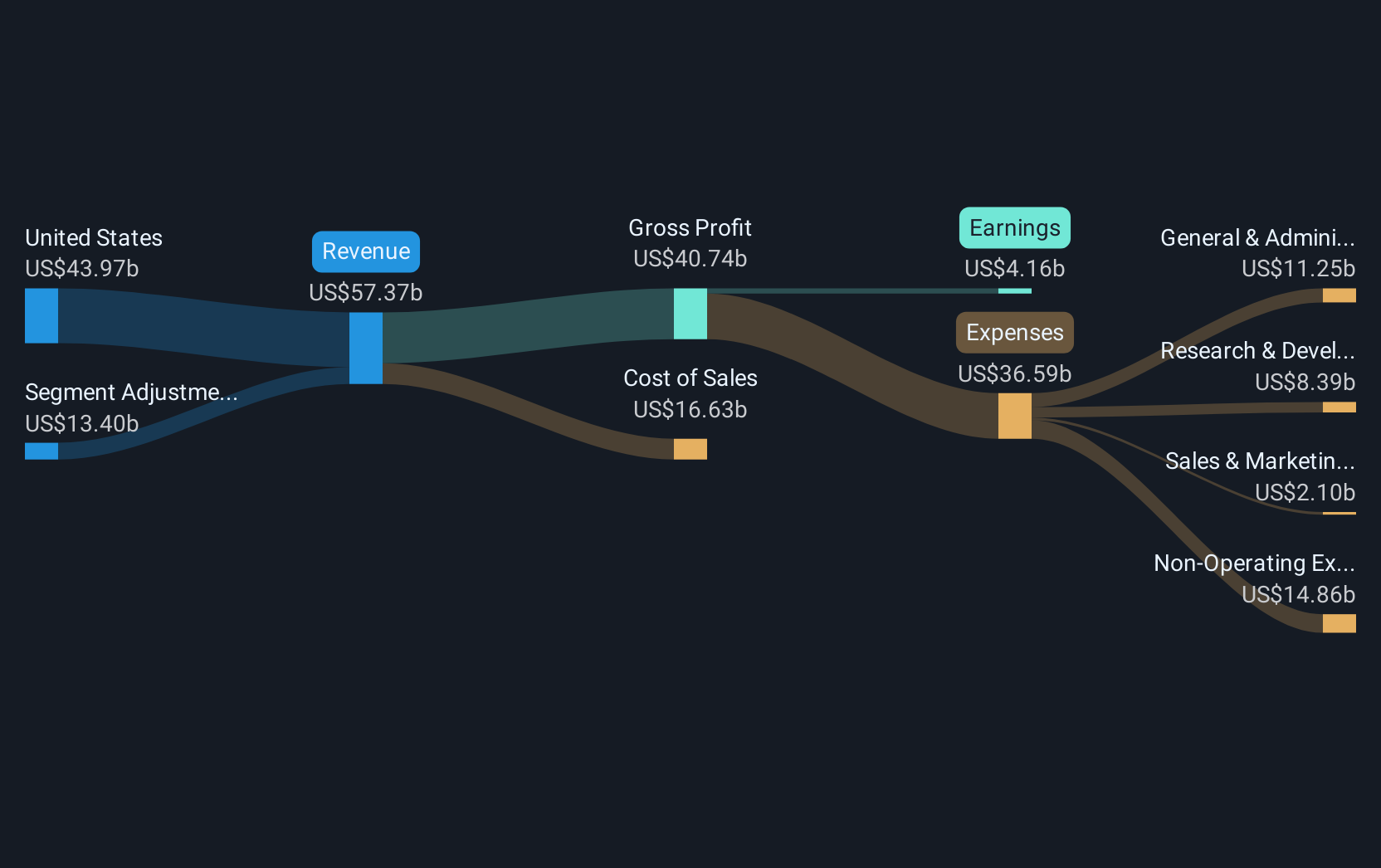

Given AbbVie’s current share price of US$187.15 and the consensus analyst price target of US$210.68, the stock appears to reflect potential upside. However, considering the revenue and margin pressures from biosimilar competition, particularly with key drugs like Humira facing competition, these forecast improvements are crucial. Investors should weigh these elements against the expected revenue growth rate and projected earnings of US$19 billion by 2028.

Unlock comprehensive insights into our analysis of AbbVie stock in this financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABBV

AbbVie

A research-based biopharmaceutical company, engages in the research and development, manufacture, commercialization, and sale of medicines and therapies worldwide.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives