A Look At Somany Ceramics' (NSE:SOMANYCERA) Share Price Returns

Somany Ceramics Limited (NSE:SOMANYCERA) shareholders will doubtless be very grateful to see the share price up 68% in the last quarter. But that is meagre solace in the face of the shocking decline over three years. The share price has sunk like a leaky ship, down 72% in that time. Arguably, the recent bounce is to be expected after such a bad drop. Of course the real question is whether the business can sustain a turnaround.

Check out our latest analysis for Somany Ceramics

While Somany Ceramics made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

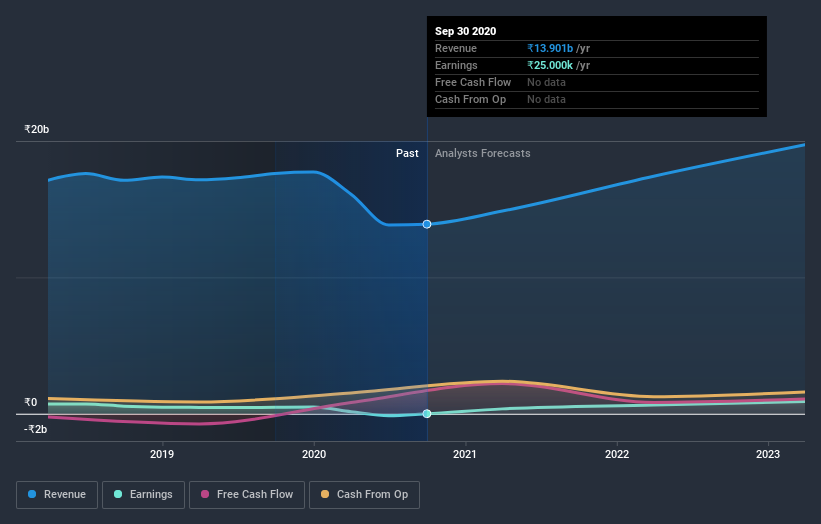

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. This free report showing analyst forecasts should help you form a view on Somany Ceramics

A Different Perspective

It's good to see that Somany Ceramics has rewarded shareholders with a total shareholder return of 25% in the last twelve months. Of course, that includes the dividend. That certainly beats the loss of about 5% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand Somany Ceramics better, we need to consider many other factors. Take risks, for example - Somany Ceramics has 5 warning signs (and 1 which is significant) we think you should know about.

Somany Ceramics is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

When trading Somany Ceramics or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:SOMANYCERA

Somany Ceramics

Engages in the manufacture and sale of ceramic tiles and related products in India.

Excellent balance sheet with reasonable growth potential and pays a dividend.