The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that 3SBio Inc. (HKG:1530) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for 3SBio

What Is 3SBio's Net Debt?

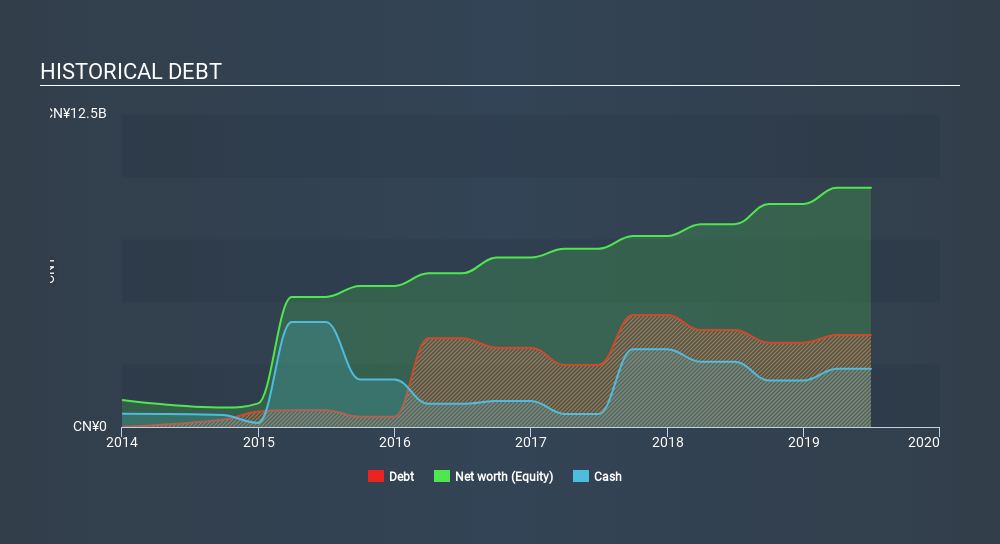

As you can see below, 3SBio had CN¥3.68b of debt at June 2019, down from CN¥3.87b a year prior. On the flip side, it has CN¥2.33b in cash leading to net debt of about CN¥1.35b.

How Strong Is 3SBio's Balance Sheet?

We can see from the most recent balance sheet that 3SBio had liabilities of CN¥2.36b falling due within a year, and liabilities of CN¥2.98b due beyond that. On the other hand, it had cash of CN¥2.33b and CN¥1.55b worth of receivables due within a year. So its liabilities total CN¥1.47b more than the combination of its cash and short-term receivables.

Of course, 3SBio has a market capitalization of CN¥17.9b, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

3SBio has a low net debt to EBITDA ratio of only 0.79. And its EBIT easily covers its interest expense, being 30.2 times the size. So you could argue it is no more threatened by its debt than an elephant is by a mouse. Also positive, 3SBio grew its EBIT by 21% in the last year, and that should make it easier to pay down debt, going forward. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if 3SBio can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. Over the most recent three years, 3SBio recorded free cash flow worth 66% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Our View

Happily, 3SBio's impressive interest cover implies it has the upper hand on its debt. And that's just the beginning of the good news since its EBIT growth rate is also very heartening. Zooming out, 3SBio seems to use debt quite reasonably; and that gets the nod from us. After all, sensible leverage can boost returns on equity. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with 3SBio , and understanding them should be part of your investment process.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:1530

3SBio

An investment holding company, develops, produces markets, and sells biopharmaceutical products in Mainland China and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives