- United Kingdom

- /

- Media

- /

- AIM:EYE

3 UK Penny Stocks With Market Caps Under £200M

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index experiencing a downturn due to weak trade data from China, highlighting global economic interdependencies. For investors seeking alternatives beyond established blue-chip stocks, penny stocks—representing smaller or newer companies—can offer intriguing opportunities despite their historical connotations. These stocks may present a blend of affordability and potential growth, especially when backed by robust financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.12 | £463.53M | ✅ 4 ⚠️ 1 View Analysis > |

| Stelrad Group (LSE:SRAD) | £1.46 | £185.93M | ✅ 5 ⚠️ 2 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.846 | £1.15B | ✅ 4 ⚠️ 2 View Analysis > |

| Ultimate Products (LSE:ULTP) | £0.746 | £62.8M | ✅ 4 ⚠️ 3 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.38 | £41.12M | ✅ 5 ⚠️ 2 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.50 | £433.86M | ✅ 2 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.90 | £299.56M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.065 | £169.9M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.86 | £11.84M | ✅ 3 ⚠️ 3 View Analysis > |

| Braemar (LSE:BMS) | £2.31 | £72.27M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 407 stocks from our UK Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Blackbird (AIM:BIRD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Blackbird plc develops and operates a cloud-based video editing and publishing software platform under the Blackbird name, serving markets in the United Kingdom, Europe, North America, and internationally, with a market cap of £18.39 million.

Operations: The company's revenue comes from its integrated web-based platform, totaling £1.61 million.

Market Cap: £18.39M

Blackbird plc, with a market cap of £18.39 million and revenue of £1.61 million, operates in the cloud-based video editing sector but remains unprofitable. Despite its seasoned management and board, Blackbird faces challenges such as high share price volatility and limited cash runway under a year. The company is debt-free with short-term assets exceeding liabilities, yet it lacks meaningful revenue growth and has seen increased losses over the past five years. Recent board changes include Anne de Kerckhove stepping down due to overboarding issues, highlighting potential governance adjustments ahead for the company.

- Click here and access our complete financial health analysis report to understand the dynamics of Blackbird.

- Learn about Blackbird's historical performance here.

Eagle Eye Solutions Group (AIM:EYE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Eagle Eye Solutions Group plc offers marketing technology software as a service across various regions including the United Kingdom, France, the United States, Canada, Australia, Europe, and the Asia Pacific with a market cap of £67.80 million.

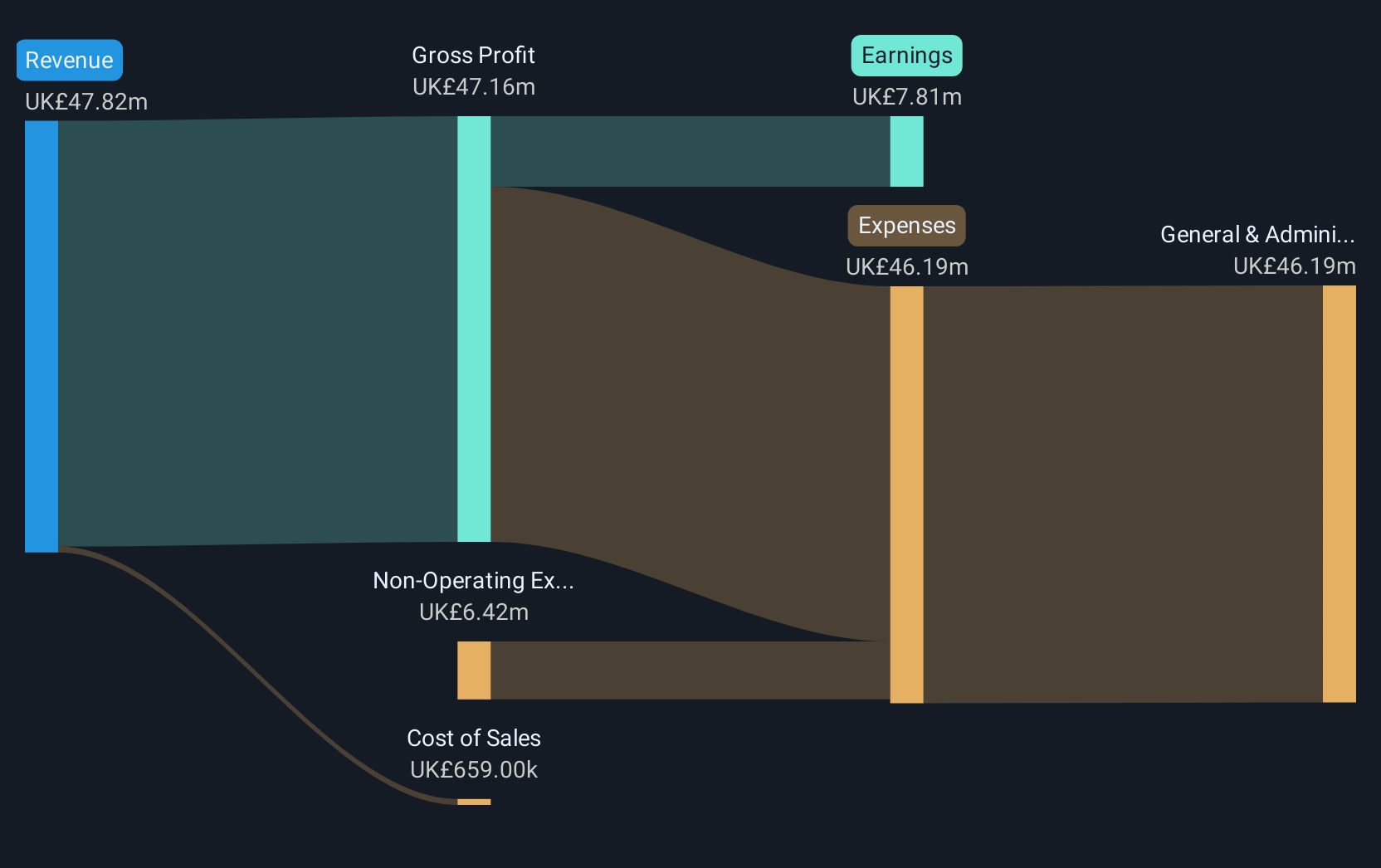

Operations: No specific revenue segments are reported for this company.

Market Cap: £67.8M

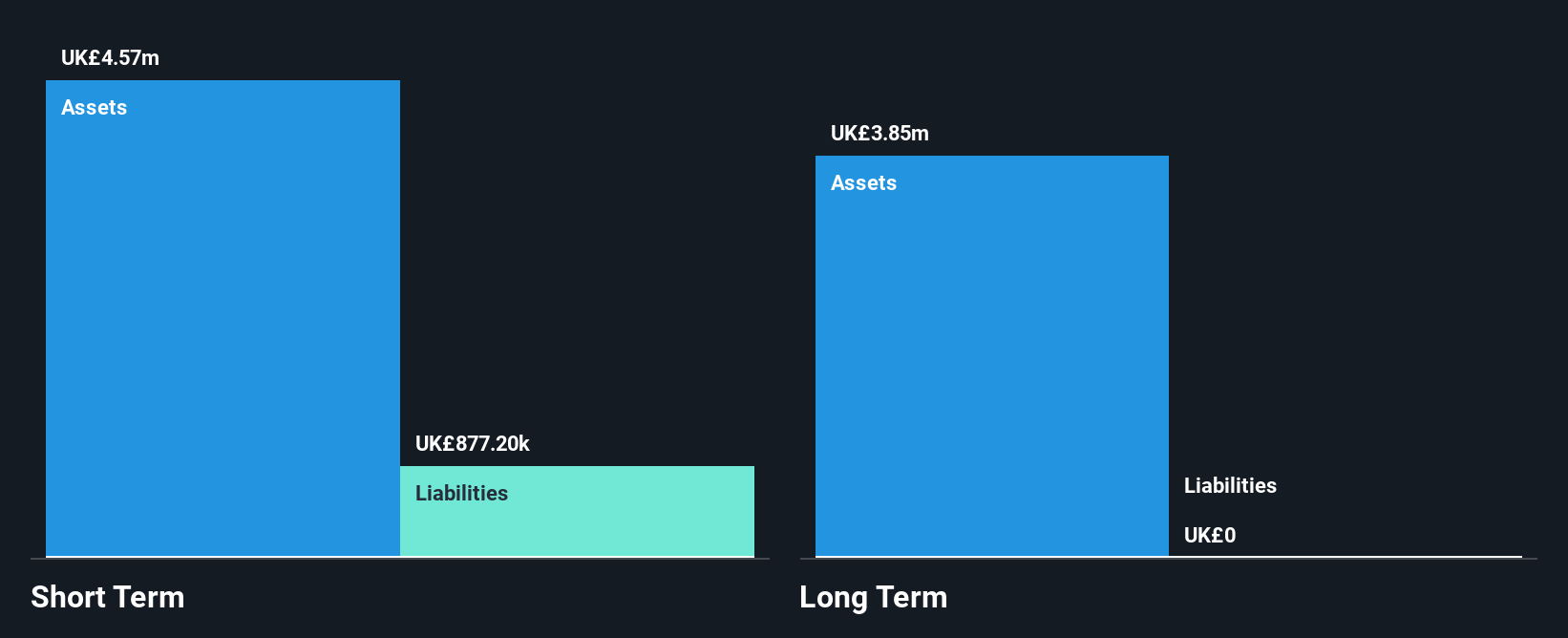

Eagle Eye Solutions Group, with a market cap of £67.80 million, has shown financial resilience by becoming profitable and maintaining strong coverage of interest payments and debt through cash flow. The company recently reported a half-year net income of £1.66 million, reversing a prior loss, but faces challenges such as increased share price volatility and the termination of a significant contract worth up to £10 million in annual revenue. Despite these hurdles, Eagle Eye's seasoned management and board are focused on growth in North America, with strategic leadership changes aimed at enhancing its market position.

- Take a closer look at Eagle Eye Solutions Group's potential here in our financial health report.

- Gain insights into Eagle Eye Solutions Group's outlook and expected performance with our report on the company's earnings estimates.

Hostelworld Group (LSE:HSW)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hostelworld Group plc is an online travel agent specializing in the hostel market globally, with a market cap of £145.89 million.

Operations: The company generates €92 million in revenue from providing software and data processing services.

Market Cap: £145.89M

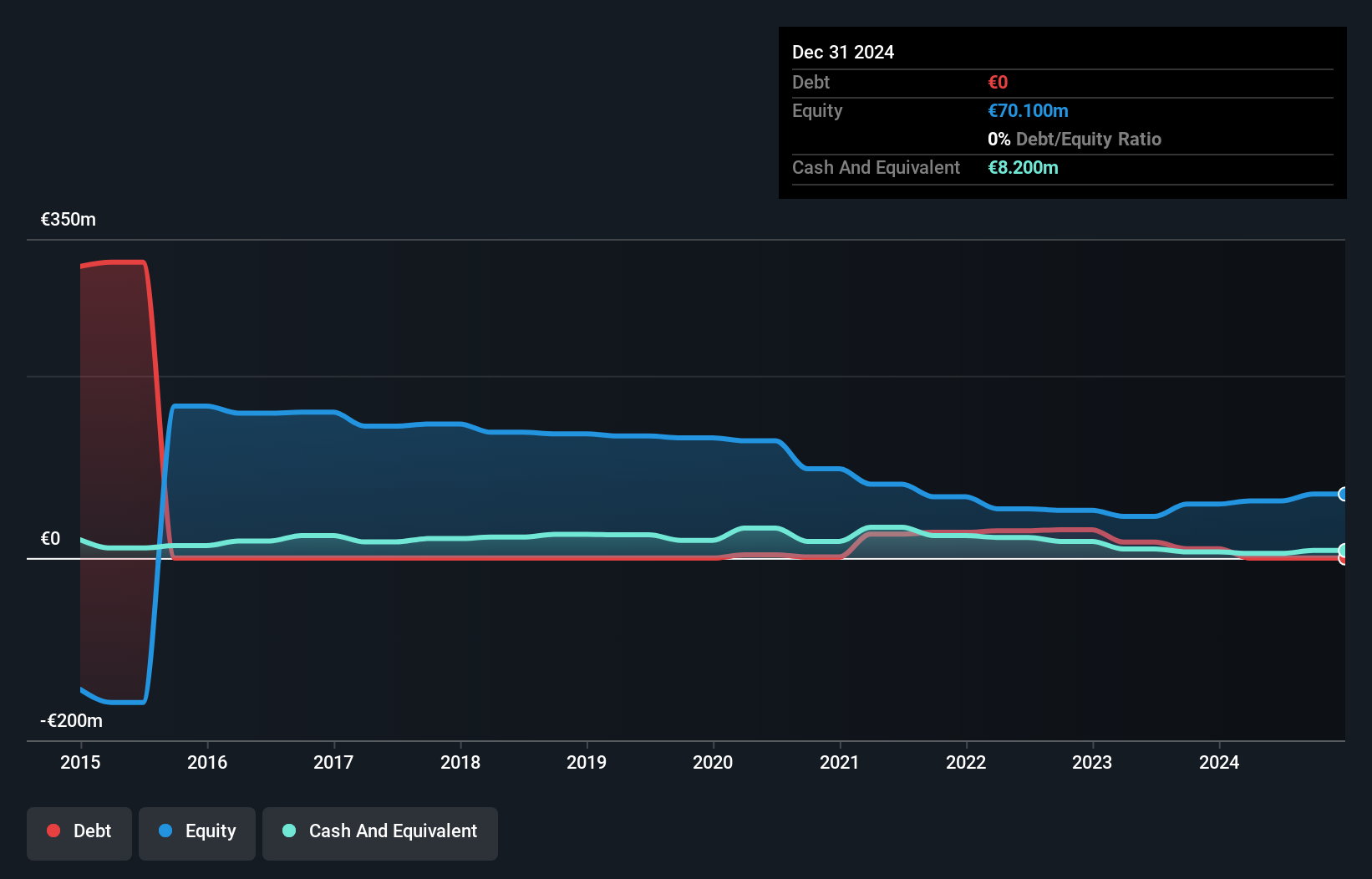

Hostelworld Group, with a market cap of £145.89 million, has demonstrated robust financial performance by achieving a net income of €9.1 million for 2024, up from €5.1 million the previous year, and maintaining high-quality earnings without incurring debt. The company's earnings growth significantly surpassed the hospitality industry's average and is projected to continue growing at 21.85% annually. Despite trading below its estimated fair value and having experienced insider selling recently, Hostelworld's experienced management team is navigating leadership changes as they prepare for ambitious growth following their Chairman's upcoming departure later in 2025.

- Get an in-depth perspective on Hostelworld Group's performance by reading our balance sheet health report here.

- Learn about Hostelworld Group's future growth trajectory here.

Next Steps

- Click here to access our complete index of 407 UK Penny Stocks.

- Ready To Venture Into Other Investment Styles? We've found 17 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eagle Eye Solutions Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:EYE

Eagle Eye Solutions Group

Provides marketing technology software as a service solution in the United Kingdom, France, the United States, Canada, Australia, rest of Europe, and the Asia Pacific.

Flawless balance sheet slight.

Similar Companies

Market Insights

Community Narratives