- Canada

- /

- Metals and Mining

- /

- TSX:SAU

3 TSX Penny Stocks With Market Caps Under CA$500M

Reviewed by Simply Wall St

As Canada's economy shows signs of resilience with improved labour productivity and healthy wage growth, investors are exploring diverse opportunities within the market. Penny stocks, despite their somewhat outdated moniker, continue to attract attention for their potential to offer significant value. These smaller or newer companies can present intriguing opportunities for investors seeking financial strength and long-term potential in less conventional areas of the market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.61 | CA$60.69M | ✅ 3 ⚠️ 3 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.315 | CA$47.31M | ✅ 2 ⚠️ 1 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.03 | CA$2.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.45 | CA$12.89M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.87 | CA$558.85M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.94 | CA$18.83M | ✅ 2 ⚠️ 4 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.12 | CA$332.67M | ✅ 2 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$4.19 | CA$210.63M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.94 | CA$183.3M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.65 | CA$9.71M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 429 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

St. Augustine Gold and Copper (TSX:SAU)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: St. Augustine Gold and Copper Limited is a mineral exploration company focused on acquiring, exploring, and evaluating mineral properties in the Philippines, with a market cap of CA$445.79 million.

Operations: Currently, there are no reported revenue segments for this mineral exploration company focused on the Philippines.

Market Cap: CA$445.79M

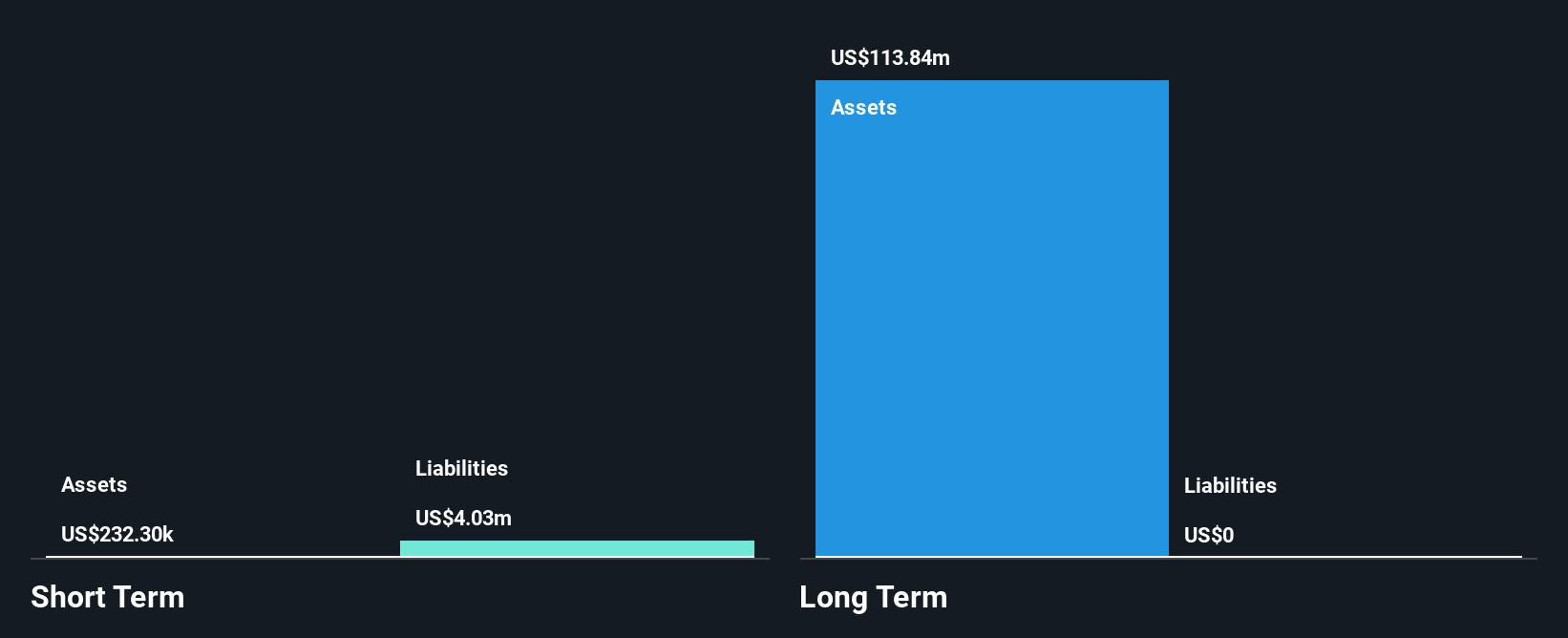

St. Augustine Gold and Copper Limited, with a market cap of CA$445.79 million, remains pre-revenue as it focuses on mineral exploration in the Philippines. Recent developments include an updated Preliminary Feasibility Study for the Kingking Copper-Gold Project, which positions the company to advance towards construction. Despite its high volatility and short-term liabilities exceeding assets, St. Augustine has no long-term debt and recently raised capital through private placements to support its operations. Leadership changes bring seasoned executives like Michael G. Regino to the board, potentially strengthening strategic direction amidst ongoing project development efforts.

- Unlock comprehensive insights into our analysis of St. Augustine Gold and Copper stock in this financial health report.

- Learn about St. Augustine Gold and Copper's historical performance here.

Supremex (TSX:SXP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Supremex Inc. is a manufacturer and marketer of envelopes and paper-based packaging solutions for various sectors in Canada and the United States, with a market cap of CA$104.13 million.

Operations: The company generates revenue from two main segments: CA$188.48 million from envelopes and CA$86.14 million from packaging and specialty products.

Market Cap: CA$104.13M

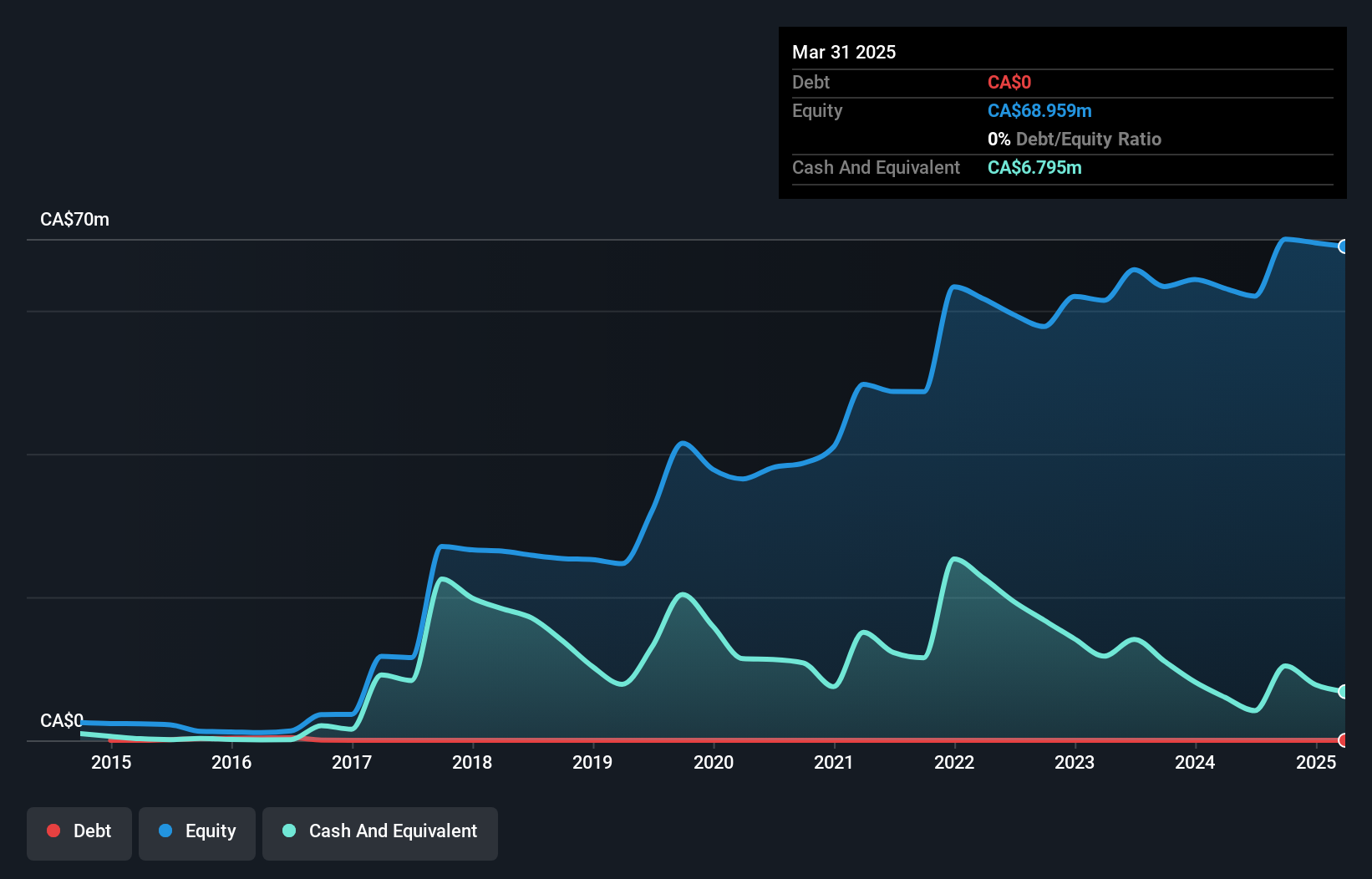

Supremex Inc., with a market cap of CA$104.13 million, has faced challenges recently, reporting a net loss for the second quarter of 2025 compared to net income a year ago. Despite this, the company maintains strong financial management with a reduced debt-to-equity ratio over five years and satisfactory coverage of debt by operating cash flow. The board and management team are experienced, contributing to strategic decision-making like announcing a special dividend and initiating share buybacks. While currently unprofitable, its short-term assets exceed liabilities, offering some financial stability amid fluctuating earnings performance.

- Click here to discover the nuances of Supremex with our detailed analytical financial health report.

- Review our growth performance report to gain insights into Supremex's future.

Aurion Resources (TSXV:AU)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Aurion Resources Ltd. is involved in the acquisition, exploration, and evaluation of mineral properties in Finland with a market cap of CA$122.67 million.

Operations: Aurion Resources Ltd. has not reported any revenue segments.

Market Cap: CA$122.67M

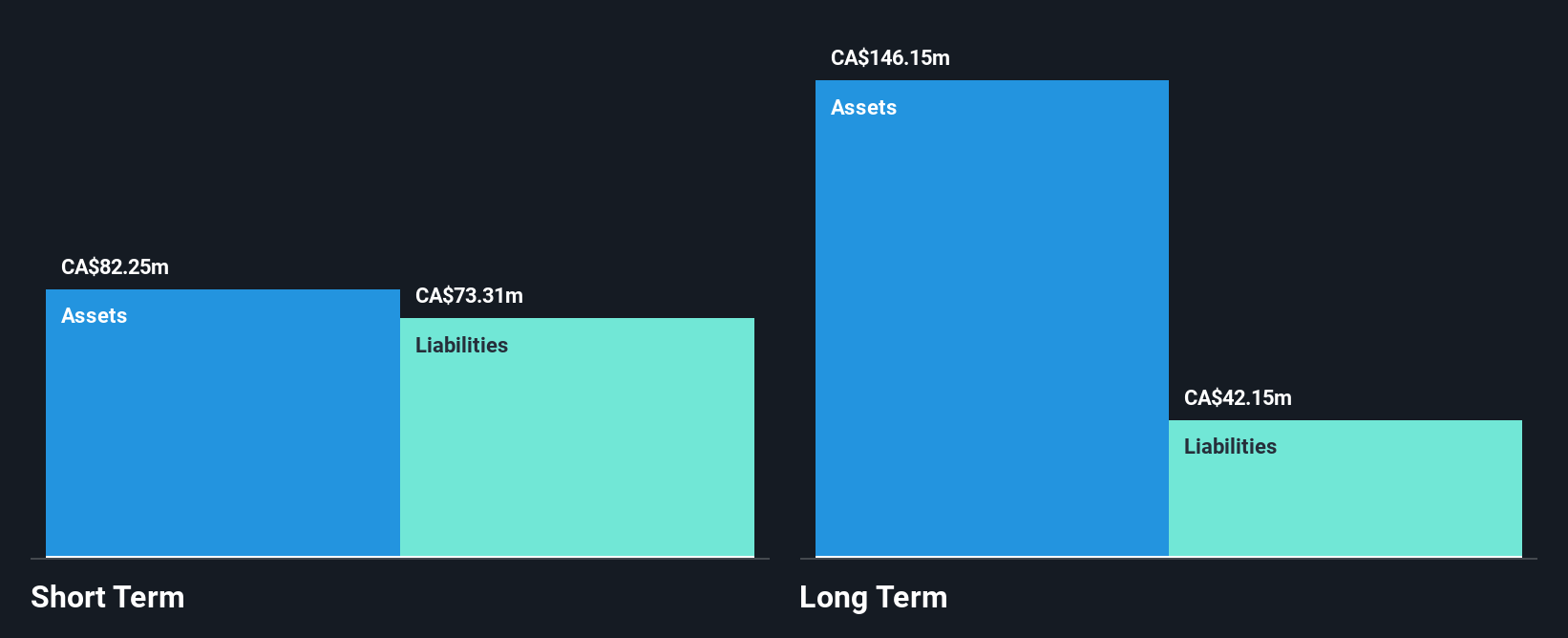

Aurion Resources Ltd., with a market cap of CA$122.67 million, remains pre-revenue as it focuses on developing its mineral properties in Finland. Recent drilling results at the Vanha prospect within the Risti property have extended the gold mineralized system along strike and depth, suggesting potential for significant resource expansion. The company has no debt and maintains a cash runway exceeding one year under stable conditions, although profitability is not anticipated in the near term. Despite being unprofitable, Aurion's financial position is bolstered by short-term assets covering both short- and long-term liabilities effectively.

- Jump into the full analysis health report here for a deeper understanding of Aurion Resources.

- Understand Aurion Resources' earnings outlook by examining our growth report.

Turning Ideas Into Actions

- Gain an insight into the universe of 429 TSX Penny Stocks by clicking here.

- Ready To Venture Into Other Investment Styles? Uncover 14 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SAU

St. Augustine Gold and Copper

A mineral exploration company, engages in the acquisition, exploration, and evaluation of mineral properties in the Philippines.

Excellent balance sheet very low.

Market Insights

Community Narratives