- Canada

- /

- Capital Markets

- /

- TSX:WNDR

3 TSX Penny Stocks With Market Caps Over CA$40M To Watch

Reviewed by Simply Wall St

The Canadian market has been experiencing a mix of optimism and caution, influenced by ongoing trade negotiations and economic growth concerns. In such a landscape, investors often look beyond the major players to find opportunities in smaller companies that may offer unique potential. Penny stocks, despite their somewhat antiquated name, continue to capture attention as they can provide surprising value when backed by strong financials and clear growth prospects.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.60 | CA$60.69M | ✅ 3 ⚠️ 3 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.67 | CA$612.77M | ✅ 3 ⚠️ 4 View Analysis > |

| illumin Holdings (TSX:ILLM) | CA$1.82 | CA$93.91M | ✅ 4 ⚠️ 1 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.025 | CA$2M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.425 | CA$12.18M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.76 | CA$505.63M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.00 | CA$19.82M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.10 | CA$157.34M | ✅ 1 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.85 | CA$177.41M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.10 | CA$6.28M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 453 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Quarterhill (TSX:QTRH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Quarterhill Inc. operates in the intelligent transportation systems sector both in Canada and internationally, with a market cap of CA$160.67 million.

Operations: The company generates revenue of $152.30 million from its Intelligent Transportation Systems segment.

Market Cap: CA$160.67M

Quarterhill Inc., operating in the intelligent transportation systems sector, has a market cap of CA$160.67 million and reported Q1 2025 revenue of US$33.89 million, reflecting a slight decline from the previous year. The company remains unprofitable with increasing losses and is not expected to achieve profitability within three years. Despite this, Quarterhill's cash runway is sufficient for over three years based on current free cash flow. Recent executive changes include appointing David Charron as CFO, bringing extensive experience in driving growth and operational excellence. A recent CAD 200 million shelf registration could provide financial flexibility for future initiatives or debt management.

- Click to explore a detailed breakdown of our findings in Quarterhill's financial health report.

- Understand Quarterhill's earnings outlook by examining our growth report.

NamSys (TSXV:CTZ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NamSys Inc. offers software solutions for currency management and processing to the banking and merchant industries in North America, with a market cap of CA$41.37 million.

Operations: Revenue Segments: Not reported.

Market Cap: CA$41.37M

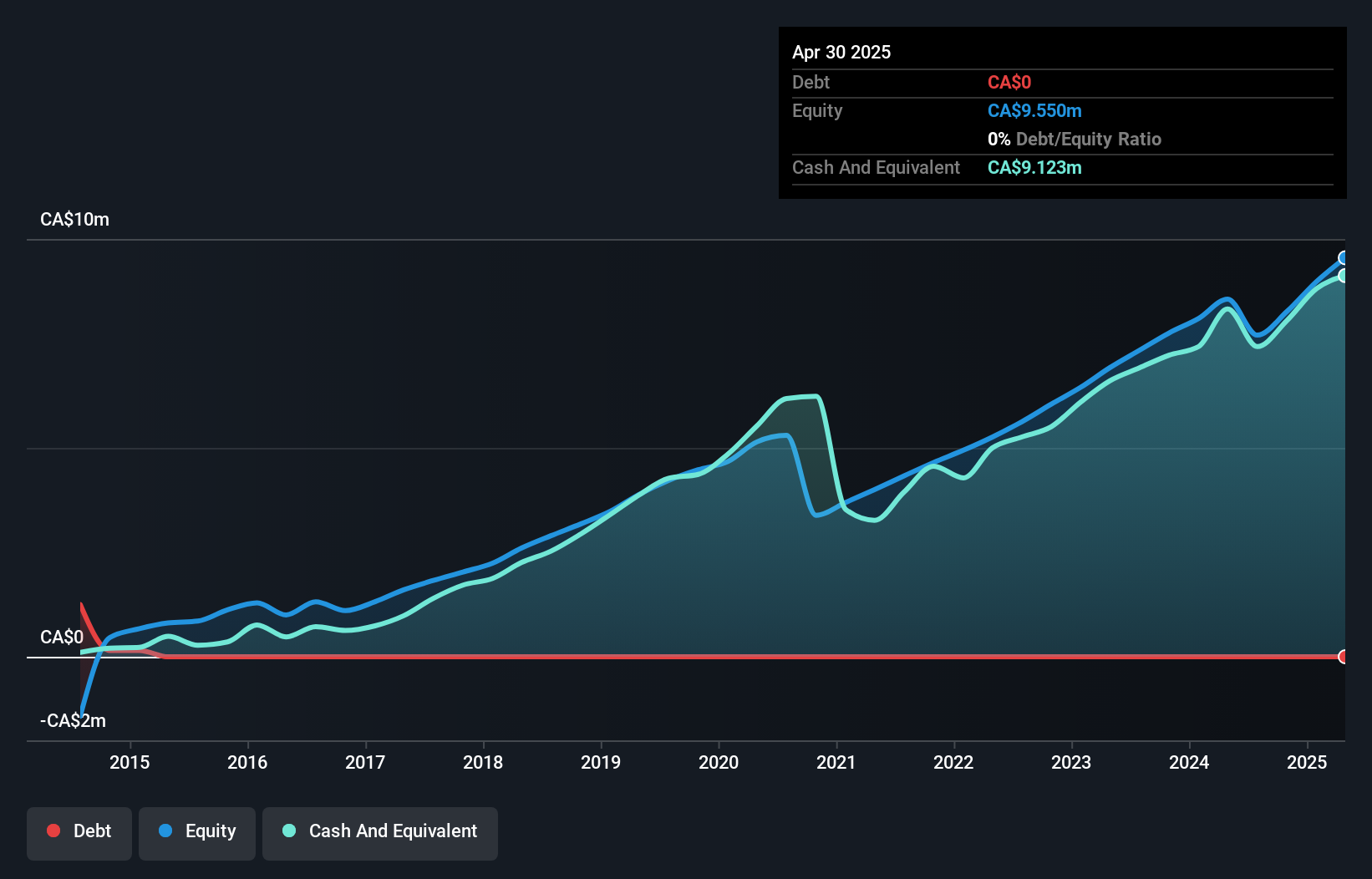

NamSys Inc., with a market cap of CA$41.37 million, reported second-quarter sales of CA$2.01 million, up from CA$1.66 million the previous year, indicating steady revenue growth. The company remains debt-free and has no long-term liabilities, providing financial stability and flexibility. Its earnings growth over the past year was 35.3%, surpassing the software industry's average growth rate of 28.6%. NamSys's return on equity is high at 25.1%, reflecting efficient management of shareholder funds, while its profit margins have improved to 31.8% from last year's 28.1%. Additionally, short-term assets significantly exceed liabilities, ensuring liquidity strength.

- Dive into the specifics of NamSys here with our thorough balance sheet health report.

- Assess NamSys' previous results with our detailed historical performance reports.

WonderFi Technologies (TSX:WNDR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: WonderFi Technologies Inc, with a market cap of CA$232.38 million, develops and acquires technology platforms to facilitate investments in digital assets.

Operations: The company's revenue is primarily derived from its Trading segment, which accounts for CA$53.87 million, and its Payments segment, contributing CA$1.69 million.

Market Cap: CA$232.38M

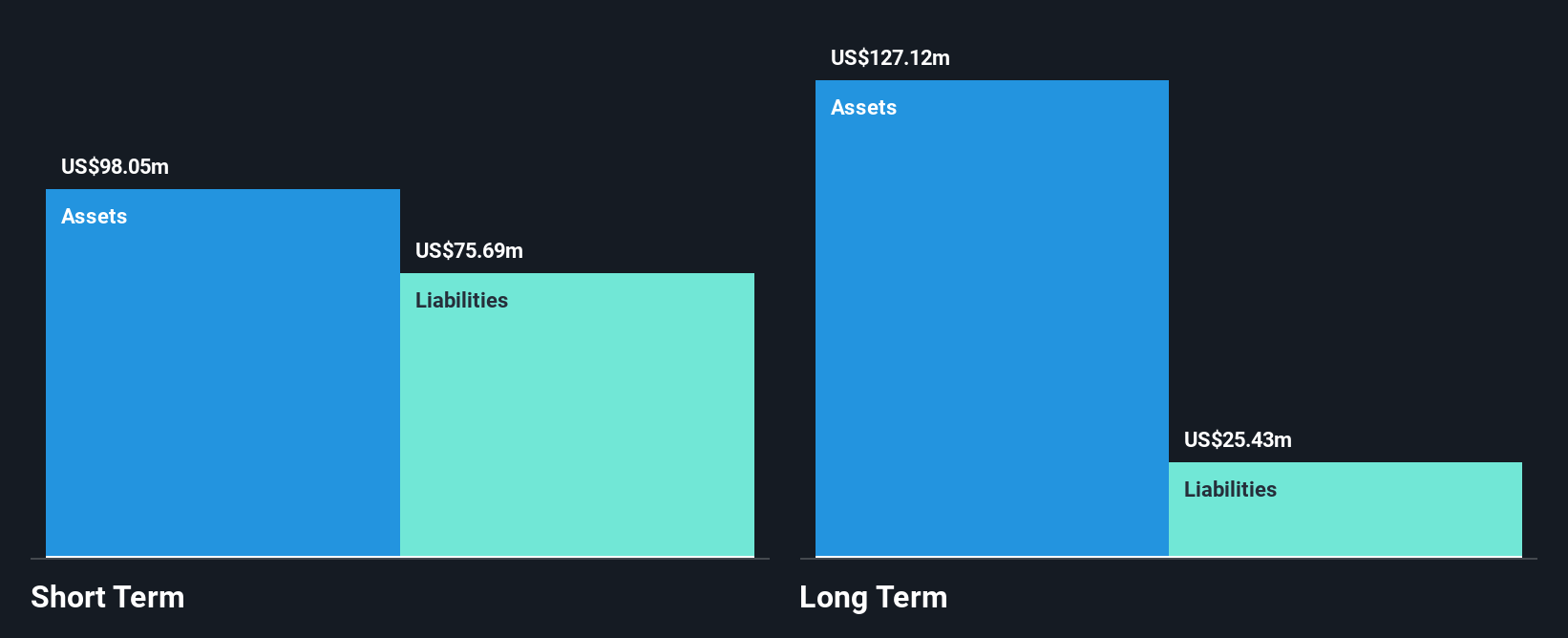

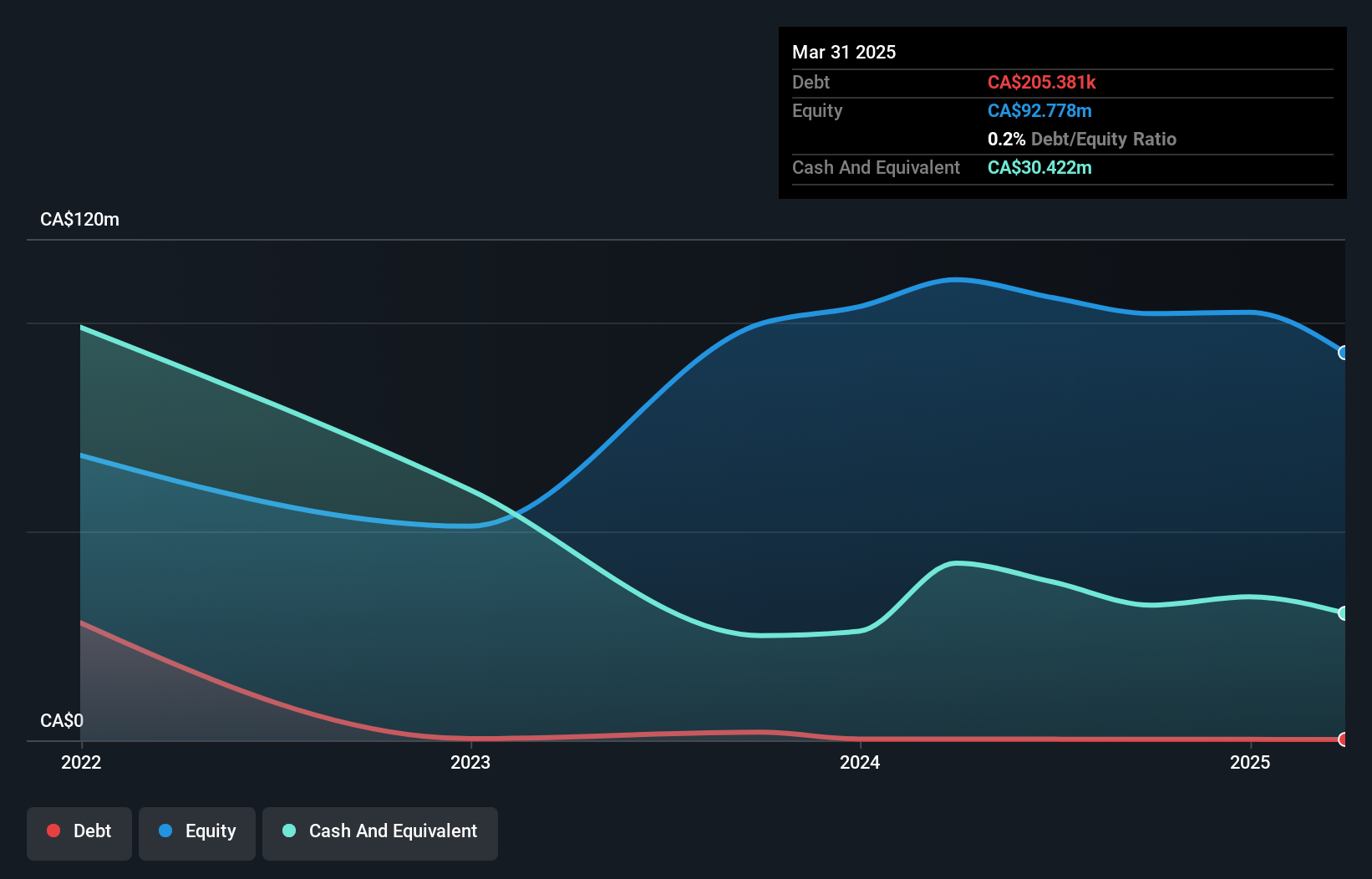

WonderFi Technologies Inc., with a market cap of CA$232.38 million, is experiencing financial challenges as it remains unprofitable and reported a net loss of CA$16.12 million for Q1 2025. The company's revenue primarily comes from its Trading segment, contributing CA$53.87 million annually, but recent earnings show a decline in sales compared to the previous year. Despite having more cash than debt and sufficient short-term assets to cover liabilities, WonderFi's profitability has not improved over the past five years. An acquisition by Robinhood Markets for approximately CA$240 million is pending completion in late 2025, subject to regulatory approvals.

- Take a closer look at WonderFi Technologies' potential here in our financial health report.

- Explore WonderFi Technologies' analyst forecasts in our growth report.

Next Steps

- Access the full spectrum of 453 TSX Penny Stocks by clicking on this link.

- Want To Explore Some Alternatives? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WonderFi Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WNDR

WonderFi Technologies

WonderFi Technologies Inc, together with its subsidiaries, engages in the development and acquisition of technology platforms to facilitate investments in the emerging industry of digital assets.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives