- Canada

- /

- Oil and Gas

- /

- TSX:SU

3 TSX Dividend Stocks With Yields Up To 9.4%

Reviewed by Simply Wall St

With recent economic data showing a slight uptick in unemployment rates and moderated inflation pressures, both the U.S. and Canadian markets are navigating through a period of cautious optimism. In this environment, dividend stocks can offer stability and income potential, making them an attractive option for investors looking to weather market fluctuations while benefiting from regular payouts.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Sun Life Financial (TSX:SLF) | 4.22% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 3.93% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.47% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 4.38% | ★★★★★☆ |

| National Bank of Canada (TSX:NA) | 3.29% | ★★★★★☆ |

| IGM Financial (TSX:IGM) | 5.01% | ★★★★★☆ |

| Canadian Imperial Bank of Commerce (TSX:CM) | 3.92% | ★★★★★☆ |

| Bank of Montreal (TSX:BMO) | 4.26% | ★★★★★☆ |

| Atrium Mortgage Investment (TSX:AI) | 9.54% | ★★★★★☆ |

| Acadian Timber (TSX:ADN) | 6.47% | ★★★★★☆ |

Click here to see the full list of 24 stocks from our Top TSX Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Magna International (TSX:MG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Magna International Inc. manufactures and supplies vehicle engineering, contract, and automotive components with a market cap of CA$16.08 billion.

Operations: Magna International Inc.'s revenue segments include Power & Vision at $15.13 billion, Body Exteriors & Structures at $16.32 billion, Seating Systems at $5.64 billion, and Complete Vehicles at $5.06 billion.

Dividend Yield: 4.7%

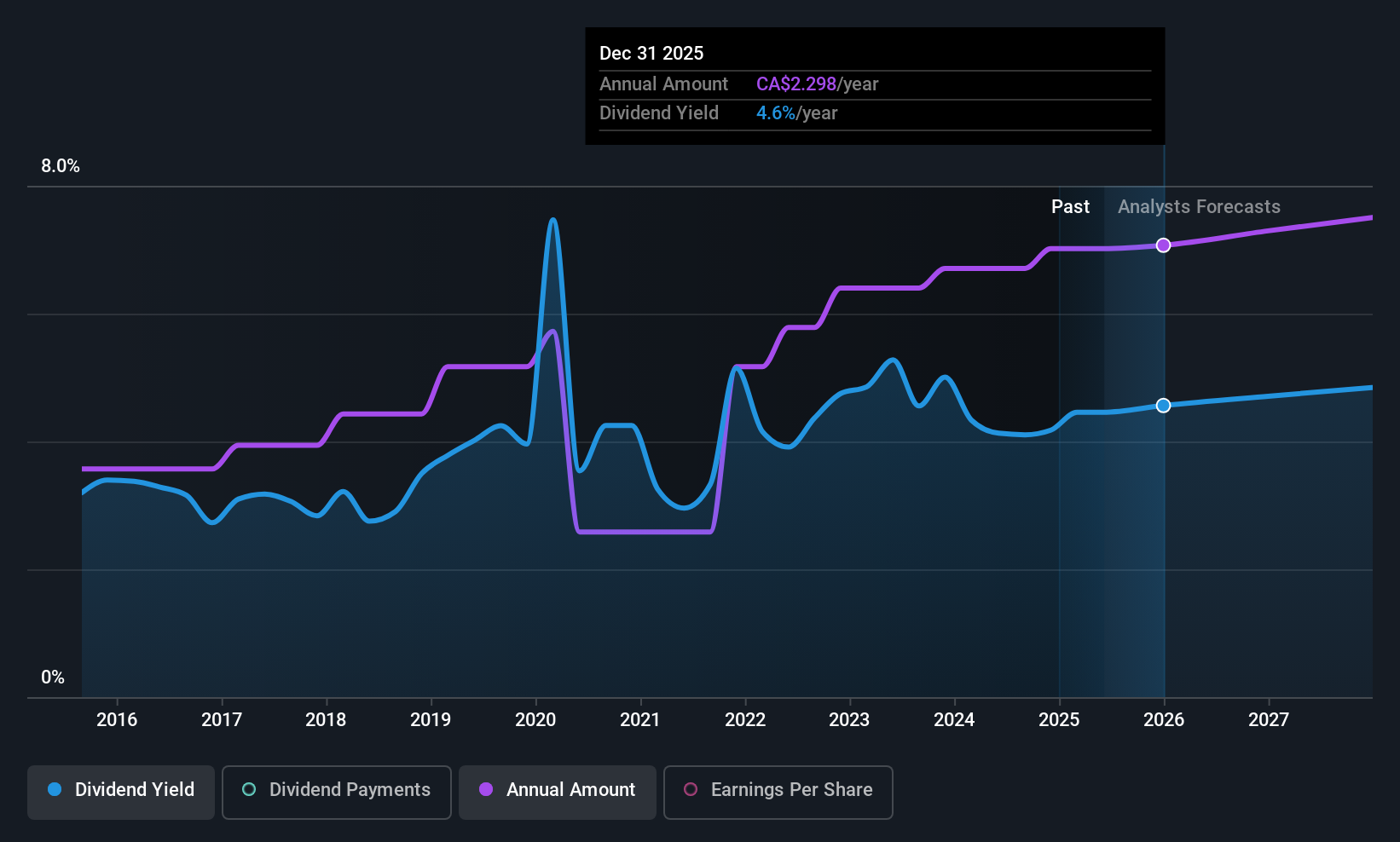

Magna International's dividend payments are well-supported by both earnings and cash flows, with a payout ratio of 45.3% and a cash payout ratio of 33.3%. The company has consistently provided dividends over the past decade, demonstrating stability and reliability. Despite trading at a discount to its estimated fair value, Magna's dividend yield of 4.69% is below the Canadian market's top tier payers. Recent earnings growth further supports its dividend sustainability.

- Take a closer look at Magna International's potential here in our dividend report.

- The analysis detailed in our Magna International valuation report hints at an deflated share price compared to its estimated value.

Suncor Energy (TSX:SU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Suncor Energy Inc. is an integrated energy company operating in Canada, the United States, and internationally with a market cap of CA$66.12 billion.

Operations: Suncor Energy Inc.'s revenue segments comprise CA$25.80 billion from Oil Sands, CA$31.36 billion from Refining and Marketing, and CA$2.17 billion from Exploration and Production.

Dividend Yield: 4.2%

Suncor Energy's recent approval of a quarterly dividend of C$0.57 per share highlights its commitment to returning value to shareholders, supported by a payout ratio of 46.1% and cash payout ratio of 31.1%. While the dividend yield is lower than the top Canadian payers, Suncor's dividends are covered by earnings and cash flows despite past volatility. The company reported record upstream production in Q1 2025, with net income rising to C$1.69 billion amidst ongoing share buybacks totaling C$3.26 billion since February 2024.

- Navigate through the intricacies of Suncor Energy with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Suncor Energy is trading behind its estimated value.

Alphamin Resources (TSXV:AFM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Alphamin Resources Corp., along with its subsidiaries, is involved in the production and sale of tin concentrate and has a market cap of CA$1.20 billion.

Operations: Alphamin Resources Corp. generates revenue primarily from the production and sale of tin from its Bisie Tin Mine, amounting to $539.16 million.

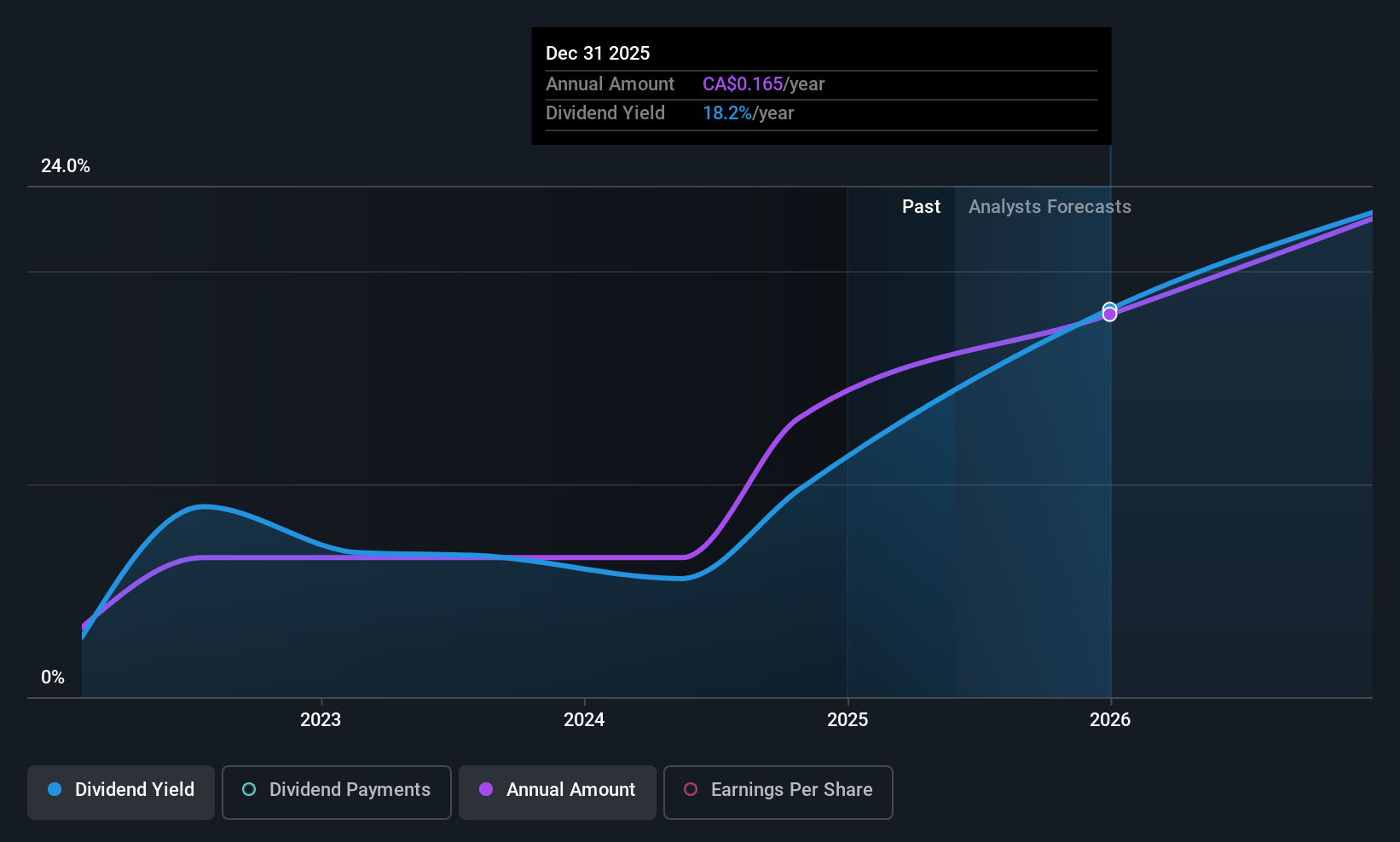

Dividend Yield: 9.5%

Alphamin Resources' dividend yield of 9.49% places it among the top Canadian payers, but its four-year history shows volatility and unreliability. Despite a payout ratio of 77% and a cash payout ratio of 63.3%, which cover dividends, the company's track record raises concerns about sustainability. Recent operational restarts have improved production levels, with Q1 2025 earnings rising to US$23.64 million from US$20.71 million year-over-year, suggesting potential for future stability in dividend payments.

- Click here to discover the nuances of Alphamin Resources with our detailed analytical dividend report.

- According our valuation report, there's an indication that Alphamin Resources' share price might be on the cheaper side.

Next Steps

- Unlock our comprehensive list of 24 Top TSX Dividend Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SU

Suncor Energy

Operates as an integrated energy company in Canada, the United States, and internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives