- Canada

- /

- Food and Staples Retail

- /

- TSX:NWC

3 TSX Dividend Stocks Offering Yields Up To 6.3%

Reviewed by Simply Wall St

As the Canadian economy navigates a landscape of improving labour productivity and stable inflation, investors are keeping a close eye on dividend stocks that offer attractive yields. In this context, finding stocks with solid earnings growth and sustainable dividends can be particularly appealing, providing both income and potential resilience in uncertain market conditions.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Sun Life Financial (TSX:SLF) | 4.49% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.33% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.35% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 4.32% | ★★★★★☆ |

| North West (TSX:NWC) | 3.31% | ★★★★★☆ |

| National Bank of Canada (TSX:NA) | 3.21% | ★★★★★☆ |

| Magna International (TSX:MG) | 4.59% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 5.70% | ★★★★★☆ |

| Canadian Imperial Bank of Commerce (TSX:CM) | 3.87% | ★★★★★☆ |

| Bank of Montreal (TSX:BMO) | 4.19% | ★★★★★☆ |

Click here to see the full list of 22 stocks from our Top TSX Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

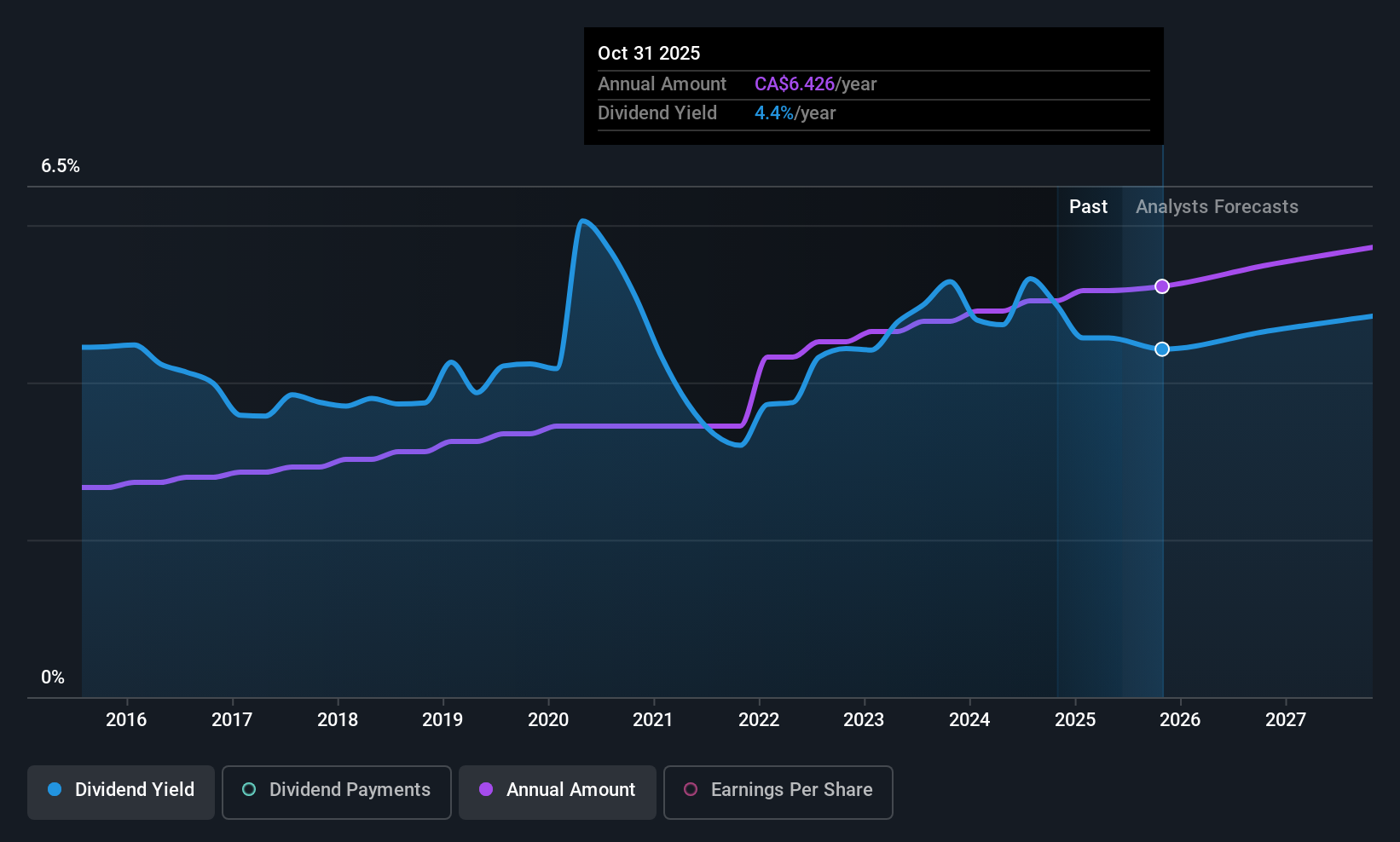

Bank of Montreal (TSX:BMO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank of Montreal offers diversified financial services primarily in North America, with a market cap of CA$112.07 billion.

Operations: Bank of Montreal generates revenue from several key segments, including BMO Capital Markets (CA$6.63 billion), BMO Wealth Management (CA$6.01 billion), U.S. Personal and Commercial Banking (CA$8.29 billion), and Canadian Personal and Commercial Banking (CA$9.77 billion).

Dividend Yield: 4.2%

Bank of Montreal's dividend payments have been reliable and stable over the past decade, with a current yield of 4.19%. The payout ratio stands at 58.3%, indicating dividends are well-covered by earnings, and this is expected to improve to 51.2% in three years. Despite trading below estimated fair value, its dividend yield is lower than the top quartile in Canada. Recent strategic moves include fixed-income offerings and digital platform enhancements through partnerships like My Financial Progress.

- Take a closer look at Bank of Montreal's potential here in our dividend report.

- The valuation report we've compiled suggests that Bank of Montreal's current price could be inflated.

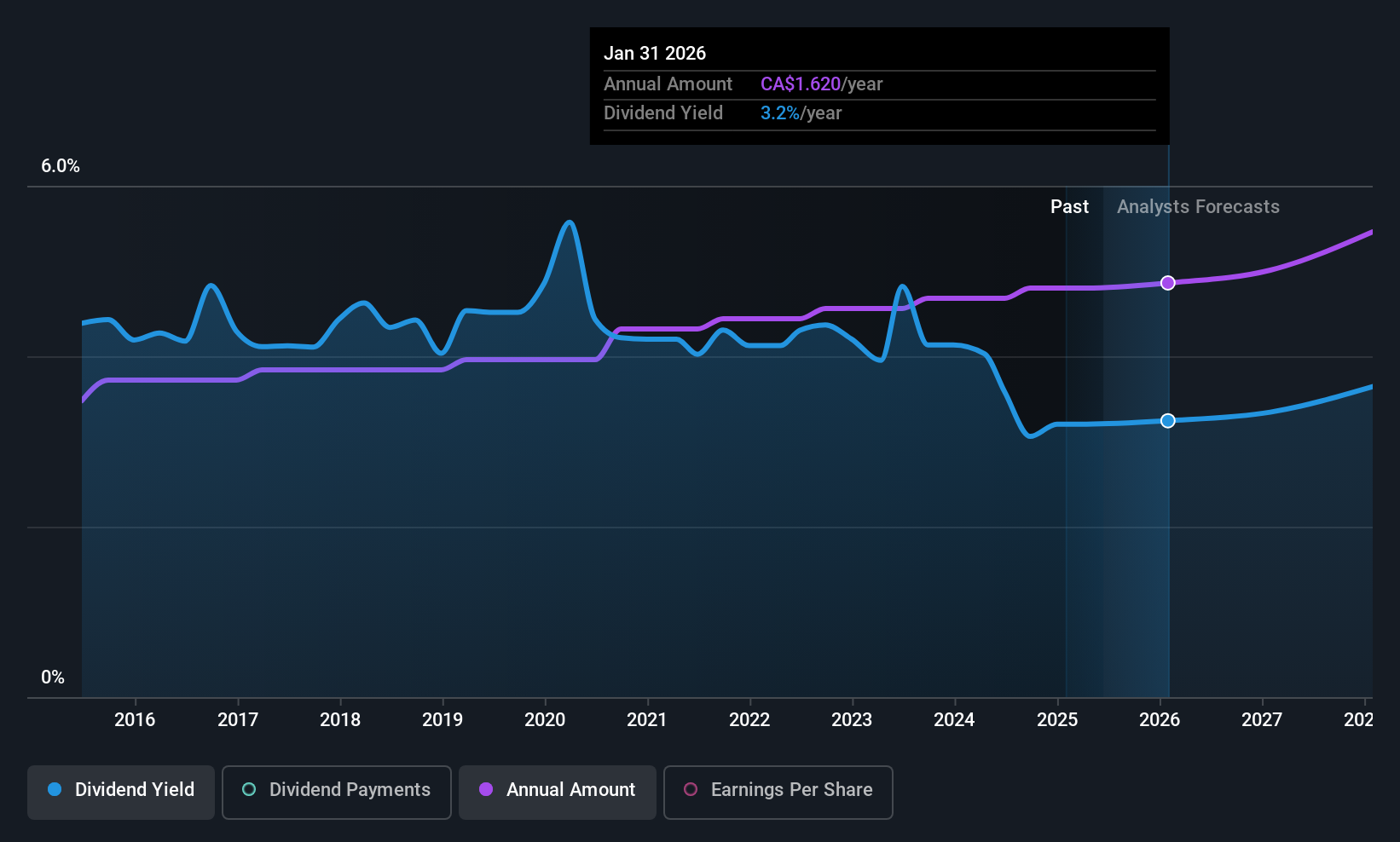

North West (TSX:NWC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The North West Company Inc. operates as a retailer of food and everyday products and services in northern Canada, rural Alaska, the South Pacific, and the Caribbean, with a market cap of CA$2.30 billion.

Operations: The North West Company Inc. generates its revenue primarily from its CA$2.60 billion segment focused on the retail of food and everyday products and services across northern Canada, rural Alaska, the South Pacific, and the Caribbean.

Dividend Yield: 3.3%

North West Company offers a stable dividend history with payments increasing over the past decade. The dividend yield of 3.31% is lower than Canada's top quartile, but dividends are well-covered by earnings and cash flows, with payout ratios of 55.3% and 64.9%, respectively. Recent earnings showed modest growth, while the appointment of Gregg Saretsky to the board may enhance strategic oversight given his extensive corporate experience in aviation sectors.

- Unlock comprehensive insights into our analysis of North West stock in this dividend report.

- According our valuation report, there's an indication that North West's share price might be on the cheaper side.

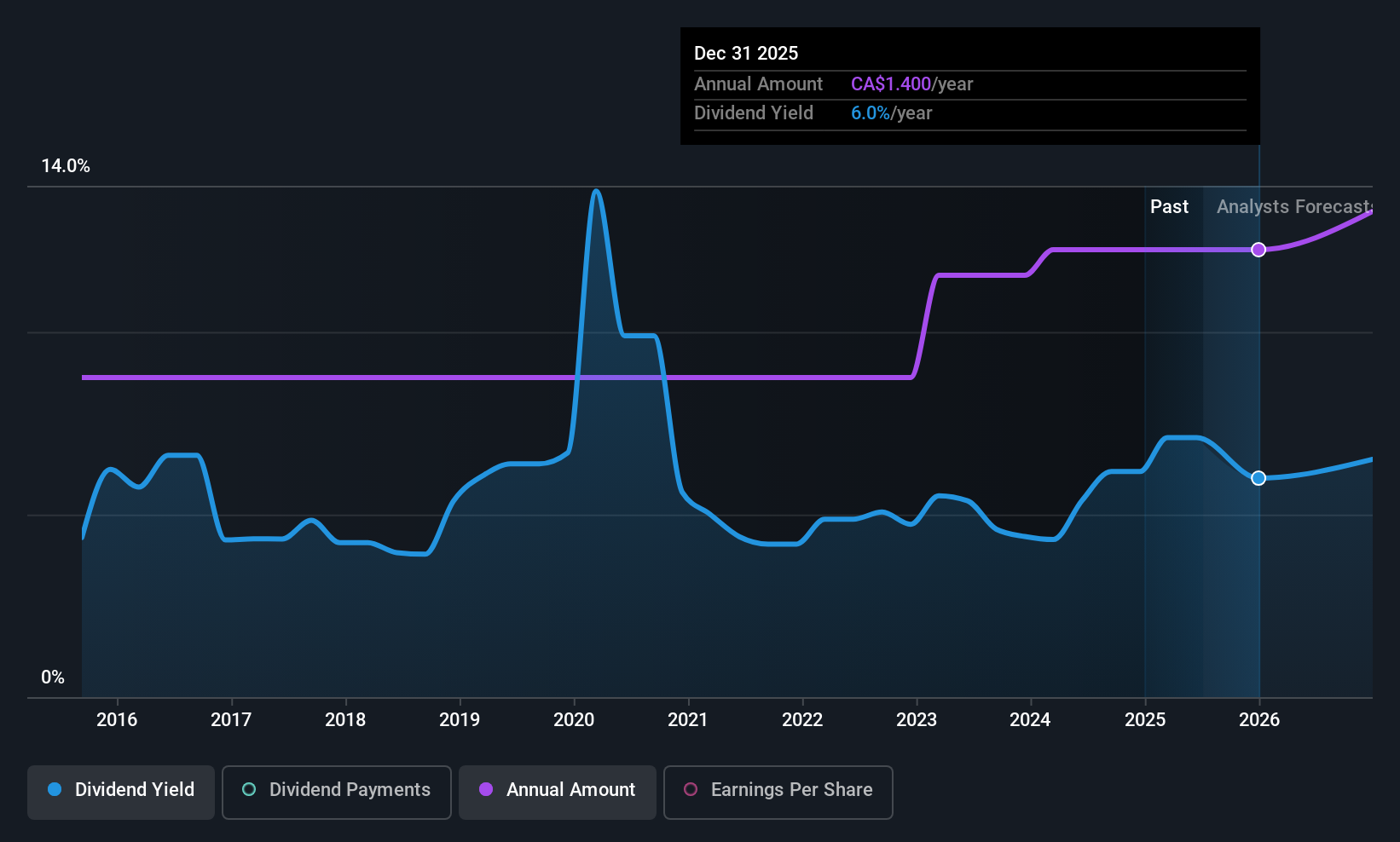

Wajax (TSX:WJX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wajax Corporation operates in Canada, offering industrial products and services, with a market cap of CA$476.23 million.

Operations: Wajax Corporation generates revenue from three main segments: Equipment sales at CA$1.09 billion, Product support at CA$570 million, and Industrial parts and services at CA$650 million.

Dividend Yield: 6.4%

Wajax's dividend yield is among the top 25% in Canada, but its history of volatile payments over the past decade raises concerns about reliability. Despite this, dividends are well-covered by cash flows with a low cash payout ratio of 23.4%, though earnings coverage is tighter at an 84.7% payout ratio. Recent earnings show a decline in profit margins and net income, impacting financial stability and dividend sustainability.

- Delve into the full analysis dividend report here for a deeper understanding of Wajax.

- In light of our recent valuation report, it seems possible that Wajax is trading behind its estimated value.

Key Takeaways

- Unlock more gems! Our Top TSX Dividend Stocks screener has unearthed 19 more companies for you to explore.Click here to unveil our expertly curated list of 22 Top TSX Dividend Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if North West might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NWC

North West

Through its subsidiaries, engages in the retail of food and everyday products and services in northern Canada, rural Alaska, the South Pacific, and the Caribbean.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion