- Germany

- /

- Marine and Shipping

- /

- XTRA:HLAG

3 Top European Dividend Stocks To Consider

Reviewed by Simply Wall St

Amid ongoing trade negotiations and a stable interest rate environment, European markets have shown resilience, with the pan-European STOXX Europe 600 Index rising modestly. As investors navigate these developments, dividend stocks remain an attractive option for those seeking steady income amid market fluctuations.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.42% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.20% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.63% | ★★★★★★ |

| Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM) | 5.73% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.76% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.83% | ★★★★★★ |

| ERG (BIT:ERG) | 5.15% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.00% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.56% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.51% | ★★★★★★ |

Click here to see the full list of 229 stocks from our Top European Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Repsol (BME:REP)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Repsol, S.A. is a multi-energy company operating in Spain, Peru, the United States, Portugal, and internationally with a market cap of approximately €15.44 billion.

Operations: Repsol, S.A.'s revenue is primarily derived from its Industrial segment (€41.94 billion), followed by the Customer segment (€25.99 billion), Upstream operations (€4.82 billion), and Low Carbon Generation (€827 million).

Dividend Yield: 7.2%

Repsol's dividend yield is among the top 25% in Spain, supported by a payout ratio of 86.5% and a cash payout ratio of 73.1%, indicating dividends are covered by earnings and cash flows. However, its dividend history has been volatile over the past decade despite recent increases. Recent earnings reports show decreased net income (€603 million for H1 2025), reflecting potential challenges in maintaining stable dividends long-term amidst fluctuating profit margins and production levels.

- Unlock comprehensive insights into our analysis of Repsol stock in this dividend report.

- Our valuation report unveils the possibility Repsol's shares may be trading at a premium.

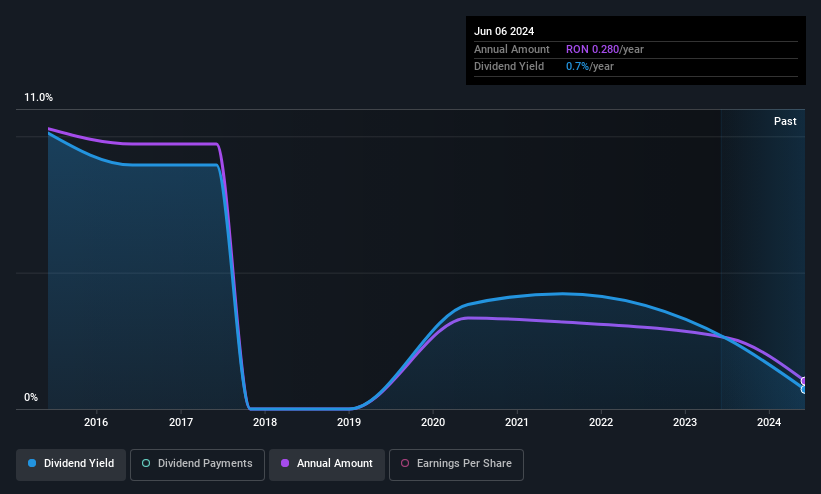

CNTEE Transelectrica (BVB:TEL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CNTEE Transelectrica SA operates as a transmission and system operator for the national power system, with a market cap of RON4.41 billion.

Operations: CNTEE Transelectrica's revenue primarily comes from its Transmission and Dispatch segment, which generated RON7.33 billion.

Dividend Yield: 6.3%

CNTEE Transelectrica's dividends are well covered by earnings and cash flows, with payout ratios of 44.4% and 66%, respectively. Despite a recent annual dividend increase to RON 3.81 per share, its dividend yield is slightly below the top tier in Romania at 6.34%. The company's earnings have grown significantly by 163.1% over the past year; however, its dividend history remains unstable and volatile over the last decade despite growth in payments.

- Navigate through the intricacies of CNTEE Transelectrica with our comprehensive dividend report here.

- Our expertly prepared valuation report CNTEE Transelectrica implies its share price may be lower than expected.

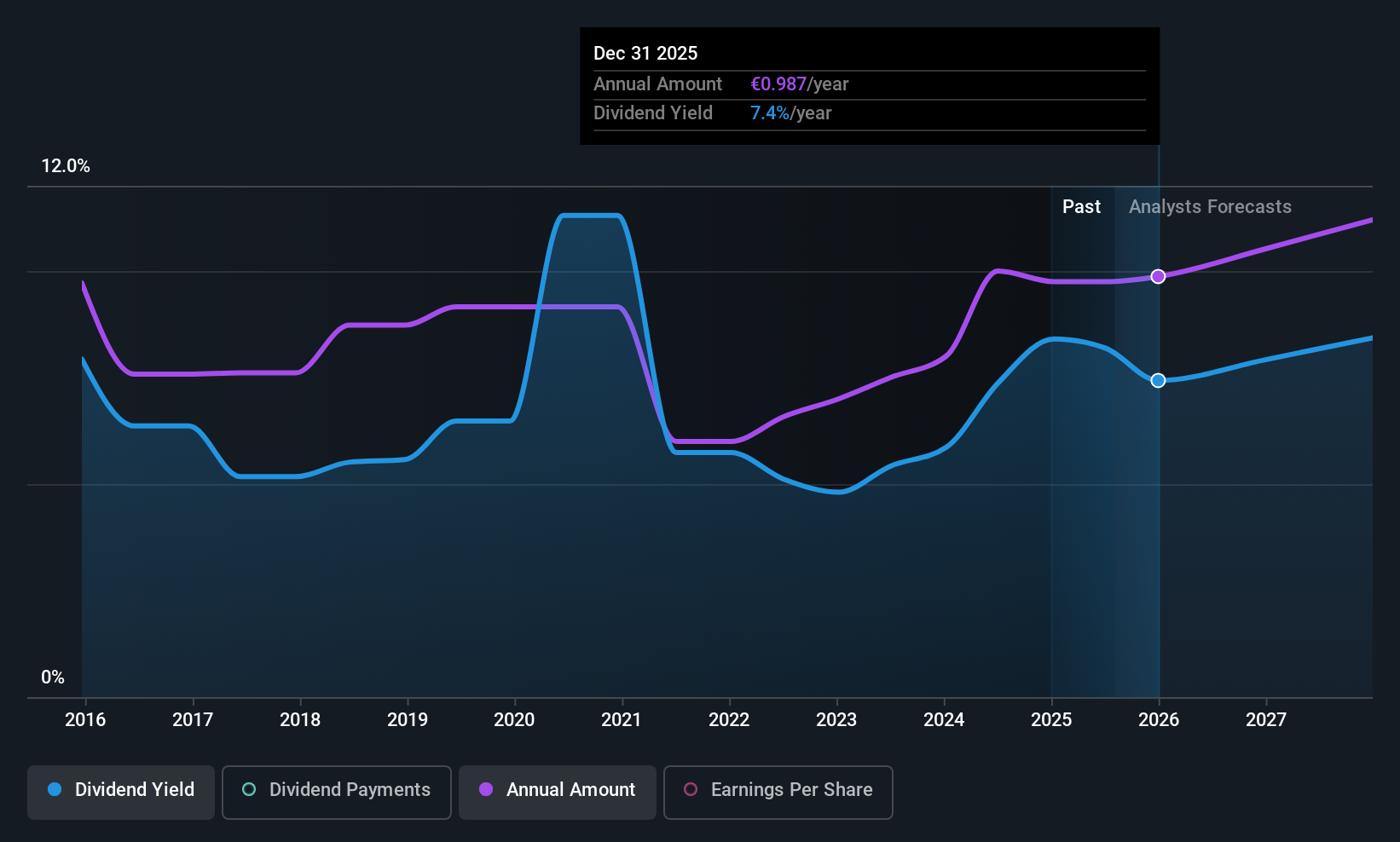

Hapag-Lloyd (XTRA:HLAG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hapag-Lloyd Aktiengesellschaft, along with its subsidiaries, operates as a global liner shipping company with a market cap of approximately €23.48 billion.

Operations: Hapag-Lloyd generates its revenue primarily from Liner Shipping (€19.54 billion) and Terminal & Infrastructure (€406.90 million).

Dividend Yield: 6.1%

Hapag-Lloyd's dividend yield of 6.14% ranks within the top 25% in Germany, supported by a payout ratio of 56.9%. However, its six-year dividend history is marked by volatility and unreliability with annual drops over 20%. Recent earnings growth, evidenced by Q1 sales rising to €5.05 billion from €4.26 billion year-on-year, contrasts with forecasts predicting a decline in future earnings. The company’s dividends are well-covered by both earnings and cash flows at a cash payout ratio of 57%.

- Click here and access our complete dividend analysis report to understand the dynamics of Hapag-Lloyd.

- Insights from our recent valuation report point to the potential overvaluation of Hapag-Lloyd shares in the market.

Where To Now?

- Access the full spectrum of 229 Top European Dividend Stocks by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hapag-Lloyd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:HLAG

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion