- Singapore

- /

- Construction

- /

- SGX:MR7

3 Top Asian Dividend Stocks Yielding Up To 9.7%

Reviewed by Simply Wall St

As global markets respond to new U.S. tariffs with muted reactions, Asian economies are navigating a complex landscape of trade tensions and economic stimuli. In this environment, dividend stocks in Asia offer potential stability and income, making them an attractive consideration for investors seeking resilience amid market fluctuations.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.40% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.05% | ★★★★★★ |

| NCD (TSE:4783) | 4.37% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.29% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.32% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.34% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.39% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.07% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.40% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.99% | ★★★★★★ |

Click here to see the full list of 1194 stocks from our Top Asian Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

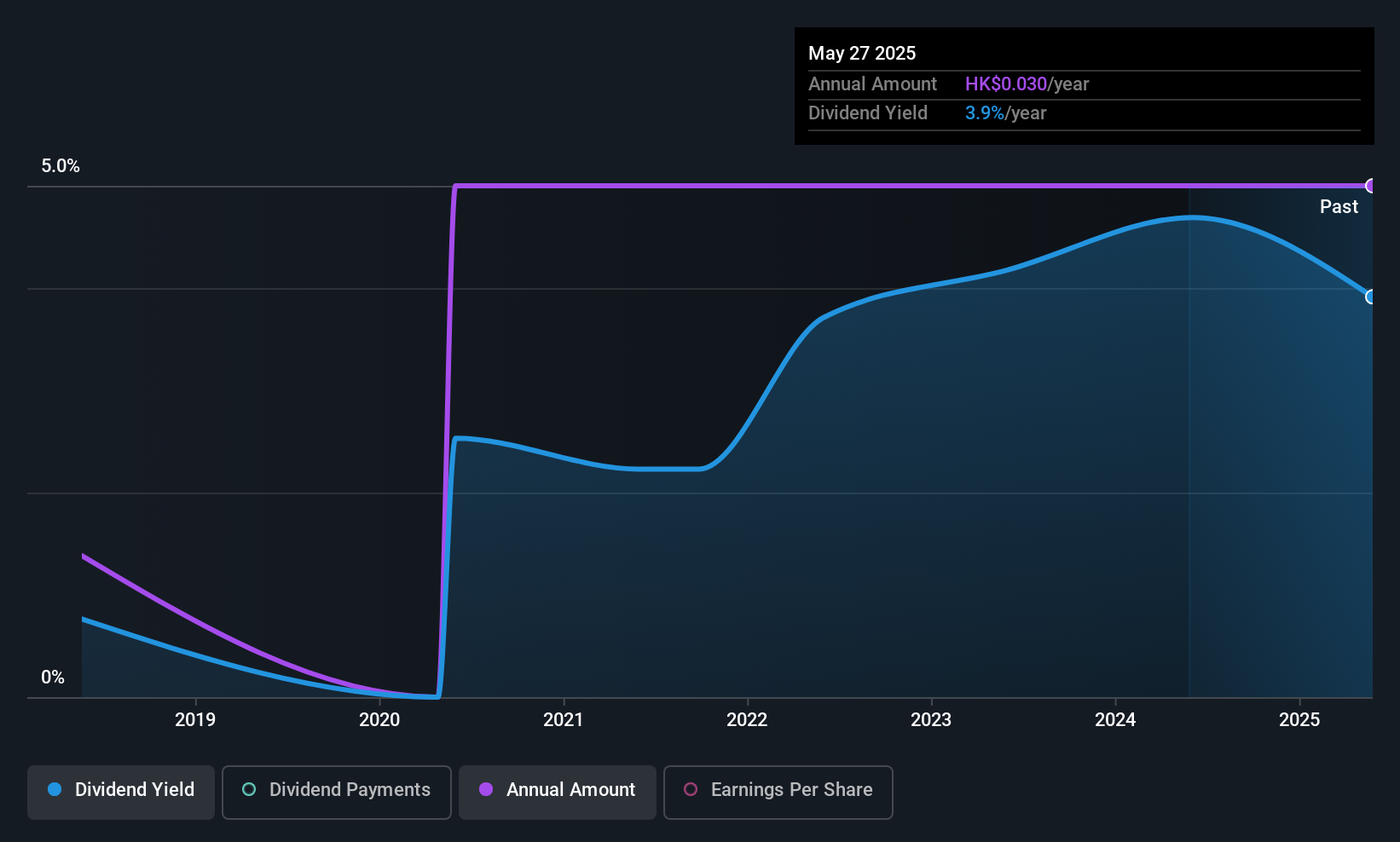

Automated Systems Holdings (SEHK:771)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Automated Systems Holdings Limited is an investment holding company that offers IT services to corporate clients across Hong Kong, the United States, Singapore, Mainland China, Macau, Thailand, and Taiwan with a market cap of HK$817.02 million.

Operations: Automated Systems Holdings Limited generates revenue primarily from IT Products, which contribute HK$1.11 billion, and IT Services, amounting to HK$1.28 billion.

Dividend Yield: 3.1%

Automated Systems Holdings offers a mixed dividend profile. Despite a low payout ratio of 16.7% and cash flow coverage at 23.9%, indicating strong dividend sustainability, its track record is volatile with unreliable payments over the past decade. The recent approval of a final dividend of 3 HK cents per share reflects ongoing commitment, but the yield remains low compared to top-tier Hong Kong payers. Recent board changes may influence future strategic decisions impacting dividends.

- Click here to discover the nuances of Automated Systems Holdings with our detailed analytical dividend report.

- Our valuation report here indicates Automated Systems Holdings may be undervalued.

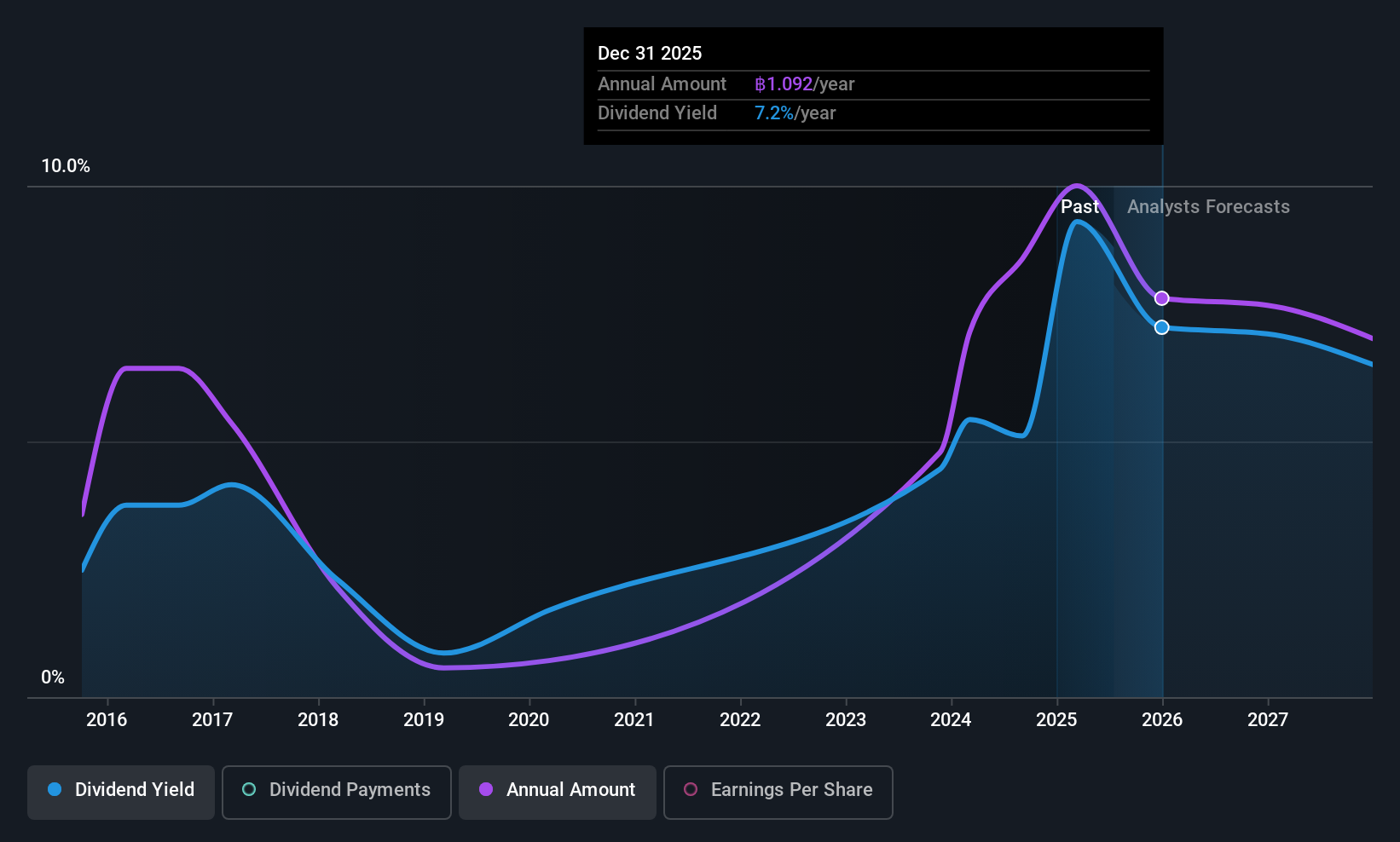

Bangkok Airways (SET:BA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bangkok Airways Public Company Limited, along with its subsidiaries, offers air transportation and airport services, with a market cap of THB30 billion.

Operations: Bangkok Airways generates revenue primarily from its airlines segment (THB18.14 billion), along with supporting airlines business (THB5.50 billion) and airport services (THB590 million).

Dividend Yield: 9.8%

Bangkok Airways' dividend yield ranks in the top 25% of Thai payers, yet its history of volatile payments over the past decade raises concerns about reliability. Despite this, dividends are covered by earnings and cash flows with payout ratios of 76.1% and 58.8%, respectively. The recent approval of a share repurchase program aims to enhance return on equity and earnings per share using excess liquidity, potentially benefiting shareholders indirectly through increased value.

- Dive into the specifics of Bangkok Airways here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Bangkok Airways is priced lower than what may be justified by its financials.

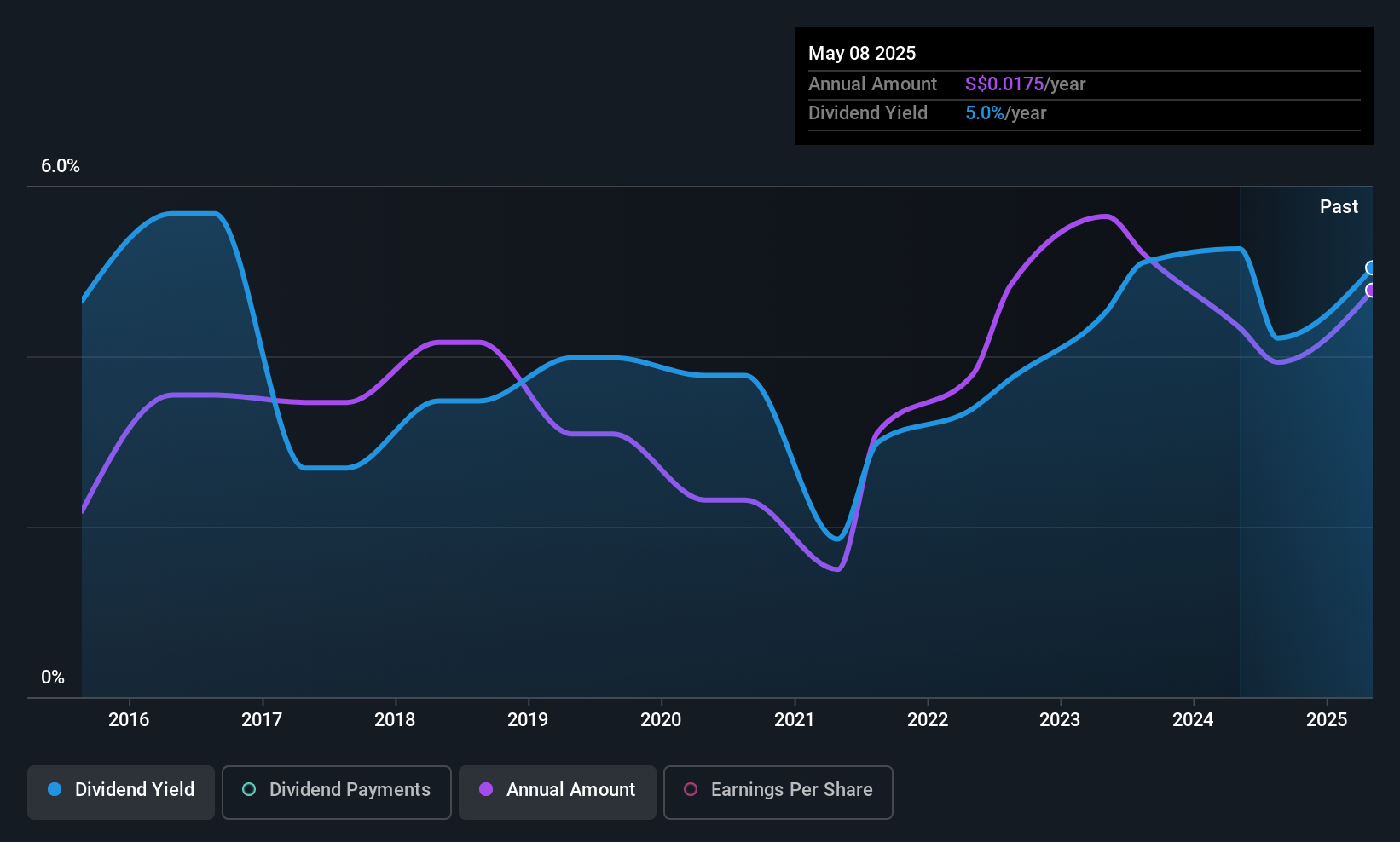

Nordic Group (SGX:MR7)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nordic Group Limited is an investment holding company that offers a wide range of solutions including system integration, maintenance, repair, overhaul, trading, precision engineering, and various engineering services globally with a market capitalization of SGD155.42 million.

Operations: Nordic Group Limited's revenue segments consist of Project Services generating SGD82.10 million and Maintenance Services contributing SGD81.85 million.

Dividend Yield: 4.5%

Nordic Group's dividend payments are well-covered by earnings and cash flows, with payout ratios of 39.9% and 42.7%, respectively, though its history shows volatility over the past decade. The dividend yield is below the top tier in Singapore's market at 4.49%. Recent expansion into Thailand through Avitools aims to bolster regional growth without impacting current financial metrics significantly, suggesting a strategic focus on long-term value creation for shareholders.

- Delve into the full analysis dividend report here for a deeper understanding of Nordic Group.

- Our valuation report here indicates Nordic Group may be overvalued.

Summing It All Up

- Reveal the 1194 hidden gems among our Top Asian Dividend Stocks screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nordic Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:MR7

Nordic Group

An investment holding company, provides solutions in the areas of system integration, maintenance, repair, overhaul, trading, precision engineering, scaffolding, insulation, petrochemical and environmental engineering, cleanroom, air and water engineering, and engineering and construction services worldwide.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives