- France

- /

- Aerospace & Defense

- /

- ENXTPA:HO

3 Stocks In The Global Market That May Be Undervalued July 2025

Reviewed by Simply Wall St

As global markets continue to experience robust growth, with major U.S. indices like the S&P 500 and Nasdaq Composite reaching record highs, investors are keenly observing economic indicators such as job growth and inflation trends. In this environment of heightened market activity, identifying stocks that may be undervalued can present unique opportunities for investors seeking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| JRCLtd (TSE:6224) | ¥1154.00 | ¥2307.33 | 50% |

| I.CO.P.. Società Benefit (BIT:ICOP) | €13.20 | €26.23 | 49.7% |

| Guangdong Marubi Biotechnology (SHSE:603983) | CN¥42.35 | CN¥84.40 | 49.8% |

| Forum Engineering (TSE:7088) | ¥1204.00 | ¥2399.74 | 49.8% |

| doValue (BIT:DOV) | €2.492 | €4.98 | 49.9% |

| Dive (TSE:151A) | ¥935.00 | ¥1857.72 | 49.7% |

| Bloks Group (SEHK:325) | HK$146.60 | HK$292.82 | 49.9% |

| Beijing Kawin Technology Share-Holding (SHSE:688687) | CN¥26.51 | CN¥52.74 | 49.7% |

| ATEME (ENXTPA:ATEME) | €5.20 | €10.35 | 49.8% |

| APAC Realty (SGX:CLN) | SGD0.475 | SGD0.95 | 49.9% |

Let's review some notable picks from our screened stocks.

Thales (ENXTPA:HO)

Overview: Thales S.A. operates globally, offering solutions in defence and security, aerospace and space, as well as digital identity and security markets, with a market cap of €50.55 billion.

Operations: Thales generates revenue through its key segments: Aerospace (€5.64 billion), Cyber & Digital (€4.15 billion), and Defence excluding Digital Identity & Security (€11.32 billion).

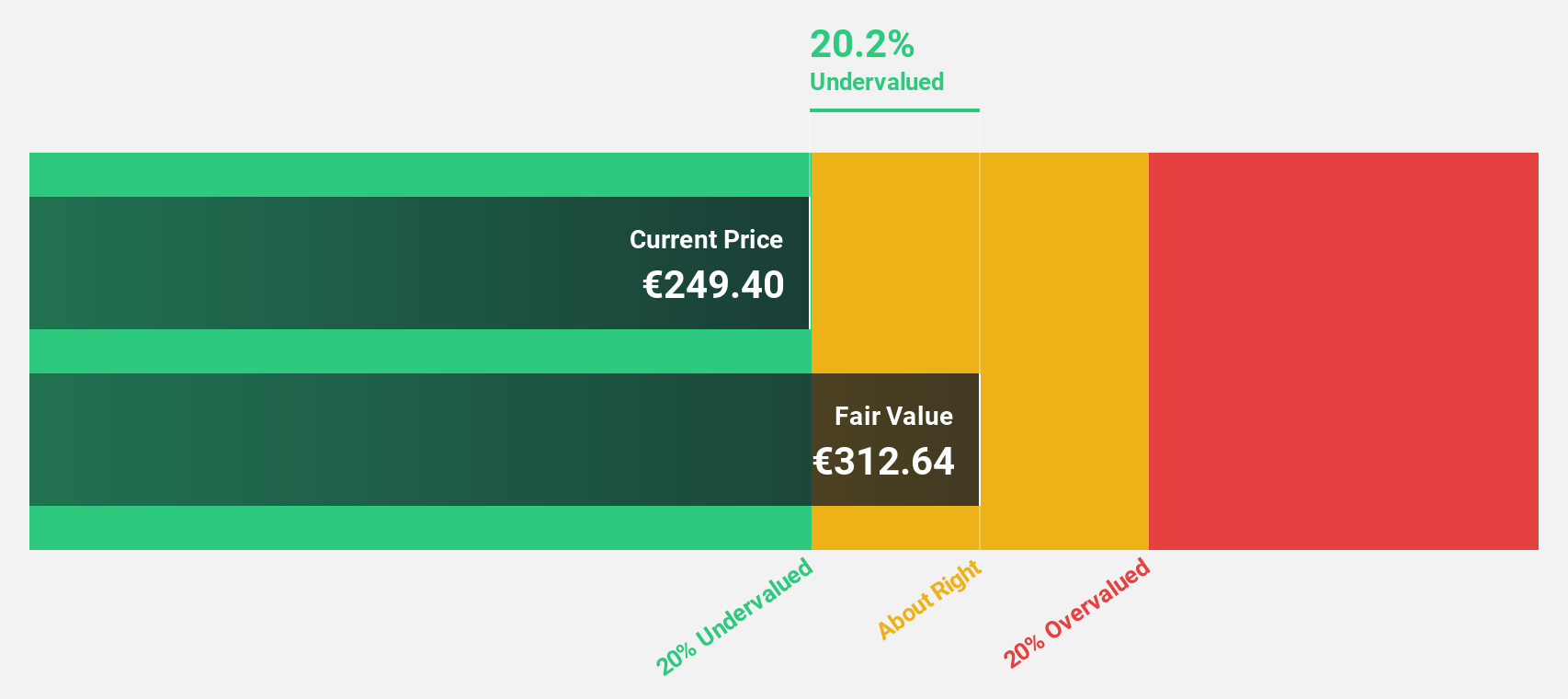

Estimated Discount To Fair Value: 24%

Thales is trading significantly below its estimated fair value, suggesting potential undervaluation based on cash flows. The company's earnings are projected to grow faster than the French market, supported by strategic initiatives like achieving essential security certifications for its eSIM solutions and expanding partnerships in secure payment systems. These developments enhance Thales' position in high-demand sectors such as IoT and cybersecurity, potentially driving future revenue growth beyond current market expectations.

- Our expertly prepared growth report on Thales implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Thales.

Orion Oyj (HLSE:ORNBV)

Overview: Orion Oyj is a company that develops, manufactures, and markets human and veterinary pharmaceuticals as well as active pharmaceutical ingredients across Finland, Scandinavia, Europe, North America, and internationally, with a market cap of €9.23 billion.

Operations: The company's revenue from its pharmaceuticals segment is €1.59 billion.

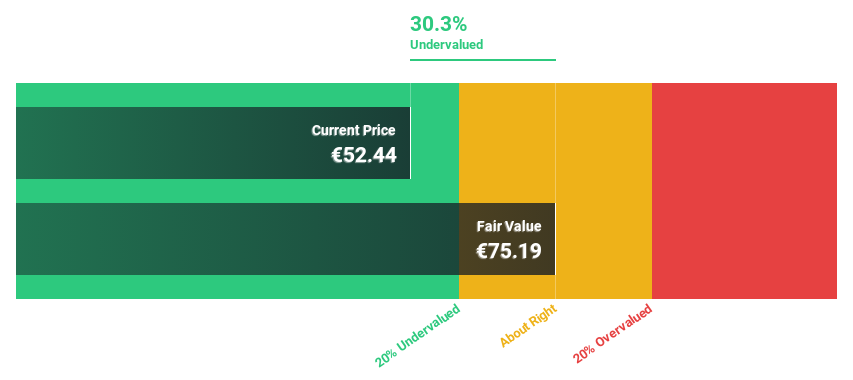

Estimated Discount To Fair Value: 40.6%

Orion Oyj is trading well below its estimated fair value, highlighting potential undervaluation based on cash flows. Despite a modest 2.5% dividend not fully covered by free cash flows, the company's earnings are forecast to grow faster than the Finnish market. Recent strategic moves, including FDA approval for darolutamide and expanded collaborations in antibody-drug conjugates, position Orion for growth in oncology and solid tumor treatments, potentially enhancing long-term revenue streams.

- Our earnings growth report unveils the potential for significant increases in Orion Oyj's future results.

- Navigate through the intricacies of Orion Oyj with our comprehensive financial health report here.

d'Alba Global (KOSE:A483650)

Overview: d'Alba Global Co., Ltd. is involved in the manufacturing and sale of perfumes and cosmetic products both in South Korea and internationally, with a market cap of ₩2.58 trillion.

Operations: The company's revenue primarily comes from its cosmetics manufacturing and sales segment, amounting to ₩356.64 billion.

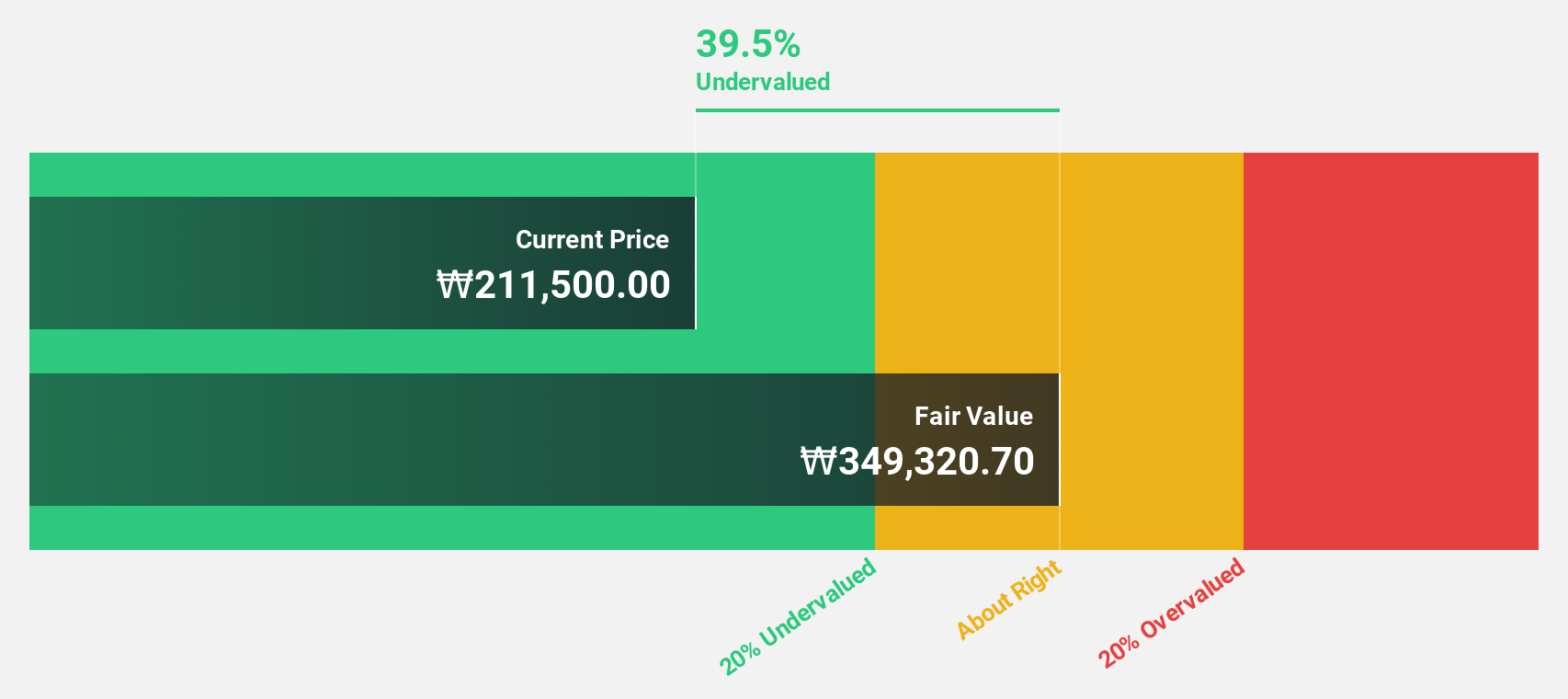

Estimated Discount To Fair Value: 36.4%

d'Alba Global's recent IPO raised KRW 43.36 billion, potentially enhancing its financial position. The stock trades at a 36.4% discount to its estimated fair value, suggesting significant undervaluation based on cash flows. Earnings are forecast to grow by 39.5% annually, surpassing the Korean market average, while revenue is expected to increase by 33.9% per year. However, investors should note the stock's high volatility over the past three months.

- Insights from our recent growth report point to a promising forecast for d'Alba Global's business outlook.

- Dive into the specifics of d'Alba Global here with our thorough financial health report.

Key Takeaways

- Dive into all 487 of the Undervalued Global Stocks Based On Cash Flows we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thales might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:HO

Thales

Provides various solutions in the defence and security, aerospace and space, and digital identity and security markets worldwide.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives