- United States

- /

- Capital Markets

- /

- NasdaqCM:VALU

3 Reliable Dividend Stocks Offering Up To 3.8% Yield

Reviewed by Simply Wall St

The United States market has experienced a flat performance over the past week but has shown a 9.9% increase over the last year, with earnings projected to grow by 15% annually in the coming years. In this context, reliable dividend stocks that offer competitive yields can be an attractive option for investors seeking steady income and potential capital appreciation amidst evolving market conditions.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Universal (UVV) | 5.56% | ★★★★★★ |

| Southside Bancshares (SBSI) | 5.13% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 3.94% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 7.17% | ★★★★★★ |

| Ennis (EBF) | 5.41% | ★★★★★★ |

| Dillard's (DDS) | 6.52% | ★★★★★★ |

| Credicorp (BAP) | 5.11% | ★★★★★☆ |

| CompX International (CIX) | 5.04% | ★★★★★★ |

| Columbia Banking System (COLB) | 6.46% | ★★★★★★ |

| Citizens & Northern (CZNC) | 6.03% | ★★★★★☆ |

Click here to see the full list of 153 stocks from our Top US Dividend Stocks screener.

We'll examine a selection from our screener results.

Virginia National Bankshares (VABK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Virginia National Bankshares Corporation, with a market cap of $197.51 million, operates as the holding company for Virginia National Bank, offering a variety of commercial and retail banking products and services in Virginia.

Operations: Virginia National Bankshares Corporation generates revenue primarily through its banking operations, totaling $54.95 million, with additional contributions from VNB Trust & Estate Services amounting to $0.95 million.

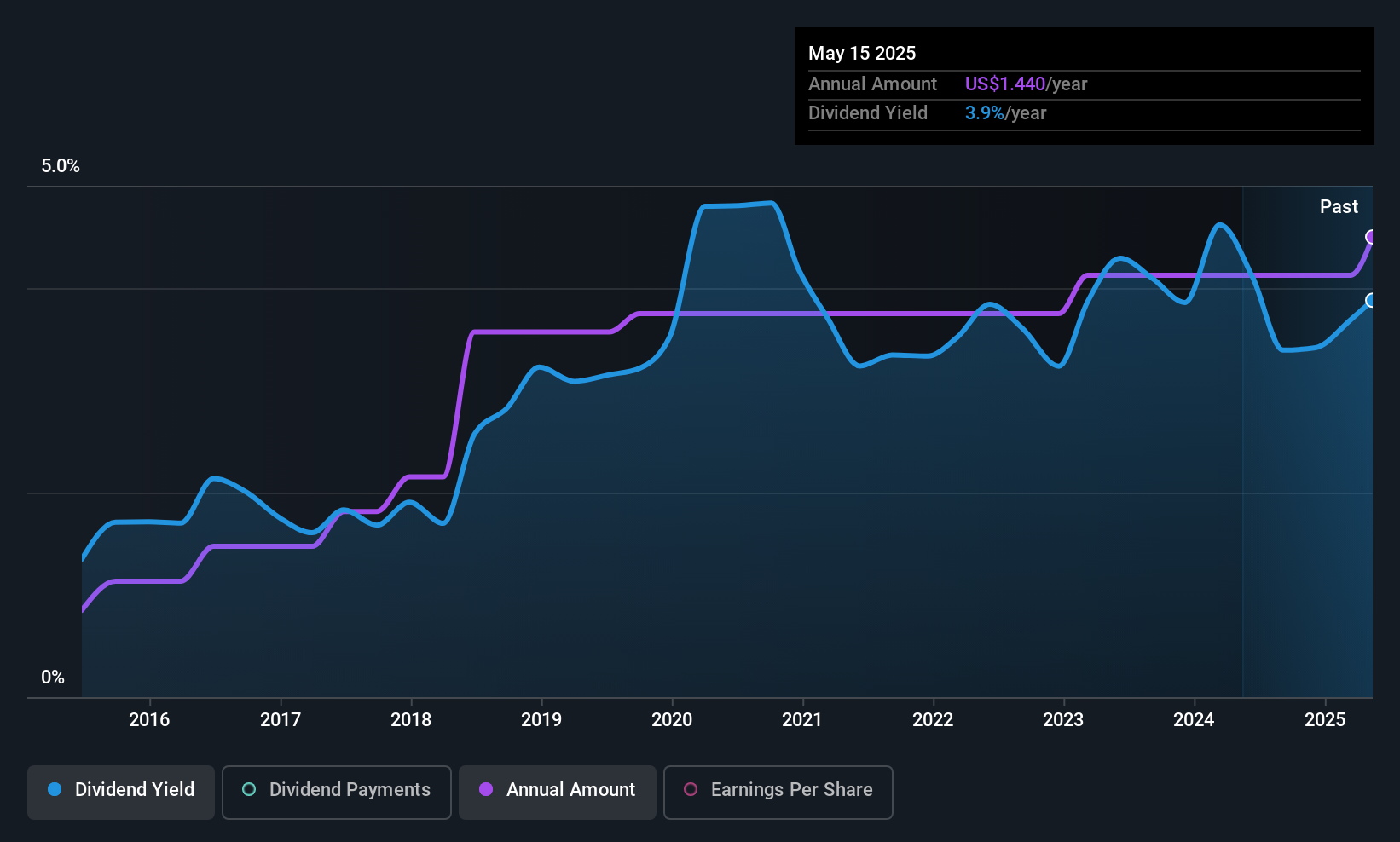

Dividend Yield: 3.9%

Virginia National Bankshares offers a reliable dividend, recently increased by 9.1% to $0.36 per share, yielding approximately 4.09%. Its dividends have been stable and growing over the past decade with a low payout ratio of 39.8%, indicating sustainability from earnings. Despite trading below estimated fair value, its dividend yield is lower than the top US payers at 3.87%. Recent earnings growth supports its dividend strategy, with net income rising to $4.49 million in Q1 2025.

- Click to explore a detailed breakdown of our findings in Virginia National Bankshares' dividend report.

- Our expertly prepared valuation report Virginia National Bankshares implies its share price may be lower than expected.

Value Line (VALU)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Value Line, Inc. produces and sells investment periodicals and related publications, with a market cap of $350.84 million.

Operations: Value Line, Inc.'s revenue is primarily derived from its publishing segment, which generated $35.70 million.

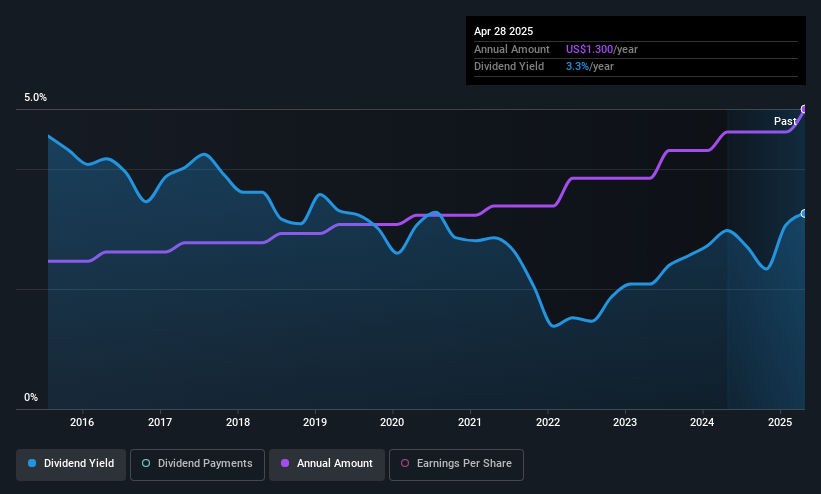

Dividend Yield: 3.4%

Value Line, Inc. recently increased its quarterly dividend by 8.3% to $0.325 per share, marking the 11th consecutive annual increase. With a payout ratio of 52.5% and cash payout ratio of 67.2%, dividends are well-covered by earnings and cash flows, ensuring sustainability despite a lower yield of 3.39% compared to top US payers. Earnings growth of 17.8% over the past year supports this strategy, maintaining stable and growing dividends over the last decade.

- Take a closer look at Value Line's potential here in our dividend report.

- Our valuation report unveils the possibility Value Line's shares may be trading at a discount.

Old Republic International (ORI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Old Republic International Corporation operates through its subsidiaries to offer insurance underwriting and related services mainly in the United States and Canada, with a market cap of approximately $8.99 billion.

Operations: Old Republic International Corporation generates revenue primarily from its Specialty Insurance segment at $5.57 billion and Title Insurance segment at $2.74 billion.

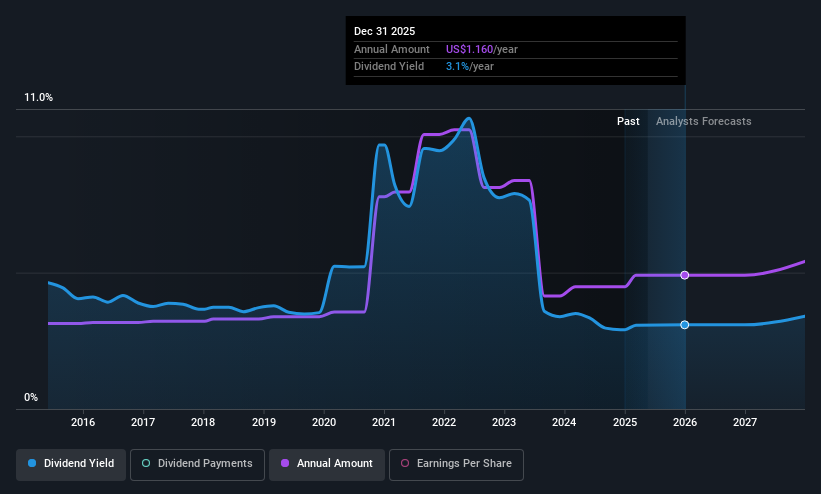

Dividend Yield: 3.1%

Old Republic International's dividend is supported by a low payout ratio of 34.9% and cash payout ratio of 21.7%, indicating strong coverage by earnings and cash flows, despite a volatile past decade. The recent strategic partnership with Endurance Vehicle Services may enhance its financial strength, supporting future dividends. Trading at 56.1% below estimated fair value, it offers potential upside but has a relatively low yield of 3.14% compared to top US dividend payers.

- Unlock comprehensive insights into our analysis of Old Republic International stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Old Republic International is priced lower than what may be justified by its financials.

Make It Happen

- Reveal the 153 hidden gems among our Top US Dividend Stocks screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:VALU

Value Line

Engages in the production and sale of investment periodicals and related publications.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives