- United States

- /

- Oil and Gas

- /

- NYSE:EGY

3 Promising Penny Stocks With Market Caps Over $100M

Reviewed by Simply Wall St

As the U.S. stock market sees a rise with investor optimism surrounding U.S.-China trade talks, attention is also turning to lesser-known opportunities in the market. Penny stocks, often associated with smaller or newer companies, offer unique growth potential at lower price points despite being considered a somewhat outdated term. By focusing on those with strong financials and clear growth paths, investors can uncover promising penny stocks that may provide both stability and upside potential.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Imperial Petroleum (IMPP) | $3.09 | $103.93M | ✅ 4 ⚠️ 1 View Analysis > |

| New Horizon Aircraft (HOVR) | $1.09 | $29.35M | ✅ 4 ⚠️ 5 View Analysis > |

| Waterdrop (WDH) | $1.47 | $533.45M | ✅ 4 ⚠️ 0 View Analysis > |

| Greenland Technologies Holding (GTEC) | $2.09 | $35.83M | ✅ 2 ⚠️ 5 View Analysis > |

| WM Technology (MAPS) | $1.11 | $186.68M | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $1.79 | $184.86M | ✅ 4 ⚠️ 0 View Analysis > |

| Table Trac (TBTC) | $4.73 | $22.55M | ✅ 2 ⚠️ 2 View Analysis > |

| Flexible Solutions International (FSI) | $4.325 | $54.64M | ✅ 1 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.849 | $6.17M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.77 | $76.88M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 709 stocks from our US Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Kyverna Therapeutics (KYTX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kyverna Therapeutics, Inc. is a clinical-stage biopharmaceutical company that develops cell therapies for autoimmune diseases and has a market cap of approximately $146.51 million.

Operations: Kyverna Therapeutics, Inc. has not reported any revenue segments at this time.

Market Cap: $146.51M

Kyverna Therapeutics, Inc., with a market cap of US$146.51 million, is a pre-revenue clinical-stage biopharmaceutical company focused on cell therapies for autoimmune diseases. Despite having no revenue and being unprofitable, it maintains strong financial stability with short-term assets of US$247.7 million exceeding liabilities and no debt over the past five years. However, its management team and board are relatively inexperienced, which could pose challenges as they navigate development stages. Recent activities include a US$50 million equity offering and ongoing clinical trials with expected data releases in 2025-2026 that may influence future prospects.

- Navigate through the intricacies of Kyverna Therapeutics with our comprehensive balance sheet health report here.

- Examine Kyverna Therapeutics' earnings growth report to understand how analysts expect it to perform.

VAALCO Energy (EGY)

Simply Wall St Financial Health Rating: ★★★★★☆

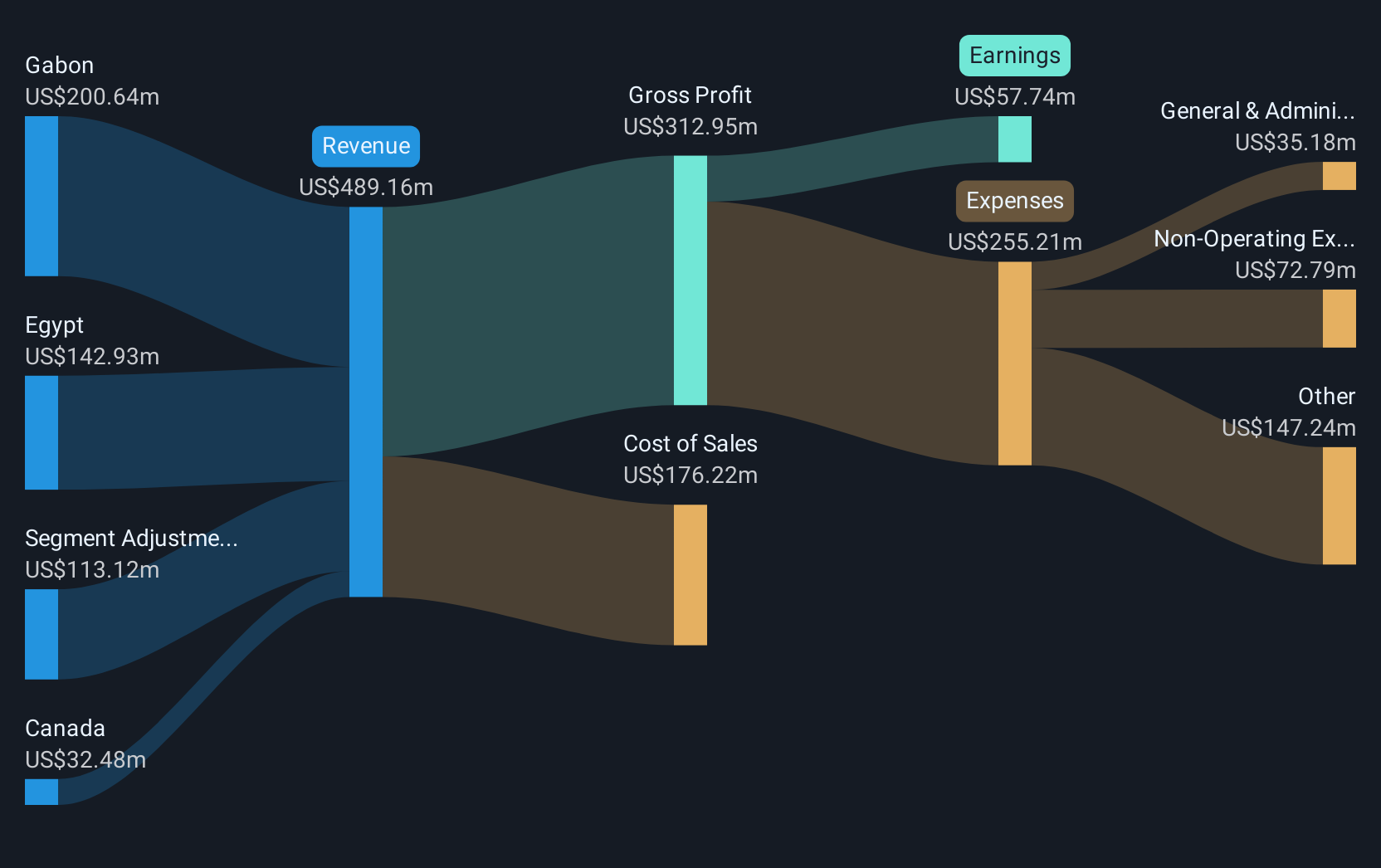

Overview: VAALCO Energy, Inc. is an independent energy company focused on the acquisition, exploration, development, and production of crude oil, natural gas, and natural gas liquids across Gabon, Egypt, Equatorial Guinea, Cote d'Ivoire, and Canada with a market capitalization of $357.14 million.

Operations: The company's revenue is primarily derived from its operations in the exploration and production of hydrocarbons, totaling $489.16 million.

Market Cap: $357.14M

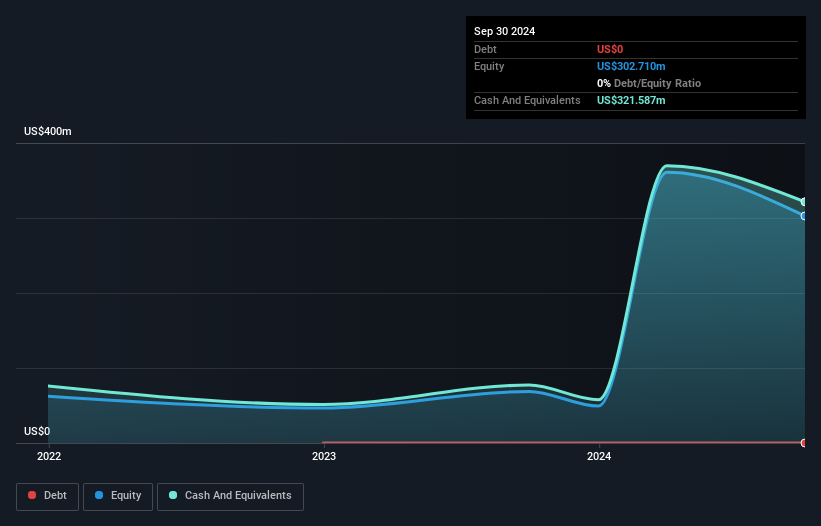

VAALCO Energy, with a market cap of US$357.14 million, operates in the energy sector focusing on oil and gas exploration and production. The company is debt-free, which enhances its financial stability, although its return on equity at 11.6% is considered low. Recent earnings results show net income of US$7.73 million for Q1 2025, maintaining stable profitability compared to the previous year. However, profit margins have decreased slightly from last year’s figures. Despite offering a dividend yield of 7.02%, it is not well covered by free cash flows, raising sustainability concerns amidst forecasts of declining earnings over the next three years.

- Click here and access our complete financial health analysis report to understand the dynamics of VAALCO Energy.

- Understand VAALCO Energy's earnings outlook by examining our growth report.

ATRenew (RERE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ATRenew Inc. operates a platform for pre-owned consumer electronics transactions and services in the People’s Republic of China, with a market cap of approximately $553.81 million.

Operations: The company's revenue is primarily generated from its retail electronics segment, amounting to CN¥17.33 billion.

Market Cap: $553.81M

ATRenew Inc., with a market cap of US$553.81 million, has shown resilience in the penny stock category by achieving profitability over the past year. The company reported a net income of CN¥42.8 million for Q1 2025, reversing from a loss in the previous year, and forecasts revenue growth between 24.7% to 27.4% for Q2 2025. Its debt levels are well-managed with cash exceeding total debt, and short-term assets comfortably cover liabilities. However, its return on equity remains low at 3.4%. The recent launch of its Paijitang store in Shenzhen enhances its market footprint and standardization efforts across China’s electronics trade sector.

- Take a closer look at ATRenew's potential here in our financial health report.

- Evaluate ATRenew's prospects by accessing our earnings growth report.

Summing It All Up

- Discover the full array of 709 US Penny Stocks right here.

- Ready For A Different Approach? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EGY

VAALCO Energy

An independent energy company, engages in the acquisition, exploration, development, and production of crude oil, natural gas, and natural gas liquids in Gabon, Egypt, Equatorial Guinea, Cote d'Ivoire, and Canada.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives