- United States

- /

- Real Estate

- /

- NasdaqCM:REAX

3 Penny Stocks With Market Caps Over $800M To Consider

Reviewed by Simply Wall St

Major stock indexes in the United States recently ended lower as investors weighed earnings reports and ongoing U.S.-China trade tensions. In such a fluctuating market, penny stocks—despite their somewhat outdated moniker—remain a compelling area for investment, particularly when they are backed by solid financials. These smaller or newer companies can offer surprising value and potential for growth, making them worth considering for investors seeking hidden opportunities in quality stocks.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.90 | $405.04M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.79 | $640.14M | ✅ 4 ⚠️ 0 View Analysis > |

| CuriosityStream (CURI) | $4.44 | $253.73M | ✅ 4 ⚠️ 2 View Analysis > |

| WM Technology (MAPS) | $1.08 | $181.28M | ✅ 4 ⚠️ 2 View Analysis > |

| Global Self Storage (SELF) | $4.9823 | $56.41M | ✅ 5 ⚠️ 1 View Analysis > |

| Performance Shipping (PSHG) | $1.97 | $24.12M | ✅ 4 ⚠️ 2 View Analysis > |

| CI&T (CINT) | $4.97 | $652.72M | ✅ 4 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| BAB (BABB) | $0.983404 | $6.98M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.20 | $75M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 361 stocks from our US Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Real Brokerage (REAX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The Real Brokerage Inc. operates as a real estate technology company in the United States and Canada, with a market cap of $818.36 million.

Operations: The company's revenue is primarily generated from its North American Brokerage segment, which accounts for $1.61 billion.

Market Cap: $818.36M

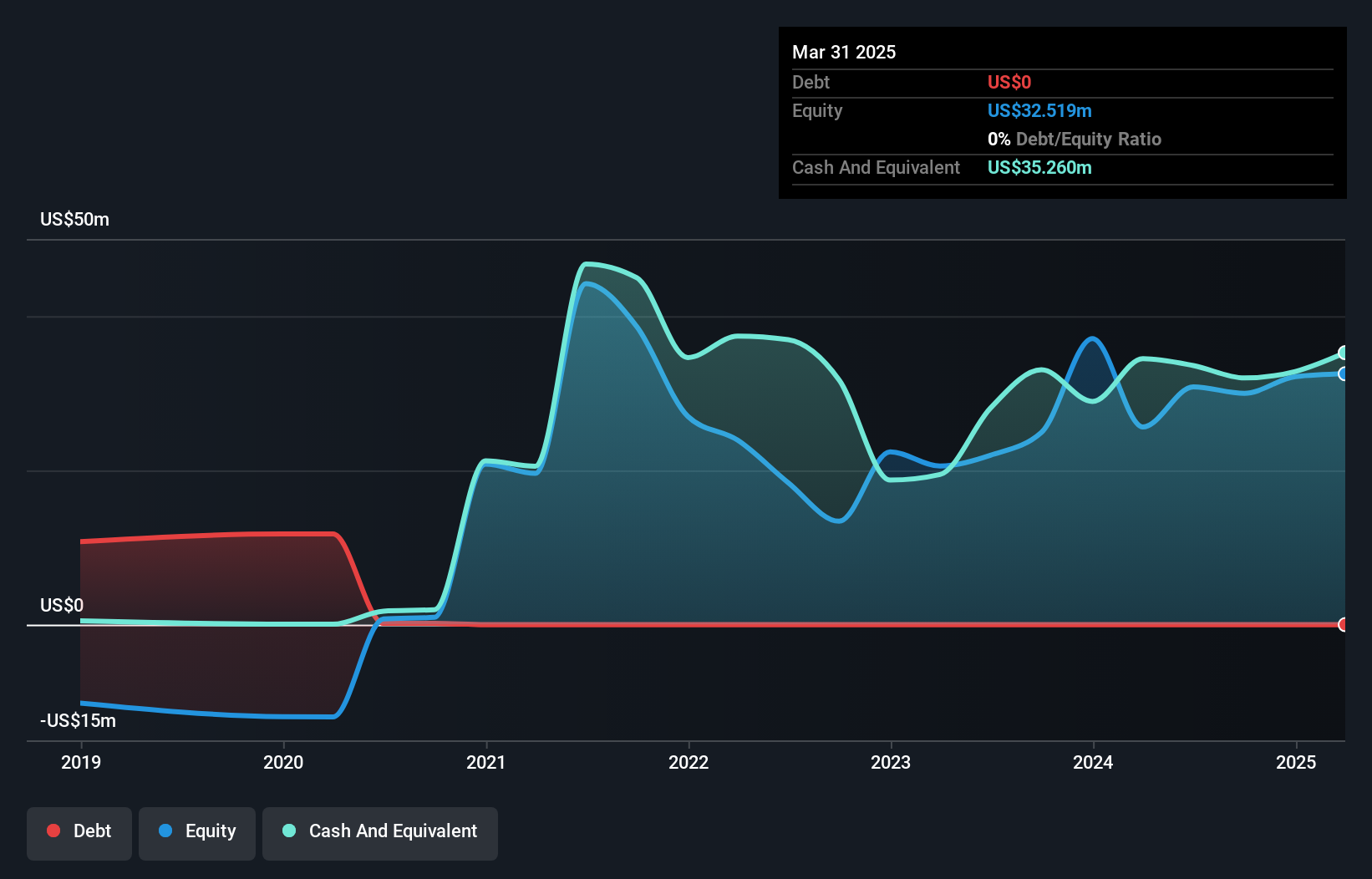

Real Brokerage, with a market cap of US$818.36 million, has shown significant revenue growth in its North American Brokerage segment, reaching US$1.61 billion. Despite being unprofitable with a negative return on equity of -26.17%, the company boasts no debt and sufficient cash runway for over three years due to positive free cash flow. Recent initiatives include Real Wallet Capital, an innovative lending solution enhancing agent financial management through embedded finance technology within their reZEN platform. Additionally, Real's involvement in high-profile projects like Bozeman Yards highlights its strategic expansion into luxury real estate markets across the U.S., demonstrating potential growth opportunities despite current challenges.

- Get an in-depth perspective on Real Brokerage's performance by reading our balance sheet health report here.

- Explore Real Brokerage's analyst forecasts in our growth report.

Marqeta (MQ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Marqeta, Inc. operates a cloud-based open API platform for card issuing and transaction processing services, with a market cap of approximately $2.09 billion.

Operations: The company's revenue is primarily derived from data processing, amounting to $553.22 million.

Market Cap: $2.09B

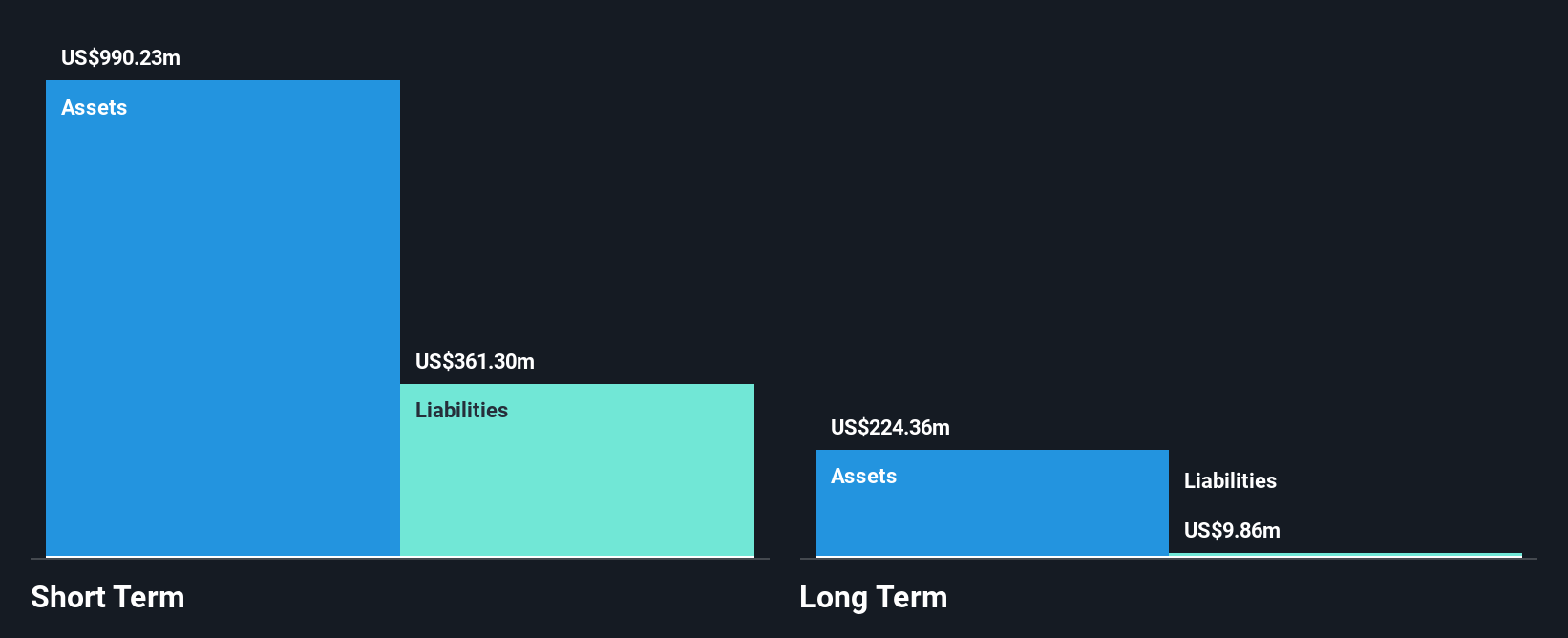

Marqeta, Inc., with a market cap of US$2.09 billion, has demonstrated robust revenue generation, reaching US$553.22 million primarily from data processing services. Despite being unprofitable and experiencing significant insider selling recently, Marqeta remains debt-free with a positive free cash flow that supports a cash runway exceeding three years. The company's short-term assets of US$990.2 million comfortably cover both short and long-term liabilities. Recent executive changes include Michael Milotich's appointment as CEO and ongoing CFO duties during the search for his successor, reflecting strategic leadership adjustments amid evolving financial guidance for 2025 revenue growth expectations.

- Dive into the specifics of Marqeta here with our thorough balance sheet health report.

- Learn about Marqeta's future growth trajectory here.

ATRenew (RERE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ATRenew Inc. operates a platform for pre-owned consumer electronics transactions and services in the People's Republic of China, with a market cap of $902.18 million.

Operations: The company generates revenue from its retail electronics segment, amounting to CN¥18.55 billion.

Market Cap: $902.18M

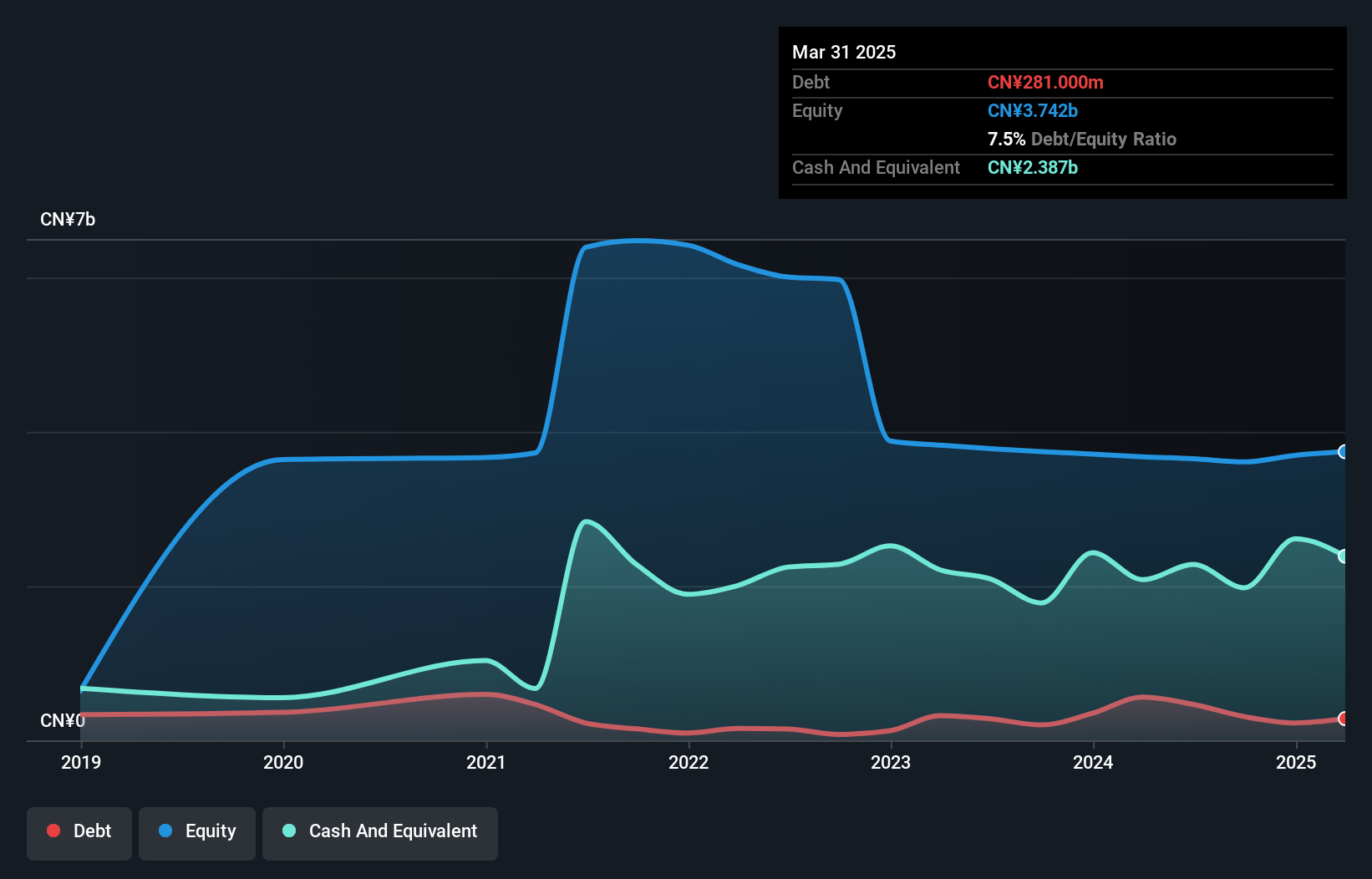

ATRenew Inc., with a market cap of $902.18 million, has recently turned profitable, reporting net income of CN¥72.34 million for Q2 2025 compared to a loss the previous year. The company forecasts revenue growth between RMB 5,050 million and RMB 5,150 million for Q3 2025. Its financial stability is underscored by short-term assets exceeding liabilities and reduced debt levels over five years. ATRenew's seasoned management team supports its strategic direction, while recent share buybacks indicate confidence in its valuation. Despite low return on equity at 5.5%, the company trades below estimated fair value, presenting potential investment interest among penny stocks.

- Click here to discover the nuances of ATRenew with our detailed analytical financial health report.

- Assess ATRenew's future earnings estimates with our detailed growth reports.

Turning Ideas Into Actions

- Unlock our comprehensive list of 361 US Penny Stocks by clicking here.

- Interested In Other Possibilities? Uncover 16 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:REAX

Real Brokerage

Operates as a real estate technology company in the United States and Canada.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives