- United Arab Emirates

- /

- Banks

- /

- DFM:MASQ

3 Middle Eastern Dividend Stocks Yielding Up To 8.5%

Reviewed by Simply Wall St

As Middle Eastern markets, particularly in the UAE, experience an upswing with indices reaching notable highs amidst anticipation of U.S.-China trade talks, investors are keenly observing opportunities that align with this positive momentum. In such a climate, dividend stocks can be appealing for their potential to provide steady income streams while benefiting from the region's economic growth.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Saudi Telecom (SASE:7010) | 9.77% | ★★★★★☆ |

| Saudi National Bank (SASE:1180) | 5.84% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.19% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.46% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 7.30% | ★★★★★☆ |

| Emirates NBD Bank PJSC (DFM:EMIRATESNBD) | 4.55% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.55% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.87% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 6.04% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 7.98% | ★★★★★☆ |

Click here to see the full list of 74 stocks from our Top Middle Eastern Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Abu Dhabi Islamic Bank PJSC (ADX:ADIB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Abu Dhabi Islamic Bank PJSC offers banking, financing, and investing services across the United Arab Emirates, the Middle East, and internationally with a market capitalization of AED72.64 billion.

Operations: Abu Dhabi Islamic Bank PJSC's revenue is primarily derived from its Global Retail Banking segment (AED5.29 billion), followed by Global Wholesale Banking (AED1.79 billion), Associates & Subsidiaries (AED1.48 billion), Treasury operations (AED257.90 million), Real Estate activities (AED163.44 million), and Private Banking services (AED243.19 million).

Dividend Yield: 4.2%

Abu Dhabi Islamic Bank PJSC (ADIB) has shown growth in net interest and net income, with recent earnings reporting AED 2.03 billion and AED 1.62 billion respectively for Q1 2025. Despite a low dividend yield of 4.17% compared to the top market payers, its payout ratio of 53.3% suggests dividends are currently covered by earnings and forecasted to remain so in three years at 51.5%. However, ADIB's dividend history is marked by volatility, with significant annual drops over the past decade, raising concerns about reliability despite ongoing profit growth.

- Click to explore a detailed breakdown of our findings in Abu Dhabi Islamic Bank PJSC's dividend report.

- Our comprehensive valuation report raises the possibility that Abu Dhabi Islamic Bank PJSC is priced higher than what may be justified by its financials.

Dubai Islamic Bank P.J.S.C (DFM:DIB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dubai Islamic Bank P.J.S.C. operates in corporate, retail, and investment banking both within the United Arab Emirates and internationally, with a market cap of AED62.08 billion.

Operations: Dubai Islamic Bank P.J.S.C.'s revenue is primarily derived from Consumer Banking (AED4.50 billion), Corporate Banking (AED3.35 billion), Treasury operations (AED2.59 billion), and Real Estate Development (AED700.58 million).

Dividend Yield: 5.2%

Dubai Islamic Bank P.J.S.C. (DIB) has experienced an 18% earnings growth over the past year, with Q1 2025 net income reaching AED 1.74 billion. Despite a low dividend yield of 5.24% compared to top payers in the AE market, its payout ratio of 42.5% indicates dividends are currently well covered by earnings and forecasted to remain so in three years at 48.5%. However, DIB's dividend history is marked by volatility and an unstable track record, raising concerns about reliability despite trading at good value relative to peers with a low price-to-earnings ratio of 8.1x.

- Unlock comprehensive insights into our analysis of Dubai Islamic Bank P.J.S.C stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Dubai Islamic Bank P.J.S.C shares in the market.

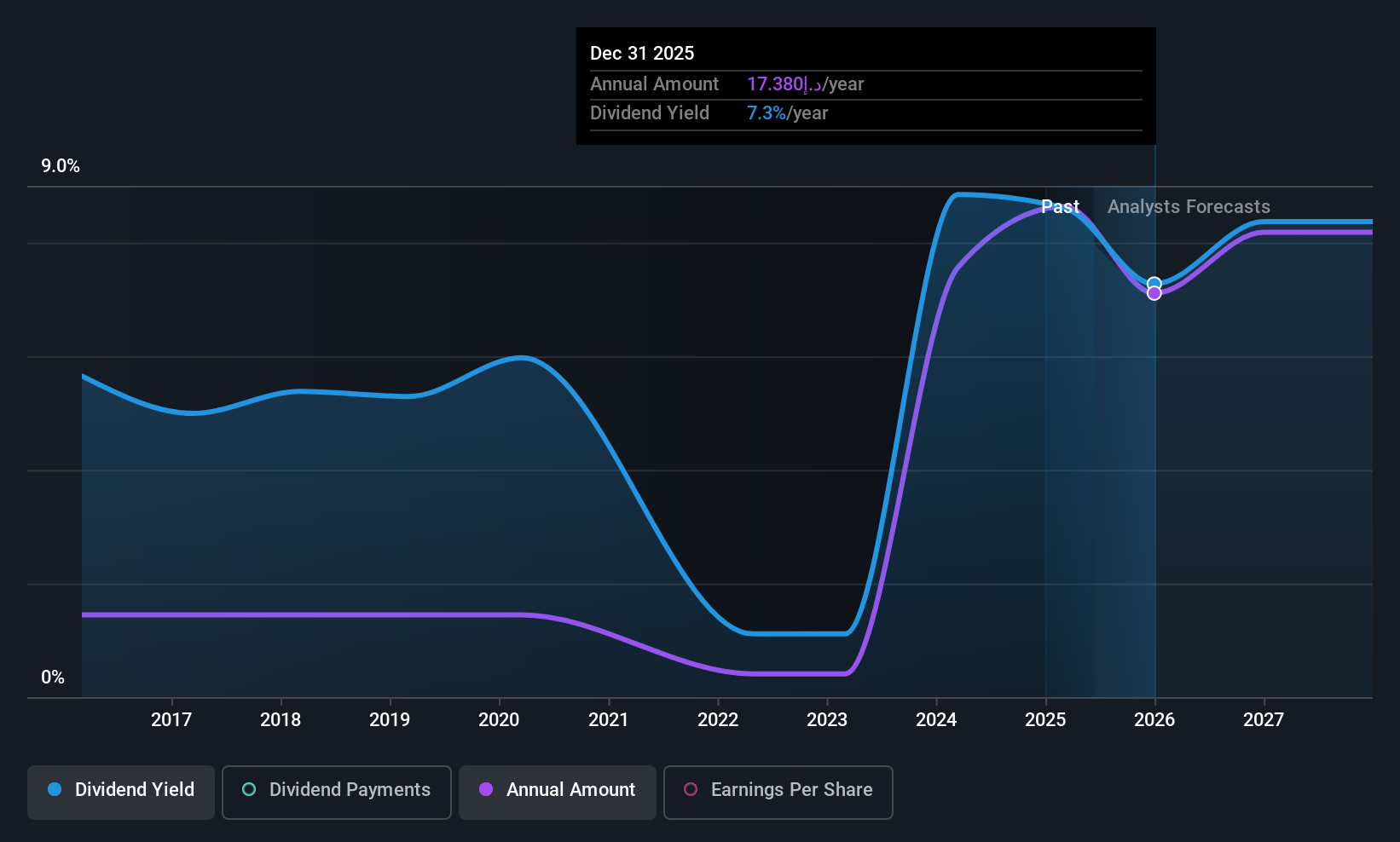

Mashreqbank PSC (DFM:MASQ)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mashreqbank PSC offers a range of banking and financial services to both individuals and corporates, with a market cap of AED49.75 billion.

Operations: Mashreqbank PSC's revenue segments include Retail at AED4.19 billion, Wholesale Banking at AED4.72 billion, Insurance & Others at AED3.36 billion, and Treasury and Capital Markets at AED1.13 billion.

Dividend Yield: 8.5%

Mashreqbank PSC's dividend yield of 8.51% is among the top 25% in the AE market, supported by a low payout ratio of 48.8%, indicating dividends are well covered by earnings and forecasted to remain sustainable at 53.4% in three years. Despite this, its dividend history has been volatile over the past decade, impacting reliability. Recent Q1 earnings showed a decrease with net income at AED 1.76 billion compared to AED 2 billion last year, highlighting some financial pressure amidst ongoing strategic initiatives like fixed-income offerings and leadership roles in regional Sukuk issuances.

- Click here and access our complete dividend analysis report to understand the dynamics of Mashreqbank PSC.

- Our valuation report unveils the possibility Mashreqbank PSC's shares may be trading at a discount.

Where To Now?

- Take a closer look at our Top Middle Eastern Dividend Stocks list of 74 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:MASQ

Mashreqbank PSC

Provides various banking and financial services to individuals and corporates.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives