- Taiwan

- /

- Semiconductors

- /

- TWSE:3711

3 Global Stocks That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

In recent weeks, global markets have been influenced by trade policy developments and inflation trends, with U.S. stocks showing resilience despite fluctuating investor sentiment driven by tariff-related news. As the economic landscape continues to evolve, identifying stocks that may be undervalued becomes crucial for investors looking to capitalize on potential market inefficiencies; such opportunities often arise when companies are trading below their estimated intrinsic value amidst broader market volatility.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vestas Wind Systems (CPSE:VWS) | DKK106.20 | DKK209.54 | 49.3% |

| USU Software (HMSE:OSP2) | €25.485 | €50.86 | 49.9% |

| Sparebank 68° Nord (OB:SB68) | NOK179.40 | NOK358.38 | 49.9% |

| Sahara International Petrochemical (SASE:2310) | SAR18.98 | SAR37.74 | 49.7% |

| Micro Systemation (OM:MSAB B) | SEK48.30 | SEK95.13 | 49.2% |

| Livero (TSE:9245) | ¥1701.00 | ¥3370.53 | 49.5% |

| Kanto Denka Kogyo (TSE:4047) | ¥844.00 | ¥1677.39 | 49.7% |

| Good Will Instrument (TWSE:2423) | NT$43.80 | NT$87.36 | 49.9% |

| Absolent Air Care Group (OM:ABSO) | SEK211.00 | SEK416.98 | 49.4% |

| 3U Holding (XTRA:UUU) | €1.495 | €2.99 | 49.9% |

Let's uncover some gems from our specialized screener.

Turkiye Garanti Bankasi (IBSE:GARAN)

Overview: Turkiye Garanti Bankasi A.S. offers a range of banking products and services in Turkey, with a market cap of TRY485.94 billion.

Operations: The company's revenue segments include retail banking at TRY25.60 billion, corporate and commercial banking at TRY18.75 billion, treasury operations at TRY8.45 billion, and asset management at TRY2.30 billion.

Estimated Discount To Fair Value: 21.1%

Turkiye Garanti Bankasi is trading at 21.1% below its estimated fair value of TRY146.56, with a current price of TRY115.7, highlighting its undervaluation based on discounted cash flow analysis. Despite having a high level of non-performing loans at 2.1%, the bank reported strong Q1 2025 earnings with net interest income rising to TRY39.33 billion and net income increasing to TRY25.10 billion year-over-year, indicating robust cash flow generation potential amidst forecasted revenue growth exceeding market rates.

- The analysis detailed in our Turkiye Garanti Bankasi growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Turkiye Garanti Bankasi.

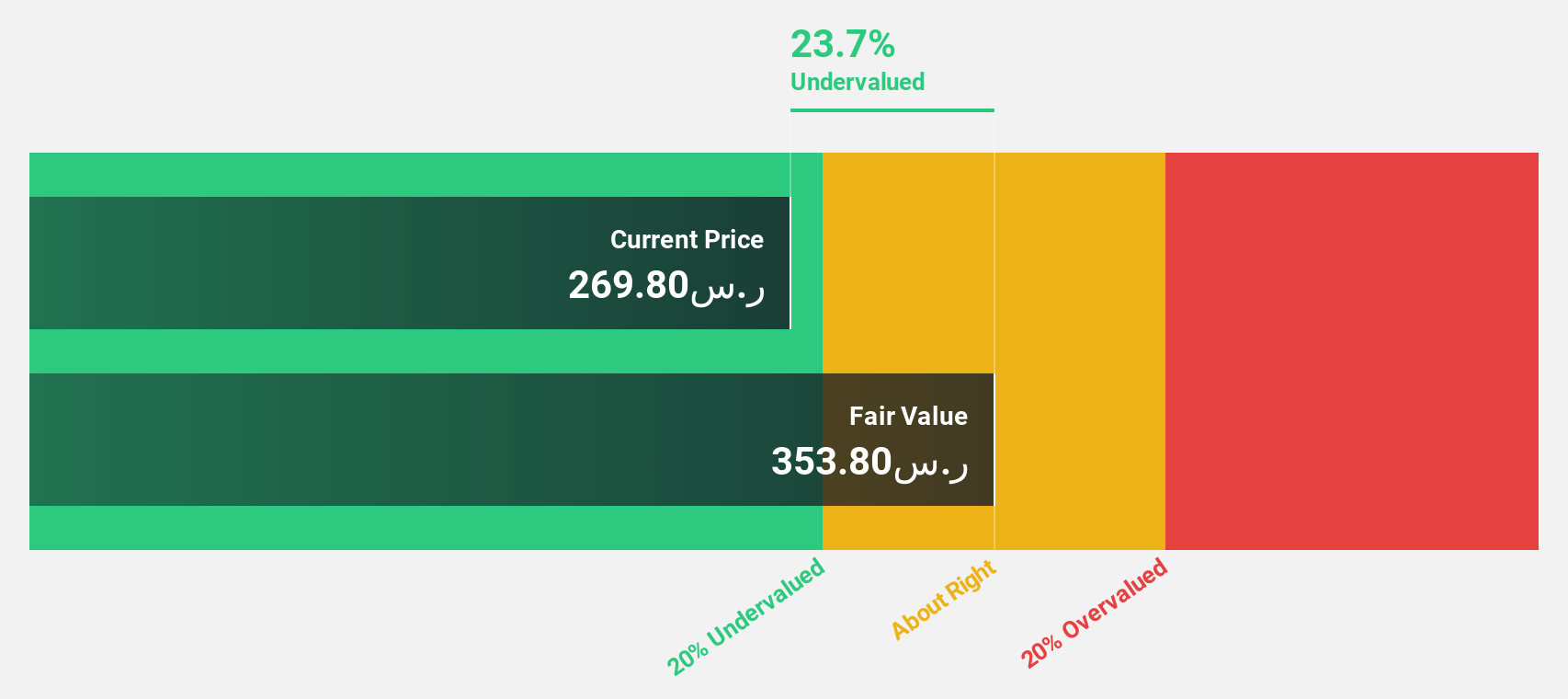

ACWA Power (SASE:2082)

Overview: ACWA Power Company, along with its subsidiaries, is involved in the investment, development, operation, and maintenance of power generation, water desalination, and green hydrogen production plants across the Kingdom of Saudi Arabia, the Middle East, Asia, and Africa with a market cap of SAR194.42 billion.

Operations: ACWA Power's revenue segments consist of SAR1.72 billion from renewables and SAR5.28 billion from thermal and water desalination operations.

Estimated Discount To Fair Value: 34.3%

ACWA Power is trading at 34.3% below its estimated fair value of SAR410.82, with a current price of SAR269.8, reflecting potential undervaluation based on cash flow analysis. Despite high volatility and low forecasted return on equity, earnings are projected to grow significantly above the market rate at 23.12% annually over the next three years. Recent strategic partnerships in Malaysia could enhance growth prospects by expanding renewable energy capacity and supporting global climate objectives aligned with Saudi Vision 2030.

- Insights from our recent growth report point to a promising forecast for ACWA Power's business outlook.

- Click here to discover the nuances of ACWA Power with our detailed financial health report.

ASE Technology Holding (TWSE:3711)

Overview: ASE Technology Holding Co., Ltd. operates in semiconductor packaging and testing, as well as electronic manufacturing services across the United States, Taiwan, Asia, Europe, and globally with a market cap of NT$608.45 billion.

Operations: The company's revenue is primarily derived from NT$58.94 billion in testing, NT$276.77 billion in packaging, and NT$310.28 billion in electronic assembly services.

Estimated Discount To Fair Value: 27.1%

ASE Technology Holding is trading at NT$140, significantly below its estimated fair value of NT$192.06, suggesting potential undervaluation based on cash flow analysis. Earnings are forecasted to grow substantially at 24.9% annually, outpacing the Taiwan market's growth rate. However, the dividend yield of 3.71% is not adequately supported by free cash flows, and return on equity is expected to remain low at 16.2%. Recent revenue increases indicate robust operational performance.

- According our earnings growth report, there's an indication that ASE Technology Holding might be ready to expand.

- Take a closer look at ASE Technology Holding's balance sheet health here in our report.

Where To Now?

- Navigate through the entire inventory of 507 Undervalued Global Stocks Based On Cash Flows here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3711

ASE Technology Holding

Provides semiconductor manufacturing services in the United States, Taiwan, rest of Asia, Europe, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion