- Taiwan

- /

- Semiconductors

- /

- TWSE:2344

3 Global Stocks That May Be Trading At A Discount Of Up To 34.4%

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating inflation rates, geopolitical tensions, and shifting economic policies, investors are keenly observing the performance of various indices. With U.S. stocks advancing despite volatile headlines and European business activity reaching new highs, the search for undervalued opportunities becomes increasingly relevant. In this context, identifying stocks that may be trading at a discount involves looking beyond immediate market trends to assess long-term growth potential and intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Ülker Bisküvi Sanayi (IBSE:ULKER) | TRY106.60 | TRY210.63 | 49.4% |

| Tibet GaoZheng Explosive (SZSE:002827) | CN¥37.91 | CN¥74.65 | 49.2% |

| Stratec (XTRA:SBS) | €22.60 | €45.19 | 50% |

| STEICO (XTRA:ST5) | €20.60 | €40.79 | 49.5% |

| Nordisk Bergteknik (OM:NORB B) | SEK11.90 | SEK23.59 | 49.5% |

| Ningxia Building Materials GroupLtd (SHSE:600449) | CN¥13.44 | CN¥26.47 | 49.2% |

| Lingotes Especiales (BME:LGT) | €5.55 | €11.03 | 49.7% |

| Aquafil (BIT:ECNL) | €1.936 | €3.85 | 49.7% |

| Andes Technology (TWSE:6533) | NT$268.50 | NT$528.74 | 49.2% |

| Absolent Air Care Group (OM:ABSO) | SEK240.00 | SEK473.04 | 49.3% |

Let's dive into some prime choices out of the screener.

Americana Restaurants International (ADX:AMR)

Overview: Americana Restaurants International PLC operates a chain of restaurants across several countries in the Middle East and North Africa, with a market cap of AED18.48 billion.

Operations: The company's revenue segments comprise $1.74 billion from the Major Gulf Cooperation Council (GCC), $230.15 million from the Lower Gulf, and $192.45 million from North Africa.

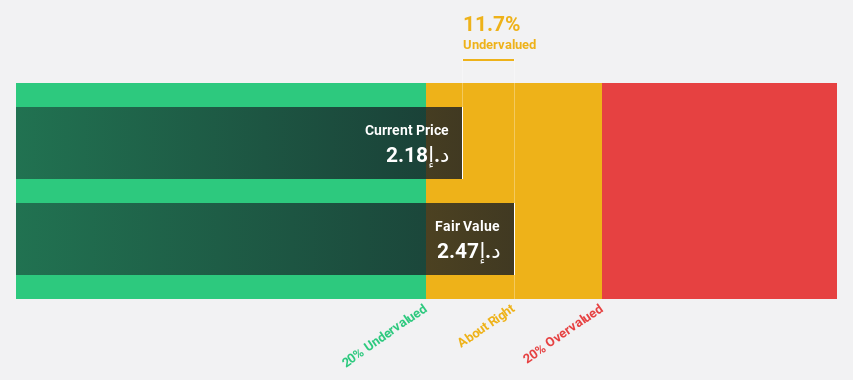

Estimated Discount To Fair Value: 20.4%

Americana Restaurants International is trading at AED2.2, below its estimated fair value of AED2.76, suggesting it may be undervalued based on cash flows. Analysts expect earnings to grow 15.6% annually, outpacing the AE market's 6.6%. Recent earnings show a rise in sales and net income for both the third quarter and nine months ended September 30, 2025, indicating solid financial performance despite slower revenue growth than some benchmarks.

- Our expertly prepared growth report on Americana Restaurants International implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Americana Restaurants International with our comprehensive financial health report here.

Japan Tobacco (TSE:2914)

Overview: Japan Tobacco Inc. is a company that manufactures and sells tobacco products, pharmaceuticals, and processed foods both in Japan and internationally, with a market cap of ¥8.74 trillion.

Operations: The company's revenue is primarily derived from its tobacco segment at ¥3.05 trillion, with additional contributions from processed foods at ¥160.14 billion and pharmaceuticals at ¥98.74 billion.

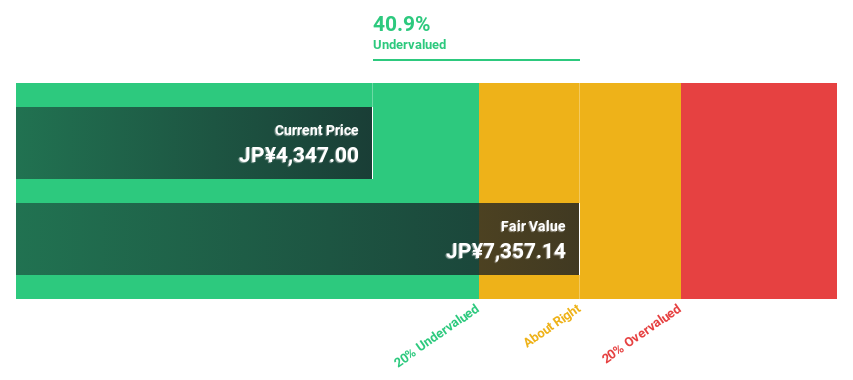

Estimated Discount To Fair Value: 34.4%

Japan Tobacco is trading at ¥5,347, significantly below its estimated fair value of ¥8,147.06. Analysts forecast earnings growth of 20.48% annually over the next three years, surpassing the Japanese market's 7.9%. Despite a recent drop in profit margins to 5.9% from last year's 16.6%, revenue growth is expected to slightly outpace the market at 4.6% per year. The company recently increased its year-end dividend guidance to ¥130 per share from ¥104 previously anticipated.

- Insights from our recent growth report point to a promising forecast for Japan Tobacco's business outlook.

- Get an in-depth perspective on Japan Tobacco's balance sheet by reading our health report here.

Winbond Electronics (TWSE:2344)

Overview: Winbond Electronics Corporation designs, develops, manufactures, and markets very large scale integration integrated circuits for various microelectronic applications globally, with a market cap of NT$248.40 billion.

Operations: The company's revenue is primarily generated from Logical Products (NT$31.15 billion), Flash Memory Product (NT$28.76 billion), and Customized Memory Solution Products (NT$19.21 billion).

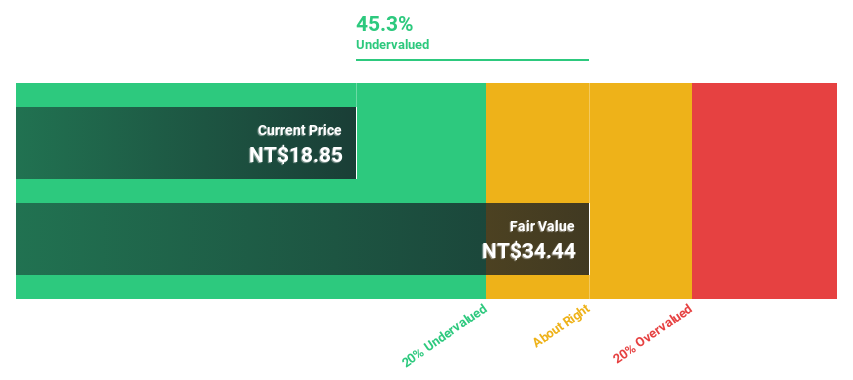

Estimated Discount To Fair Value: 20.3%

Winbond Electronics is trading at NT$54.7, over 20% below its estimated fair value of NT$68.64, offering good relative value compared to peers. Despite recent volatility and a net loss of TWD 1,312.43 million in Q2 2025, the company is forecasted to become profitable within three years with earnings growing at a substantial rate annually. While revenue growth of 19.9% per year outpaces the Taiwanese market average, return on equity remains modestly forecasted at 12.9%.

- The analysis detailed in our Winbond Electronics growth report hints at robust future financial performance.

- Take a closer look at Winbond Electronics' balance sheet health here in our report.

Seize The Opportunity

- Click here to access our complete index of 494 Undervalued Global Stocks Based On Cash Flows.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Winbond Electronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2344

Winbond Electronics

Engages in the design, development, manufacture, and marketing of very large scale integration integrated circuits (ICs) for various microelectronic applications in Asia, the Americas, Europe, and internationally.

Exceptional growth potential and undervalued.

Market Insights

Community Narratives