- South Korea

- /

- Electronic Equipment and Components

- /

- KOSE:A007660

3 Global Stocks Estimated To Be Trading Up To 49.1% Below Their Intrinsic Value

Reviewed by Simply Wall St

As global markets navigate through geopolitical tensions and fluctuating oil prices, investors are closely monitoring economic indicators that suggest mixed signals across different regions. In such an environment, identifying undervalued stocks becomes crucial, as these equities may offer potential value by trading below their intrinsic worth despite broader market volatility.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sparebank 68° Nord (OB:SB68) | NOK183.40 | NOK364.91 | 49.7% |

| Range Intelligent Computing Technology Group (SZSE:300442) | CN¥43.39 | CN¥86.00 | 49.5% |

| PixArt Imaging (TPEX:3227) | NT$219.50 | NT$435.78 | 49.6% |

| Livero (TSE:9245) | ¥1704.00 | ¥3372.67 | 49.5% |

| Kunshan Kinglai Hygienic MaterialsLtd (SZSE:300260) | CN¥28.91 | CN¥57.28 | 49.5% |

| Just Eat Takeaway.com (ENXTAM:TKWY) | €19.50 | €38.97 | 50% |

| Global Tax Free (KOSDAQ:A204620) | ₩6940.00 | ₩13841.68 | 49.9% |

| Ficont Industry (Beijing) (SHSE:605305) | CN¥26.49 | CN¥52.87 | 49.9% |

| dormakaba Holding (SWX:DOKA) | CHF705.00 | CHF1399.39 | 49.6% |

| Coca-Cola Içecek Anonim Sirketi (IBSE:CCOLA) | TRY47.06 | TRY93.72 | 49.8% |

Let's dive into some prime choices out of the screener.

ISU Petasys (KOSE:A007660)

Overview: ISU Petasys Co., Ltd. manufactures and sells printed circuit boards (PCBs) globally, with a market cap of ₩3.33 trillion.

Operations: ISU Petasys Co., Ltd. generates its revenue from the global manufacturing and sale of printed circuit boards (PCBs).

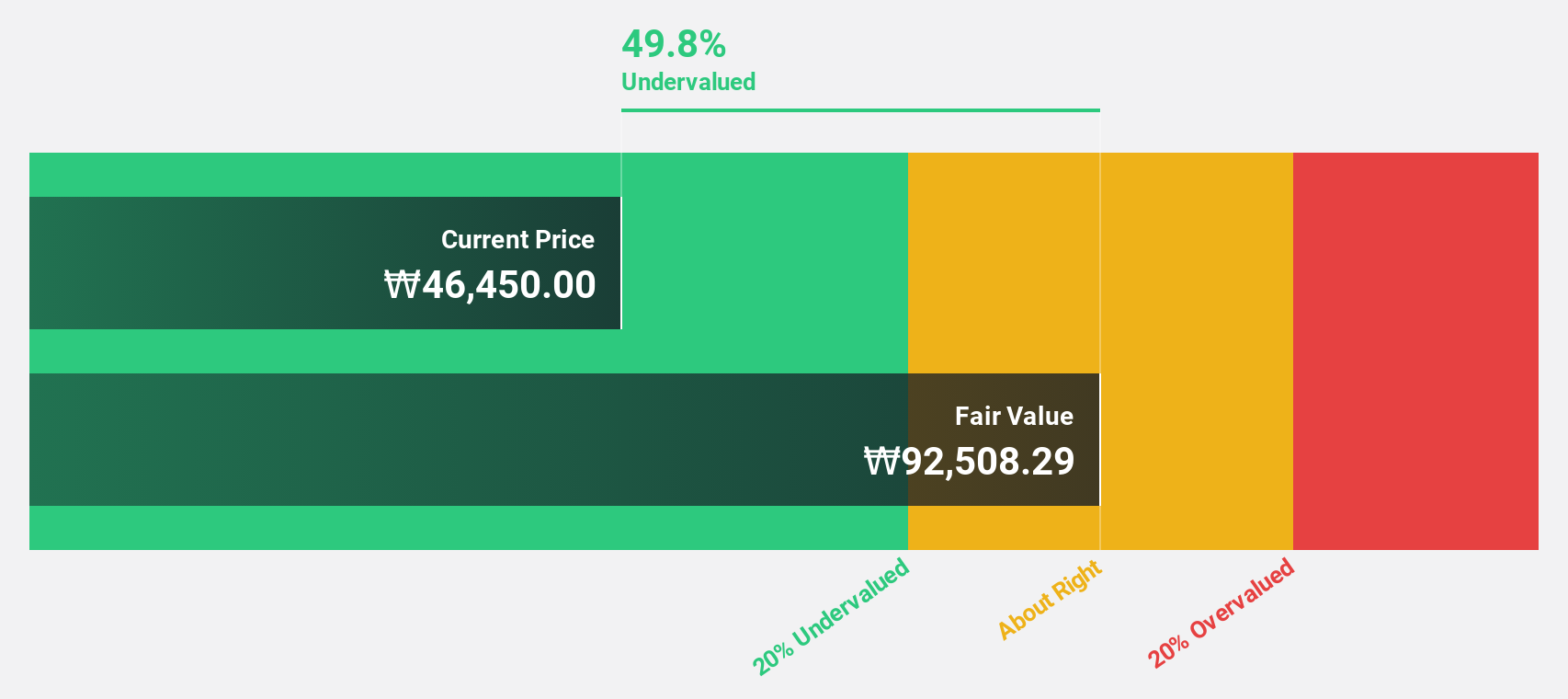

Estimated Discount To Fair Value: 49.1%

ISU Petasys is trading at ₩47,000, significantly below its estimated fair value of ₩92,419.25. Despite a high debt level and recent shareholder dilution from a KRW 282.53 billion equity offering, the company's earnings are forecast to grow at 30.44% annually over the next three years, outpacing the Korean market average of 20.9%. Revenue growth is also expected to exceed market averages, highlighting potential undervaluation based on cash flows despite share price volatility.

- Upon reviewing our latest growth report, ISU Petasys' projected financial performance appears quite optimistic.

- Take a closer look at ISU Petasys' balance sheet health here in our report.

Rayhoo Motor DiesLtd (SZSE:002997)

Overview: Rayhoo Motor Dies Co., Ltd. designs, develops, manufactures, and sells stamping dies and auto welding lines both in China and internationally, with a market cap of CN¥7.41 billion.

Operations: Rayhoo Motor Dies Co., Ltd. generates its revenue primarily from the design, development, manufacturing, and sale of stamping dies and auto welding lines in both domestic and international markets.

Estimated Discount To Fair Value: 34.6%

Rayhoo Motor Dies Ltd. is trading at CNY 37.07, significantly below its estimated fair value of CNY 56.69, suggesting potential undervaluation based on cash flows. The company's revenue is forecast to grow at 25.8% annually, outpacing the Chinese market average of 12.4%. Despite a lower expected annual profit growth compared to the market and a dividend not well covered by free cash flows, recent earnings have shown strong growth with net income increasing substantially year-over-year.

- According our earnings growth report, there's an indication that Rayhoo Motor DiesLtd might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Rayhoo Motor DiesLtd.

Nayax (TASE:NYAX)

Overview: Nayax Ltd. is a fintech company that provides comprehensive solutions for automated self-service retailers and merchants globally, with a market cap of ₪5.94 billion.

Operations: Nayax Ltd. generates revenue through its comprehensive fintech solutions tailored for automated self-service retailers and merchants across the United States, Europe, the United Kingdom, Australia, Israel, and other global markets.

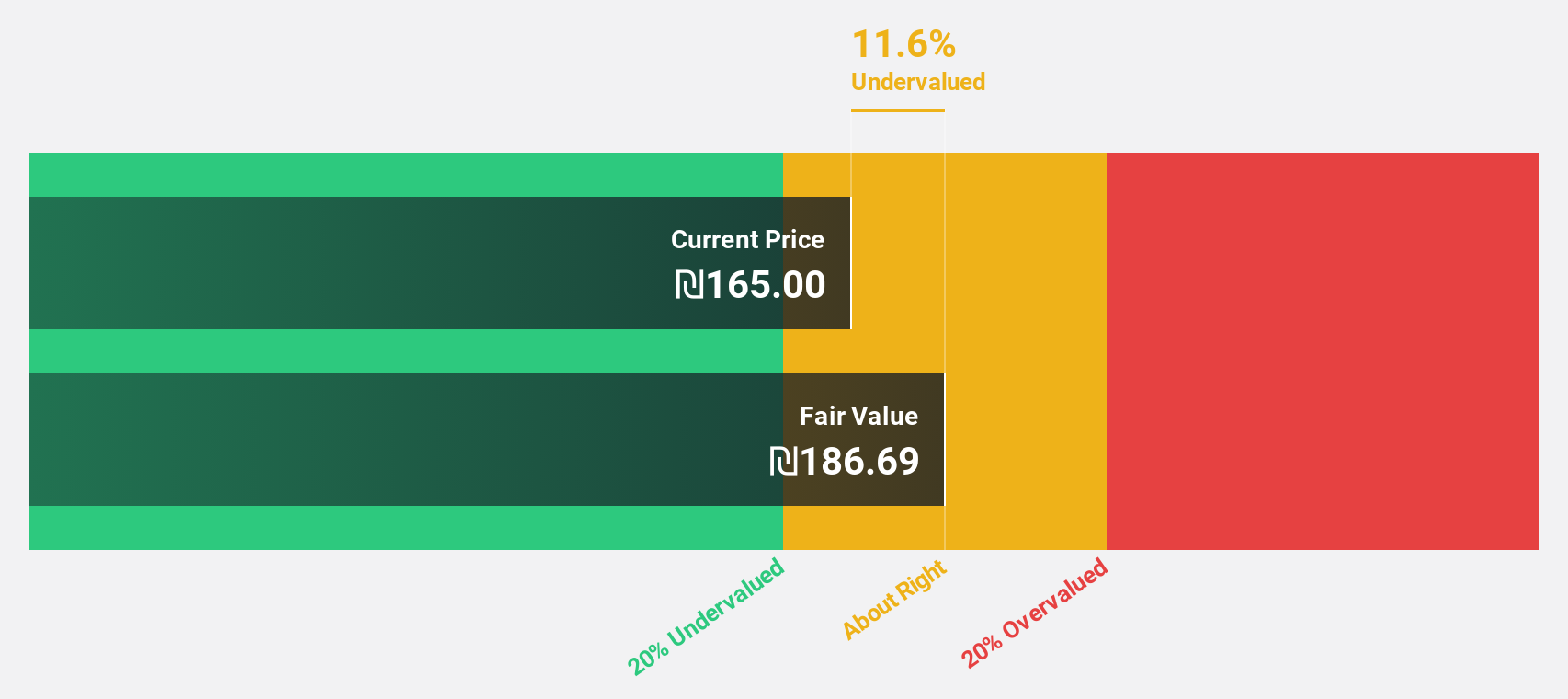

Estimated Discount To Fair Value: 13.8%

Nayax Ltd. trades at ₪160.8, below its fair value estimate of ₪186.51, indicating potential undervaluation based on cash flows. The company became profitable this year with earnings expected to grow significantly over the next three years, outpacing the Israeli market's growth rate. Recent strategic partnerships in EV charging and embedded payment technologies bolster its growth prospects, while first-quarter results showed a notable increase in sales and net income compared to last year.

- Insights from our recent growth report point to a promising forecast for Nayax's business outlook.

- Click to explore a detailed breakdown of our findings in Nayax's balance sheet health report.

Summing It All Up

- Access the full spectrum of 493 Undervalued Global Stocks Based On Cash Flows by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A007660

ISU Petasys

Manufactures and sells printed circuit boards (PCBs) worldwide.

Outstanding track record with high growth potential.

Similar Companies

Market Insights

Community Narratives