- Taiwan

- /

- Semiconductors

- /

- TWSE:3450

3 Global Stocks Estimated To Be Trading At A Discount Of Up To 48.6%

Reviewed by Simply Wall St

As global markets navigate a landscape marked by interest rate adjustments and trade developments, major U.S. stock indexes have reached record highs, buoyed by the Federal Reserve's recent decision to lower short-term interest rates. Amidst this economic climate, identifying undervalued stocks can be an appealing strategy for investors seeking opportunities; these stocks may offer potential value as market conditions continue to evolve.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Truecaller (OM:TRUE B) | SEK43.24 | SEK85.34 | 49.3% |

| Rheinmetall (XTRA:RHM) | €1928.00 | €3793.66 | 49.2% |

| Pansoft (SZSE:300996) | CN¥17.03 | CN¥33.77 | 49.6% |

| NexTone (TSE:7094) | ¥2249.00 | ¥4456.29 | 49.5% |

| Micro Systemation (OM:MSAB B) | SEK61.40 | SEK121.94 | 49.6% |

| Japan Data Science ConsortiumLtd (TSE:4418) | ¥970.00 | ¥1932.50 | 49.8% |

| Guangdong Marubi Biotechnology (SHSE:603983) | CN¥39.13 | CN¥77.81 | 49.7% |

| Gofore Oyj (HLSE:GOFORE) | €14.78 | €29.47 | 49.9% |

| Digital Workforce Services Oyj (HLSE:DWF) | €3.41 | €6.78 | 49.7% |

| ATON Green Storage (BIT:ATON) | €2.05 | €4.09 | 49.9% |

We'll examine a selection from our screener results.

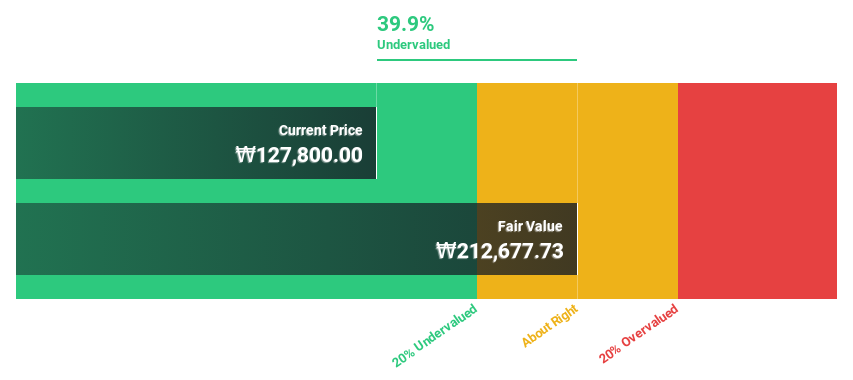

Yuhan (KOSE:A000100)

Overview: Yuhan Corporation manufactures and sells prescription drugs, over-the-counter drugs, veterinary drugs, and household goods in South Korea and internationally, with a market cap of ₩8.87 trillion.

Operations: The company's revenue is derived from biotechnology startups, contributing ₩2.17 billion.

Estimated Discount To Fair Value: 13.7%

Yuhan Corporation's recent earnings report shows a strong increase in net income, reaching KRW 45.53 billion for Q2 2025, up from KRW 32.06 billion a year ago. The company is trading at ₩123,000, below its estimated fair value of ₩142,492.94 and has initiated a share buyback program to enhance shareholder value. Despite lower profit margins compared to last year and one-off items affecting results, Yuhan's earnings are expected to grow significantly above market averages over the next three years.

- Our comprehensive growth report raises the possibility that Yuhan is poised for substantial financial growth.

- Click here to discover the nuances of Yuhan with our detailed financial health report.

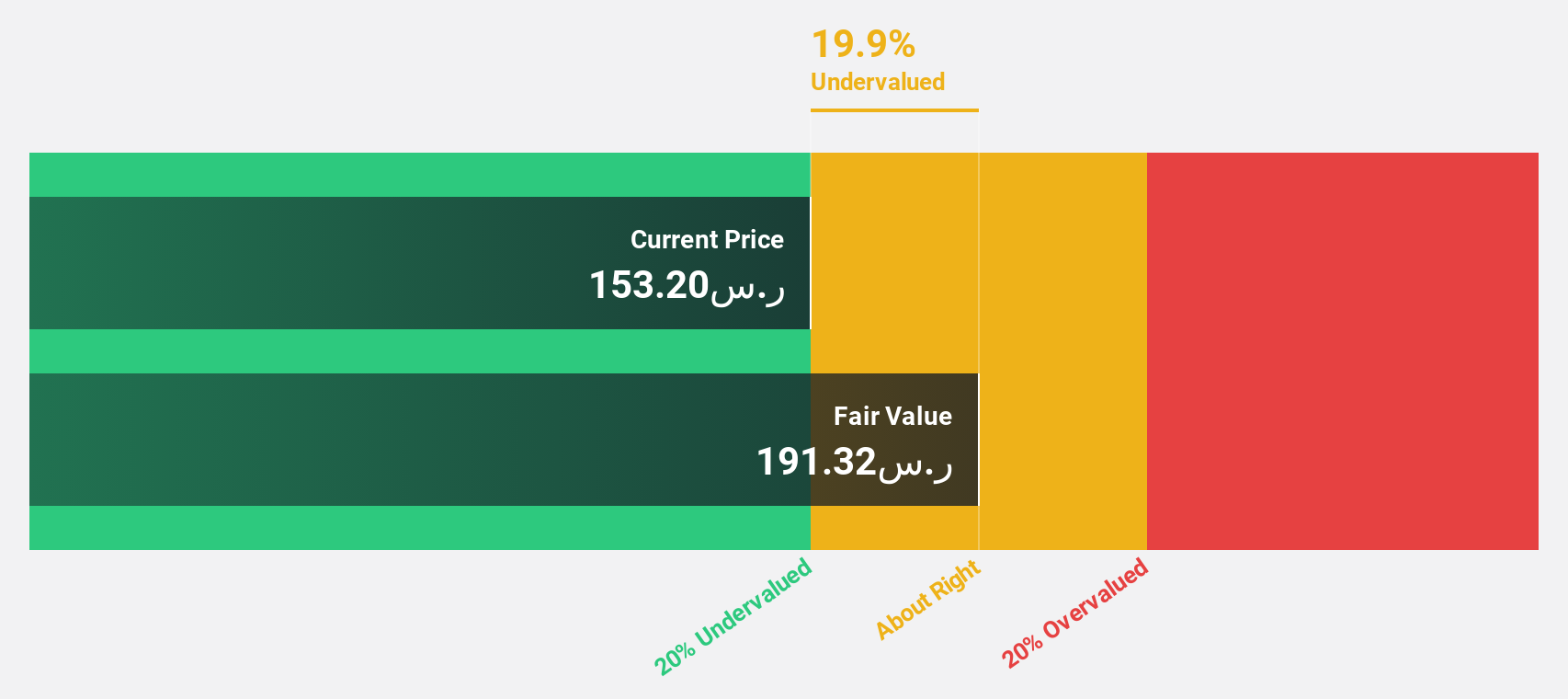

Alkhorayef Water and Power Technologies (SASE:2081)

Overview: Alkhorayef Water and Power Technologies Company, with a market cap of SAR4.76 billion, focuses on designing, constructing, operating, maintaining, and managing water and wastewater projects in Saudi Arabia.

Operations: The company's revenue segments consist of SAR991.60 million from water, SAR1.03 billion from wastewater, and SAR320.92 million from integrated water solutions.

Estimated Discount To Fair Value: 28.3%

Alkhorayef Water and Power Technologies is trading at SAR137.2, significantly below its estimated fair value of SAR191.32, indicating it is undervalued based on cash flows. Despite high non-cash earnings, the company's revenue growth forecast of 7.8% annually surpasses the SA market average and earnings are expected to grow 19% per year. Recent contract wins in Al-Kharj Governorate could boost future cash flows, although current debt coverage by operating cash flow remains a concern.

- Insights from our recent growth report point to a promising forecast for Alkhorayef Water and Power Technologies' business outlook.

- Get an in-depth perspective on Alkhorayef Water and Power Technologies' balance sheet by reading our health report here.

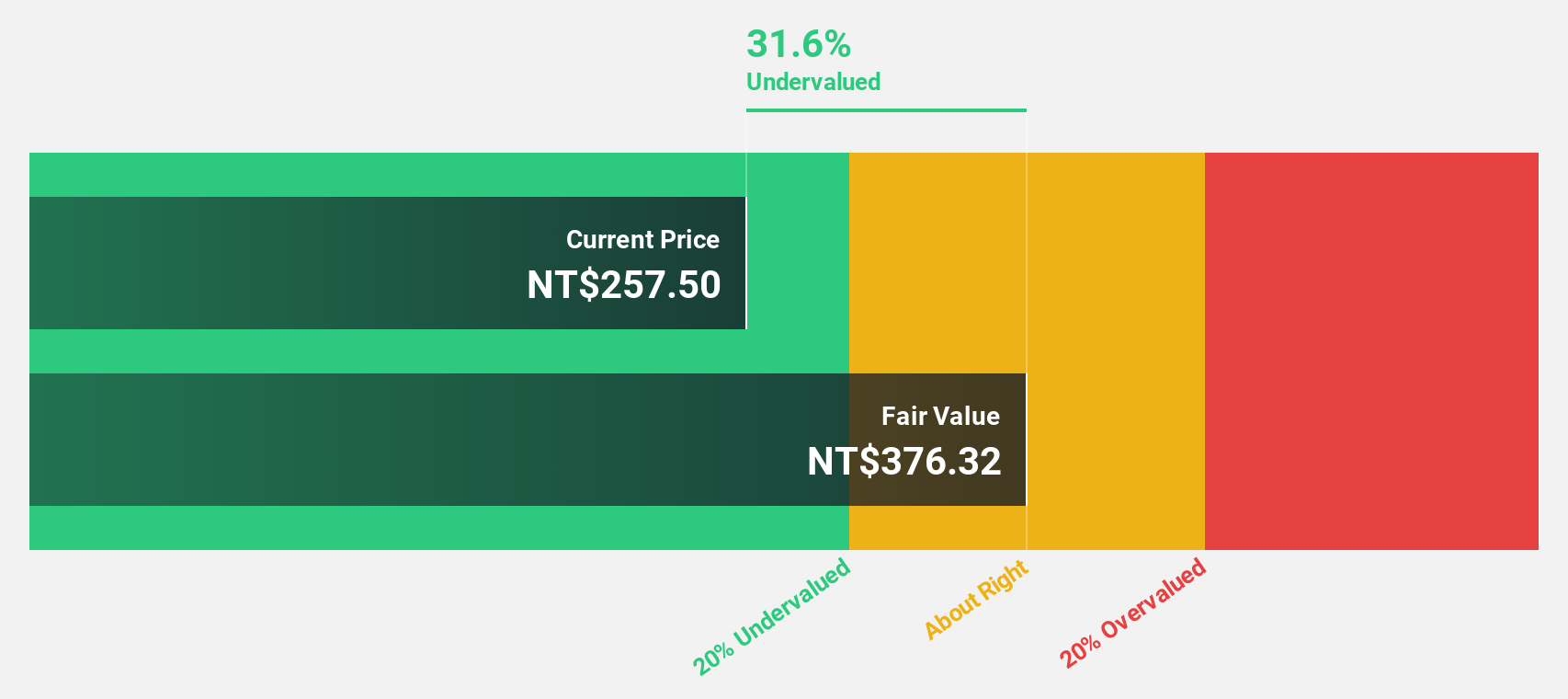

Elite Advanced Laser (TWSE:3450)

Overview: Elite Advanced Laser Corporation offers electronic manufacturing services in Taiwan and has a market cap of NT$36.20 billion.

Operations: The company's revenue is derived from three main segments: Photoelectric (NT$1.44 billion), Silicon Photonics (NT$3.01 billion), and Semiconductor (NT$5.02 billion).

Estimated Discount To Fair Value: 48.6%

Elite Advanced Laser is trading at NT$259, significantly below its estimated fair value of NT$504, highlighting its undervaluation based on cash flows. The company reported substantial earnings growth of 849.8% over the past year, with future earnings expected to grow at 38% annually, outpacing the Taiwan market average. Despite this strong financial performance and growth outlook, its share price has been highly volatile recently.

- Upon reviewing our latest growth report, Elite Advanced Laser's projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of Elite Advanced Laser.

Where To Now?

- Discover the full array of 511 Undervalued Global Stocks Based On Cash Flows right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elite Advanced Laser might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3450

Elite Advanced Laser

Provides electronic manufacturing services in Taiwan.

Outstanding track record with high growth potential.

Similar Companies

Market Insights

Community Narratives