Global markets have recently experienced a surge, with the S&P 500 and Nasdaq Composite reaching all-time highs, driven by easing geopolitical tensions and optimistic trade developments. For investors looking beyond established giants, penny stocks—often representing smaller or emerging companies—continue to hold potential despite being considered somewhat outdated. This article explores three penny stocks that stand out due to their robust financials and growth potential, offering intriguing opportunities for those willing to explore beyond the mainstream.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.46 | A$110.39M | ✅ 4 ⚠️ 2 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.29 | HK$813.93M | ✅ 4 ⚠️ 1 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.435 | £498.13M | ✅ 4 ⚠️ 0 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.42 | SGD170.22M | ✅ 4 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.22 | SGD8.74B | ✅ 5 ⚠️ 0 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.455 | SEK2.35B | ✅ 4 ⚠️ 1 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ✅ 5 ⚠️ 0 View Analysis > |

| AWC Berhad (KLSE:AWC) | MYR0.575 | MYR192.8M | ✅ 5 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.825 | £11.36M | ✅ 4 ⚠️ 3 View Analysis > |

Click here to see the full list of 3,876 stocks from our Global Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Skellerup Holdings (NZSE:SKL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Skellerup Holdings Limited designs, manufactures, and distributes engineered products for industrial and agricultural applications, with a market cap of NZ$923.50 million.

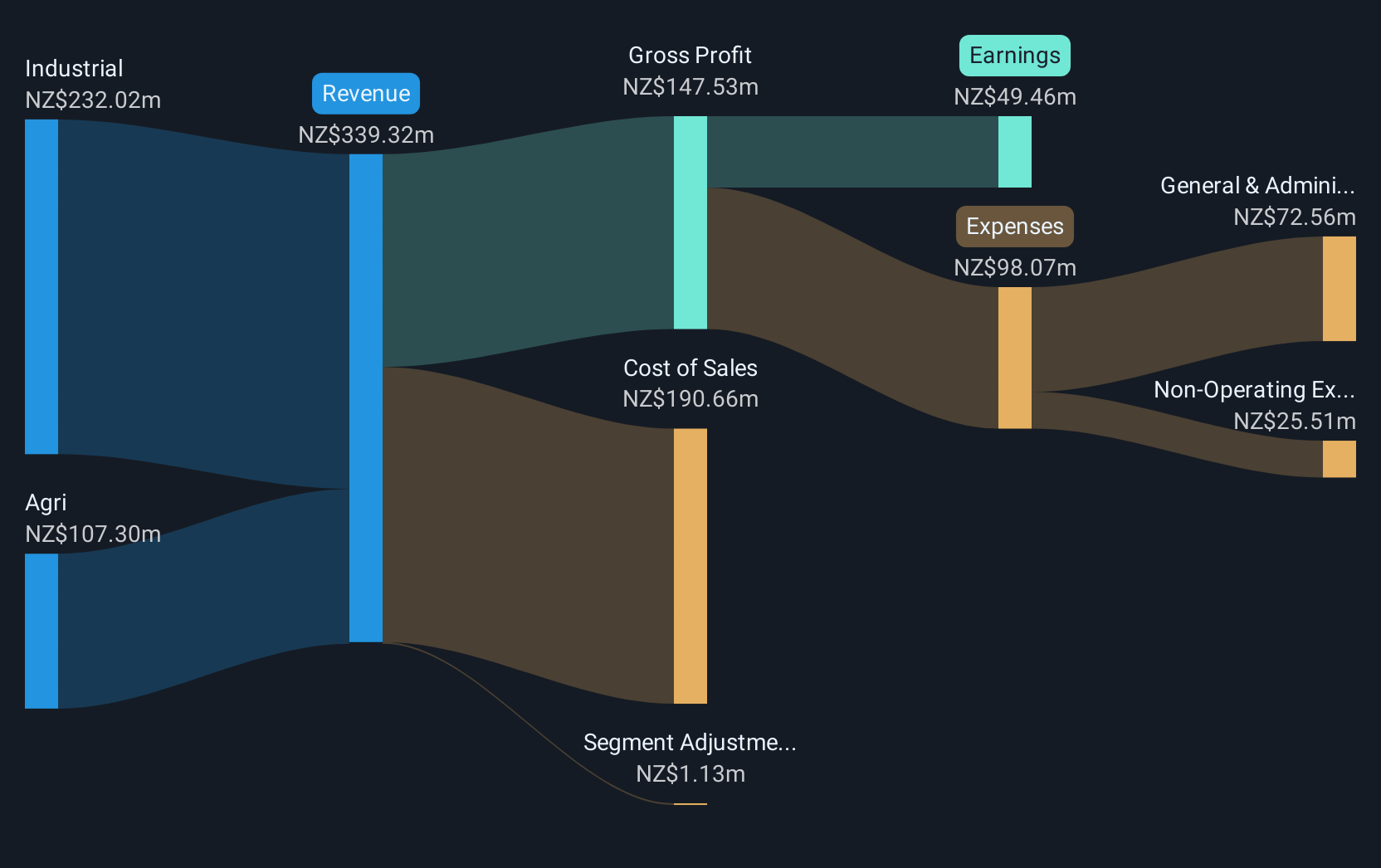

Operations: The company's revenue is derived from two primary segments: Agri, contributing NZ$107.30 million, and Industrial, generating NZ$232.02 million.

Market Cap: NZ$923.5M

Skellerup Holdings, with a market cap of NZ$923.50 million, shows financial stability through its strong asset coverage over liabilities and high-quality earnings. Despite negative earnings growth last year, the company has maintained a robust Return on Equity at 21.8% and reduced its debt-to-equity ratio from 27.3% to 17.2% over five years, indicating effective debt management. Its interest payments are well-covered by EBIT (20x), and operating cash flow covers debt comfortably (170.7%). However, the dividend yield of 4.85% is not well covered by earnings, suggesting caution for income-focused investors despite trading below estimated fair value by 21.2%.

- Unlock comprehensive insights into our analysis of Skellerup Holdings stock in this financial health report.

- Assess Skellerup Holdings' future earnings estimates with our detailed growth reports.

Frencken Group (SGX:E28)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Frencken Group Limited is an investment holding company that offers original design, original equipment, and diversified integrated manufacturing solutions globally, with a market cap of SGD529.59 million.

Operations: The company's revenue is primarily derived from its Mechatronics segment, which generated SGD706.09 million, followed by the Integrated Manufacturing Services (IMS) segment with SGD85.68 million, and Investment Holding & Management Services contributing SGD11.53 million.

Market Cap: SGD529.59M

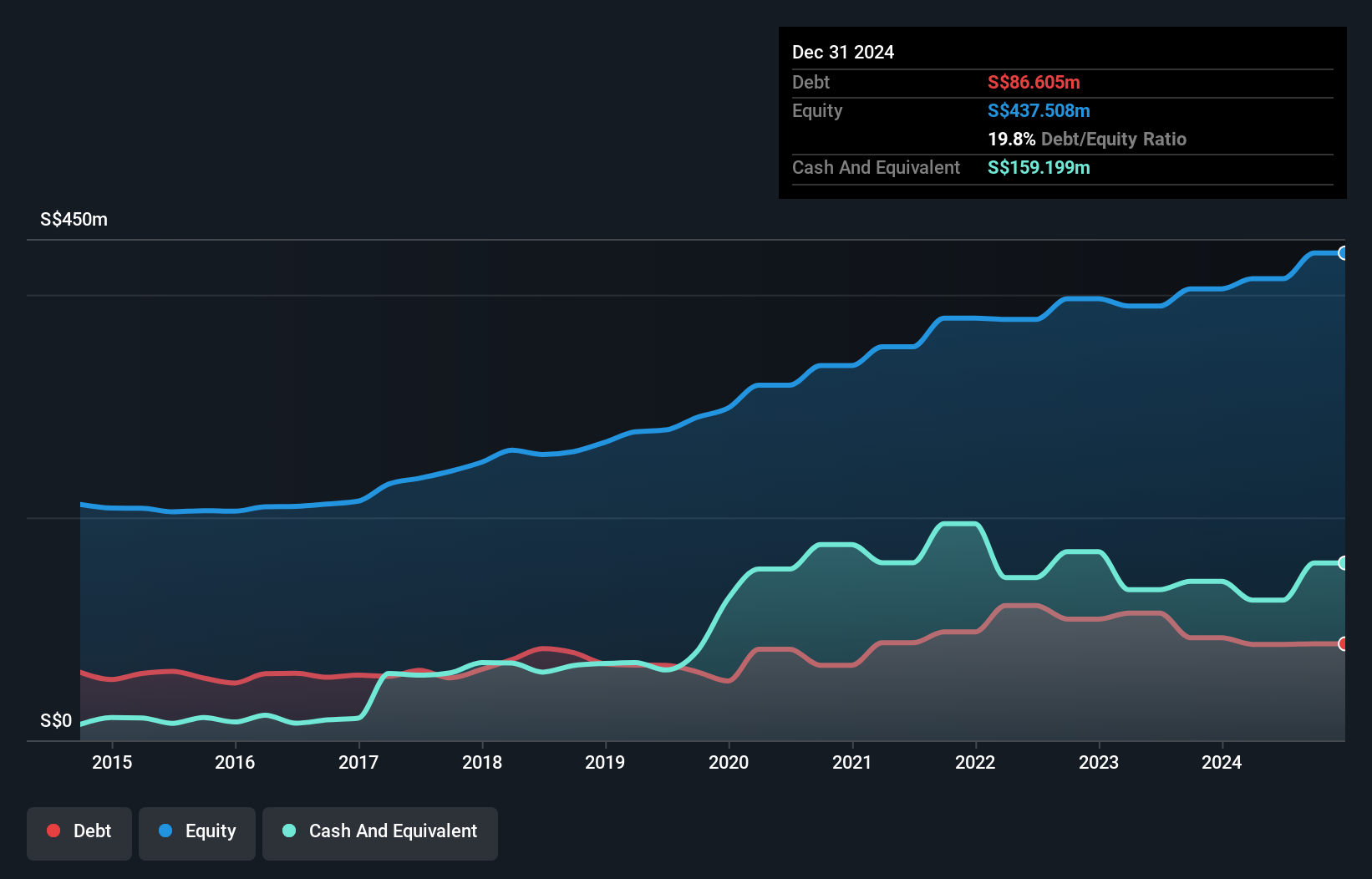

Frencken Group, with a market cap of SGD529.59 million, demonstrates financial resilience through its asset coverage over liabilities and cash exceeding total debt. While earnings have declined by 4.9% annually over the past five years, recent growth of 14.3% suggests potential recovery. The company's net profit margin improved to 4.7%, and its interest payments are well-covered by EBIT at an 8x ratio, indicating manageable debt levels supported by operating cash flow covering 55.5% of debt obligations. Despite trading at a significant discount to estimated fair value, its Return on Equity remains low at 8.4%.

- Jump into the full analysis health report here for a deeper understanding of Frencken Group.

- Gain insights into Frencken Group's outlook and expected performance with our report on the company's earnings estimates.

Jiangsu Wuyang Automation Control Technology (SZSE:300420)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Jiangsu Wuyang Automation Control Technology Co., Ltd. (SZSE:300420) operates in the automation control industry with a market cap of CN¥3.80 billion.

Operations: The company's revenue is primarily derived from the Chinese market, amounting to CN¥992.76 million.

Market Cap: CN¥3.8B

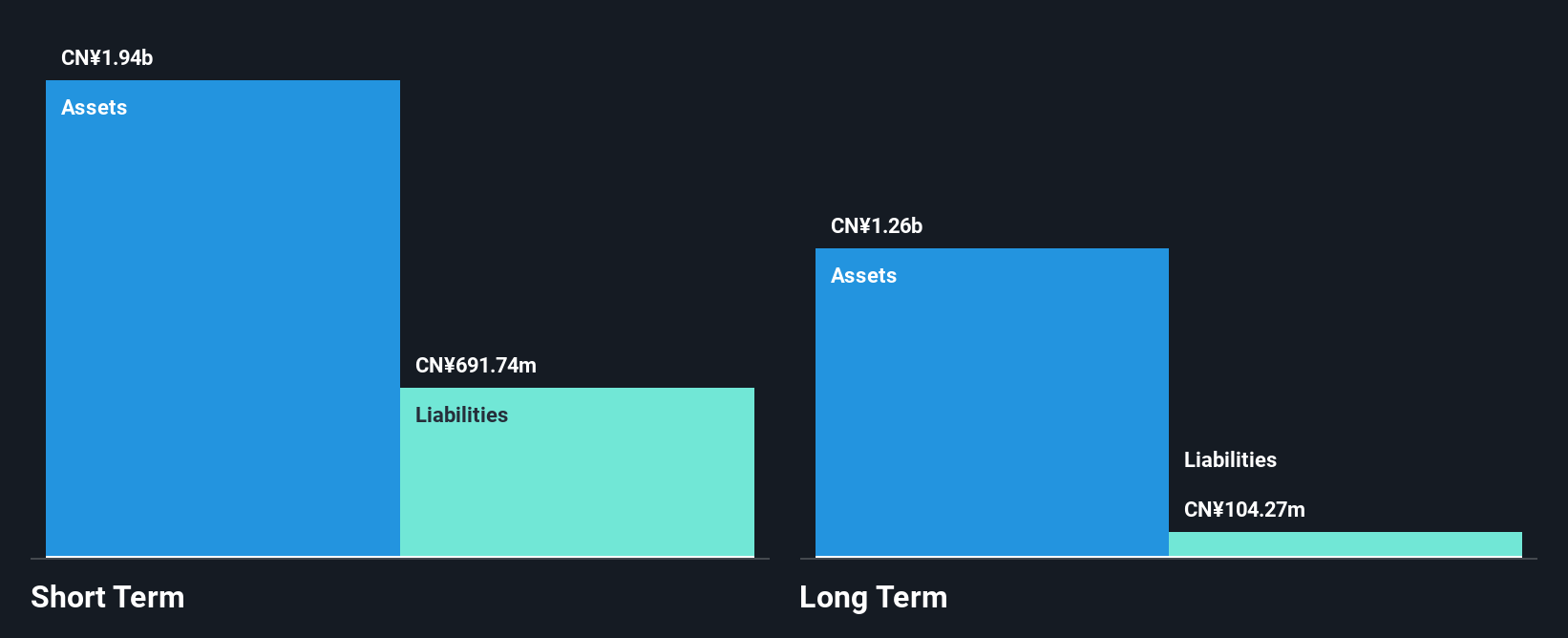

Jiangsu Wuyang Automation Control Technology, with a market cap of CN¥3.80 billion, faces challenges due to its unprofitability and declining earnings over the past five years. Despite reporting a net income increase in Q1 2025, the company experienced a significant net loss in 2024. Positively, it maintains more cash than debt and covers short-term liabilities with assets totaling CN¥1.9 billion. The management team is experienced with an average tenure of 6.3 years; however, board experience is limited at 2.6 years on average, indicating recent changes that may impact strategic direction.

- Click here and access our complete financial health analysis report to understand the dynamics of Jiangsu Wuyang Automation Control Technology.

- Examine Jiangsu Wuyang Automation Control Technology's past performance report to understand how it has performed in prior years.

Where To Now?

- Reveal the 3,876 hidden gems among our Global Penny Stocks screener with a single click here.

- Ready For A Different Approach? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:E28

Frencken Group

An investment holding company, provides original design, original equipment, and diversified integrated manufacturing solutions worldwide.

Excellent balance sheet and good value.

Market Insights

Community Narratives