3 Global Penny Stocks To Watch With Market Caps Under US$700M

Reviewed by Simply Wall St

Global markets have been buoyed by optimism surrounding potential interest rate cuts and advancements in artificial intelligence, with major indices like the Dow Jones, S&P 500, and Nasdaq reaching new record highs. In this context of heightened investor enthusiasm, penny stocks—often smaller or newer companies—remain a compelling area for exploration due to their unique potential for growth. Despite being an older term, penny stocks continue to represent opportunities for investors seeking hidden value in companies with strong financial foundations and promising prospects.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.64 | HK$989.63M | ✅ 4 ⚠️ 1 View Analysis > |

| IVE Group (ASX:IGL) | A$2.60 | A$419.04M | ✅ 4 ⚠️ 3 View Analysis > |

| HSS Engineers Berhad (KLSE:HSSEB) | MYR0.575 | MYR292.38M | ✅ 4 ⚠️ 3 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.55 | HK$2.12B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Deleum Berhad (KLSE:DELEUM) | MYR1.40 | MYR562.17M | ✅ 5 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.19 | SGD12.55B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.56 | $325.54M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.225 | £195.02M | ✅ 4 ⚠️ 3 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.918 | €30.96M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 3,737 stocks from our Global Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

XJ International Holdings (SEHK:1765)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: XJ International Holdings Co., Ltd. is an investment holding company that provides higher education and secondary vocational education services in China and Malaysia, with a market capitalization of approximately HK$1.79 billion.

Operations: XJ International Holdings generates revenue from its Domestic Education segment, amounting to CN¥3.35 billion, and its Global Education segment, contributing CN¥494.83 million.

Market Cap: HK$1.79B

XJ International Holdings has demonstrated significant earnings growth, with a remarkable increase of over 10,000% in the past year, contrasting with its five-year average growth of 5.6% annually. Despite this impressive performance, the company's short-term assets (CN¥2.6 billion) fall short of covering both its short-term (CN¥8.2 billion) and long-term liabilities (CN¥3 billion). The recent appointment of Ms. Wang Xiu and Mr. Zhang Jin to the Nomination and Remuneration Committee could signal strategic shifts following their withdrawn HKD 205 million equity offering, reflecting ongoing financial restructuring efforts amidst market volatility.

- Navigate through the intricacies of XJ International Holdings with our comprehensive balance sheet health report here.

- Gain insights into XJ International Holdings' past trends and performance with our report on the company's historical track record.

Youzan Technology (SEHK:8083)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Youzan Technology Limited is an investment holding company offering online and offline e-commerce solutions in China, Japan, and Canada, with a market cap of HK$5.07 billion.

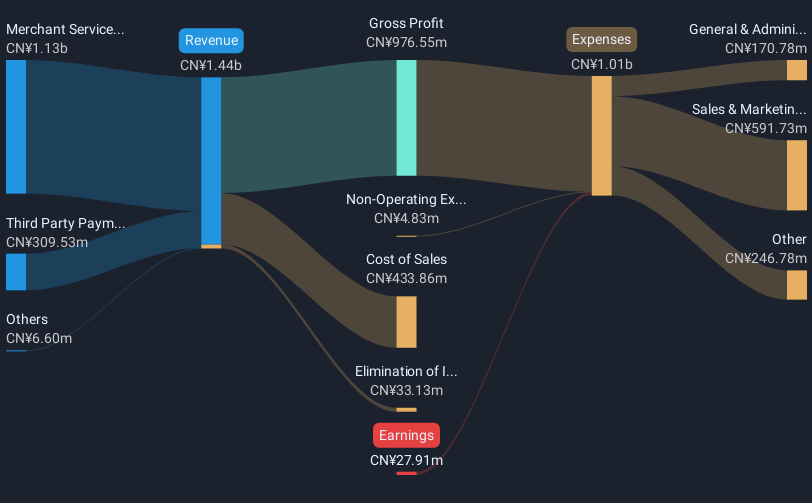

Operations: The company's revenue segments include Japan, contributing CN¥0.61 million, and a segment adjustment of CN¥1.47 billion.

Market Cap: HK$5.07B

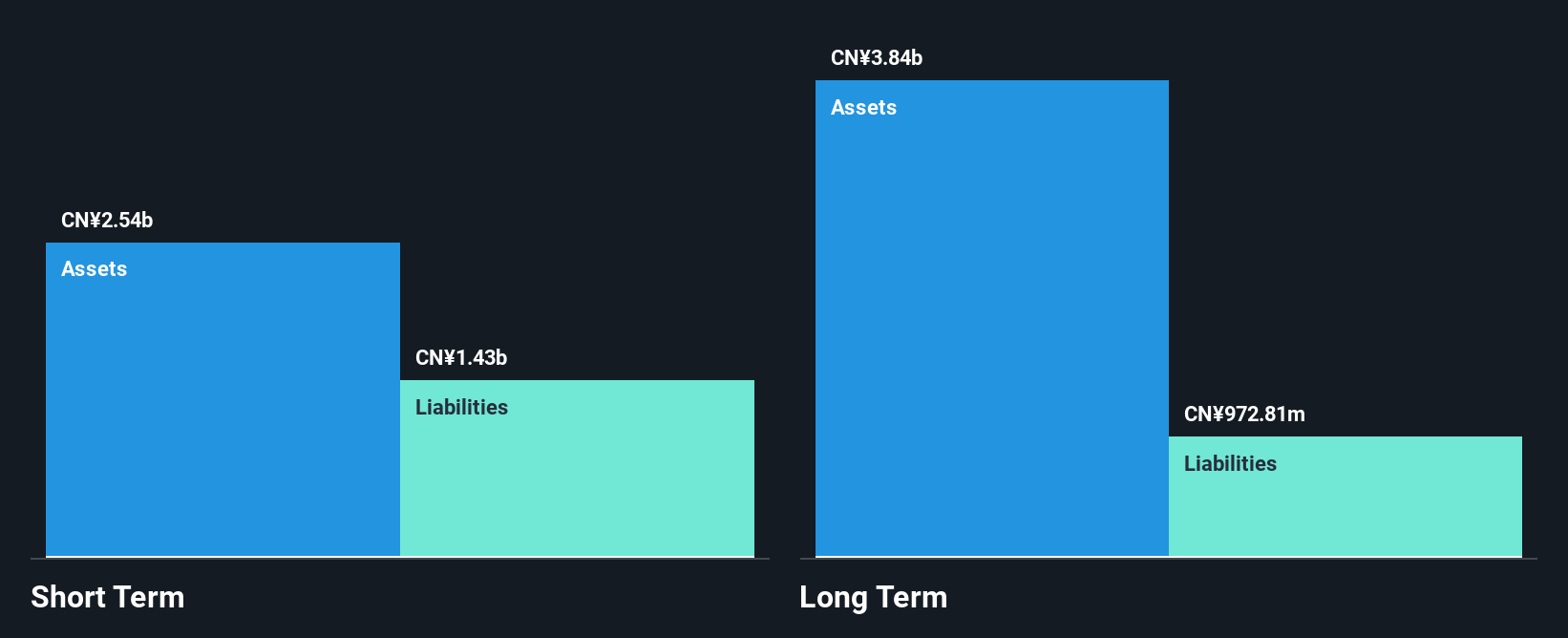

Youzan Technology has shown a turnaround to profitability with net income reaching CN¥72.74 million for H1 2025, driven by increased revenue and operational efficiency. The company completed a share buyback, repurchasing 34.2 million shares for HK$3.19 million, indicating confidence in its valuation. Despite being unprofitable historically, Youzan's short-term assets of CN¥4.7 billion comfortably cover both short- and long-term liabilities, and it maintains more cash than debt. With a seasoned board and management team, the company is positioned for potential growth as earnings are forecasted to rise significantly in the coming years.

- Click here to discover the nuances of Youzan Technology with our detailed analytical financial health report.

- Understand Youzan Technology's earnings outlook by examining our growth report.

Yiwu Huading NylonLtd (SHSE:601113)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Yiwu Huading Nylon Co., Ltd. focuses on the research, development, manufacture, and sale of nylon filaments mainly in China, with a market cap of CN¥4.28 billion.

Operations: Yiwu Huading Nylon Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥4.28B

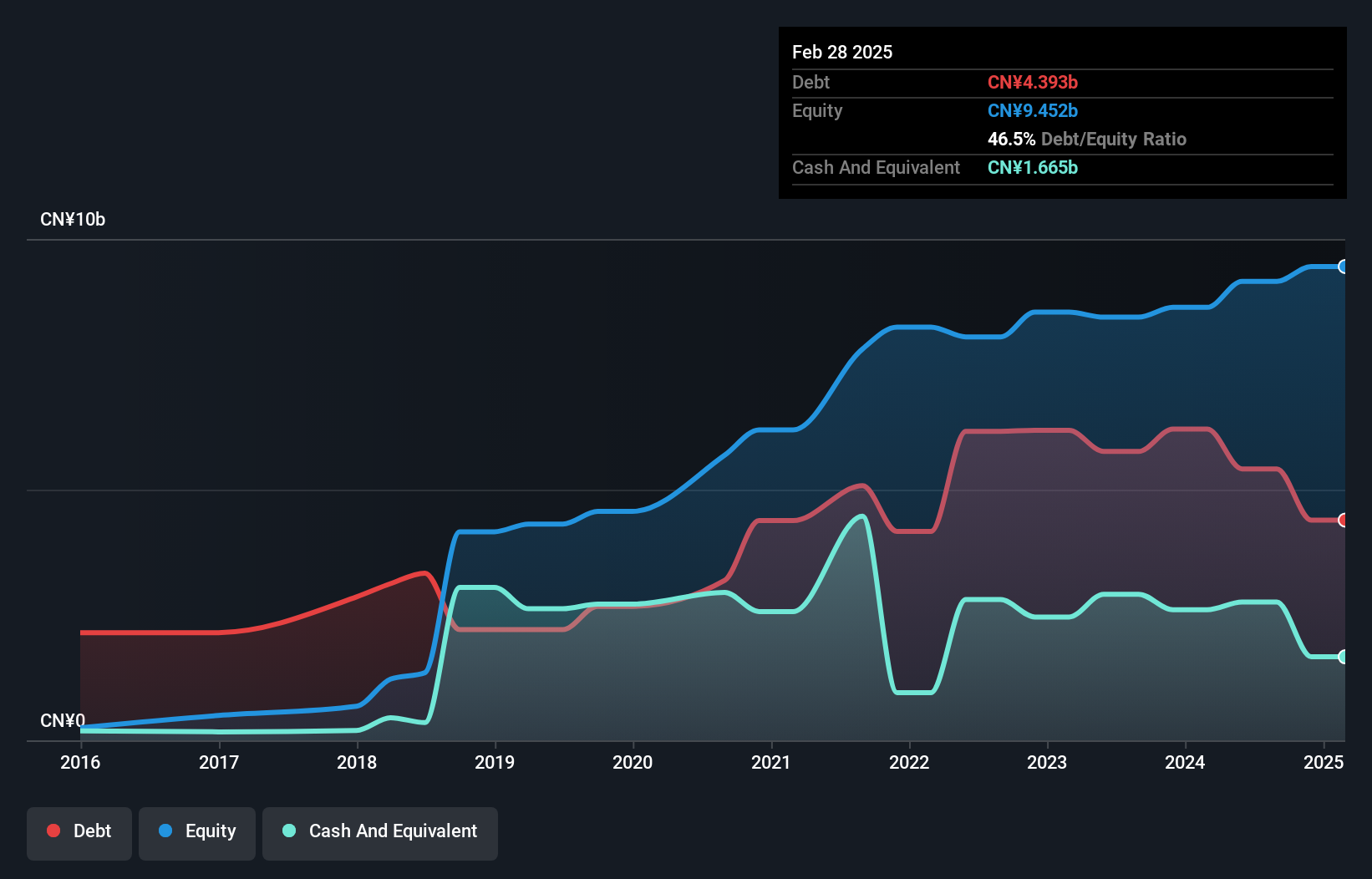

Yiwu Huading Nylon Co., Ltd. has demonstrated financial resilience despite a decline in revenue and sales for the first half of 2025 compared to the previous year. The company maintains strong liquidity, with short-term assets of CN¥2.4 billion exceeding both its short- and long-term liabilities, and it holds more cash than total debt. Earnings growth has been robust, increasing by over 100% in the past year, surpassing industry averages. With a stable price-to-earnings ratio of 9.8x below market levels and no significant shareholder dilution recently, Yiwu Huading presents a compelling case for value-oriented investors seeking exposure to this segment.

- Jump into the full analysis health report here for a deeper understanding of Yiwu Huading NylonLtd.

- Gain insights into Yiwu Huading NylonLtd's future direction by reviewing our growth report.

Key Takeaways

- Click through to start exploring the rest of the 3,734 Global Penny Stocks now.

- Ready For A Different Approach? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601113

Yiwu Huading NylonLtd

Engages in the research, development, manufacture, and sale of nylon filaments primarily in China.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives