Amid escalating geopolitical tensions in the Middle East and mixed economic signals, global markets have experienced significant volatility, with U.S. stocks reversing early gains and European indexes seeing declines. In such uncertain times, dividend stocks can offer a measure of stability and income potential for investors seeking to navigate these turbulent waters.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.61% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.30% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 4.19% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.29% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.51% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.65% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.41% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.94% | ★★★★★★ |

| Asian Terminals (PSE:ATI) | 6.28% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.62% | ★★★★★★ |

Click here to see the full list of 1584 stocks from our Top Global Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

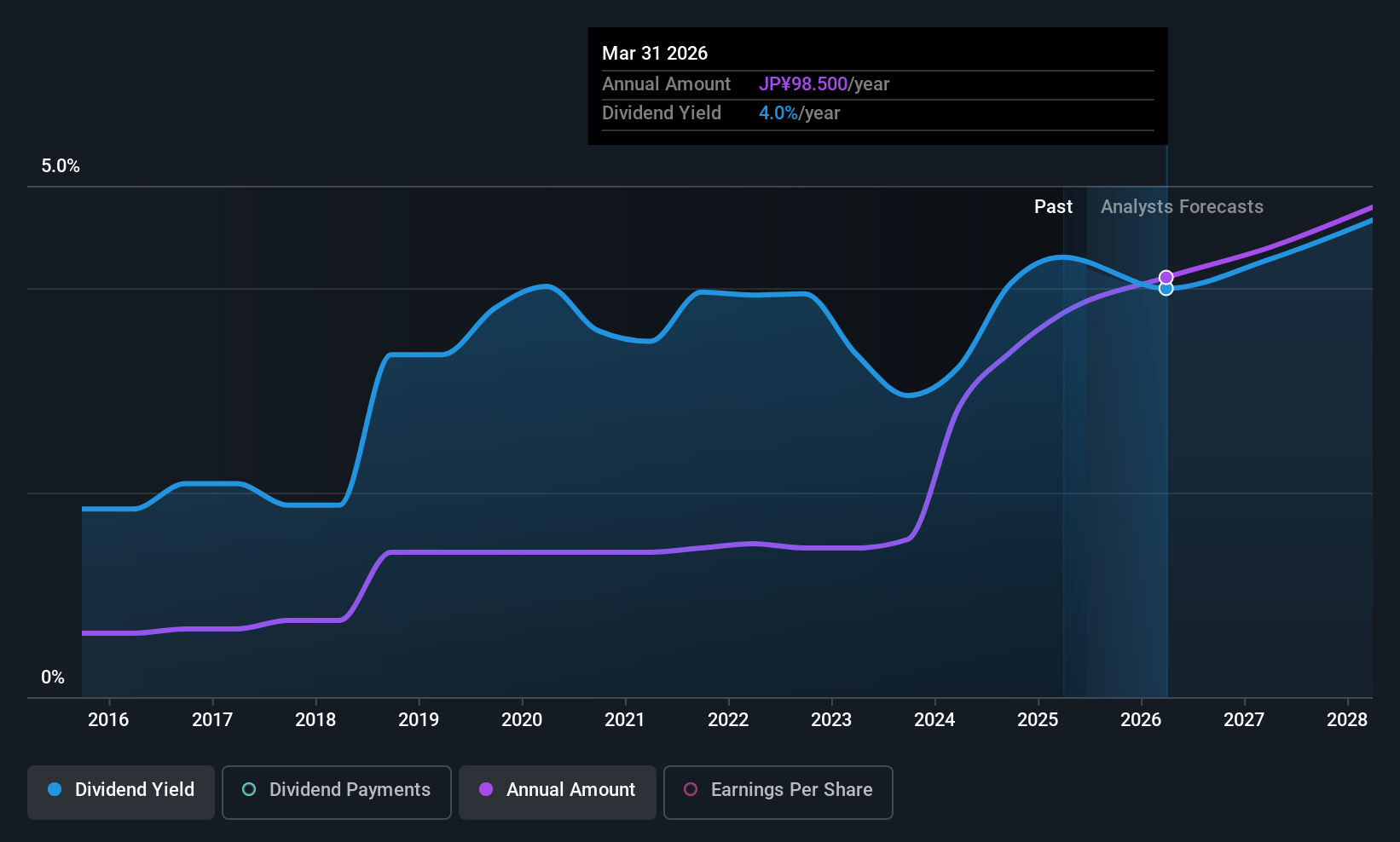

Chugoku Marine Paints (TSE:4617)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Chugoku Marine Paints, Ltd. is a company that produces and sells functional coatings globally, with a market cap of ¥114.92 billion.

Operations: Chugoku Marine Paints, Ltd. generates its revenue from several regions, including China (¥31.55 billion), Japan (¥49.85 billion), South Korea (¥21.99 billion), Southeast Asia (¥24.97 billion), and Europe and the United States of America (¥30.05 billion).

Dividend Yield: 3.8%

Chugoku Marine Paints offers a stable dividend profile with a payout ratio of 35%, ensuring dividends are well covered by earnings and cash flows. Despite recent guidance indicating a decrease to JPY 49 per share for FY2026, dividends have been reliable over the past decade, showing consistent growth. Trading at a discount compared to its fair value and peers, it presents good relative value. However, its current yield of 3.85% is below the top tier in Japan's market.

- Delve into the full analysis dividend report here for a deeper understanding of Chugoku Marine Paints.

- The analysis detailed in our Chugoku Marine Paints valuation report hints at an deflated share price compared to its estimated value.

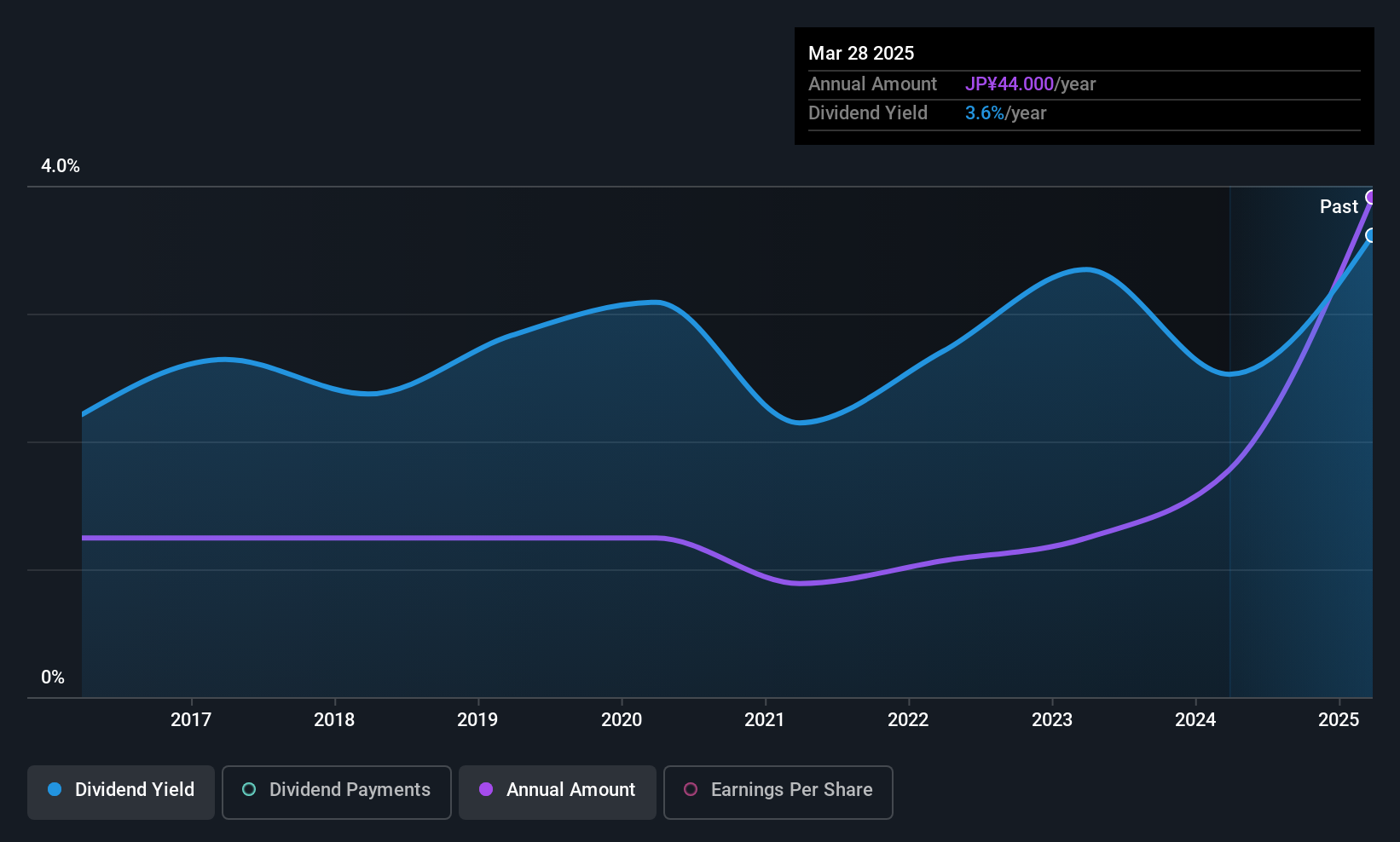

Koike Sanso KogyoLtd (TSE:6137)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koike Sanso Kogyo Co., Ltd. develops, manufactures, and sells gases, welding and cutting machines and systems for industries processing steel plates, aluminum, and stainless steel globally with a market cap of ¥25.74 billion.

Operations: Koike Sanso Kogyo Co., Ltd.'s revenue is primarily derived from its Machinery and Equipment segment at ¥25.89 billion, followed by High-Pressure Gas at ¥20.40 billion, and Welding Equipment at ¥8.16 billion.

Dividend Yield: 3.7%

Koike Sanso Kogyo Ltd.'s dividend payments are well supported by earnings and cash flows, with a payout ratio of 30.2% and a cash payout ratio of 44.4%. Despite an 18.9% earnings growth last year, its dividend history is marked by volatility over the past decade. The stock's price-to-earnings ratio of 7.5x suggests it is undervalued relative to the JP market average, though its current yield of 3.69% lags behind top-tier Japanese dividend payers.

- Get an in-depth perspective on Koike Sanso KogyoLtd's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Koike Sanso KogyoLtd is priced higher than what may be justified by its financials.

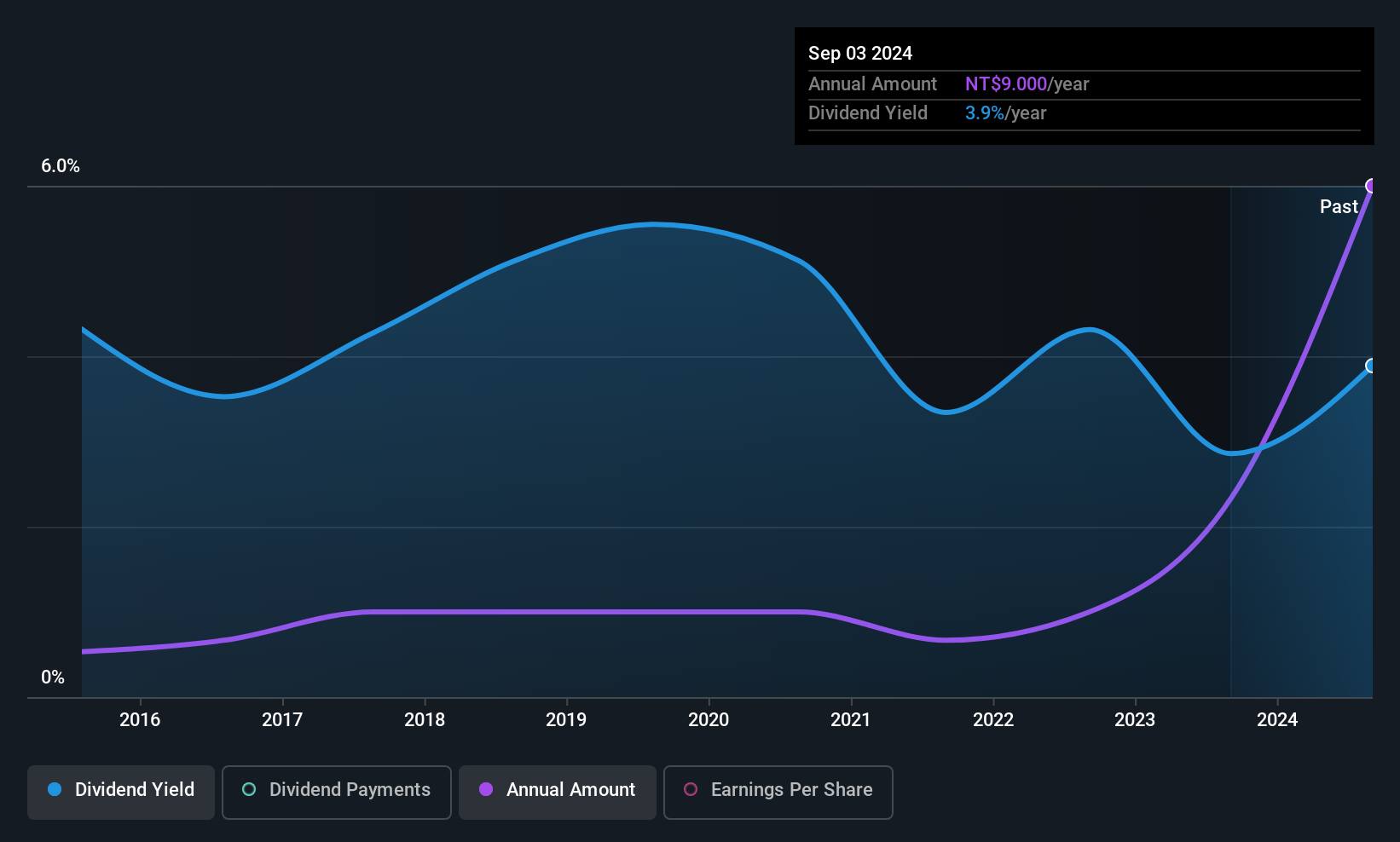

L&K Engineering (TWSE:6139)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: L&K Engineering Co., Ltd. offers turnkey engineering services in Taiwan, Hong Kong, and internationally, with a market cap of NT$62.33 billion.

Operations: L&K Engineering Co., Ltd.'s revenue segments include NT$22.75 billion from L1 Company, NT$17.21 billion from L2 Company, and NT$19.92 billion from The Company.

Dividend Yield: 4.8%

L&K Engineering's dividend payments are supported by earnings and cash flows, with a payout ratio of 76.1% and a cash payout ratio of 31.8%. Despite recent earnings growth, the dividend history has been volatile over the past decade. The stock trades at 70.6% below its estimated fair value, yet its yield of 4.76% is lower than top-tier Taiwanese dividend payers. A recent TWD 6.63 billion contract may influence future prospects positively.

- Dive into the specifics of L&K Engineering here with our thorough dividend report.

- The valuation report we've compiled suggests that L&K Engineering's current price could be quite moderate.

Key Takeaways

- Reveal the 1584 hidden gems among our Top Global Dividend Stocks screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4617

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives