As global markets experience a rally with the S&P 500 and Nasdaq Composite reaching all-time highs, investors are closely watching inflationary trends and economic indicators that suggest a mixed outlook. In this environment, dividend stocks can offer a compelling opportunity for those seeking income stability, as they provide regular payouts that can help offset market volatility.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.43% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 4.07% | ★★★★★★ |

| NCD (TSE:4783) | 4.21% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.31% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.41% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.64% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.42% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.38% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.72% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.52% | ★★★★★★ |

Click here to see the full list of 1544 stocks from our Top Global Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Bros Eastern.Ltd (SHSE:601339)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bros Eastern., Ltd is involved in the research, development, production, and sale of dyed mélange and color-spun yarns with a market capitalization of CN¥7.11 billion.

Operations: Bros Eastern., Ltd generates its revenue primarily from the research, development, production, and sale of dyed mélange and color-spun yarns.

Dividend Yield: 5%

Bros Eastern Ltd's dividend payments are covered by earnings and cash flows, with payout ratios of 76.4% and 84.5%, respectively. Despite a high dividend yield in the top 25% of the CN market, its dividends have been unstable over the past decade, showing volatility and unreliability. Recent earnings reports indicate net income growth to CNY 173.47 million for Q1 2025, although annual figures showed a decline compared to the previous year.

- Navigate through the intricacies of Bros Eastern.Ltd with our comprehensive dividend report here.

- Our expertly prepared valuation report Bros Eastern.Ltd implies its share price may be lower than expected.

Tibet Weixinkang Medicine (SHSE:603676)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tibet Weixinkang Medicine Co., Ltd. focuses on the research, development, production, and sale of chemical drugs and their bulk drugs in China, with a market cap of CN¥4.53 billion.

Operations: Tibet Weixinkang Medicine Co., Ltd. generates its revenue primarily from the pharmaceutical industry, amounting to CN¥1.28 billion.

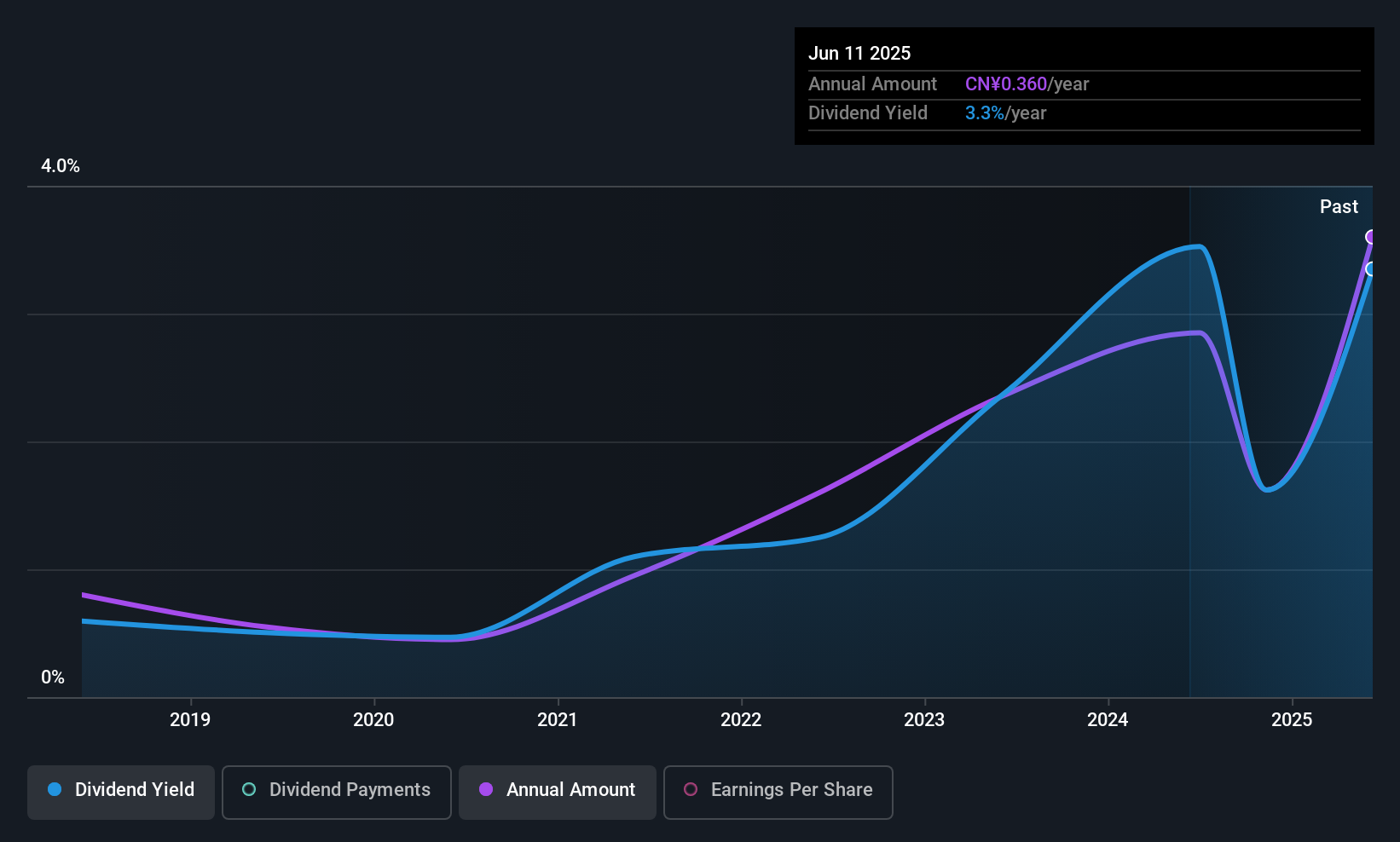

Dividend Yield: 3.1%

Tibet Weixinkang Medicine's dividends are supported by earnings and cash flows, with payout ratios of 62.3% and 64.3%, respectively, placing its yield in the top 25% of CN market payers. However, its dividend history is marked by volatility over seven years, indicating unreliability despite recent growth in payments. The company's Q1 2025 earnings showed a decline with net income at CNY 84.54 million compared to CNY 94.91 million a year earlier.

- Dive into the specifics of Tibet Weixinkang Medicine here with our thorough dividend report.

- Our valuation report unveils the possibility Tibet Weixinkang Medicine's shares may be trading at a discount.

Zhejiang Jolly PharmaceuticalLTD (SZSE:300181)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zhejiang Jolly Pharmaceutical Co., LTD focuses on the research, production, and marketing of Chinese medicinal products both domestically and internationally, with a market cap of CN¥12.12 billion.

Operations: Zhejiang Jolly Pharmaceutical Co., LTD generates its revenue through the research, production, and marketing of Chinese medicinal products in both domestic and international markets.

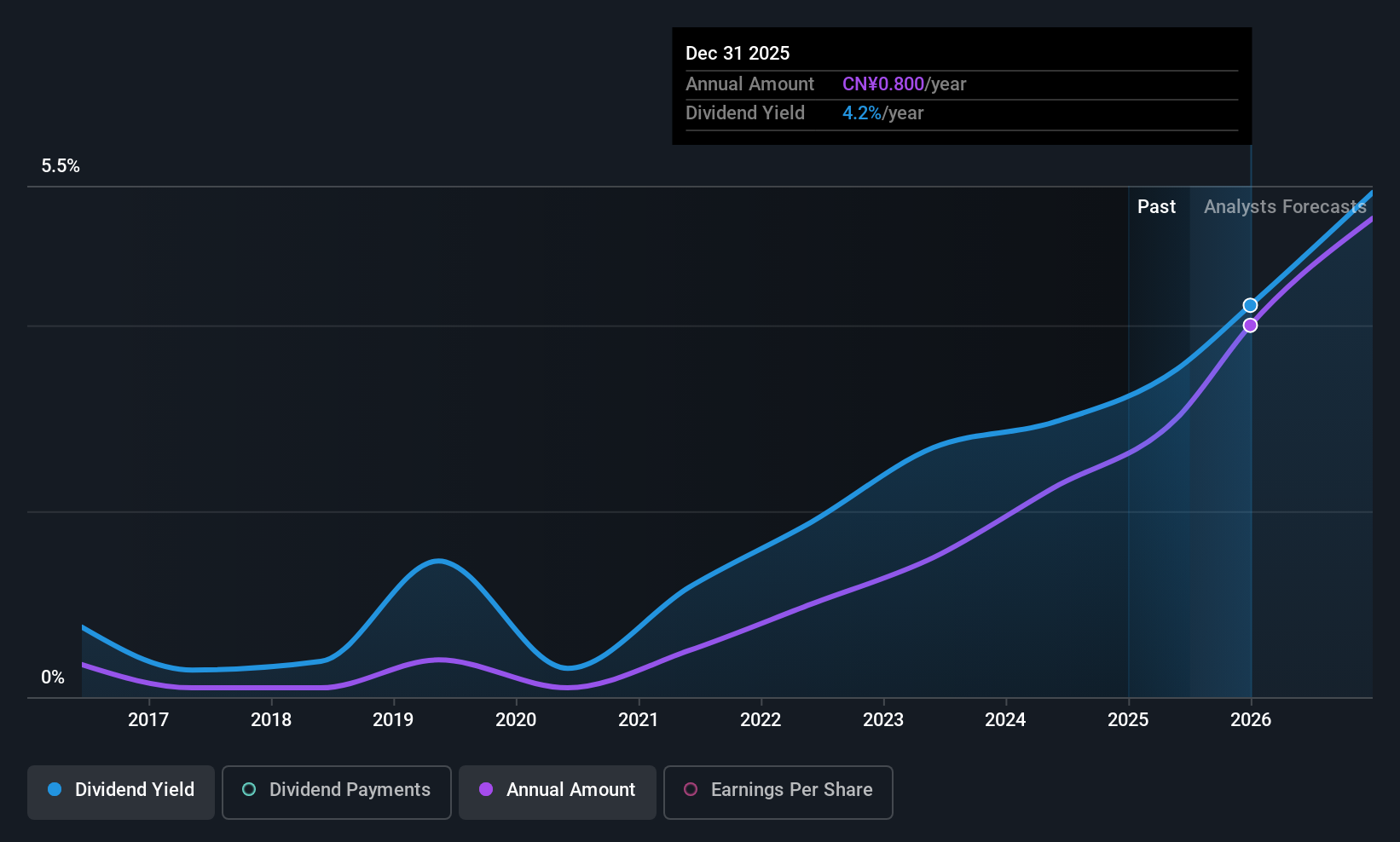

Dividend Yield: 3.2%

Zhejiang Jolly Pharmaceutical's dividend yield of 3.18% ranks in the top 25% of CN market payers, but its sustainability is questionable due to lack of free cash flow coverage and a high payout ratio of 76.4%. Despite recent increases in dividend payments, the company's history shows volatility over the past decade. Earnings have grown significantly, with Q1 2025 net income reaching CNY 181.15 million, yet non-cash earnings raise concerns about quality.

- Click to explore a detailed breakdown of our findings in Zhejiang Jolly PharmaceuticalLTD's dividend report.

- Our comprehensive valuation report raises the possibility that Zhejiang Jolly PharmaceuticalLTD is priced lower than what may be justified by its financials.

Turning Ideas Into Actions

- Gain an insight into the universe of 1544 Top Global Dividend Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tibet Weixinkang Medicine might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603676

Tibet Weixinkang Medicine

Engages in the research and development, production, and sale of chemical drugs and their bulk drugs in China.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives