The European market has recently experienced a mix of gains and setbacks, with the STOXX Europe 600 Index rising amid trade deal hopes but later curbed by tariff concerns. In this context, penny stocks remain an intriguing area for investors seeking potential value outside the mainstream indices. Despite being an older term, penny stocks represent smaller or newer companies that can offer unique investment opportunities when backed by strong financials and growth potential.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Maps (BIT:MAPS) | €3.43 | €45.56M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| IAMBA Arad (BVB:FERO) | RON0.48 | RON17.08M | ✅ 2 ⚠️ 4 View Analysis > |

| Cellularline (BIT:CELL) | €2.80 | €59.06M | ✅ 4 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.91 | €18.36M | ✅ 2 ⚠️ 3 View Analysis > |

| Abak (WSE:ABK) | PLN4.38 | PLN11.8M | ✅ 2 ⚠️ 4 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.42 | SEK2.32B | ✅ 4 ⚠️ 1 View Analysis > |

| Euroland Société anonyme (ENXTPA:ALERO) | €3.26 | €10.34M | ✅ 2 ⚠️ 5 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.18 | €300.98M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.984 | €33.18M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 326 stocks from our European Penny Stocks screener.

We'll examine a selection from our screener results.

Ennogie Solar Group (CPSE:ESG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ennogie Solar Group A/S develops, manufactures, and sells building-integrated solar roofs and energy systems in Denmark, Germany, and internationally with a market cap of DKK152.98 million.

Operations: The company's revenue is primarily derived from its Electric Equipment segment, generating DKK45.47 million.

Market Cap: DKK152.98M

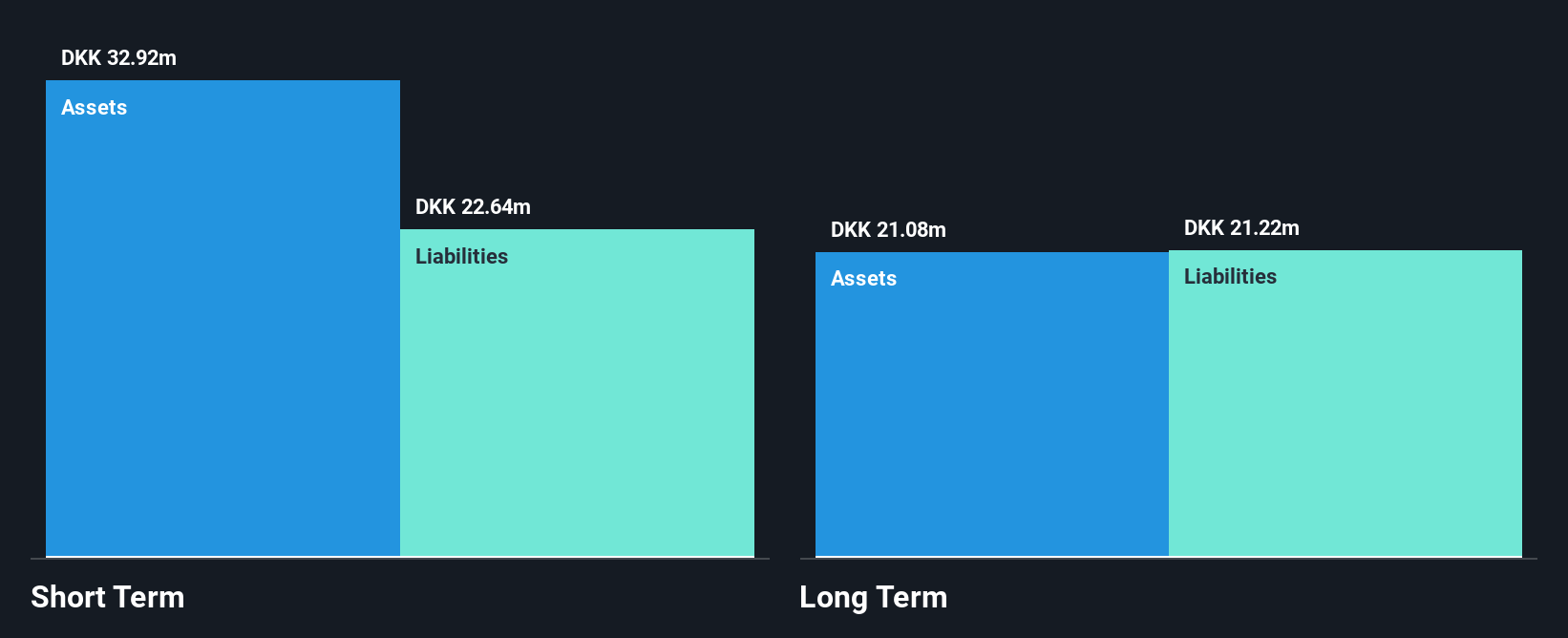

Ennogie Solar Group, with a market cap of DKK152.98 million, has been experiencing financial challenges. Despite generating DKK45.47 million in revenue from its Electric Equipment segment, the company remains unprofitable with a negative return on equity and high net debt to equity ratio of 179%. Recent earnings reports indicate declining sales and ongoing losses, while an auditor expressed doubts about its ability to continue as a going concern. However, Ennogie has reduced losses over five years and maintains sufficient cash runway for more than a year based on current free cash flow levels without significant shareholder dilution recently.

- Click here and access our complete financial health analysis report to understand the dynamics of Ennogie Solar Group.

- Gain insights into Ennogie Solar Group's past trends and performance with our report on the company's historical track record.

Arbona (NGM:ARBO A)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Arbona AB (publ) is an investment company focusing on small and medium-sized listed and unlisted companies in Sweden, with a market capitalization of approximately SEK1.81 billion.

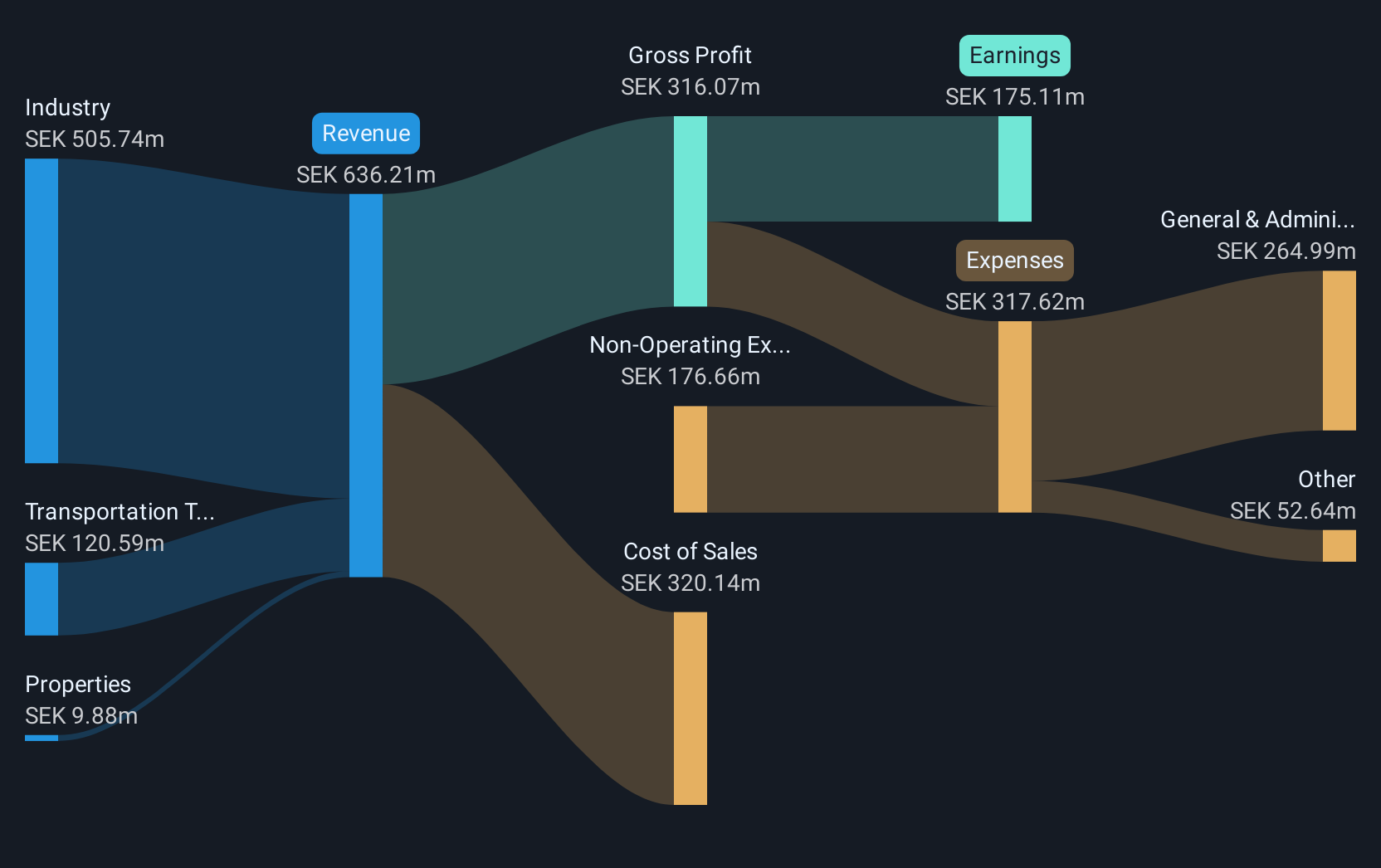

Operations: Arbona's revenue is derived from three main segments: Industry (SEK505.74 million), Transportation Technology (SEK120.59 million), and Properties (SEK9.88 million).

Market Cap: SEK1.81B

Arbona AB, with a market cap of SEK1.81 billion, focuses on investments in small and medium-sized companies across three segments: Industry (SEK505.74 million), Transportation Technology (SEK120.59 million), and Properties (SEK9.88 million). Despite trading at 35.7% below its estimated fair value, the company faces challenges with negative earnings growth over the past year and a current net profit margin of 27.5%, which is lower than last year. However, Arbona's strong cash flow covers its debt well at 68.7%, and short-term assets exceed both short-term liabilities (SEK171M) and long-term liabilities (SEK103.2M).

- Navigate through the intricacies of Arbona with our comprehensive balance sheet health report here.

- Understand Arbona's track record by examining our performance history report.

Kudelski (SWX:KUD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Kudelski SA, with a market cap of CHF78.56 million, offers digital access and security solutions for digital television and interactive applications across Switzerland, the United States, France, Germany, Austria, and other international markets.

Operations: The company's revenue is derived from three main segments: Digital TV, generating $227.83 million; Cybersecurity, contributing $108.47 million; and Internet of Things, accounting for $47.43 million.

Market Cap: CHF78.56M

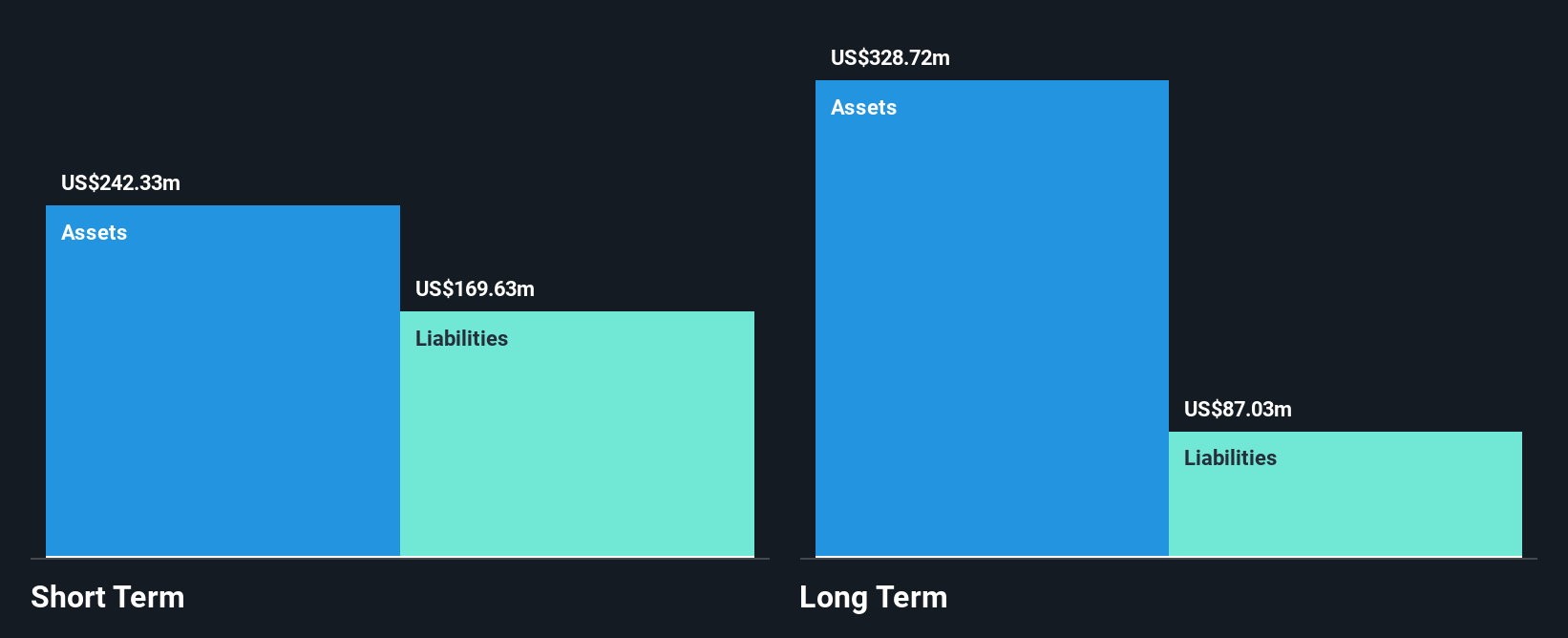

Kudelski SA, with a market cap of CHF78.56 million, operates across Digital TV, Cybersecurity, and IoT segments. Recent partnerships enhance its IoT capabilities, notably with The Niello Company adopting RecovR ID Check to tackle identity fraud in automotive retail. Despite being unprofitable and having increased losses over five years by 20.3% annually, Kudelski's debt-to-equity ratio improved drastically from 117% to 1.9%. It trades at a significant discount to estimated fair value and has more cash than total debt. Short-term assets exceed liabilities significantly, providing financial stability amid ongoing challenges in profitability growth.

- Get an in-depth perspective on Kudelski's performance by reading our balance sheet health report here.

- Explore Kudelski's analyst forecasts in our growth report.

Seize The Opportunity

- Discover the full array of 326 European Penny Stocks right here.

- Ready For A Different Approach? We've found 17 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kudelski might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:KUD

Kudelski

Provides digital access and security solutions for digital television and interactive applications in Switzerland, the United States, France, Germany, Austria, and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives