- Norway

- /

- Diversified Financial

- /

- OB:SAGA

3 European Penny Stocks Under €60M Market Cap To Consider

Reviewed by Simply Wall St

Amidst a backdrop of geopolitical tensions and economic shifts, the European market has experienced a slight downturn, with key indices like the STOXX Europe 600 Index reflecting investor caution. Despite these challenges, opportunities remain for investors willing to explore smaller companies that can offer unique value propositions. Penny stocks, though an older term, continue to represent smaller or newer firms with potential for growth when supported by strong financials.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Mistral Iberia Real Estate SOCIMI (BME:YMIB) | €1.03 | €19.6M | ✅ 2 ⚠️ 4 View Analysis > |

| KebNi (OM:KEBNI B) | SEK1.966 | SEK533.09M | ✅ 3 ⚠️ 4 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.74 | SEK280.44M | ✅ 4 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.90 | €61.17M | ✅ 4 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.43 | €16.56M | ✅ 2 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €1.95 | €41.55M | ✅ 3 ⚠️ 4 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.38 | SEK2.28B | ✅ 4 ⚠️ 1 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.52 | SEK214.15M | ✅ 2 ⚠️ 2 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.055 | €283.72M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.962 | €32.44M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 328 stocks from our European Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Patria Bank (BVB:PBK)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Patria Bank SA is a Romanian credit institution offering banking and financial services to individuals, SMEs, agribusinesses, and corporate clients with a market cap of RON267.22 million.

Operations: Patria Bank SA does not report distinct revenue segments.

Market Cap: RON267.22M

Patria Bank SA, with a market cap of RON267.22 million, has shown significant earnings growth, averaging 46.7% annually over the past five years and 39.7% in the last year alone, outpacing industry averages. Its price-to-earnings ratio of 6.2x suggests it may be undervalued compared to the broader Romanian market average of 14.1x. The bank's funding is primarily low-risk customer deposits (87%), though it faces challenges with a high bad loans ratio of 5.1%. Recent earnings reports indicate continued profitability improvements with net income rising to RON12.68 million for Q1 2025 from RON10.53 million a year prior.

- Jump into the full analysis health report here for a deeper understanding of Patria Bank.

- Evaluate Patria Bank's prospects by accessing our earnings growth report.

Tulikivi (HLSE:TULAV)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tulikivi Corporation manufactures and sells fireplaces, sauna heaters, and interior stone products across Finland, the United States, and Europe with a market cap of €28.44 million.

Operations: The company's revenue is primarily derived from its Building Products segment, which generated €32.01 million.

Market Cap: €28.44M

Tulikivi Corporation, with a market cap of €28.44 million, has experienced challenges in recent performance, reporting a net loss of €0.9 million for Q1 2025 compared to a profit the previous year. Despite this setback, the company has not diluted shareholders recently and maintains high-quality earnings. Its short-term assets exceed both short- and long-term liabilities, indicating financial stability. However, Tulikivi faces pressure from high net debt to equity ratios and low return on equity at 1%. While its management team is seasoned with an average tenure of 10.4 years, interest coverage remains inadequate at just 1.4x EBIT.

- Unlock comprehensive insights into our analysis of Tulikivi stock in this financial health report.

- Review our growth performance report to gain insights into Tulikivi's future.

Saga Pure (OB:SAGA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Saga Pure ASA is an investment company focused on industry, energy, and real estate sectors with a market capitalization of NOK652.16 million.

Operations: The company's revenue segments include an investment segment with a revenue of -NOK28.74 million and a segment adjustment of NOK8.88 million.

Market Cap: NOK652.16M

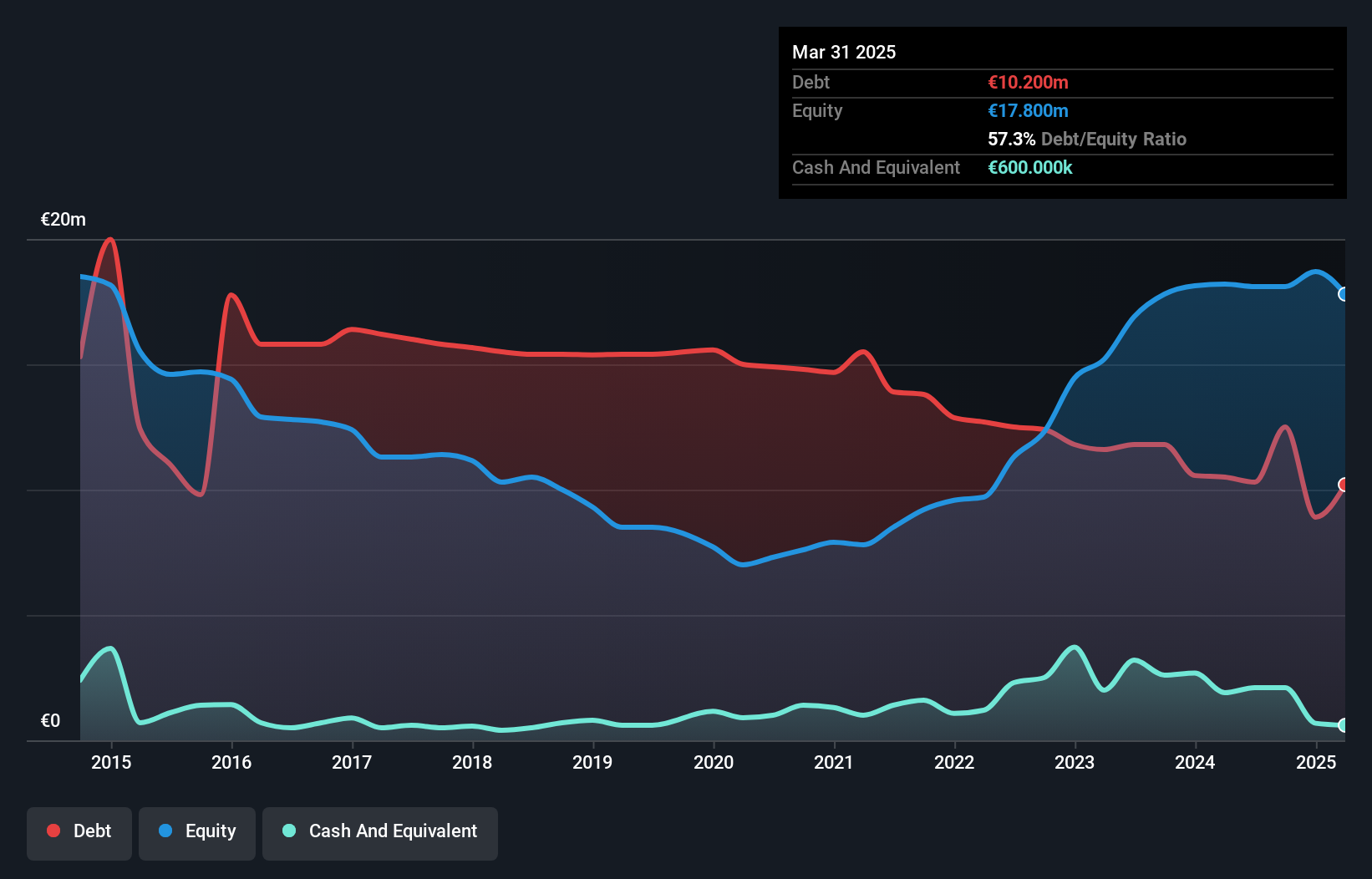

Saga Pure ASA, with a market cap of NOK652.16 million, is currently pre-revenue and unprofitable. The company has more cash than its total debt, and its short-term assets significantly exceed both short- and long-term liabilities, indicating solid financial positioning. Despite this, it has experienced increasing losses over the past five years at a rate of 35.6% annually. Recent developments include Tycoon Industrier AS acquiring an additional stake in Saga Pure, triggering a mandatory offer for remaining shares amidst board changes following their Annual General Meeting in May 2025. The acquisition highlights ongoing strategic shifts within the company’s ownership structure.

- Navigate through the intricacies of Saga Pure with our comprehensive balance sheet health report here.

- Understand Saga Pure's track record by examining our performance history report.

Summing It All Up

- Reveal the 328 hidden gems among our European Penny Stocks screener with a single click here.

- Ready For A Different Approach? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 24 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:SAGA

Saga Pure

An investment company, engages in the investment and management related to industry, energy, and real estate.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives