- United States

- /

- Specialized REITs

- /

- NYSE:SMA

3 Compelling Stocks Estimated To Be Trading Up To 31.6% Below Intrinsic Value

Reviewed by Simply Wall St

As the U.S. stock market navigates through investor concerns over banking sector health and geopolitical tensions, major indices like the Dow Jones, S&P 500, and Nasdaq have shown modest gains amidst ongoing volatility. In this environment, identifying stocks that are trading below their intrinsic value can offer potential opportunities for investors seeking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wix.com (WIX) | $132.44 | $259.78 | 49% |

| Trade Desk (TTD) | $49.90 | $96.49 | 48.3% |

| TowneBank (TOWN) | $32.51 | $62.93 | 48.3% |

| Old National Bancorp (ONB) | $19.60 | $38.50 | 49.1% |

| Northwest Bancshares (NWBI) | $11.84 | $22.81 | 48.1% |

| NeuroPace (NPCE) | $10.64 | $20.24 | 47.4% |

| Midland States Bancorp (MSBI) | $15.61 | $30.63 | 49% |

| First Advantage (FA) | $14.06 | $27.21 | 48.3% |

| ChoiceOne Financial Services (COFS) | $26.29 | $51.66 | 49.1% |

| AGNC Investment (AGNC) | $9.92 | $19.51 | 49.2% |

Underneath we present a selection of stocks filtered out by our screen.

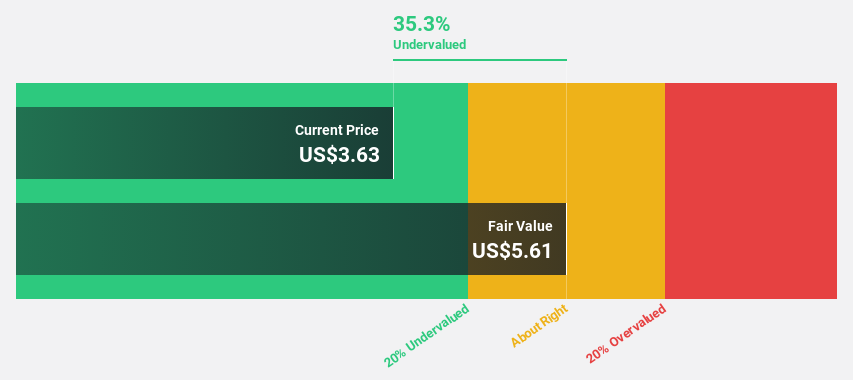

Blend Labs (BLND)

Overview: Blend Labs, Inc. offers a cloud-based software platform for financial services firms in the United States and has a market cap of approximately $848 million.

Operations: The company generates revenue primarily through its Blend Platform, which accounts for $121.52 million, with an additional segment adjustment of $46.26 million.

Estimated Discount To Fair Value: 16.3%

Blend Labs is trading at US$3.27, below its estimated fair value of US$3.91, indicating it may be undervalued based on cash flows despite recent volatility and insider selling. With a forecasted annual profit growth above market averages and expected profitability within three years, Blend's AI-driven Intelligent Origination platform could enhance operational efficiency in lending. Recent financials show improving revenue and reduced net losses, signaling potential for future cash flow improvements amidst strategic innovations.

- Insights from our recent growth report point to a promising forecast for Blend Labs' business outlook.

- Take a closer look at Blend Labs' balance sheet health here in our report.

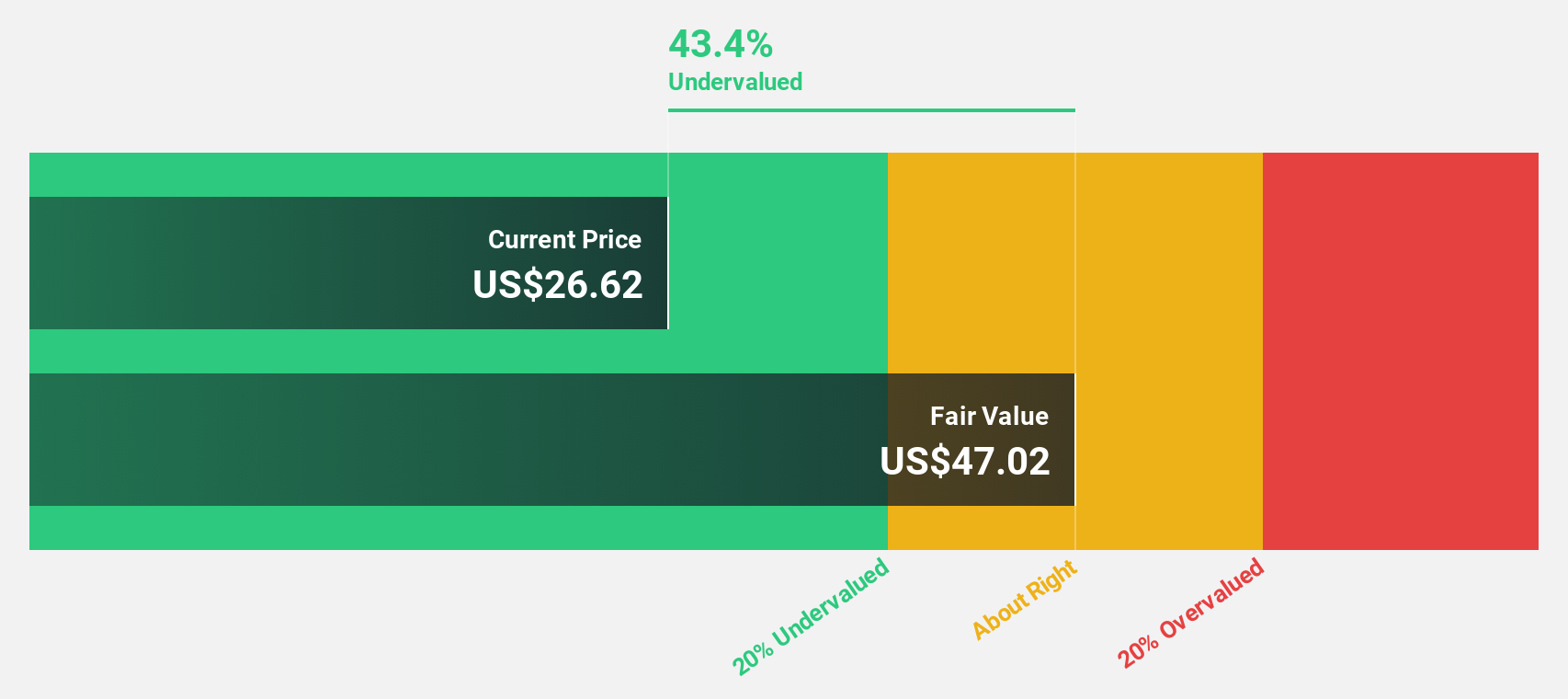

Excelerate Energy (EE)

Overview: Excelerate Energy, Inc. offers liquefied natural gas (LNG) solutions globally and has a market capitalization of $3.23 billion.

Operations: The company's revenue is primarily derived from its Utilities - Gas segment, amounting to $987.64 million.

Estimated Discount To Fair Value: 31.6%

Excelerate Energy is trading at US$28.17, below its estimated fair value of US$41.18, suggesting potential undervaluation based on cash flows. Despite a decrease in recent quarterly net income to US$4.73 million, the company's revenue grew to US$204.56 million from the previous year. With forecasted earnings growth of over 20% annually and revenue expected to outpace the broader U.S. market, Excelerate's financial trajectory shows promise amidst strategic developments like increased dividends.

- Our growth report here indicates Excelerate Energy may be poised for an improving outlook.

- Get an in-depth perspective on Excelerate Energy's balance sheet by reading our health report here.

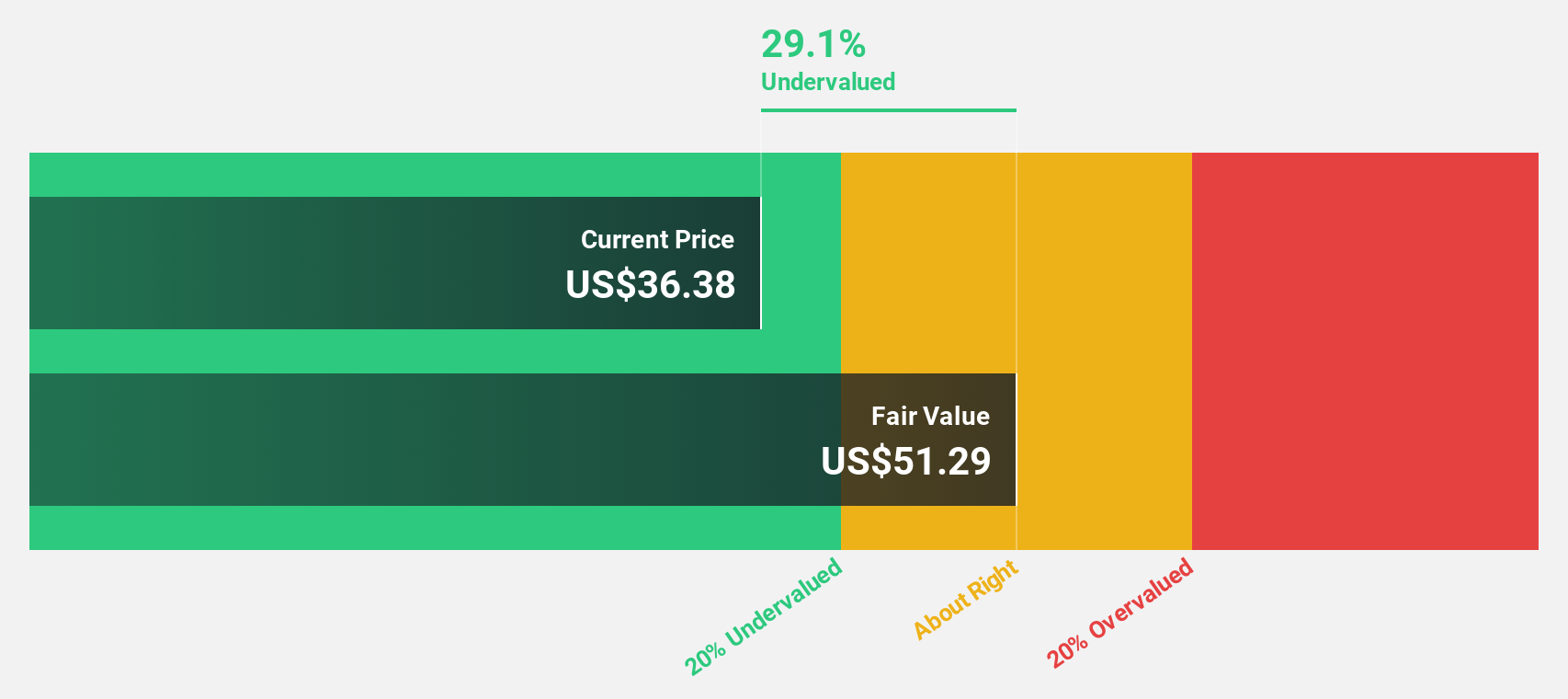

SmartStop Self Storage REIT (SMA)

Overview: SmartStop Self Storage REIT, Inc. (NYSE: SMA) is a self-managed real estate investment trust with over 600 professionals dedicated to expanding its self-storage brand, and it has a market cap of approximately $1.37 billion.

Operations: SmartStop generates revenue primarily from its Self Storage segment, which accounts for $231.41 million, and its Managed REIT Platform, contributing $13.05 million.

Estimated Discount To Fair Value: 30.2%

SmartStop Self Storage REIT is trading at US$36.58, significantly below its estimated fair value of US$52.4, highlighting potential undervaluation based on cash flows. Although currently facing a net loss, the company is forecasted to achieve profitability within three years and has a projected revenue growth rate of 10.8% annually, surpassing the U.S. market average. Recent strategic moves include private placements raising US$75 million and acquisitions in New Jersey and Alberta to expand its portfolio.

- Upon reviewing our latest growth report, SmartStop Self Storage REIT's projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of SmartStop Self Storage REIT.

Taking Advantage

- Reveal the 176 hidden gems among our Undervalued US Stocks Based On Cash Flows screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SMA

SmartStop Self Storage REIT

SmartStop Self Storage REIT, Inc. (“SmartStop”) (NYSE: SMA) is a self-managed REIT with a fully integrated operations team of more than 1,000 self-storage professionals focused on growing the SmartStop Self Storage brand.

Good value with reasonable growth potential.

Market Insights

Community Narratives