- Australia

- /

- Professional Services

- /

- ASX:ALQ

3 ASX Stocks Estimated To Be Trading At Up To 35% Below Intrinsic Value

Reviewed by Simply Wall St

In recent trading sessions, the Australian market has experienced significant fluctuations, with profit-taking in major stocks like Commonwealth Bank impacting overall performance and a notable rotation into the materials sector. Amidst these shifts, investors are increasingly seeking opportunities in undervalued stocks that may be trading below their intrinsic value. Identifying such stocks requires careful analysis of market conditions and company fundamentals to uncover potential investment opportunities.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Ridley (ASX:RIC) | A$2.98 | A$5.90 | 49.5% |

| PointsBet Holdings (ASX:PBH) | A$1.185 | A$2.11 | 43.8% |

| Pantoro Gold (ASX:PNR) | A$3.15 | A$5.52 | 42.9% |

| Integral Diagnostics (ASX:IDX) | A$2.51 | A$4.57 | 45.1% |

| Infomedia (ASX:IFM) | A$1.22 | A$2.08 | 41.2% |

| Fenix Resources (ASX:FEX) | A$0.285 | A$0.51 | 43.8% |

| Domino's Pizza Enterprises (ASX:DMP) | A$17.33 | A$34.14 | 49.2% |

| Collins Foods (ASX:CKF) | A$9.20 | A$15.95 | 42.3% |

| City Chic Collective (ASX:CCX) | A$0.083 | A$0.14 | 38.7% |

| Charter Hall Group (ASX:CHC) | A$19.07 | A$35.43 | 46.2% |

Let's take a closer look at a couple of our picks from the screened companies.

ALS (ASX:ALQ)

Overview: ALS Limited provides professional technical services focused on testing, measurement, and inspection across regions including Africa, Asia Pacific, Europe, the Middle East, North Africa, and the United States with a market cap of A$8.76 billion.

Operations: The company's revenue segments consist of Commodities, generating A$1.09 billion, and Life Sciences, contributing A$1.91 billion.

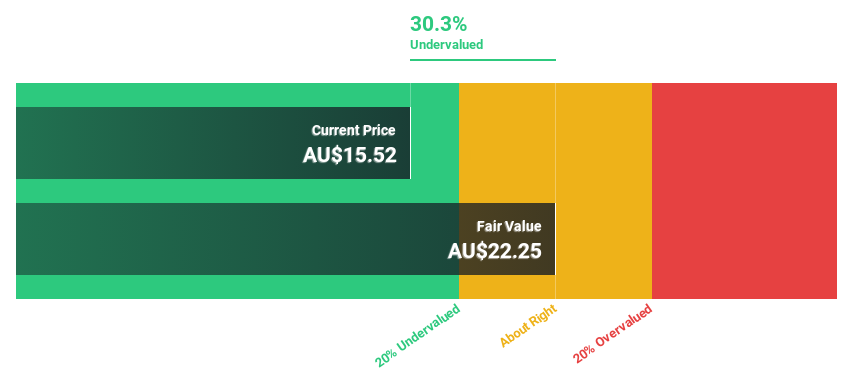

Estimated Discount To Fair Value: 35%

ALS Limited is trading at A$17.28, significantly below its estimated fair value of A$26.59, suggesting undervaluation based on cash flows. Despite a high debt level, ALS's earnings are forecast to grow 13.1% annually, outpacing the Australian market average of 10.9%. Recent equity offerings raised substantial capital for lab upgrades and M&A opportunities while maintaining a deleveraging focus, potentially bolstering future cash flows and financial stability amidst sector consolidation efforts.

- Insights from our recent growth report point to a promising forecast for ALS' business outlook.

- Take a closer look at ALS' balance sheet health here in our report.

James Hardie Industries (ASX:JHX)

Overview: James Hardie Industries plc manufactures and sells fiber cement, fiber gypsum, and cement bonded building products for interior and exterior construction applications across the United States, Australia, Europe, and New Zealand with a market cap of A$18.65 billion.

Operations: The company's revenue segments consist of $2.86 billion from North America Fiber Cement, $519.90 million from Asia Pacific Fiber Cement, and $494.30 million from Europe Building Products.

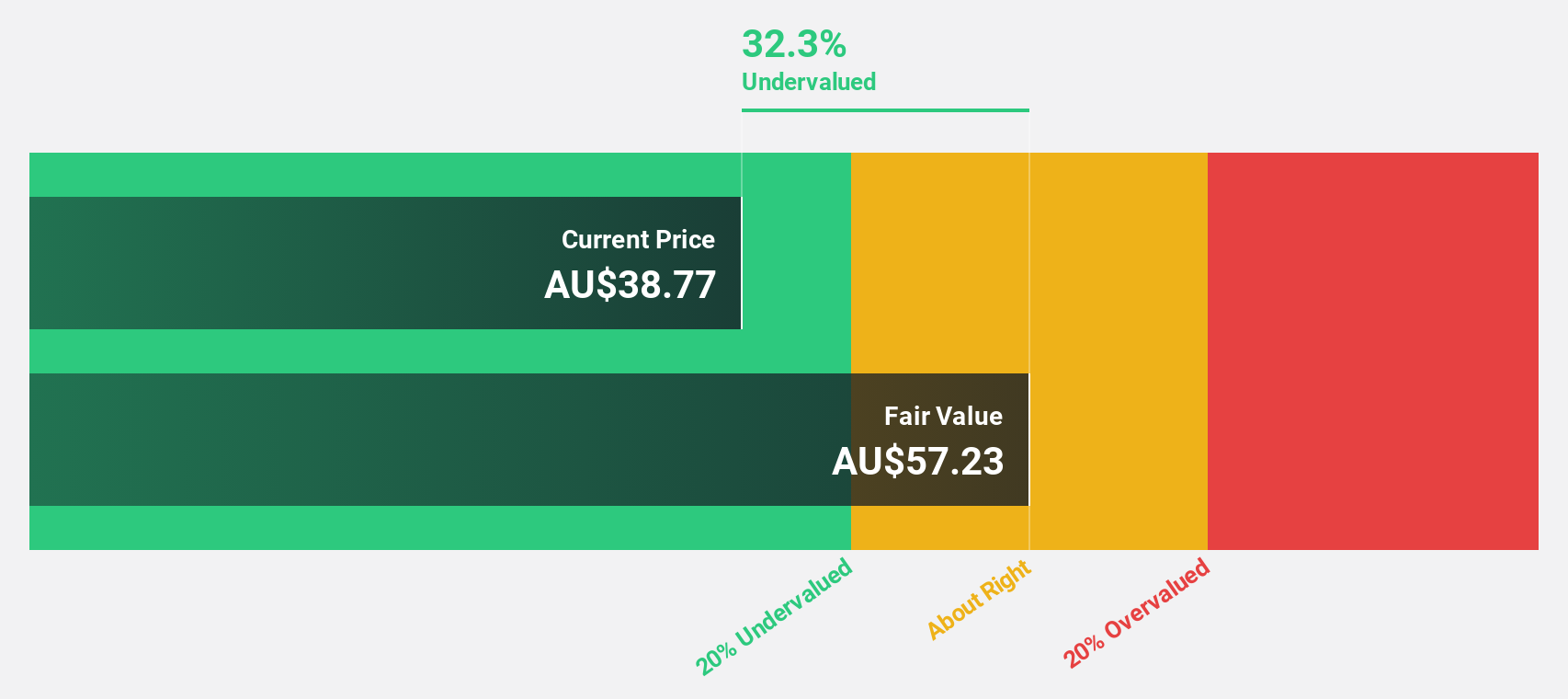

Estimated Discount To Fair Value: 26.4%

James Hardie Industries is trading at A$43.39, significantly below its fair value estimate of A$58.93, indicating undervaluation based on cash flows. Earnings are projected to grow 19.2% annually, surpassing the Australian market's average growth rate of 10.9%. The recent acquisition of AZEK and new credit facilities totaling $3.5 billion aim to enhance operational capacity and strategic positioning, though increased debt levels warrant careful monitoring for potential impacts on future cash flows.

- Our expertly prepared growth report on James Hardie Industries implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of James Hardie Industries with our detailed financial health report.

Megaport (ASX:MP1)

Overview: Megaport Limited offers on-demand interconnection and internet exchange services to enterprises and service providers across various regions including Australia, New Zealand, Asia, North America, and Europe, with a market cap of A$2.20 billion.

Operations: Revenue segments for Megaport are composed of A$33.85 million from Europe, A$55.29 million from Asia-Pacific, and A$117.77 million from North America.

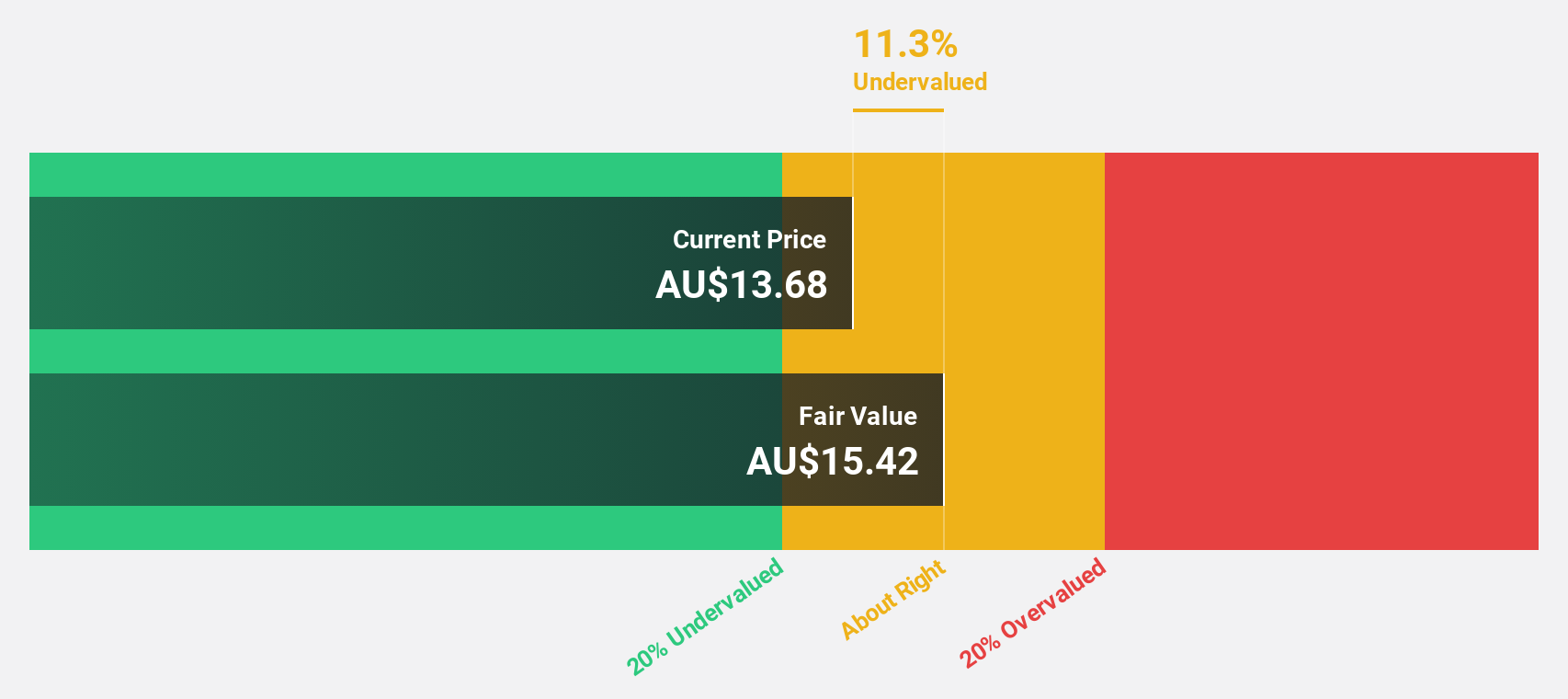

Estimated Discount To Fair Value: 11.2%

Megaport, trading at A$13.68, is undervalued relative to its fair value estimate of A$15.41 based on cash flows. With earnings expected to grow significantly at 33.9% annually, outpacing the Australian market's 10.9%, Megaport shows potential for robust financial performance despite lower profit margins than last year. Recent strategic partnerships enhance its service offerings and security measures, potentially strengthening its competitive edge in cloud connectivity and data center interconnect services globally.

- Our earnings growth report unveils the potential for significant increases in Megaport's future results.

- Delve into the full analysis health report here for a deeper understanding of Megaport.

Summing It All Up

- Discover the full array of 34 Undervalued ASX Stocks Based On Cash Flows right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ALQ

ALS

Engages in the provision of professional technical services primarily in the areas of testing, measurement, and inspection in Africa, Asia Pacific, Europe, the Middle East, North Africa, and the United States.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives