- Australia

- /

- Medical Equipment

- /

- ASX:PNV

3 ASX Stocks Estimated To Be 18.5% To 30.8% Below Intrinsic Value

Reviewed by Simply Wall St

The Australian market has experienced a subdued start to the week, with the XJO index down nearly half a percent as most sectors faced declines except for staples and energy. In this environment, identifying undervalued stocks can be crucial for investors looking to capitalize on potential growth opportunities, especially when these stocks are estimated to be significantly below their intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Web Travel Group (ASX:WEB) | A$4.34 | A$7.93 | 45.3% |

| Reckon (ASX:RKN) | A$0.61 | A$1.19 | 48.8% |

| ReadyTech Holdings (ASX:RDY) | A$2.80 | A$5.08 | 44.8% |

| PointsBet Holdings (ASX:PBH) | A$1.25 | A$2.12 | 41.2% |

| Mader Group (ASX:MAD) | A$7.97 | A$13.45 | 40.7% |

| Kogan.com (ASX:KGN) | A$4.13 | A$7.79 | 47% |

| Hillgrove Resources (ASX:HGO) | A$0.039 | A$0.073 | 46.8% |

| Elders (ASX:ELD) | A$7.38 | A$14.04 | 47.4% |

| Credit Clear (ASX:CCR) | A$0.27 | A$0.47 | 42.6% |

| Austal (ASX:ASB) | A$6.97 | A$13.25 | 47.4% |

Underneath we present a selection of stocks filtered out by our screen.

PolyNovo (ASX:PNV)

Overview: PolyNovo Limited designs, manufactures, and sells biodegradable medical devices across several countries including Australia, New Zealand, the United States, and others, with a market cap of A$873.92 million.

Operations: The company's revenue primarily comes from the development, manufacturing, and commercialization of NovoSorb Technology, amounting to A$128.70 million.

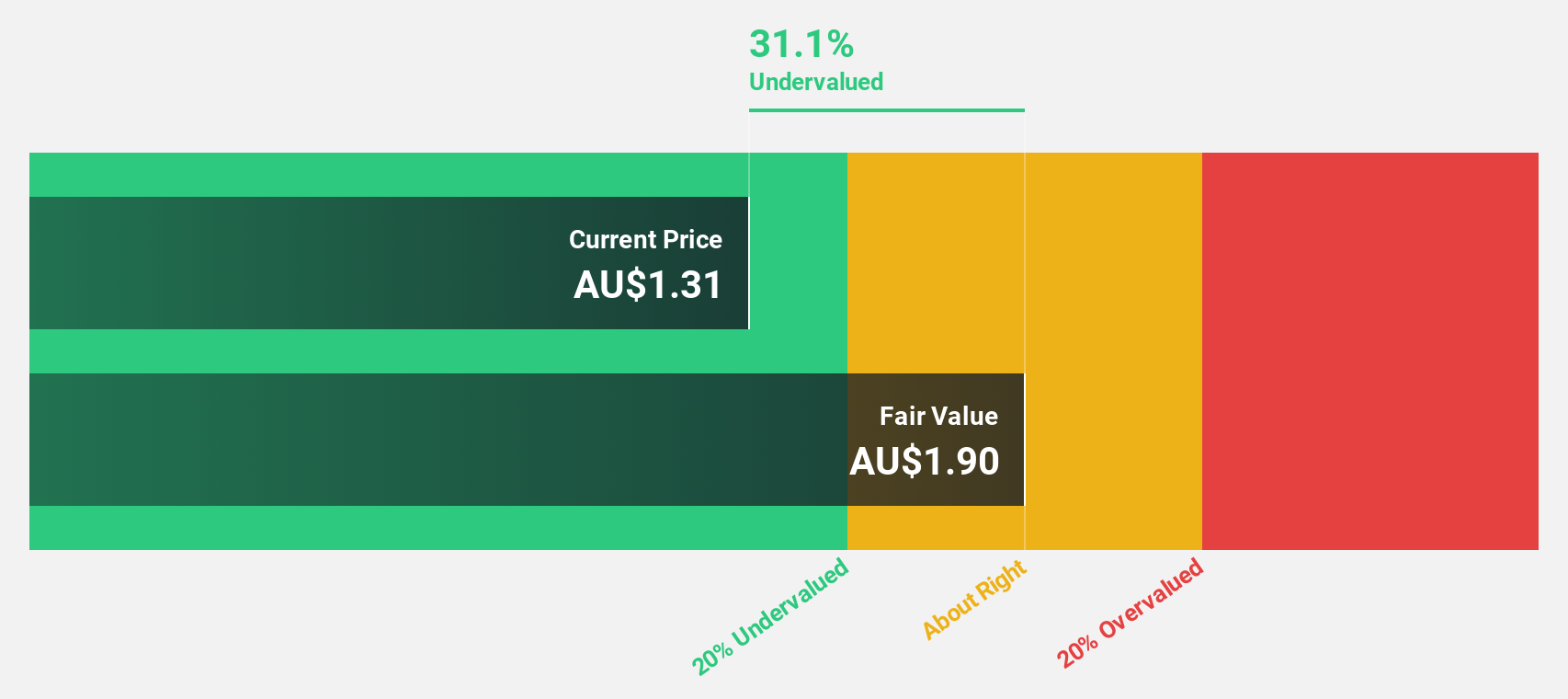

Estimated Discount To Fair Value: 18.5%

PolyNovo's recent earnings report highlights a doubling of net income to A$13.21 million, with revenue rising to A$129.19 million. Despite trading at 18.5% below its estimated fair value of A$1.55, the stock is not significantly undervalued based on discounted cash flow analysis. Forecasted earnings growth of 28.3% per year surpasses the Australian market average, though it has a high level of non-cash earnings impacting quality assessments.

- Our growth report here indicates PolyNovo may be poised for an improving outlook.

- Navigate through the intricacies of PolyNovo with our comprehensive financial health report here.

Regal Partners (ASX:RPL)

Overview: Regal Partners Limited is a privately owned hedge fund sponsor with a market cap of A$984.77 million.

Operations: Regal Partners Limited's revenue segments are not specified in the provided text.

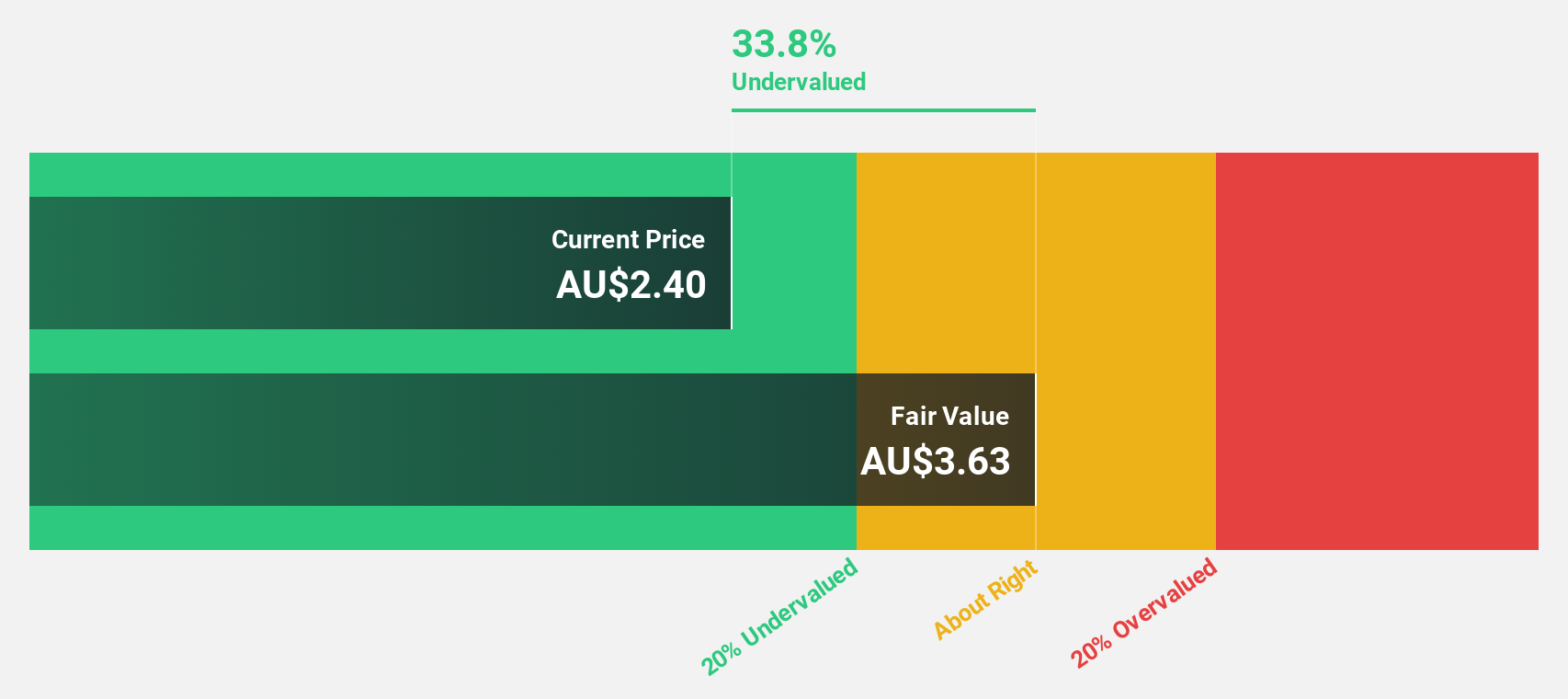

Estimated Discount To Fair Value: 28.0%

Regal Partners is trading at A$2.81, below its estimated fair value of A$3.9, indicating undervaluation based on discounted cash flow analysis. Despite a recent decline in revenue and net income, with earnings per share dropping compared to last year, the company forecasts significant annual earnings growth of 32.22%, surpassing the Australian market average. However, insider selling and a dividend not well covered by earnings present challenges for investors considering this stock.

- The analysis detailed in our Regal Partners growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Regal Partners.

SiteMinder (ASX:SDR)

Overview: SiteMinder Limited develops, markets, and sells an online guest acquisition platform and commerce solutions for accommodation providers globally, with a market cap of A$1.52 billion.

Operations: The company's revenue segment consists of A$203.65 million from its software and programming services for accommodation providers worldwide.

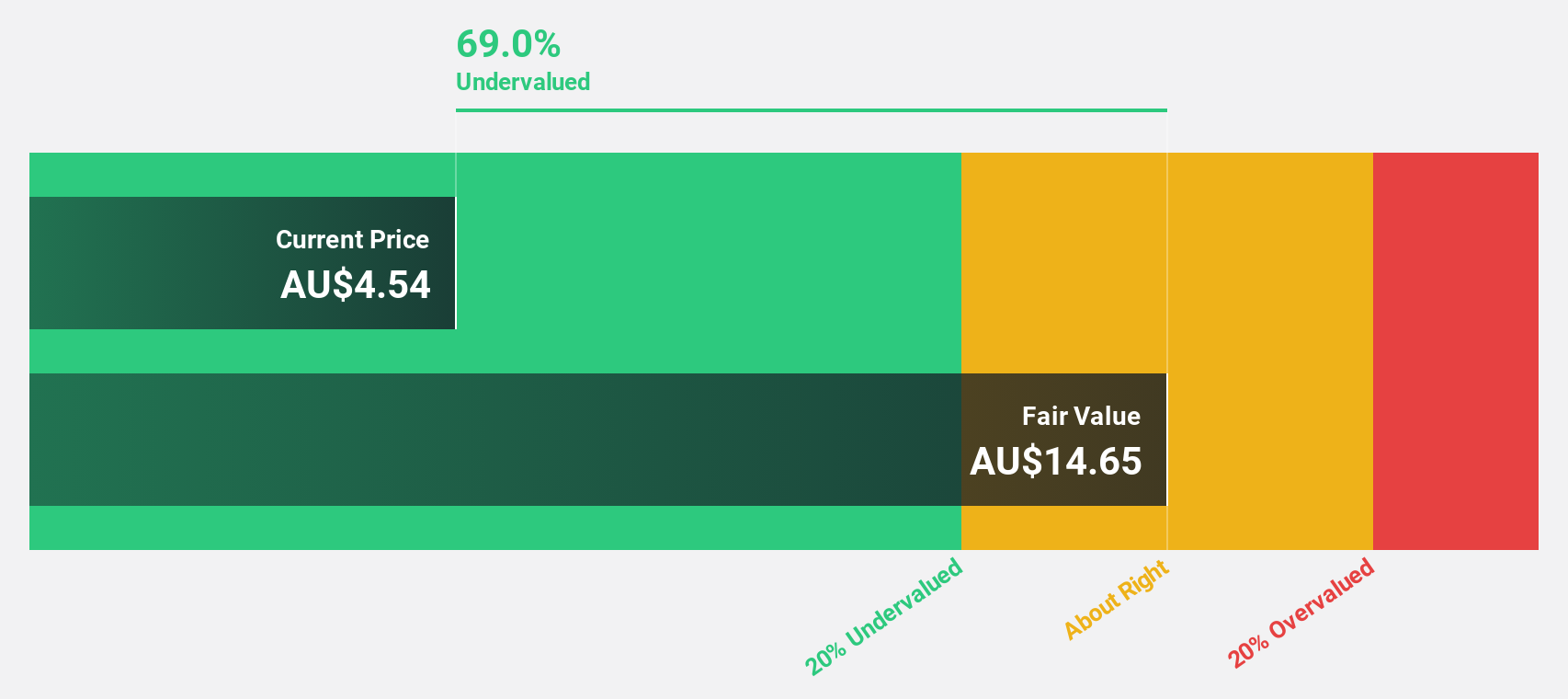

Estimated Discount To Fair Value: 30.8%

SiteMinder is trading at A$5.45, significantly below its estimated fair value of A$7.88, suggesting undervaluation based on discounted cash flow analysis. The company is forecast to become profitable within three years, with earnings expected to grow 61.66% annually, outpacing the market average. Despite slower revenue growth at 18% per year compared to its earnings trajectory, SiteMinder's financial outlook appears robust amidst recent executive changes.

- Our comprehensive growth report raises the possibility that SiteMinder is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in SiteMinder's balance sheet health report.

Next Steps

- Take a closer look at our Undervalued ASX Stocks Based On Cash Flows list of 35 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PNV

PolyNovo

Designs, manufactures, and sells biodegradable medical devices in Australia, New Zealand, the United States, the United Kingdom, Ireland, Singapore, India, and Hong Kong.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives