- Australia

- /

- Specialty Stores

- /

- ASX:AX1

3 ASX Penny Stocks With Market Caps Over A$70M

Reviewed by Simply Wall St

As Australian shares anticipate a modest rise, the market is buzzing with activity, influenced by global indices like the S&P 500 reaching new heights. Amidst this backdrop, penny stocks continue to capture investor interest for their potential growth opportunities at accessible price points. While the term "penny stocks" might seem outdated, these smaller or newer companies can offer significant value when they possess strong financials and clear growth paths.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.37 | A$106.04M | ✅ 3 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.23 | A$105.2M | ✅ 4 ⚠️ 3 View Analysis > |

| GTN (ASX:GTN) | A$0.62 | A$118.24M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.82 | A$434.79M | ✅ 4 ⚠️ 2 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.80 | A$475.94M | ✅ 4 ⚠️ 1 View Analysis > |

| Sugar Terminals (NSX:SUG) | A$0.99 | A$363.6M | ✅ 2 ⚠️ 2 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.71 | A$838.04M | ✅ 5 ⚠️ 3 View Analysis > |

| Accent Group (ASX:AX1) | A$1.41 | A$847.67M | ✅ 3 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.75 | A$177.94M | ✅ 3 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.80 | A$144.98M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 474 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

AMCIL (ASX:AMH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Amcil Limited is a publicly owned investment manager with a market cap of A$358.12 million.

Operations: The company generates its revenue primarily from investments, amounting to A$9.74 million.

Market Cap: A$358.12M

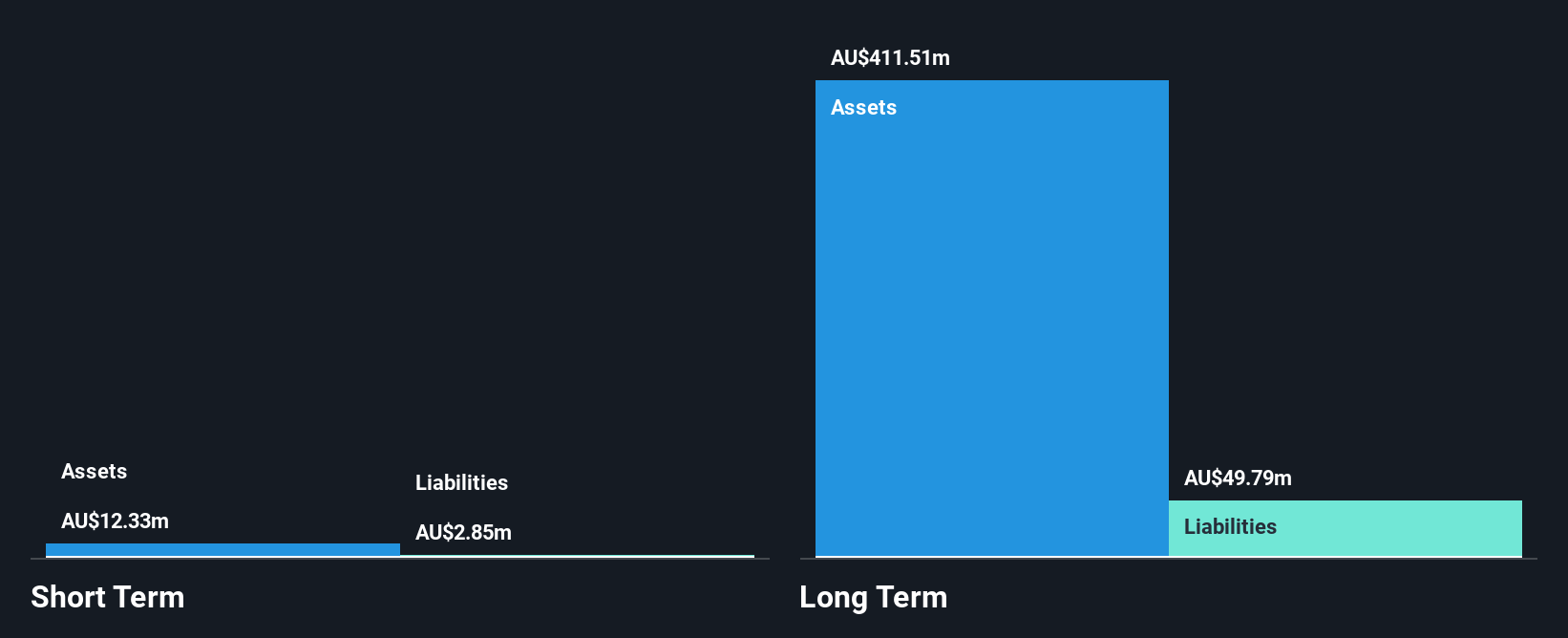

Amcil Limited, with a market cap of A$358.12 million, primarily generates its revenue from investments totaling A$9.74 million. Despite negative earnings growth of -7.5% over the past year, Amcil's short-term assets (A$12.3M) comfortably exceed its short-term liabilities (A$2.9M). The company is debt-free and benefits from a seasoned management team with an average tenure of 9 years and an experienced board averaging 8.1 years in tenure. However, its dividend yield of 3.52% is not well covered by earnings or free cash flows, and long-term liabilities (A$49.8M) surpass short-term assets.

- Jump into the full analysis health report here for a deeper understanding of AMCIL.

- Assess AMCIL's previous results with our detailed historical performance reports.

Accent Group (ASX:AX1)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Accent Group Limited operates in the retail, distribution, and franchise sectors for lifestyle footwear, apparel, and accessories across Australia and New Zealand, with a market cap of A$847.67 million.

Operations: Accent Group generates its revenue primarily from two segments: Retail, which accounts for A$1.30 billion, and Wholesale, contributing A$475.92 million.

Market Cap: A$847.67M

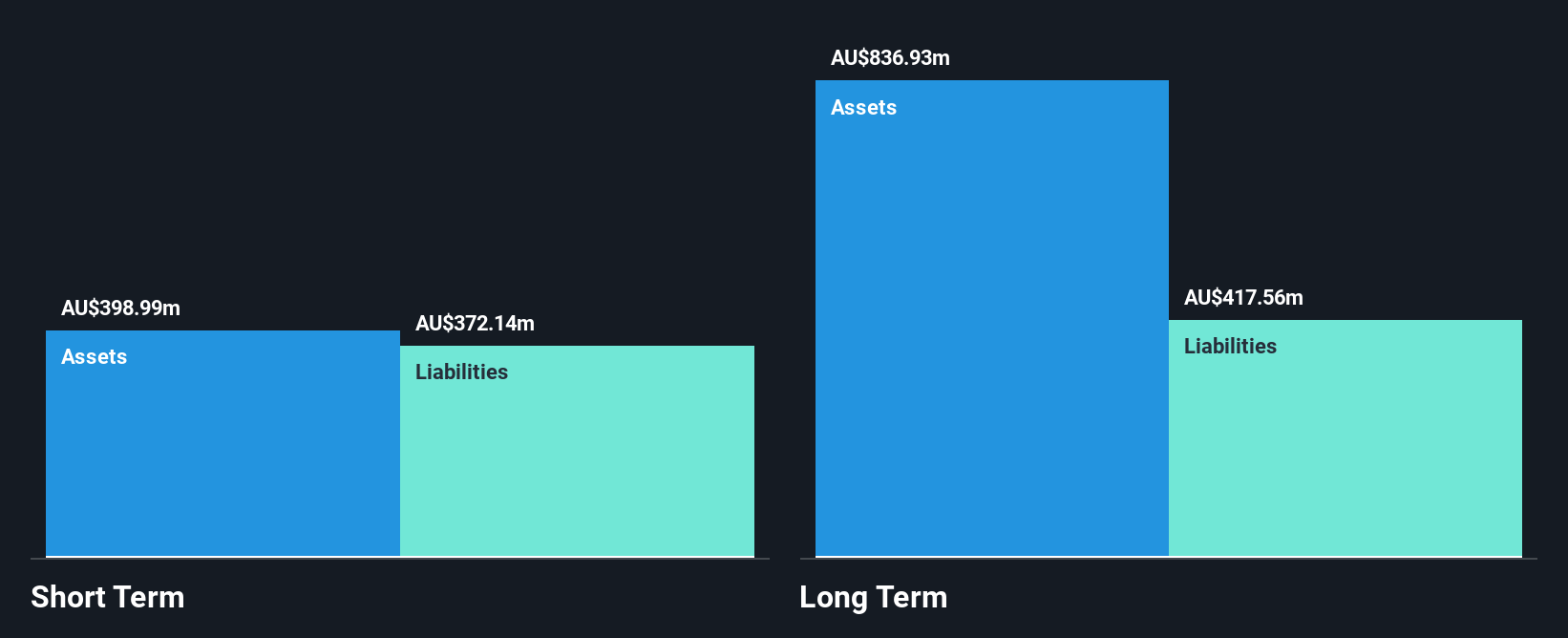

Accent Group Limited, with a market cap of A$847.67 million, operates in the retail sector with substantial revenue streams from its Retail (A$1.30 billion) and Wholesale (A$475.92 million) segments. Despite recent negative earnings growth, the company is trading at a significant discount to its estimated fair value and offers high-quality earnings with well-covered interest payments on debt. Recent strategic initiatives include a partnership with Frasers Group to launch Sports Direct in Australasia, providing access to global brands and potential expansion opportunities. However, challenges include increased debt levels and lower net profit margins compared to last year.

- Navigate through the intricacies of Accent Group with our comprehensive balance sheet health report here.

- Assess Accent Group's future earnings estimates with our detailed growth reports.

ImpediMed (ASX:IPD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: ImpediMed Limited is a medical technology company that manufactures and sells bioimpedance spectroscopy (BIS) technology medical devices in the United States and Europe, with a market cap of A$79.00 million.

Operations: The company generates revenue of A$11.54 million from its medical segment.

Market Cap: A$79M

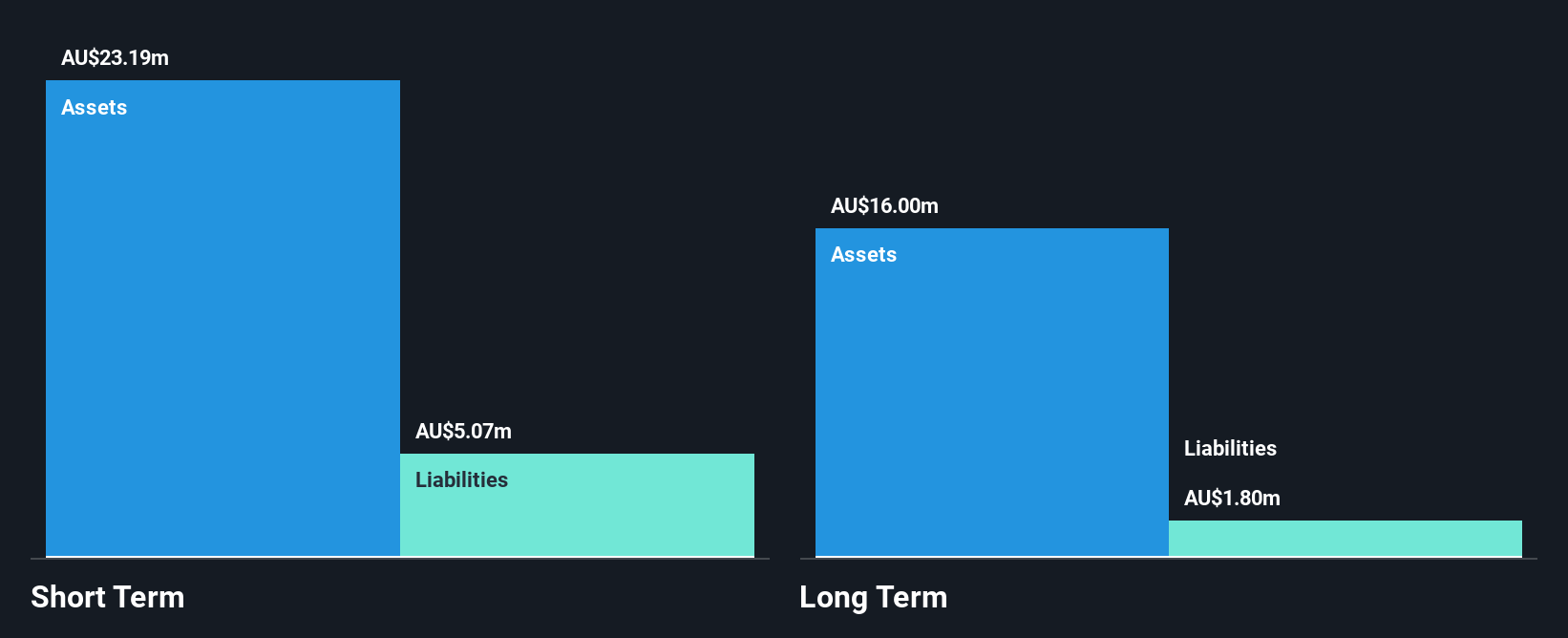

ImpediMed Limited, with a market cap of A$79 million, operates in the medical technology sector and generates A$11.54 million in revenue from its medical devices. The company is debt-free and has seen a reduction in losses over the past five years, although it remains unprofitable with no forecasted profitability within three years. Analysts expect significant stock price appreciation despite high volatility and limited cash runway under current conditions. The board and management are relatively new, indicating potential strategic shifts but also posing risks due to their lack of experience. Recent participation at an industry conference highlights ongoing engagement with key stakeholders.

- Click here and access our complete financial health analysis report to understand the dynamics of ImpediMed.

- Examine ImpediMed's earnings growth report to understand how analysts expect it to perform.

Taking Advantage

- Click this link to deep-dive into the 474 companies within our ASX Penny Stocks screener.

- Want To Explore Some Alternatives? We've found 16 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AX1

Accent Group

Engages in the retail, distribution, and franchise of lifestyle footwear, apparel, and accessories in Australia and New Zealand.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives