- Hong Kong

- /

- Medical Equipment

- /

- SEHK:1858

3 Asian Stocks Estimated To Be Up To 38.1% Below Intrinsic Value

Reviewed by Simply Wall St

As global markets experience a mix of highs and lows, with the U.S. indices hitting record peaks and Asian markets showing varied performance, investors are increasingly focused on opportunities that may be undervalued in the current economic landscape. In this context, identifying stocks that are trading below their intrinsic value can be a prudent strategy for those looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Taiwan Union Technology (TPEX:6274) | NT$229.00 | NT$455.26 | 49.7% |

| Serko (NZSE:SKO) | NZ$3.14 | NZ$6.27 | 49.9% |

| Nanya New Material TechnologyLtd (SHSE:688519) | CN¥42.98 | CN¥85.50 | 49.7% |

| Livero (TSE:9245) | ¥1715.00 | ¥3414.75 | 49.8% |

| Lai Yih Footwear (TWSE:6890) | NT$287.50 | NT$571.27 | 49.7% |

| HL Holdings (KOSE:A060980) | ₩40850.00 | ₩81170.42 | 49.7% |

| Hibino (TSE:2469) | ¥2364.00 | ¥4705.08 | 49.8% |

| Dive (TSE:151A) | ¥933.00 | ¥1858.19 | 49.8% |

| Darbond Technology (SHSE:688035) | CN¥39.42 | CN¥78.37 | 49.7% |

| cottaLTD (TSE:3359) | ¥429.00 | ¥854.05 | 49.8% |

Let's review some notable picks from our screened stocks.

Beijing Chunlizhengda Medical Instruments (SEHK:1858)

Overview: Beijing Chunlizhengda Medical Instruments Co., Ltd. is a company that specializes in the production and sale of orthopedic implants and medical instruments, with a market cap of approximately HK$7.16 billion.

Operations: The company's revenue primarily comes from its manufacture and trading of surgical implants, instruments, and related products, totaling approximately CN¥813.85 million.

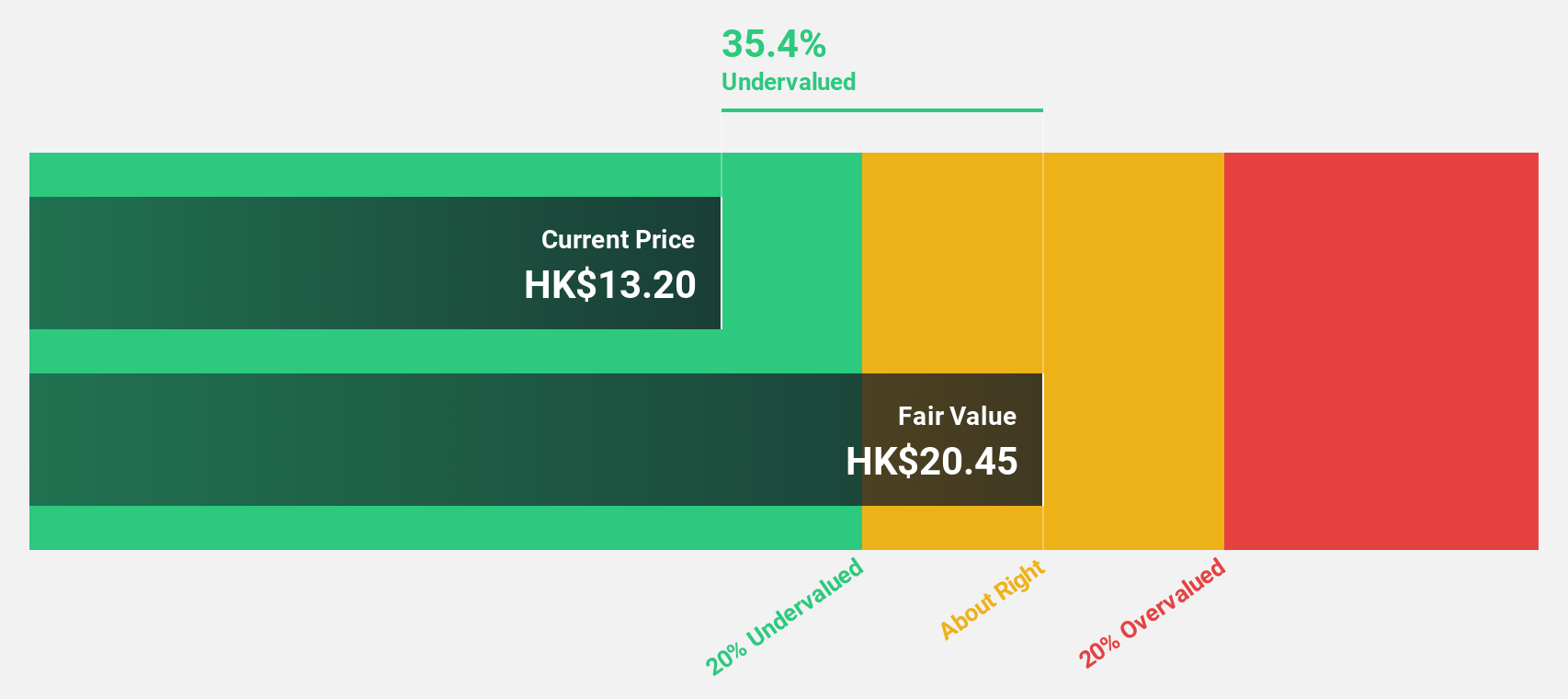

Estimated Discount To Fair Value: 35.2%

Beijing Chunlizhengda Medical Instruments is trading at HK$13.24, significantly below its estimated fair value of HK$20.42, suggesting undervaluation based on discounted cash flow analysis. Despite a recent decline in profit margins from 23.4% to 15.7%, the company exhibits robust earnings growth forecasts of over 27% annually, outpacing the Hong Kong market's average growth rate. Recent share buybacks and stable dividends further underline its potential as an undervalued investment opportunity in Asia.

- Our earnings growth report unveils the potential for significant increases in Beijing Chunlizhengda Medical Instruments' future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Beijing Chunlizhengda Medical Instruments.

Shenzhen Noposion Crop Science (SZSE:002215)

Overview: Shenzhen Noposion Crop Science Co., Ltd. engages in the research, development, production, and sale of agricultural inputs both in China and internationally, with a market cap of CN¥10.60 billion.

Operations: Shenzhen Noposion Crop Science Co., Ltd. generates its revenue primarily through the research, development, production, and sale of agricultural inputs in both domestic and international markets.

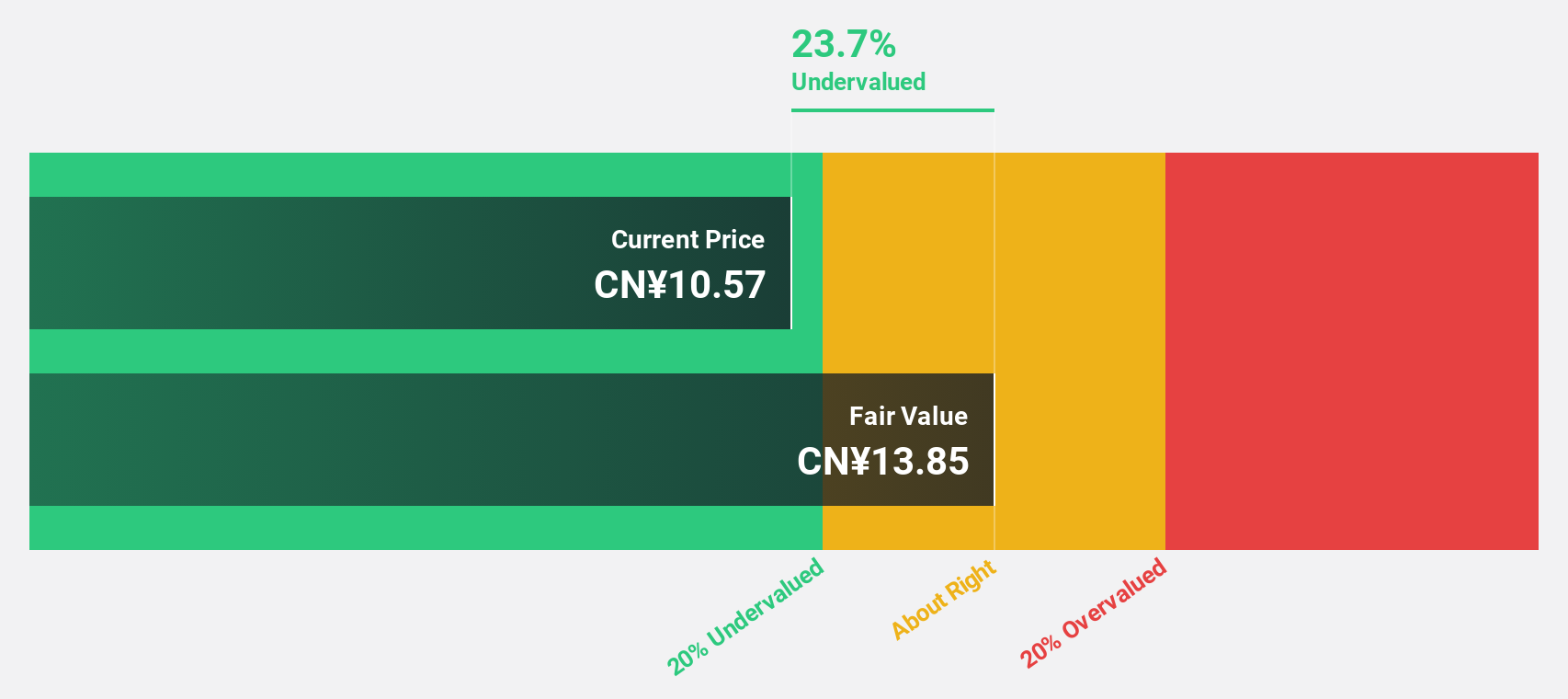

Estimated Discount To Fair Value: 22.8%

Shenzhen Noposion Crop Science is trading at CNY 10.7, below its estimated fair value of CNY 13.85, indicating undervaluation based on discounted cash flow analysis. Despite having a high level of debt and a dividend yield not fully covered by free cash flows, the company shows strong earnings growth with net income rising to CNY 626.93 million in Q1 2025 from CNY 454.31 million a year earlier, reflecting robust profit expansion prospects in Asia.

- Upon reviewing our latest growth report, Shenzhen Noposion Crop Science's projected financial performance appears quite optimistic.

- Click here to discover the nuances of Shenzhen Noposion Crop Science with our detailed financial health report.

MeHow Innovative (SZSE:301363)

Overview: MeHow Innovative Ltd. is a company that designs, develops, manufactures, and sells precision medical device components and products both in China and internationally, with a market cap of CN¥10.30 billion.

Operations: MeHow Innovative generates its revenue from the design, development, manufacturing, and sales of precision medical device components and products across domestic and international markets.

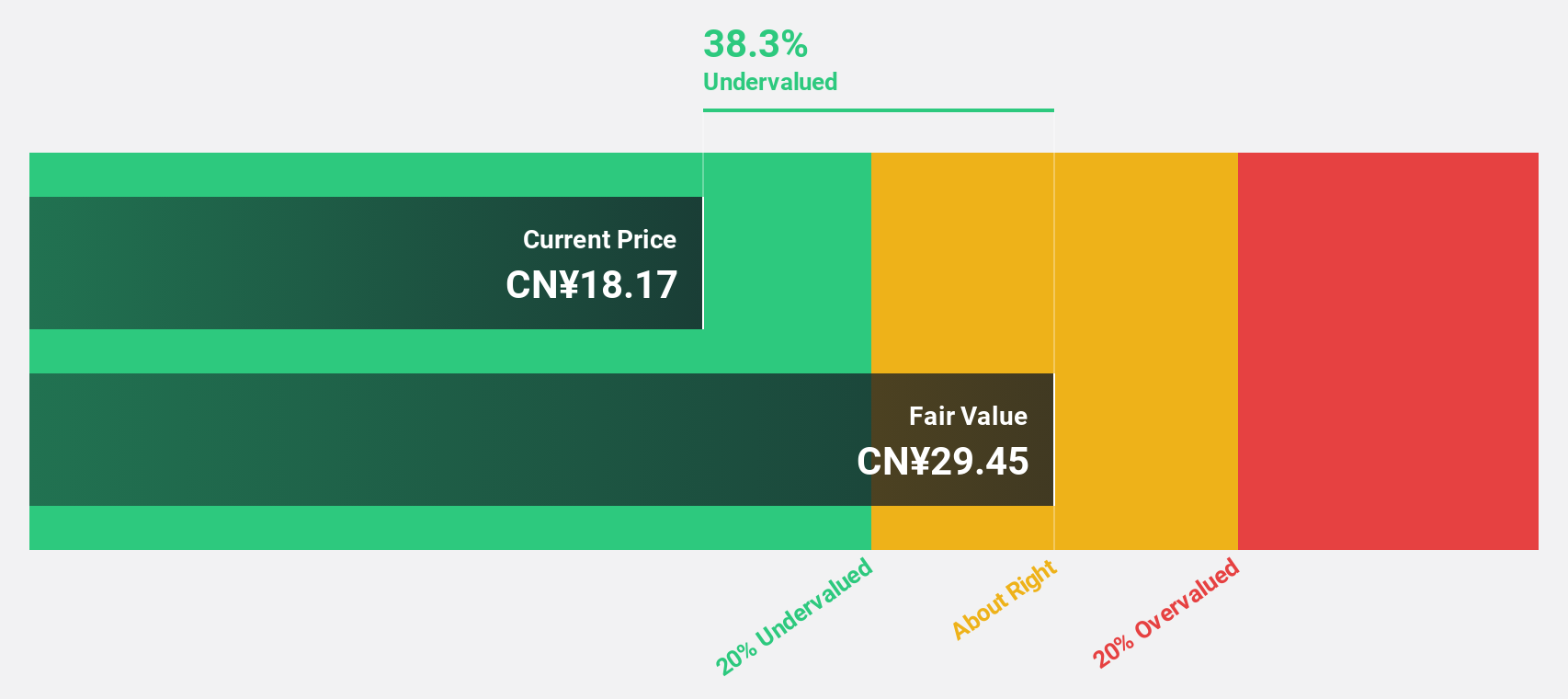

Estimated Discount To Fair Value: 38.1%

MeHow Innovative is trading at CN¥18.22, significantly below its estimated fair value of CN¥29.42, highlighting potential undervaluation based on discounted cash flow analysis. Despite a recent decrease in net income to CN¥51.87 million for Q1 2025 from CN¥58.04 million a year ago, earnings grew by 36% over the past year and are forecasted to increase by 22.87% annually, outpacing China's market revenue growth projections of 12.4%.

- Our growth report here indicates MeHow Innovative may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in MeHow Innovative's balance sheet health report.

Next Steps

- Delve into our full catalog of 267 Undervalued Asian Stocks Based On Cash Flows here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Chunlizhengda Medical Instruments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1858

Beijing Chunlizhengda Medical Instruments

Beijing Chunlizhengda Medical Instruments Co., Ltd.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives