- China

- /

- Communications

- /

- SZSE:300548

3 Asian Stocks Estimated To Be Trading Below Their Intrinsic Value By At Least 21.1%

Reviewed by Simply Wall St

As global markets navigate a complex landscape of trade negotiations and economic indicators, Asian stock markets present intriguing opportunities for investors seeking value. In this context, identifying stocks trading below their intrinsic value can be particularly appealing, offering potential for growth as market conditions evolve.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wenzhou Yihua Connector (SZSE:002897) | CN¥38.16 | CN¥75.78 | 49.6% |

| Taiyo Yuden (TSE:6976) | ¥2602.00 | ¥5175.73 | 49.7% |

| Taiwan Union Technology (TPEX:6274) | NT$230.50 | NT$459.98 | 49.9% |

| Shanghai Conant Optical (SEHK:2276) | HK$36.80 | HK$73.36 | 49.8% |

| Prospect Logistics and Industrial Freehold and Leasehold Real Estate Investment Trust (SET:PROSPECT) | THB7.20 | THB14.33 | 49.7% |

| KeePer Technical Laboratory (TSE:6036) | ¥3390.00 | ¥6741.63 | 49.7% |

| Giant Biogene Holding (SEHK:2367) | HK$54.75 | HK$108.84 | 49.7% |

| Duk San NeoluxLtd (KOSDAQ:A213420) | ₩33450.00 | ₩66758.79 | 49.9% |

| Dive (TSE:151A) | ¥925.00 | ¥1837.79 | 49.7% |

| BalnibarbiLtd (TSE:3418) | ¥1178.00 | ¥2324.94 | 49.3% |

Let's uncover some gems from our specialized screener.

Shanghai OPM Biosciences (SHSE:688293)

Overview: Shanghai OPM Biosciences Co., Ltd. offers cell culture media and CDMO services both in China and internationally, with a market cap of CN¥5.06 billion.

Operations: Shanghai OPM Biosciences Co., Ltd. generates revenue through its provision of cell culture media and contract development and manufacturing organization (CDMO) services across domestic and international markets.

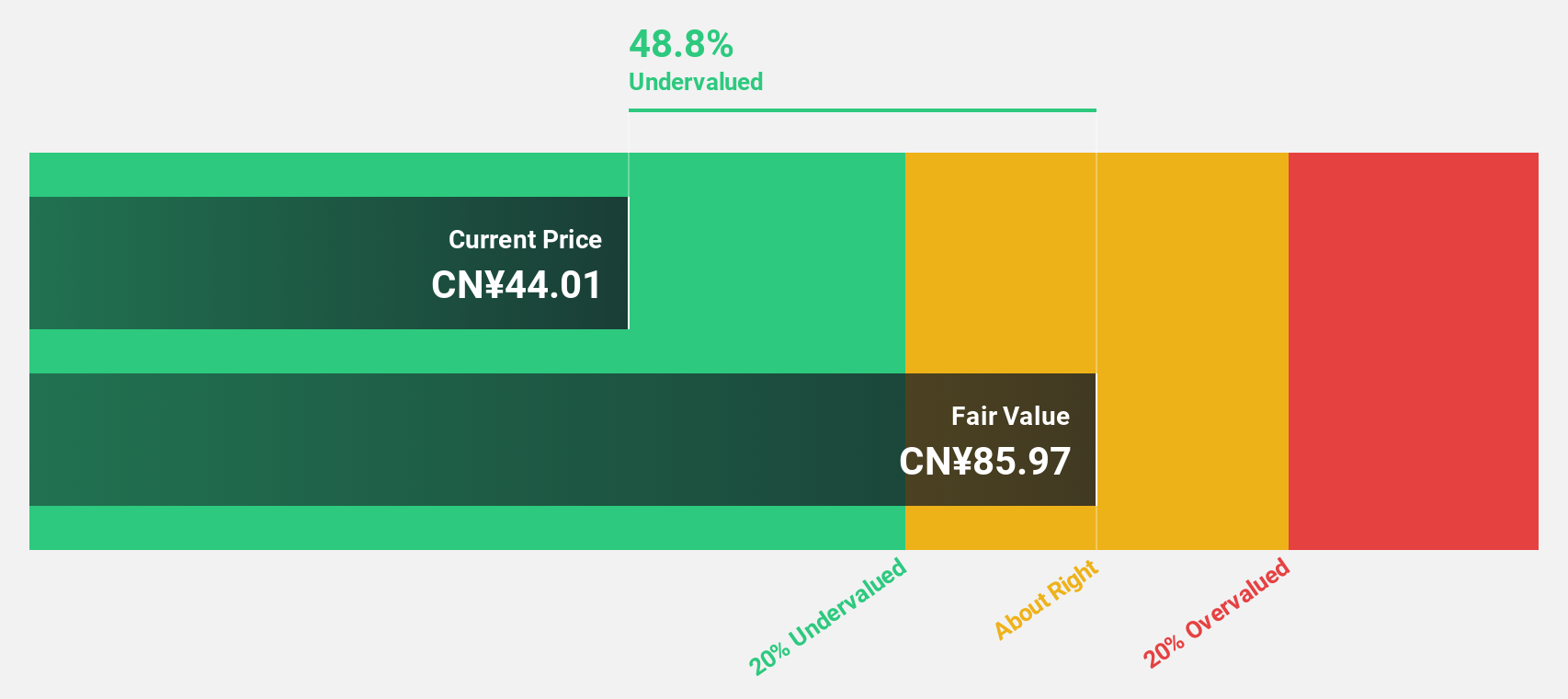

Estimated Discount To Fair Value: 48.2%

Shanghai OPM Biosciences is trading at CN¥44.52, significantly below its estimated fair value of CN¥85.97, indicating potential undervaluation based on discounted cash flows. Despite a recent decline in profit margins to 5.4%, the company's earnings are projected to grow substantially by 53% annually, outpacing market expectations. However, the dividend yield of 0.94% is not well-covered by earnings or free cash flows, and return on equity remains low at a forecasted 6.2%.

- Insights from our recent growth report point to a promising forecast for Shanghai OPM Biosciences' business outlook.

- Get an in-depth perspective on Shanghai OPM Biosciences' balance sheet by reading our health report here.

Beijing Aosaikang Pharmaceutical (SZSE:002755)

Overview: Beijing Aosaikang Pharmaceutical Co., Ltd. operates in the pharmaceutical industry, focusing on the development and manufacturing of medications, with a market cap of CN¥15.22 billion.

Operations: Beijing Aosaikang Pharmaceutical Co., Ltd. generates its revenue primarily from the development and manufacturing of medications.

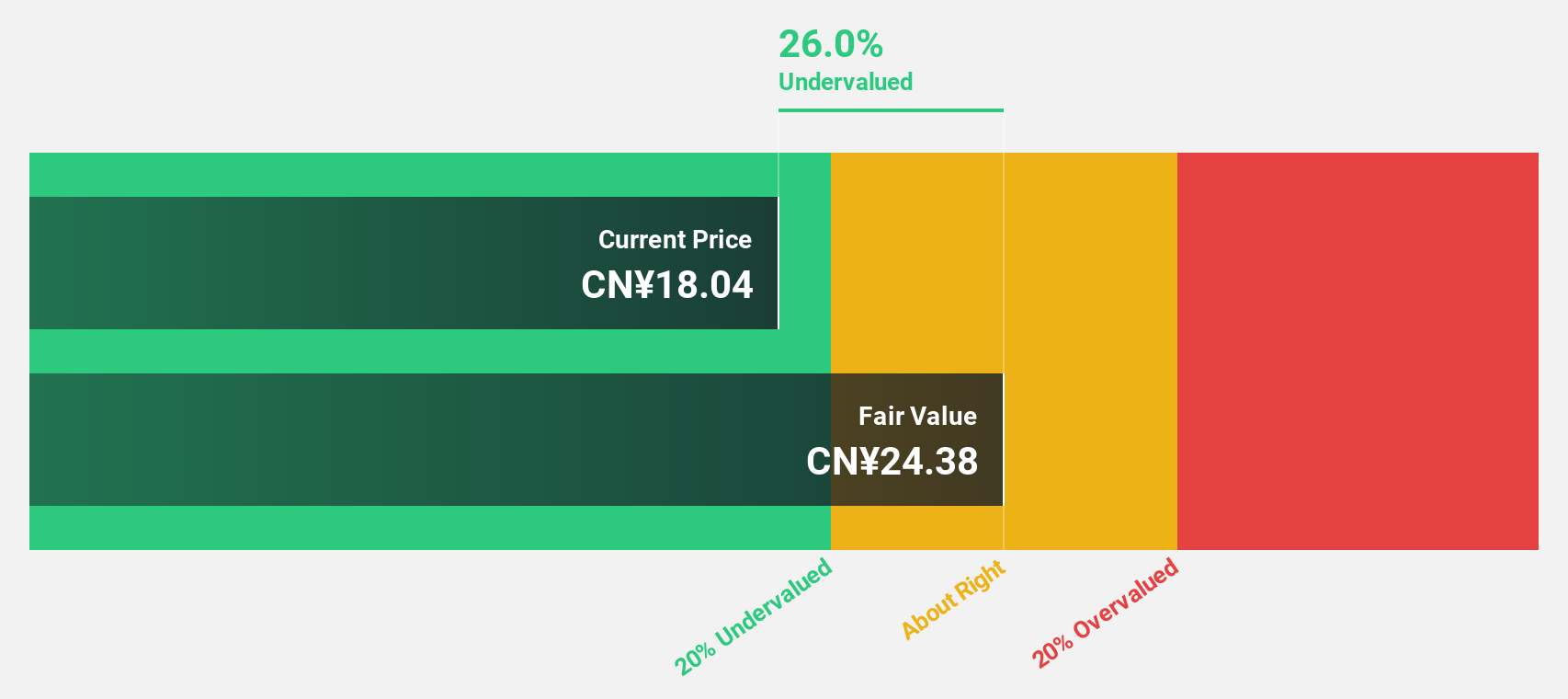

Estimated Discount To Fair Value: 32.7%

Beijing Aosaikang Pharmaceutical is trading at CN¥16.4, below its estimated fair value of CN¥24.38, highlighting potential undervaluation based on discounted cash flows. Despite an unstable dividend track record, earnings are forecast to grow significantly at 34.4% annually, surpassing market growth rates. Recent financials show a net income increase to CNY 54.73 million for Q1 2025 from CNY 31.54 million a year ago, though return on equity remains low with large one-off items affecting results.

- Upon reviewing our latest growth report, Beijing Aosaikang Pharmaceutical's projected financial performance appears quite optimistic.

- Dive into the specifics of Beijing Aosaikang Pharmaceutical here with our thorough financial health report.

Broadex Technologies (SZSE:300548)

Overview: Broadex Technologies Co., Ltd. engages in the research, development, production, and sale of integrated optoelectronic devices for optical communications both in China and internationally, with a market cap of approximately CN¥19.12 billion.

Operations: Broadex Technologies generates revenue through the research, development, production, and sale of integrated optoelectronic devices for optical communications both domestically and internationally.

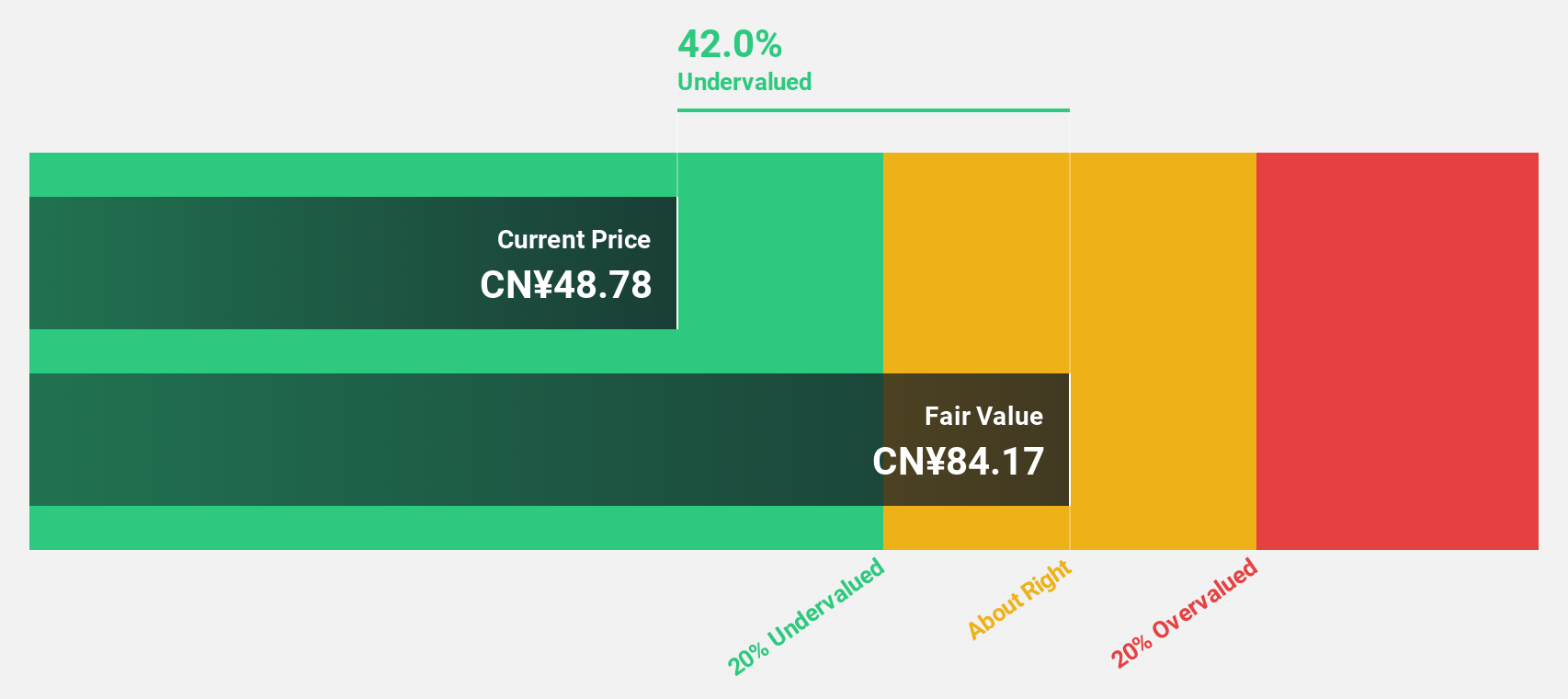

Estimated Discount To Fair Value: 21.1%

Broadex Technologies is trading at CN¥65.99, significantly below its fair value estimate of CN¥83.63, presenting an undervaluation opportunity based on discounted cash flows. The company's earnings and revenue are expected to grow substantially faster than the market at 40.9% and 23.1% per year, respectively. Despite recent share price volatility, Q1 2025 financials show a robust net income increase to CNY 89.7 million from CNY 0.0278 million the previous year, though return on equity remains modest at a forecasted 17.3%.

- Our growth report here indicates Broadex Technologies may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Broadex Technologies' balance sheet health report.

Turning Ideas Into Actions

- Embark on your investment journey to our 268 Undervalued Asian Stocks Based On Cash Flows selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Broadex Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300548

Broadex Technologies

Researches and develops, produces, and sells integrated optoelectronic devices in the field of optical communications in China and internationally.

High growth potential with solid track record.

Market Insights

Community Narratives