3 Asian Stocks Estimated To Be Trading At Up To 49% Below Intrinsic Value

Reviewed by Simply Wall St

Amidst the backdrop of global trade tensions and economic uncertainties, Asian markets have experienced mixed performances, with some indices reflecting cautious investor sentiment due to renewed tariffs and slowing economic growth in key regions like China. In this environment, identifying undervalued stocks can be a strategic approach for investors seeking potential opportunities; these stocks are often trading below their intrinsic value and may offer significant upside as market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xi'an NovaStar Tech (SZSE:301589) | CN¥155.51 | CN¥309.46 | 49.7% |

| SpiderPlus (TSE:4192) | ¥506.00 | ¥997.79 | 49.3% |

| Ningbo Sanxing Medical ElectricLtd (SHSE:601567) | CN¥22.88 | CN¥45.72 | 50% |

| Nanya Technology (TWSE:2408) | NT$43.75 | NT$87.13 | 49.8% |

| Nan Ya Printed Circuit Board (TWSE:8046) | NT$176.50 | NT$350.51 | 49.6% |

| Insource (TSE:6200) | ¥926.00 | ¥1843.53 | 49.8% |

| H.U. Group Holdings (TSE:4544) | ¥3254.00 | ¥6446.96 | 49.5% |

| Elan (TSE:6099) | ¥850.00 | ¥1696.06 | 49.9% |

| cottaLTD (TSE:3359) | ¥441.00 | ¥871.25 | 49.4% |

| Astroscale Holdings (TSE:186A) | ¥676.00 | ¥1333.68 | 49.3% |

Below we spotlight a couple of our favorites from our exclusive screener.

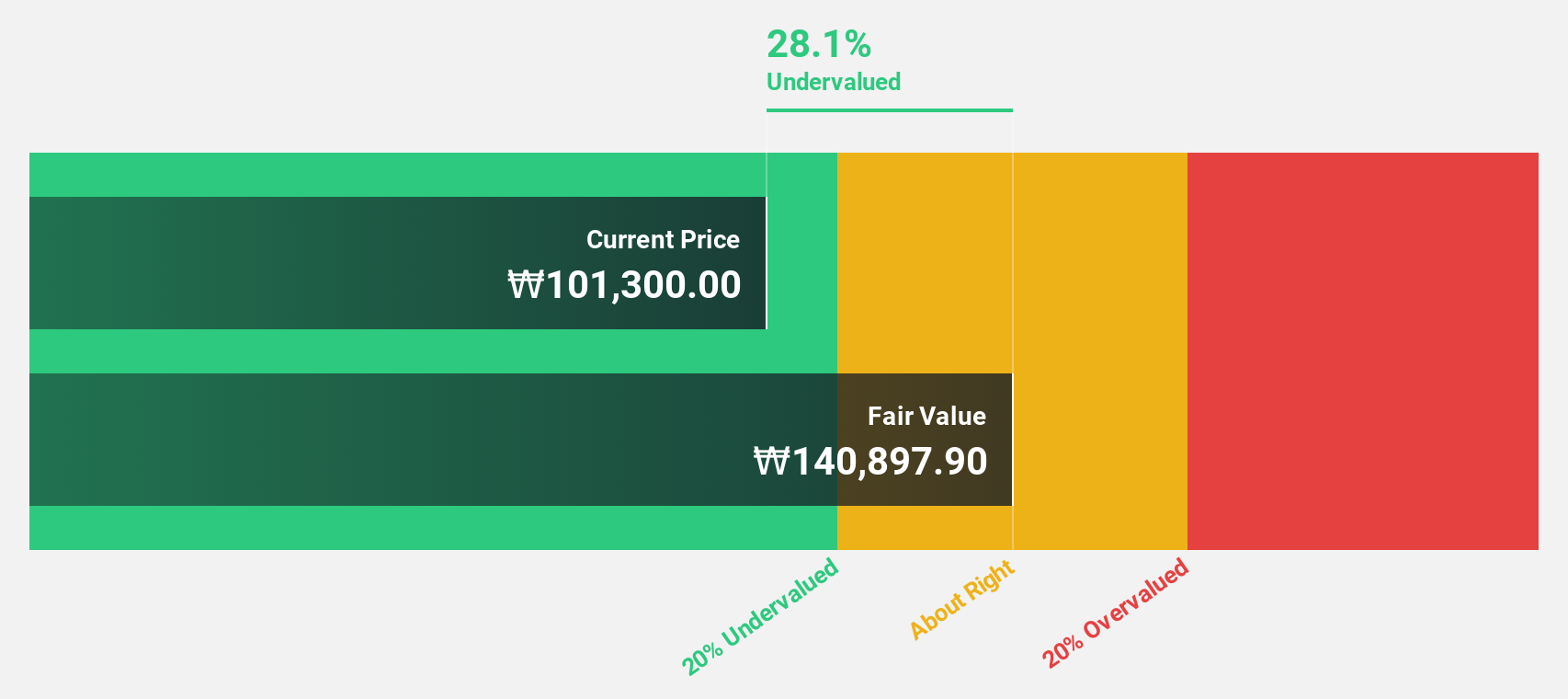

HD Hyundai Construction Equipment (KOSE:A267270)

Overview: HD Hyundai Construction Equipment Co., Ltd. operates in the construction machinery industry and has a market cap of approximately ₩1.71 trillion.

Operations: The company's revenue primarily comes from its Construction Machinery & Equipment segment, which generated approximately ₩3.37 trillion.

Estimated Discount To Fair Value: 29.3%

HD Hyundai Construction Equipment is trading at ₩98,400, significantly below its estimated fair value of ₩139,201.14. Despite a highly volatile share price recently, earnings are forecast to grow robustly at 34.87% annually over the next three years—outpacing the Korean market's growth rate of 22%. However, Return on Equity is expected to remain low at 8.8%. The company announced a merger with HD Hyundai Infracore for approximately ₩2.4 trillion, effective January 2026.

- Our growth report here indicates HD Hyundai Construction Equipment may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of HD Hyundai Construction Equipment stock in this financial health report.

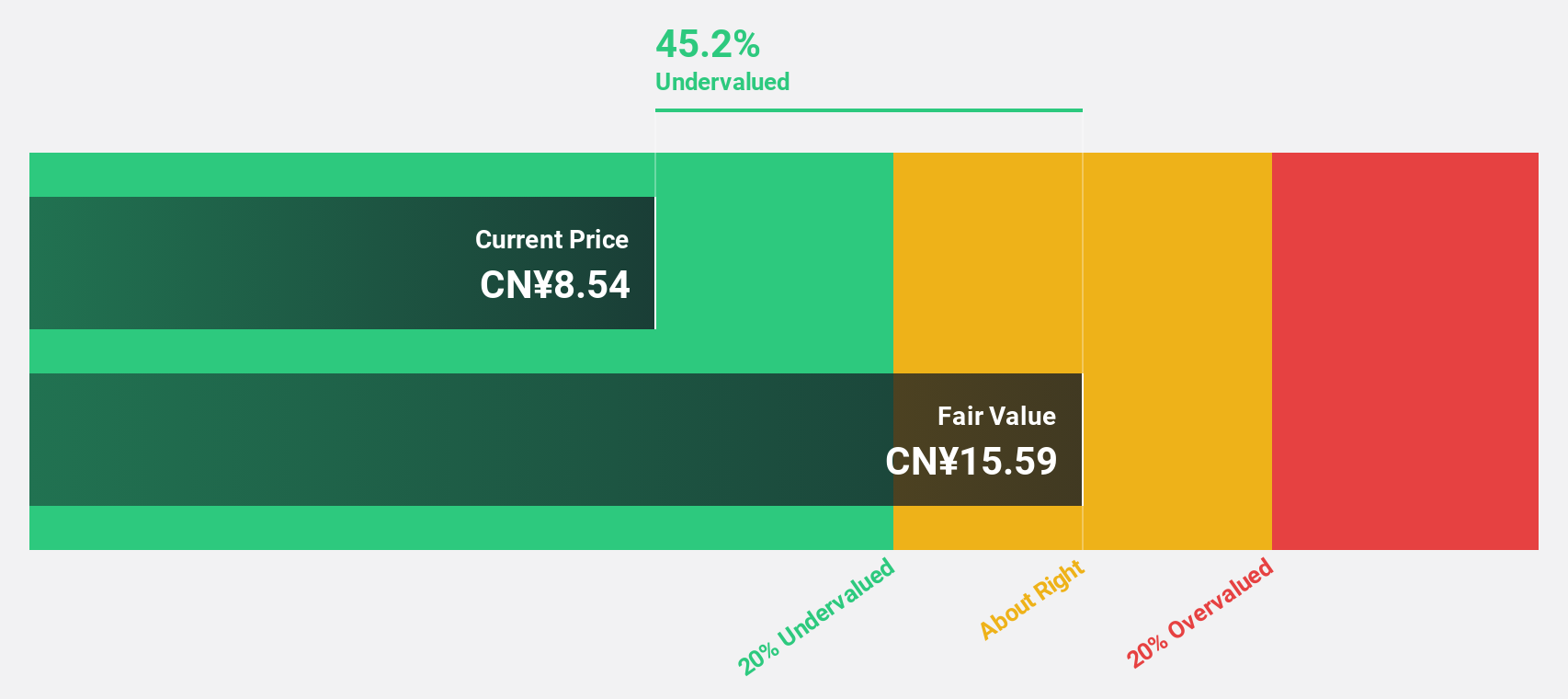

Tonghua Dongbao Pharmaceutical (SHSE:600867)

Overview: Tonghua Dongbao Pharmaceutical Co., Ltd. focuses on the research, development, manufacturing, and sale of pharmaceuticals for diabetes, endocrine, and cardiovascular and cerebrovascular diseases in China with a market cap of CN¥16.56 billion.

Operations: Tonghua Dongbao Pharmaceutical generates revenue through its pharmaceutical products targeting diabetes, endocrine disorders, and cardiovascular and cerebrovascular diseases in China.

Estimated Discount To Fair Value: 45%

Tonghua Dongbao Pharmaceutical is trading at CN¥8.52, significantly below its estimated fair value of CN¥15.49, suggesting potential undervaluation based on cash flows. Revenue is expected to grow faster than the Chinese market at 17.4% annually, with earnings projected to increase by 57.7% per year as profitability approaches within three years. Recent positive Phase 3 trial results for BioChaperone Lispro enhance its product pipeline, potentially supporting future revenue growth and cash flow generation in Asia's competitive pharmaceutical landscape.

- Our comprehensive growth report raises the possibility that Tonghua Dongbao Pharmaceutical is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Tonghua Dongbao Pharmaceutical.

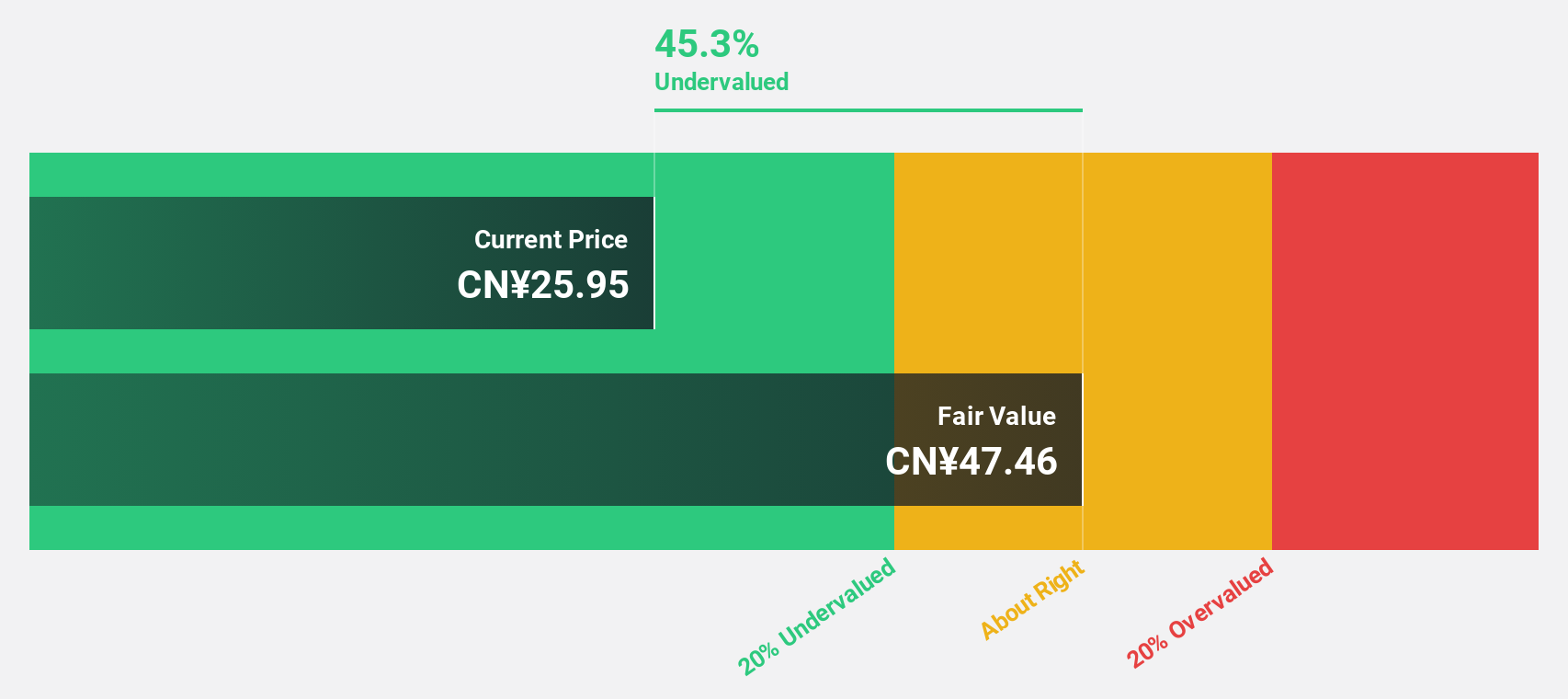

Allied Machinery (SHSE:605060)

Overview: Allied Machinery Co., Ltd. designs, researches and develops, produces, and sells high-precision mechanical parts and precision cavity mold products in China and the United States with a market cap of CN¥5.71 billion.

Operations: Allied Machinery generates revenue from the production and sale of high-precision mechanical parts and precision cavity mold products in China and the United States.

Estimated Discount To Fair Value: 49%

Allied Machinery is trading at CN¥23.72, significantly below its estimated fair value of CN¥46.48, highlighting potential undervaluation based on cash flows. Forecasts indicate annual revenue growth of 24.9%, outpacing the Chinese market's 12.6%, while earnings are expected to rise by 37.6% annually over the next three years, exceeding market averages. The recent Special Shareholders Meeting could influence strategic decisions that further impact cash flow and valuation dynamics in the machinery sector.

- The analysis detailed in our Allied Machinery growth report hints at robust future financial performance.

- Dive into the specifics of Allied Machinery here with our thorough financial health report.

Taking Advantage

- Discover the full array of 274 Undervalued Asian Stocks Based On Cash Flows right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605060

Allied Machinery

Designs, researches and develops, produces, and sells high-precision mechanical parts and precision cavity mold products in China and the United States.

Undervalued with high growth potential.

Market Insights

Community Narratives