3 Asian Stocks Estimated To Be Trading At Discounts Up To 39.2%

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by mixed performances and geopolitical developments, Asia's stock markets present intriguing opportunities for investors. With Japan's record highs and China's cautious optimism amid trade discussions, identifying undervalued stocks becomes crucial in capitalizing on potential market inefficiencies. In this context, understanding the fundamentals that make a stock undervalued—such as strong financial health, growth potential, and favorable market conditions—can guide investors in making informed decisions.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xi'an International Medical Investment (SZSE:000516) | CN¥4.80 | CN¥9.37 | 48.8% |

| Tibet GaoZheng Explosive (SZSE:002827) | CN¥37.91 | CN¥74.85 | 49.3% |

| TESEC (TSE:6337) | ¥2101.00 | ¥4157.22 | 49.5% |

| TaewoongLtd (KOSDAQ:A044490) | ₩30750.00 | ₩60323.96 | 49% |

| Ningxia Building Materials GroupLtd (SHSE:600449) | CN¥13.44 | CN¥26.42 | 49.1% |

| New Zealand King Salmon Investments (NZSE:NZK) | NZ$0.198 | NZ$0.39 | 48.7% |

| LianChuang Electronic TechnologyLtd (SZSE:002036) | CN¥10.25 | CN¥19.87 | 48.4% |

| EVE Energy (SZSE:300014) | CN¥83.18 | CN¥161.75 | 48.6% |

| Andes Technology (TWSE:6533) | NT$268.00 | NT$528.47 | 49.3% |

| Alibaba Health Information Technology (SEHK:241) | HK$5.80 | HK$11.30 | 48.7% |

Let's explore several standout options from the results in the screener.

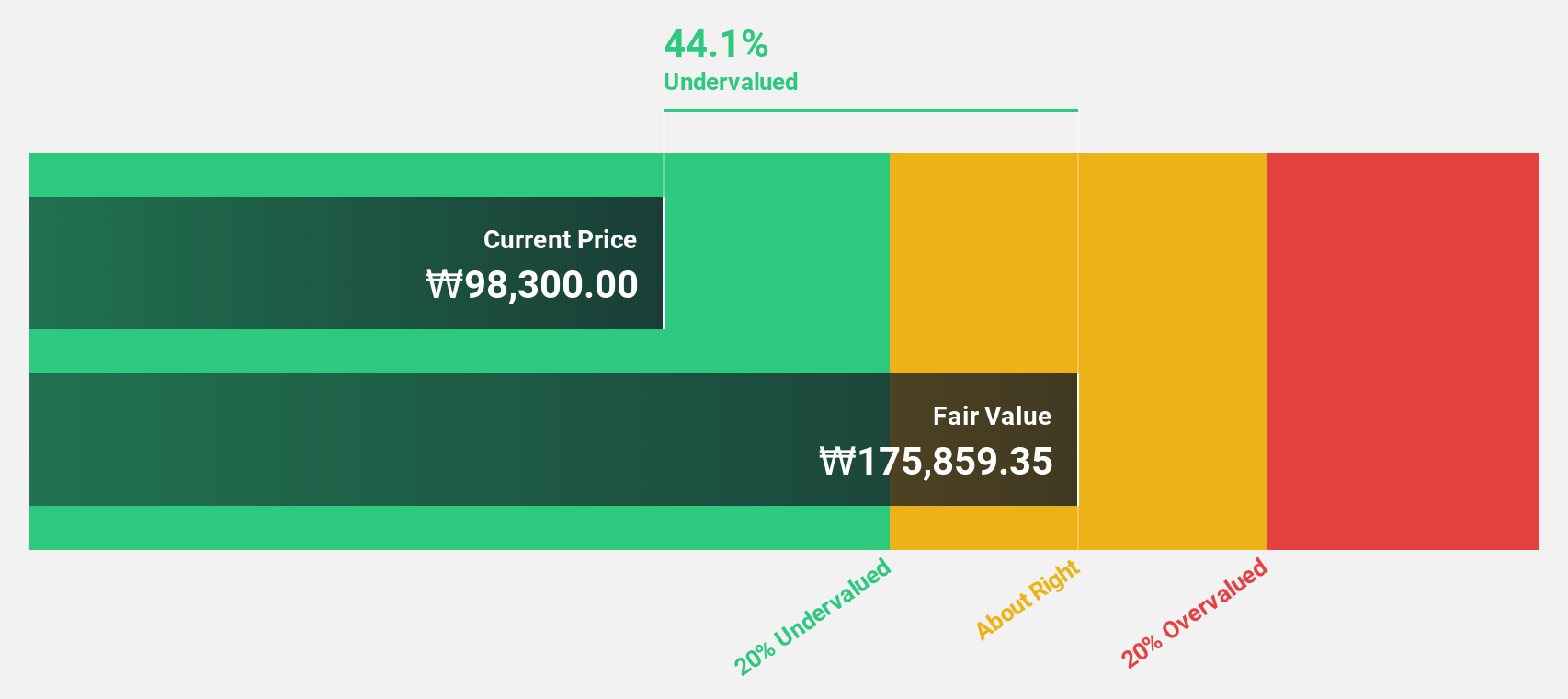

SK Biopharmaceuticals (KOSE:A326030)

Overview: SK Biopharmaceuticals Co., Ltd. is a pharmaceutical company focused on the research, development, and commercialization of drugs for central nervous system disorders, with a market cap of ₩9.05 trillion.

Operations: The company generates revenue primarily from its New Pharmaceutical Business segment, which reported ₩620.28 million.

Estimated Discount To Fair Value: 39.2%

SK Biopharmaceuticals is trading at ₩115,500, significantly below its estimated fair value of ₩189,933.83. Earnings have grown very large over the past year and are forecast to grow 22.7% annually, with revenue expected to increase by 23.4% per year—outpacing the Korean market's growth rate. Recent strategic alliances, such as the joint venture with Eurofarma for AI-based epilepsy management platforms, enhance its digital healthcare expansion potential beyond traditional pharmaceuticals.

- In light of our recent growth report, it seems possible that SK Biopharmaceuticals' financial performance will exceed current levels.

- Take a closer look at SK Biopharmaceuticals' balance sheet health here in our report.

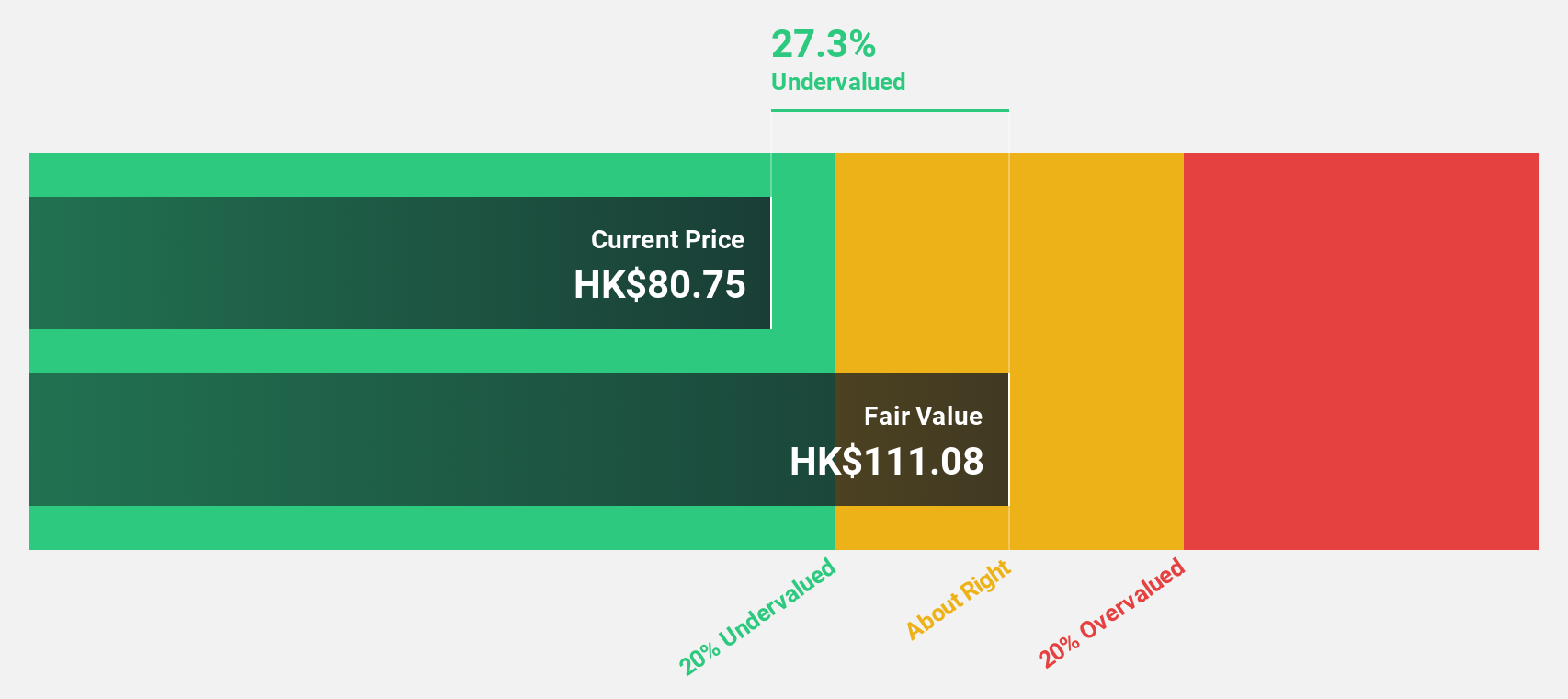

Innovent Biologics (SEHK:1801)

Overview: Innovent Biologics, Inc. is a biopharmaceutical company focused on the research and development of antibody and protein medicine products in China, the United States, and internationally, with a market cap of HK$149.08 billion.

Operations: The company generates revenue primarily from its biotechnology segment, amounting to CN¥11.42 billion.

Estimated Discount To Fair Value: 16.5%

Innovent Biologics is trading at HK$87, below its estimated fair value of HK$104.15. Recent announcements highlight robust revenue growth, with third-quarter product revenue exceeding RMB 3.3 billion driven by oncology and biomedicine expansions. Strategic alliances, like the partnership with Takeda for next-gen cancer therapies, bolster its global footprint. Despite strong cash flow potential from new products like mazdutide, the stock's undervaluation isn't significant but remains a compelling consideration for investors focused on cash flows in Asia.

- Our expertly prepared growth report on Innovent Biologics implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Innovent Biologics stock in this financial health report.

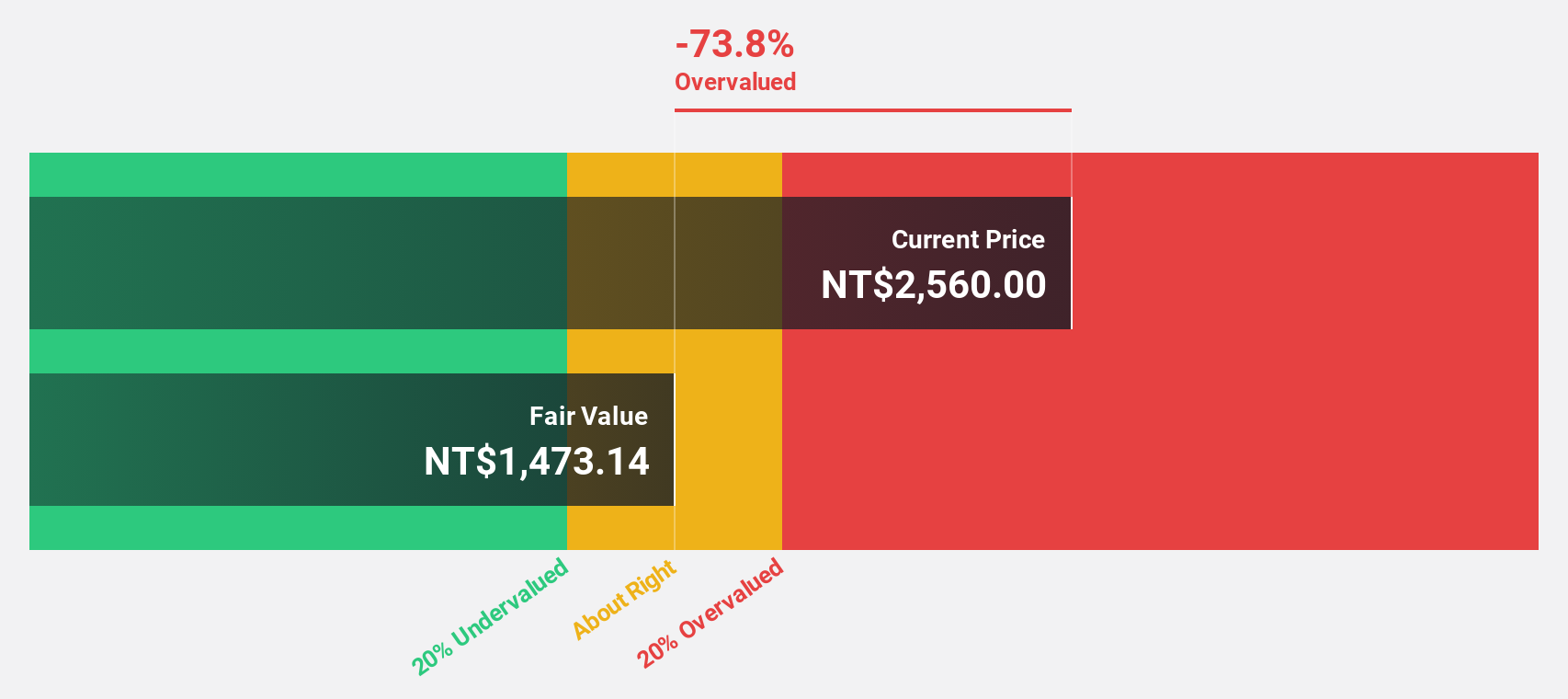

Wiwynn (TWSE:6669)

Overview: Wiwynn Corporation is involved in the research, development, design, testing, and sales of semiconductor products and peripheral equipment globally, with a market cap of NT$811.20 billion.

Operations: The company's revenue primarily comes from its computer hardware segment, which generated NT$604.83 billion.

Estimated Discount To Fair Value: 32%

Wiwynn is trading at NT$4,365, significantly below its fair value estimate of NT$6,417.21, highlighting potential undervaluation based on cash flows. Recent earnings show substantial growth with net income reaching TWD 12.12 billion for Q2 2025 compared to TWD 4.69 billion a year ago. Strategic collaborations with Fabric8Labs enhance Wiwynn's position in advanced thermal management solutions for AI infrastructure, potentially reducing operational costs and boosting efficiency in high-density data centers across Asia.

- Insights from our recent growth report point to a promising forecast for Wiwynn's business outlook.

- Get an in-depth perspective on Wiwynn's balance sheet by reading our health report here.

Summing It All Up

- Explore the 268 names from our Undervalued Asian Stocks Based On Cash Flows screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1801

Innovent Biologics

A biopharmaceutical company, engages in the research and development of antibody and protein medicine products in the People’s Republic of China, the United States, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives