3 Asian Stocks Estimated To Be Trading 20.8% To 43.1% Below Intrinsic Value

Reviewed by Simply Wall St

As global markets grapple with mixed economic signals, Asian stocks have been under the spotlight, particularly amid ongoing trade negotiations and economic data releases. In this context, identifying undervalued stocks can be crucial for investors seeking opportunities in a market characterized by cautious optimism and fluctuating indices.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Taiwan Union Technology (TPEX:6274) | NT$229.00 | NT$455.26 | 49.7% |

| Serko (NZSE:SKO) | NZ$3.14 | NZ$6.27 | 49.9% |

| Nanya New Material TechnologyLtd (SHSE:688519) | CN¥42.98 | CN¥85.50 | 49.7% |

| Livero (TSE:9245) | ¥1715.00 | ¥3414.75 | 49.8% |

| Lai Yih Footwear (TWSE:6890) | NT$287.50 | NT$571.27 | 49.7% |

| HL Holdings (KOSE:A060980) | ₩40850.00 | ₩81170.42 | 49.7% |

| Hibino (TSE:2469) | ¥2364.00 | ¥4705.08 | 49.8% |

| Dive (TSE:151A) | ¥933.00 | ¥1858.19 | 49.8% |

| Darbond Technology (SHSE:688035) | CN¥39.42 | CN¥78.37 | 49.7% |

| cottaLTD (TSE:3359) | ¥429.00 | ¥854.05 | 49.8% |

Here we highlight a subset of our preferred stocks from the screener.

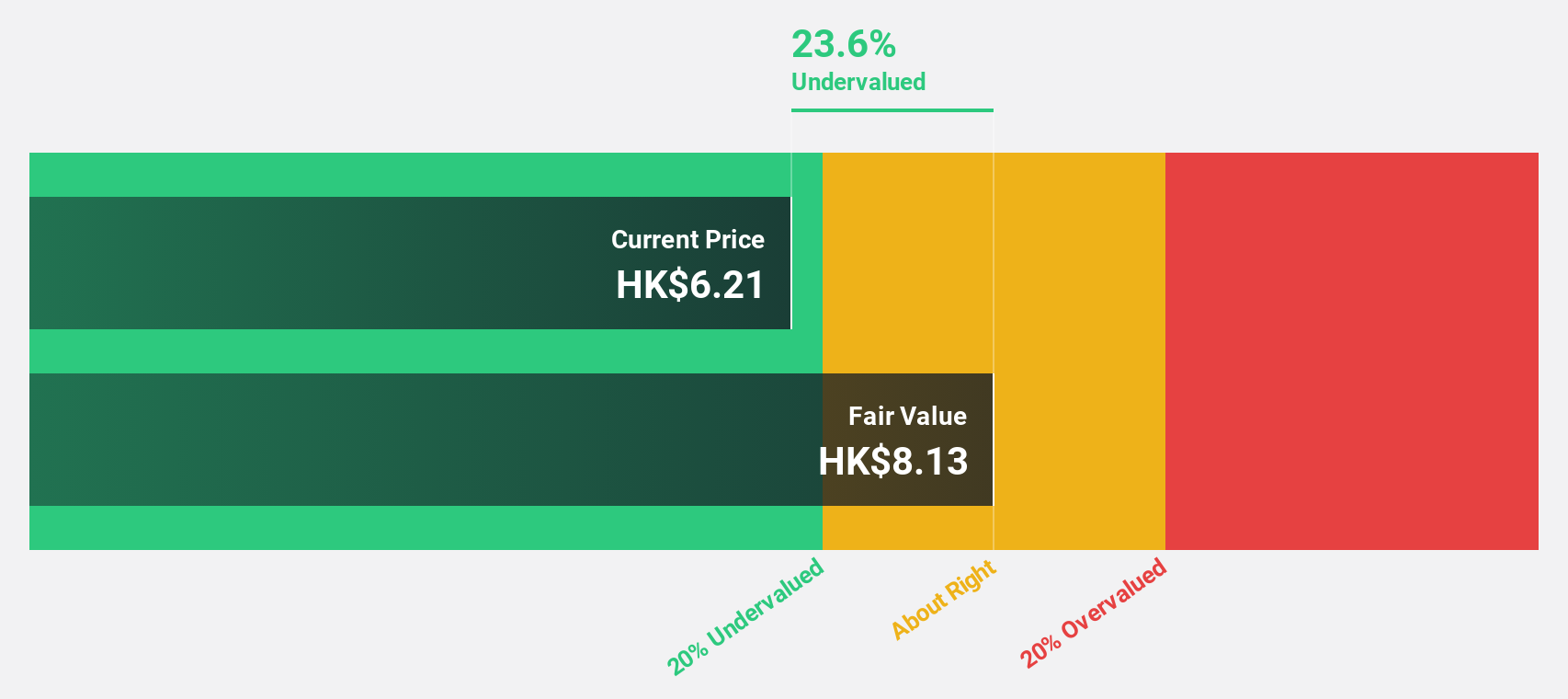

Plover Bay Technologies (SEHK:1523)

Overview: Plover Bay Technologies Limited is an investment holding company that designs, develops, and markets software-defined wide area network routers with a market cap of HK$6.68 billion.

Operations: The company's revenue is derived from sales of SD-WAN routers with fixed first connectivity ($17.15 million), mobile first connectivity ($66.18 million), and software licenses along with warranty and support services ($33.47 million).

Estimated Discount To Fair Value: 25.5%

Plover Bay Technologies is trading at HK$6.06, below its estimated fair value of HK$8.13, indicating it may be undervalued based on cash flows. Despite a dividend yield of 4.93% not being well covered by earnings, the company's earnings are forecast to grow at 17% annually, outpacing the Hong Kong market's growth rate of 10.3%. Additionally, revenue growth is projected at 16.5% per year and return on equity is expected to reach a very high level in three years' time.

- Our comprehensive growth report raises the possibility that Plover Bay Technologies is poised for substantial financial growth.

- Get an in-depth perspective on Plover Bay Technologies' balance sheet by reading our health report here.

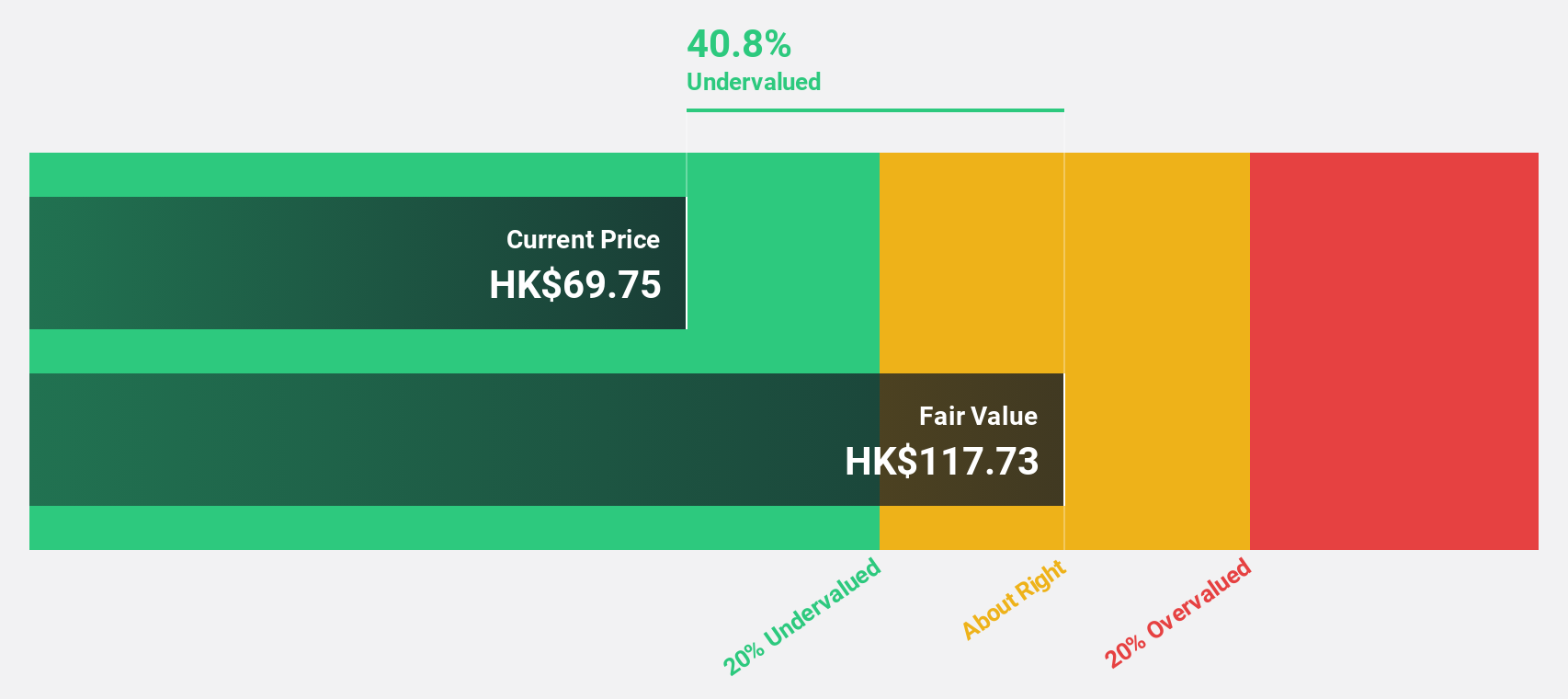

Everest Medicines (SEHK:1952)

Overview: Everest Medicines Limited is a biopharmaceutical company focused on discovering, licensing, developing, and commercializing therapies and vaccines for critical unmet medical needs in Greater China and other Asia Pacific markets, with a market cap of HK$21.79 billion.

Operations: The company's revenue is primarily derived from its pharmaceuticals segment, which generated CN¥706.68 million.

Estimated Discount To Fair Value: 43.1%

Everest Medicines, currently priced at HK$67.1, is trading significantly below its estimated fair value of HK$117.83, pointing to potential undervaluation based on cash flows. The company anticipates robust revenue growth at 30.3% annually, surpassing the Hong Kong market's 8.1%. Despite this strong outlook, return on equity is expected to remain modest at 10.2% in three years and the firm aims for profitability within three years amidst ongoing clinical advancements such as NEFECON and EVER001 developments in Asia.

- Our expertly prepared growth report on Everest Medicines implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Everest Medicines' balance sheet health report.

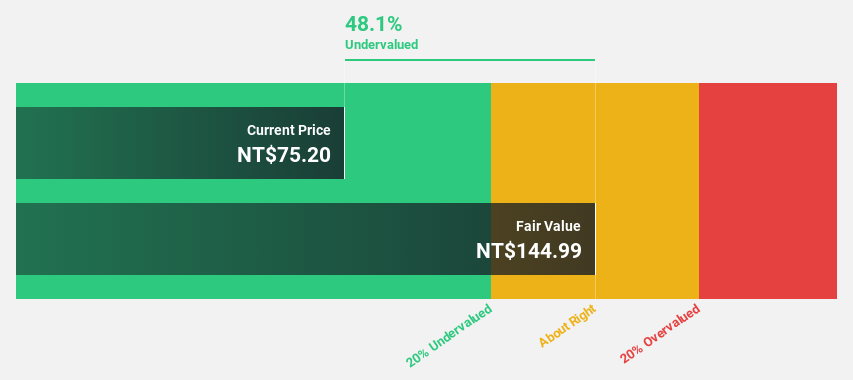

Gold Circuit Electronics (TWSE:2368)

Overview: Gold Circuit Electronics Ltd. is a Taiwan-based company that designs, manufactures, processes, and distributes printed circuit boards with a market cap of NT$145.03 billion.

Operations: The company's revenue primarily comes from the manufacturing and sales of printed circuit boards, amounting to NT$41.95 billion.

Estimated Discount To Fair Value: 20.8%

Gold Circuit Electronics, trading at NT$298, is valued below its estimated fair value of NT$376.19, indicating potential undervaluation based on cash flows. The company's earnings grew by 42.5% last year and are forecast to grow significantly at 22.21% annually, outpacing the Taiwan market's growth rate. Recent Q1 results show sales increased to TWD 12 billion from TWD 9 billion a year ago, with net income rising to TWD 1.75 billion from TWD 1.22 billion.

- Our earnings growth report unveils the potential for significant increases in Gold Circuit Electronics' future results.

- Dive into the specifics of Gold Circuit Electronics here with our thorough financial health report.

Where To Now?

- Embark on your investment journey to our 267 Undervalued Asian Stocks Based On Cash Flows selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Everest Medicines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1952

Everest Medicines

A biopharmaceutical company, engages in the discovery, license-in, development, and commercialization of therapies and vaccines to address critical unmet medical needs in Greater China and other Asia Pacific markets.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives