Amidst a backdrop of global economic shifts and policy changes, Asian markets have demonstrated resilience, with notable performances in key indices. Penny stocks, while often associated with speculative trading, can still offer substantial opportunities when supported by strong financial foundations. In this context, we explore three promising Asian penny stocks that combine growth potential with solid fundamentals, presenting intriguing prospects for investors seeking value in smaller companies.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Food Moments (SET:FM) | THB4.34 | THB4.29B | ✅ 4 ⚠️ 0 View Analysis > |

| JBM (Healthcare) (SEHK:2161) | HK$3.07 | HK$2.5B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.45 | HK$914.88M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.48 | HK$2.07B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.55 | SGD222.91M | ✅ 4 ⚠️ 0 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.87 | SGD11.3B | ✅ 5 ⚠️ 1 View Analysis > |

| Ekarat Engineering (SET:AKR) | THB1.02 | THB1.5B | ✅ 2 ⚠️ 2 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.95 | NZ$135.23M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.86 | THB9.82B | ✅ 3 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.59 | SGD984.92M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 978 stocks from our Asian Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Guangzhou Automobile Group (SEHK:2238)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Guangzhou Automobile Group Co., Ltd. operates in the research, development, manufacture, and sale of vehicles and motorcycles, along with parts and components in Mainland China and internationally, with a market cap of HK$69.61 billion.

Operations: Guangzhou Automobile Group Co., Ltd. has not reported specific revenue segments.

Market Cap: HK$69.61B

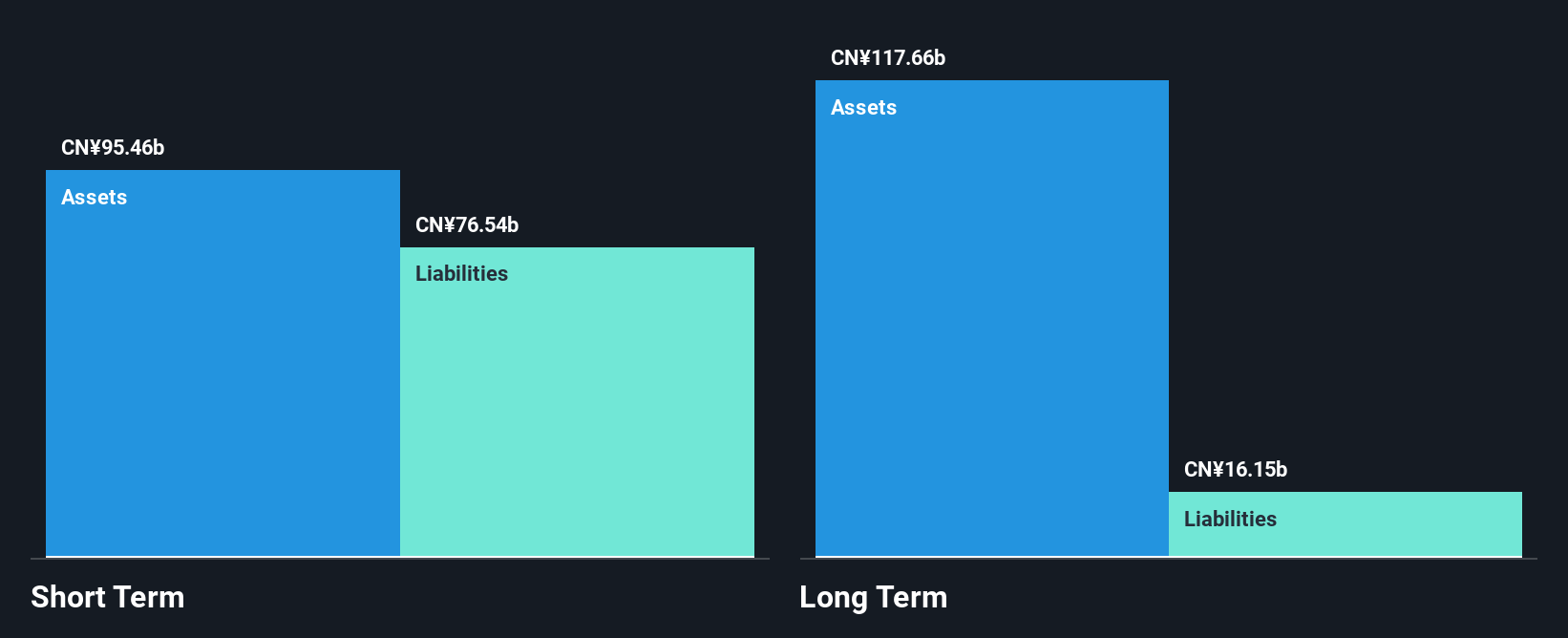

Guangzhou Automobile Group faces challenges as recent sales and production figures indicate year-on-year declines of 8.22% and 10.05%, respectively, for June 2025. Despite this, the company maintains a strong financial position with short-term assets exceeding both short- and long-term liabilities, and more cash than total debt. The strategic Brazil expansion underlines its commitment to international growth, though profitability remains an issue with rising losses over five years at an annual rate of 19.3%. Management's experience is a positive factor, while the stock trades at good value compared to peers despite being removed from a key index recently.

- Unlock comprehensive insights into our analysis of Guangzhou Automobile Group stock in this financial health report.

- Gain insights into Guangzhou Automobile Group's outlook and expected performance with our report on the company's earnings estimates.

Guoquan Food (Shanghai) (SEHK:2517)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Guoquan Food (Shanghai) Co., Ltd. operates as a home meal products company in Mainland China and has a market cap of HK$9.93 billion.

Operations: The company generates revenue from its Retail - Grocery Stores segment, amounting to CN¥7.04 billion.

Market Cap: HK$9.93B

Guoquan Food (Shanghai) Co., Ltd. shows robust financial health with short-term assets of CN¥3 billion surpassing both short- and long-term liabilities. Recent earnings reveal a significant improvement, with net income for the half-year reaching CN¥183.34 million, up from CN¥85.98 million the previous year, reflecting enhanced operating efficiency and strategic expansion of its retail network. The company is trading below estimated fair value by 21%, offering potential investment appeal despite a low return on equity at 11%. The board's average tenure suggests inexperience, but management remains seasoned with over five years of expertise.

- Click here and access our complete financial health analysis report to understand the dynamics of Guoquan Food (Shanghai).

- Assess Guoquan Food (Shanghai)'s future earnings estimates with our detailed growth reports.

Jiaze Renewables (SHSE:601619)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Jiaze Renewables Corporation Limited, with a market cap of CN¥94.94 billion, focuses on the development, construction, sale, operation, and maintenance of new energy power stations in China through its subsidiaries.

Operations: The company's revenue primarily comes from its operations in China, totaling CN¥2.49 billion.

Market Cap: CN¥9.49B

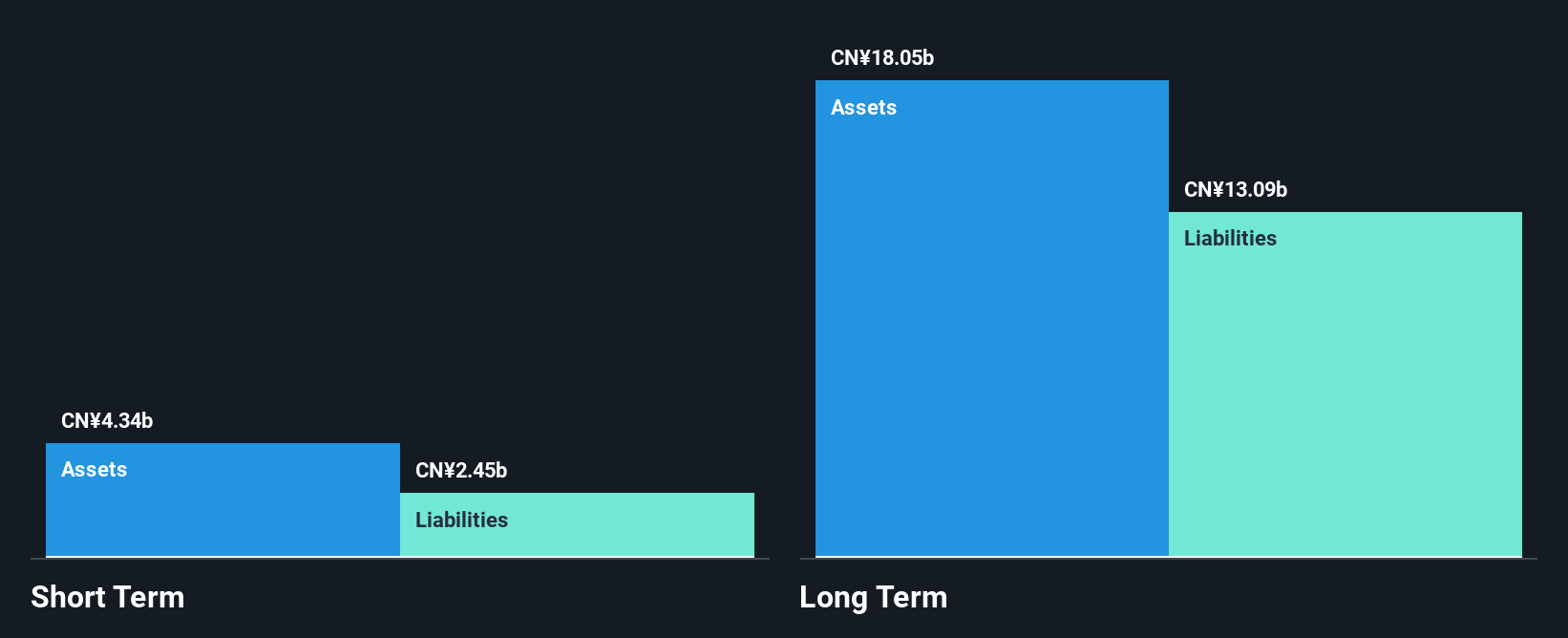

Jiaze Renewables faces challenges with negative earnings growth over the past year, contrasting its 18.7% annual growth over five years. Despite a high net debt to equity ratio of 70.7%, interest payments are well covered by EBIT, indicating manageable debt levels. The company's short-term assets exceed short-term liabilities but fall short against long-term obligations, highlighting potential liquidity concerns. Trading at 33.4% below estimated fair value suggests it may offer good relative value compared to peers, though its return on equity remains low at 9.8%. Recent shareholder meetings and earnings calls indicate active corporate governance engagement.

- Navigate through the intricacies of Jiaze Renewables with our comprehensive balance sheet health report here.

- Learn about Jiaze Renewables' future growth trajectory here.

Seize The Opportunity

- Discover the full array of 978 Asian Penny Stocks right here.

- Interested In Other Possibilities? AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2238

Guangzhou Automobile Group

Research, develops, manufactures, and sells vehicles and motorcycles, and parts and components in Mainland China and internationally.

Moderate growth potential with mediocre balance sheet.

Market Insights

Community Narratives