- China

- /

- Semiconductors

- /

- SZSE:300111

3 Asian Penny Stocks With Market Caps Under US$2B

Reviewed by Simply Wall St

Amidst a backdrop of mixed economic signals from major global markets, Asian equities have been navigating their own set of challenges and opportunities. For investors willing to explore beyond the well-trodden paths, penny stocks—often representing smaller or emerging companies—offer intriguing prospects. While the term might seem dated, these stocks can provide a blend of affordability and potential growth when backed by solid financials.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.25 | HK$788.69M | ✅ 4 ⚠️ 1 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$2.06 | HK$3.56B | ✅ 5 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.28 | HK$1.9B | ✅ 3 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.44 | SGD178.33M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.14 | HK$1.9B | ✅ 4 ⚠️ 2 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.44 | THB2.66B | ✅ 3 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.24 | SGD8.82B | ✅ 5 ⚠️ 0 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.205 | SGD41.45M | ✅ 4 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.13 | SGD858.72M | ✅ 4 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.55 | HK$52.2B | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 986 stocks from our Asian Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Shanghai Fudan-Zhangjiang Bio-PharmaceuticalLtd (SEHK:1349)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Shanghai Fudan-Zhangjiang Bio-Pharmaceutical Co., Ltd. is involved in the research, development, manufacture, and sale of bio-pharmaceutical products in China with a market capitalization of approximately HK$8.10 billion.

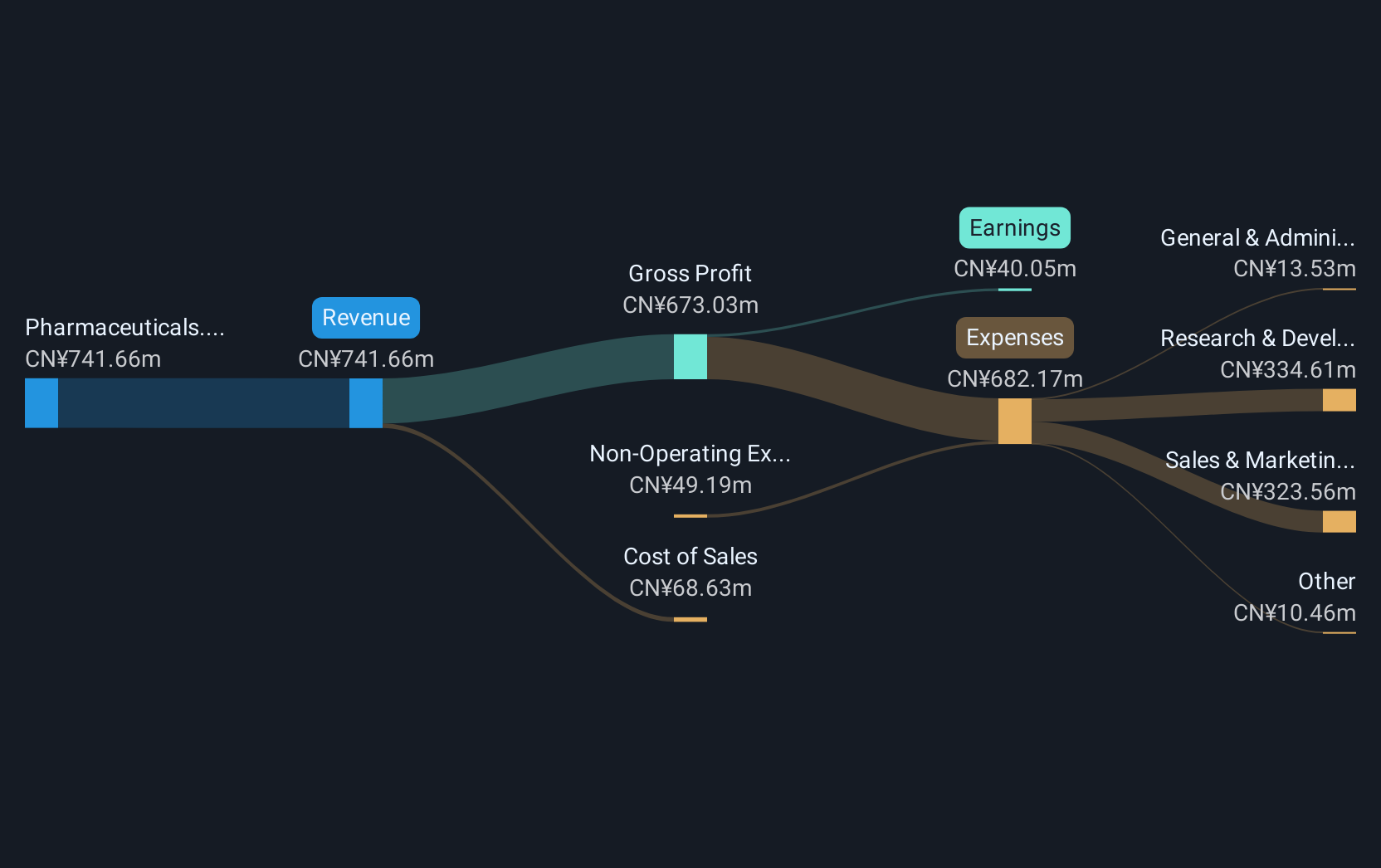

Operations: The company's revenue is derived entirely from its pharmaceuticals segment, amounting to CN¥741.66 million.

Market Cap: HK$8.1B

Shanghai Fudan-Zhangjiang Bio-Pharmaceutical Co., Ltd. has a stable financial position with no debt and sufficient short-term assets (CN¥1.6 billion) to cover liabilities, but faces challenges with declining earnings over the past five years. Recent developments include approval for a Phase I clinical trial of an innovative cancer drug, which could enhance its portfolio if successful, though it carries inherent risks typical in biotech ventures. The company declared a final dividend payable in August 2025, reflecting some shareholder value return despite lower profit margins compared to last year and low Return on Equity (1.7%).

- Dive into the specifics of Shanghai Fudan-Zhangjiang Bio-PharmaceuticalLtd here with our thorough balance sheet health report.

- Learn about Shanghai Fudan-Zhangjiang Bio-PharmaceuticalLtd's historical performance here.

Guizhou Xinbang Pharmaceutical (SZSE:002390)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Guizhou Xinbang Pharmaceutical Co., Ltd. is engaged in the research, development, manufacture, and sale of Chinese herbal medicines and other pharmaceutical products both in China and internationally, with a market cap of CN¥6.83 billion.

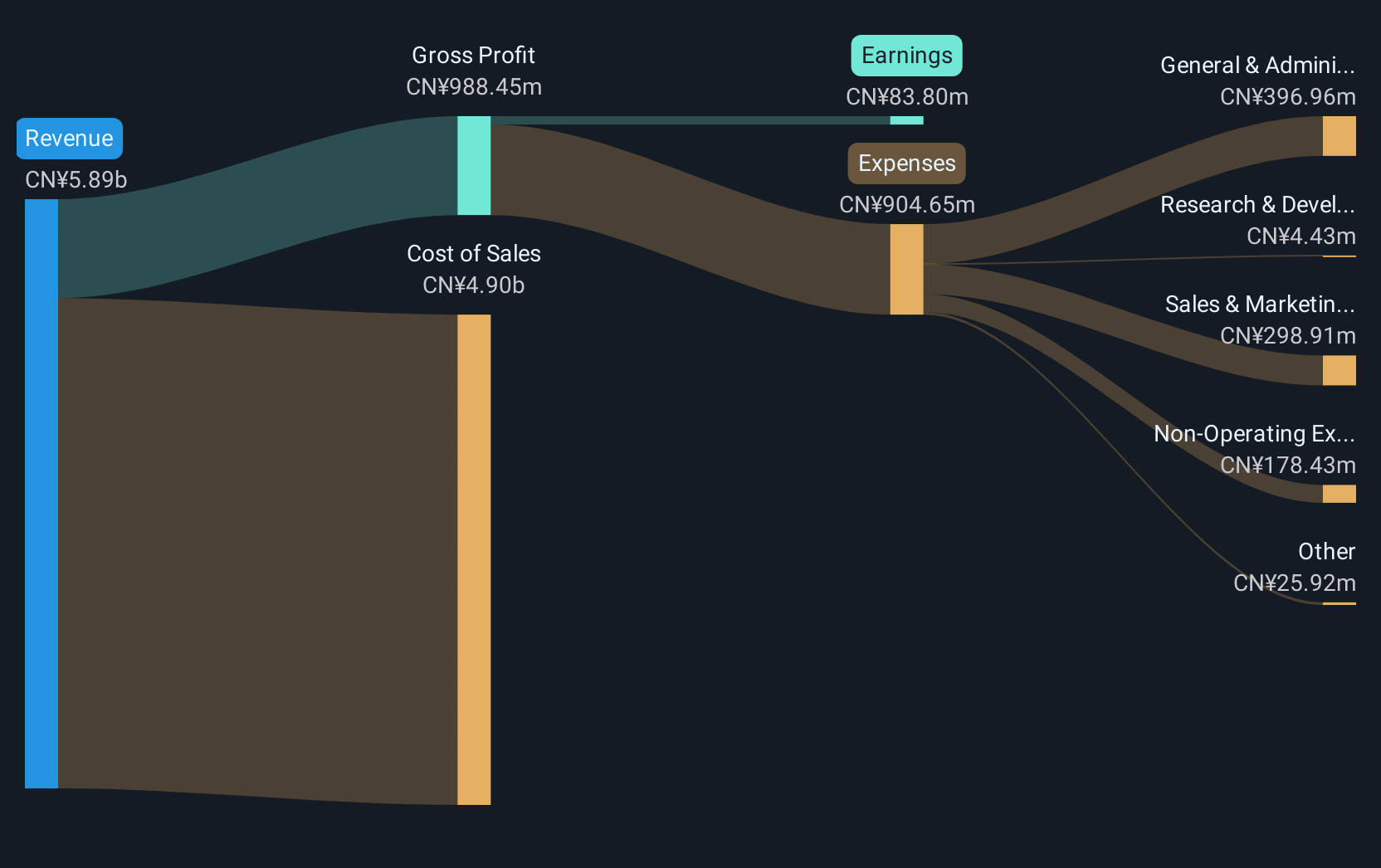

Operations: The company has not reported any specific revenue segments.

Market Cap: CN¥6.83B

Guizhou Xinbang Pharmaceutical Co., Ltd. demonstrates a mixed financial profile with its short-term assets (CN¥5.3 billion) comfortably exceeding both short and long-term liabilities, while maintaining more cash than total debt, indicating strong liquidity. However, the company faces challenges with declining earnings growth of -71.4% over the past year and a low Return on Equity of 2%. Recent earnings showed decreased revenue and net income compared to last year, reflecting operational hurdles. Despite these issues, dividends were affirmed for 2024 at CN¥0.30 per 10 shares, suggesting ongoing shareholder returns amidst financial volatility.

- Take a closer look at Guizhou Xinbang Pharmaceutical's potential here in our financial health report.

- Evaluate Guizhou Xinbang Pharmaceutical's historical performance by accessing our past performance report.

Zhejiang Sunflower Great Health (SZSE:300111)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhejiang Sunflower Great Health Co., Ltd. operates in the health industry and has a market cap of CN¥4.45 billion.

Operations: The company generates its revenue from the Pharmaceutical Industry segment, amounting to CN¥318.91 million.

Market Cap: CN¥4.45B

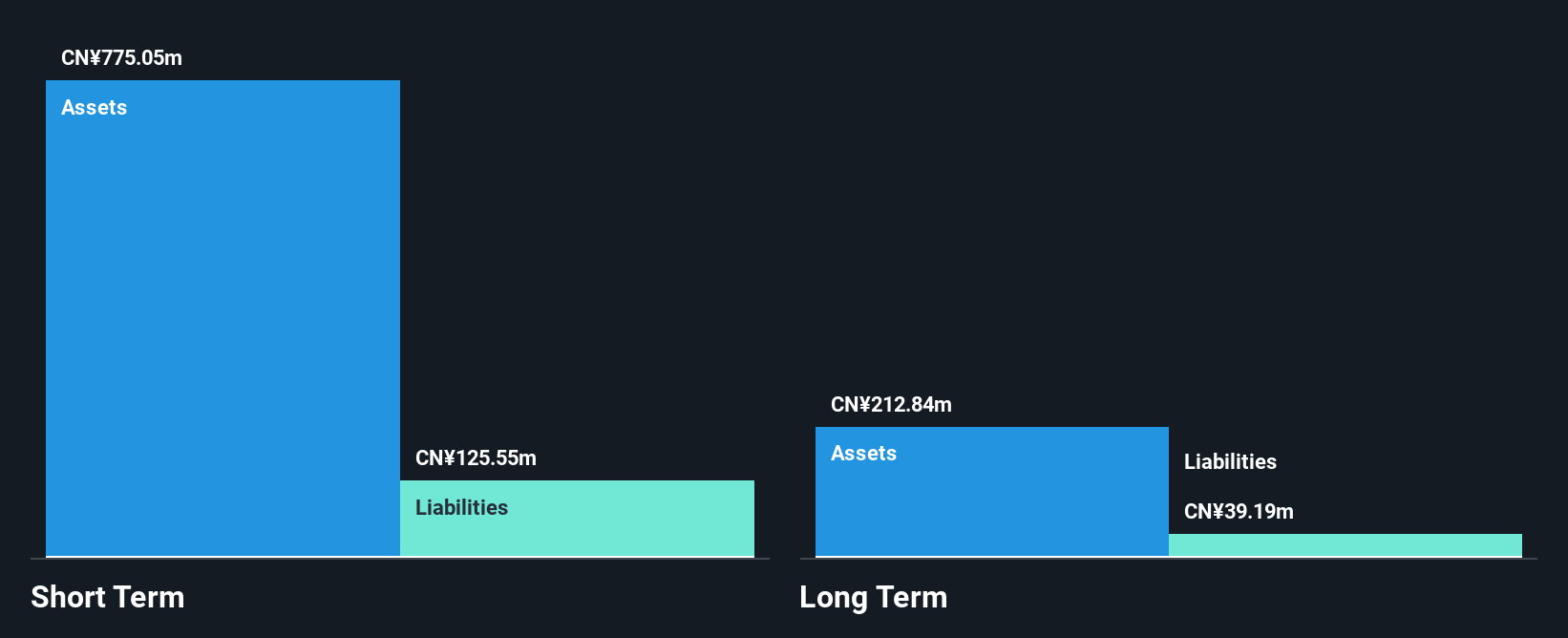

Zhejiang Sunflower Great Health Co., Ltd. presents a complex financial picture, with no debt and seasoned management, yet it faces challenges such as declining earnings growth of -79.4% over the past year and reduced profit margins from 9.6% to 2.2%. Despite stable weekly volatility at 7%, recent results showed a net loss for Q1 2025 compared to net income the previous year, reflecting operational difficulties. The company's short-term assets of CN¥775.1 million exceed liabilities, indicating liquidity strength amid these hurdles, while shareholders have not faced dilution recently despite financial pressures impacting earnings quality due to large one-off items.

- Unlock comprehensive insights into our analysis of Zhejiang Sunflower Great Health stock in this financial health report.

- Assess Zhejiang Sunflower Great Health's previous results with our detailed historical performance reports.

Key Takeaways

- Get an in-depth perspective on all 986 Asian Penny Stocks by using our screener here.

- Ready For A Different Approach? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Sunflower Great Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300111

Zhejiang Sunflower Great Health

Zhejiang Sunflower Great Health Co., Ltd.

Flawless balance sheet very low.

Market Insights

Community Narratives