- Hong Kong

- /

- Hospitality

- /

- SEHK:308

3 Asian Penny Stocks With Market Caps Below US$800M

Reviewed by Simply Wall St

As Asian markets navigate the complexities of global trade tensions and economic shifts, investors are increasingly looking for opportunities beyond the major indices. Penny stocks, a term that may seem outdated but remains significant, refer to smaller or newer companies that can offer unique investment opportunities. In this article, we explore three such penny stocks in Asia that stand out for their financial strength and potential for growth, providing investors with a chance to uncover hidden value in lesser-known companies.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.15 | HK$725.59M | ✅ 4 ⚠️ 2 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$1.88 | HK$3.25B | ✅ 5 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.09 | HK$1.74B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.44 | SGD178.33M | ✅ 4 ⚠️ 3 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.20 | HK$2B | ✅ 4 ⚠️ 2 View Analysis > |

| Halcyon Technology (SET:HTECH) | THB2.66 | THB798M | ✅ 2 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.31 | SGD9.09B | ✅ 5 ⚠️ 0 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.176 | SGD35.06M | ✅ 4 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.11 | SGD853.23M | ✅ 3 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.38 | HK$50.15B | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,153 stocks from our Asian Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Scales (NZSE:SCL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Scales Corporation Limited is involved in the manufacturing and trading of food ingredients across New Zealand, Asia, Europe, North America, and other international markets, with a market cap of NZ$648.15 million.

Operations: The company generates revenue from three main segments: Horticulture (NZ$248.88 million), Global Proteins (NZ$266.79 million), and Logistics (NZ$98.80 million).

Market Cap: NZ$648.15M

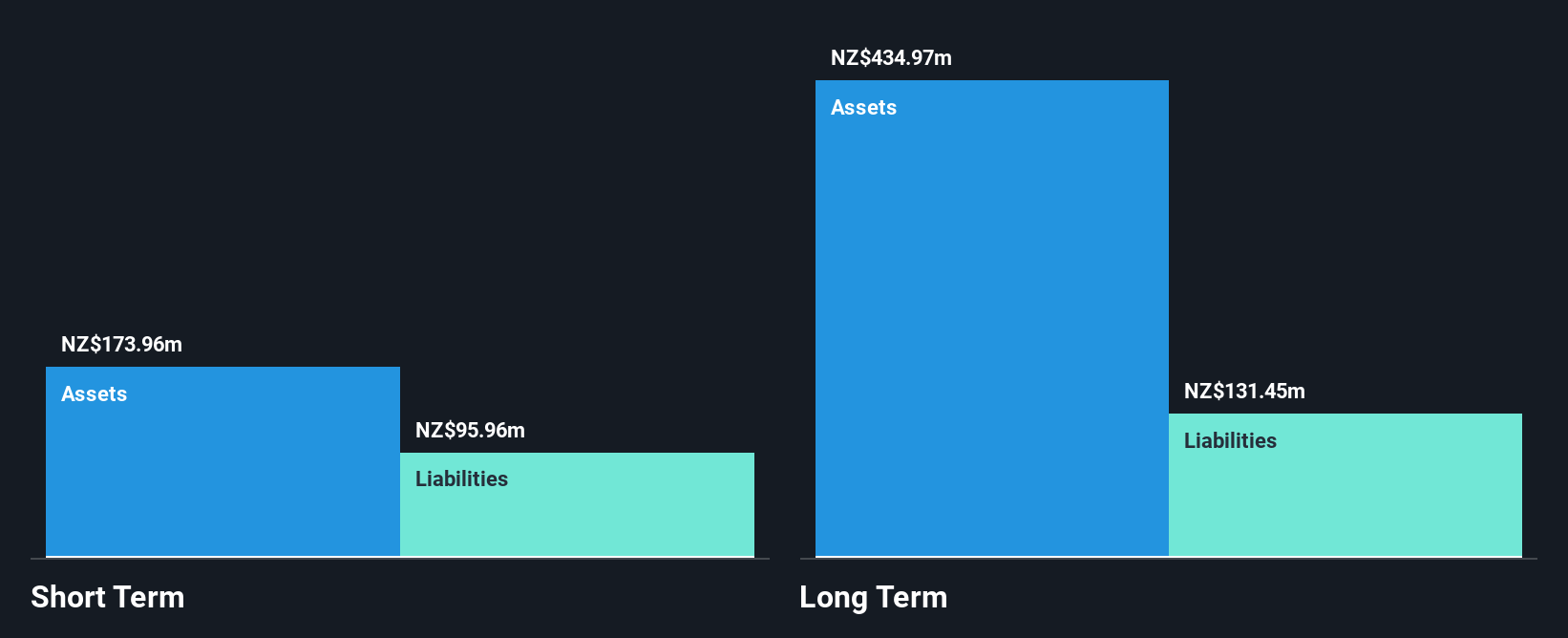

Scales Corporation Limited, with a market cap of NZ$648.15 million, demonstrates strong financial health as its short-term assets cover both short-term and long-term liabilities. The company has achieved significant earnings growth of 486.9% over the past year, surpassing industry averages and improving its net profit margins from 0.9% to 5.3%. Despite this growth, it trades at a substantial discount to its estimated fair value, suggesting potential for appreciation. Debt management is robust with cash flow well covering debt obligations and interest payments comfortably managed by EBIT. Management's experience further supports operational stability without recent shareholder dilution concerns.

- Click here and access our complete financial health analysis report to understand the dynamics of Scales.

- Gain insights into Scales' future direction by reviewing our growth report.

Tian Ge Interactive Holdings (SEHK:1980)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tian Ge Interactive Holdings Limited operates live social video platforms and other services in China and internationally, with a market cap of HK$773.88 million.

Operations: The company's revenue primarily comes from its Online Interactive Entertainment segment, which generated CN¥5.64 million.

Market Cap: HK$773.88M

Tian Ge Interactive Holdings has transitioned to profitability, reporting a net income of CN¥20 million for 2024 compared to a significant loss the previous year. Despite low revenue of CN¥10.16 million, the company's financial performance improved due to increased fair value of financial assets and unlisted equity investments. However, its dividend yield is not well-supported by earnings or cash flow. The company maintains more cash than debt but struggles with negative operating cash flow impacting debt coverage. Recent board changes indicate strategic shifts, with experienced management potentially enhancing governance and operational synergies in the future.

- Take a closer look at Tian Ge Interactive Holdings' potential here in our financial health report.

- Explore historical data to track Tian Ge Interactive Holdings' performance over time in our past results report.

China Travel International Investment Hong Kong (SEHK:308)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: China Travel International Investment Hong Kong Limited offers travel and tourism services, with a market capitalization of HK$5.92 billion.

Operations: The company's revenue is primarily derived from Tourist Attraction and Related Operations at HK$2.35 billion, Passenger Transportation Operations at HK$1.09 billion, Hotel Operations at HK$820.65 million, and Travel Document and Related Operations at HK$344.02 million.

Market Cap: HK$5.92B

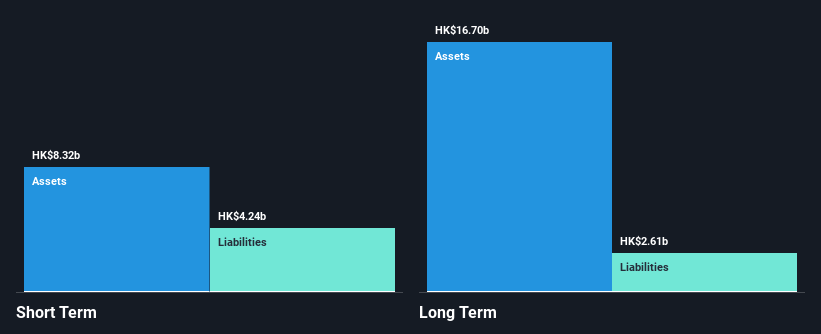

China Travel International Investment Hong Kong Limited, with a market cap of HK$5.92 billion, primarily generates revenue from tourist attractions and transportation services. Despite having more cash than debt and stable short-term liabilities coverage, the company faces challenges with declining profit margins, which fell to 2.3% from 5.3% last year due to a large one-off loss of HK$223.5 million in 2024. Recent amendments to its Articles of Association aim to modernize operations and improve flexibility in corporate governance, while experienced management oversees strategic adjustments amid negative earnings growth over the past year.

- Click to explore a detailed breakdown of our findings in China Travel International Investment Hong Kong's financial health report.

- Assess China Travel International Investment Hong Kong's future earnings estimates with our detailed growth reports.

Make It Happen

- Click through to start exploring the rest of the 1,150 Asian Penny Stocks now.

- Ready To Venture Into Other Investment Styles? We've found 20 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:308

China Travel International Investment Hong Kong

Provides travel and tourism services.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives