- Thailand

- /

- Healthcare Services

- /

- SET:BH

3 Asian Dividend Stocks Yielding Up To 5.5%

Reviewed by Simply Wall St

As global markets grapple with new U.S. tariffs, Asian indices have shown resilience amid mixed economic signals, such as Japan's tariff-related tensions and China's potential stimulus measures. In this environment, dividend stocks can offer a stable income stream for investors seeking to navigate the complexities of the market while benefiting from consistent payouts.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.42% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.04% | ★★★★★★ |

| NCD (TSE:4783) | 4.23% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.31% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.31% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.87% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.11% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.43% | ★★★★★★ |

| Daicel (TSE:4202) | 4.81% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.01% | ★★★★★★ |

Click here to see the full list of 1189 stocks from our Top Asian Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

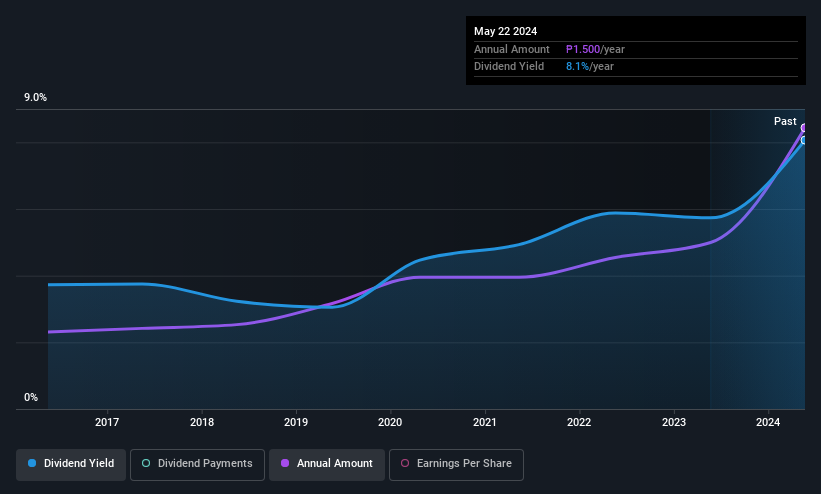

Asian Terminals (PSE:ATI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Asian Terminals, Inc. operates and manages the South Harbor Port of Manila and the Port of Batangas in the Philippines, with a market capitalization of ₱55.79 billion.

Operations: Asian Terminals, Inc.'s revenue is primarily derived from its Ports Business segment, amounting to ₱16.91 billion.

Dividend Yield: 5.4%

Asian Terminals, Inc. offers a stable dividend profile with a payout ratio of 41.7%, indicating dividends are well-covered by earnings and cash flows (70.5% cash payout). The company has consistently increased its dividends over the past decade, though its 5.38% yield is slightly below the top quartile in the Philippine market. Recent earnings growth of 29% supports this stability, alongside declared regular and special dividends totaling PHP 2.145 billion and PHP 858.14 million, respectively, payable in June 2025.

- Take a closer look at Asian Terminals' potential here in our dividend report.

- Our valuation report here indicates Asian Terminals may be overvalued.

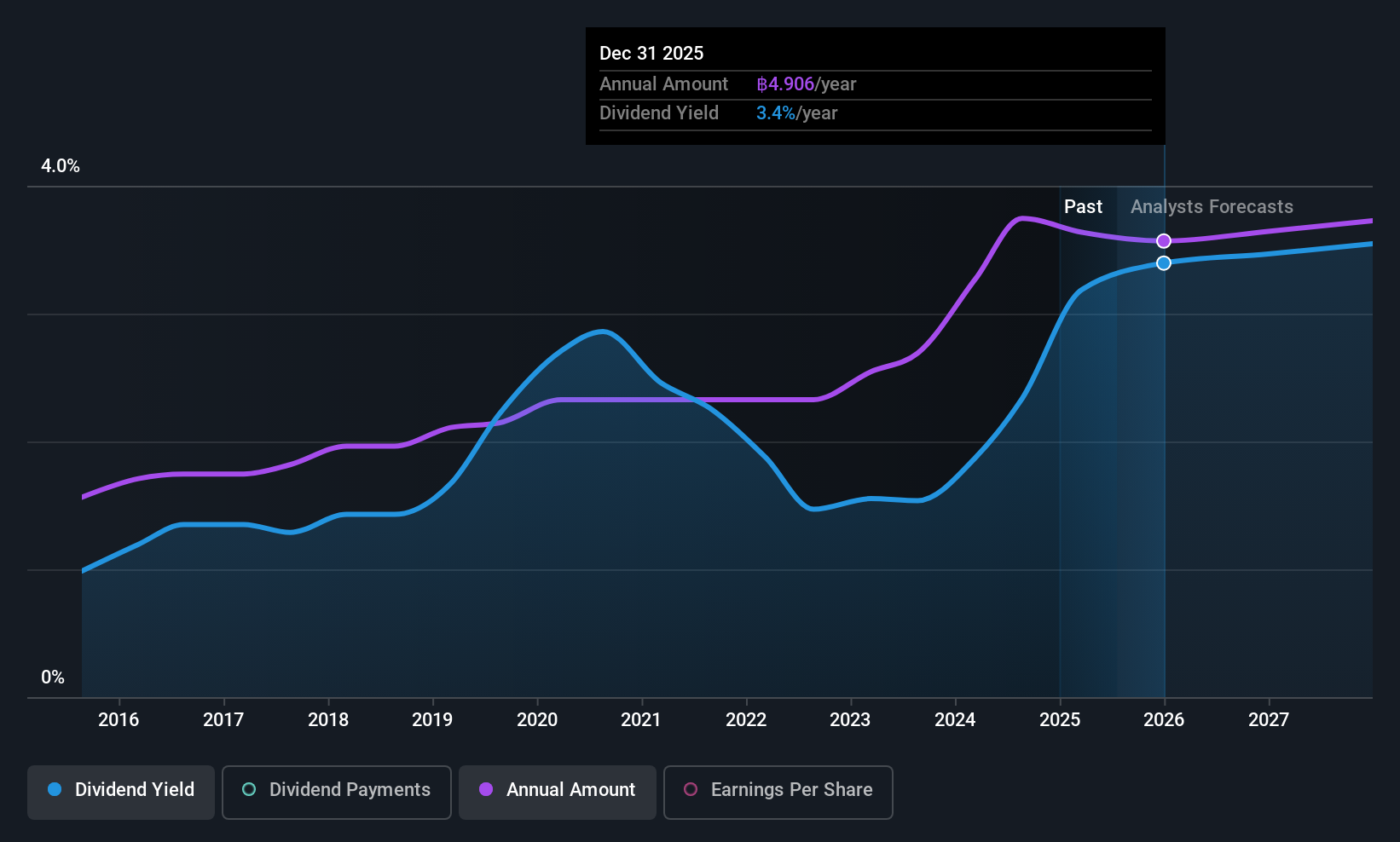

Bumrungrad Hospital (SET:BH)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bumrungrad Hospital Public Company Limited owns and operates hospitals in Thailand and internationally, with a market cap of THB116.86 billion.

Operations: Bumrungrad Hospital Public Company Limited generates revenue primarily from its Hospital and Health Care Center Business, amounting to THB25.50 billion.

Dividend Yield: 3.4%

Bumrungrad Hospital maintains a stable dividend profile with a payout ratio of 52.8%, ensuring dividends are covered by earnings and cash flows (56.6% cash payout). Although its 3.4% yield is below top-tier dividend payers in Thailand, the company has consistently increased dividends over the past decade with little volatility. Despite recent declines in revenue and net income, it trades at good value compared to peers, supporting its potential as a reliable dividend stock.

- Navigate through the intricacies of Bumrungrad Hospital with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Bumrungrad Hospital's current price could be quite moderate.

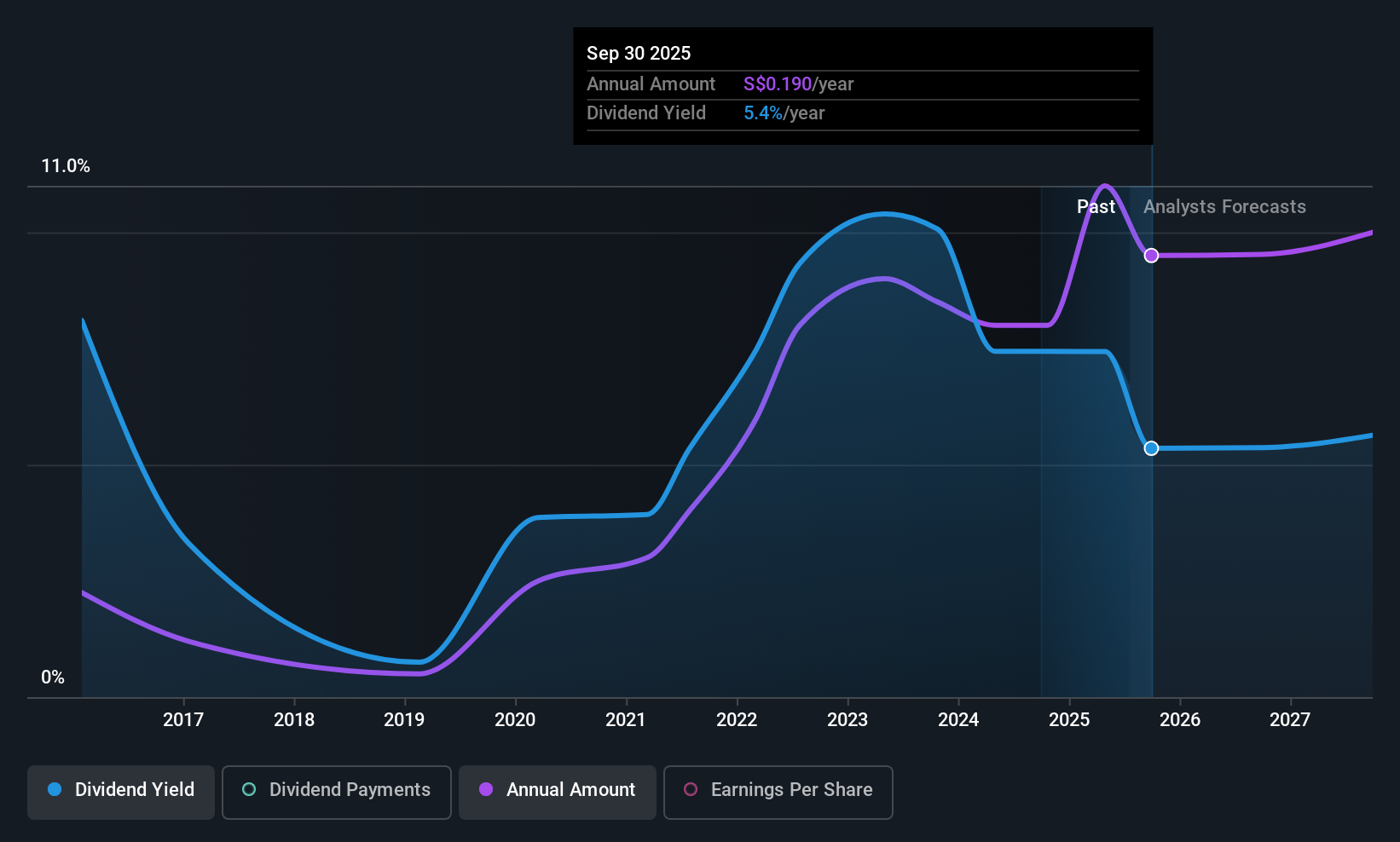

BRC Asia (SGX:BEC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: BRC Asia Limited, with a market cap of SGD987.66 million, specializes in the prefabrication of steel reinforcement for concrete across Singapore and several international markets including Australia, Brunei, Hong Kong, Indonesia, Malaysia, Thailand, and India.

Operations: BRC Asia Limited's revenue is primarily derived from its Fabrication and Manufacturing segment, which accounts for SGD1.18 billion, followed by its Trading segment at SGD255.23 million.

Dividend Yield: 5.6%

BRC Asia's dividends are well-covered by earnings (payout ratio of 39.6%) and cash flows (68.2% cash payout), though its dividend history shows volatility with past annual drops over 20%. Despite a modest yield of 5.56%, slightly below Singapore's top-tier payers, the company benefits from a strong contract pipeline, including a recent SGD 570 million Changi Airport Terminal 5 project, which may bolster future financial stability without guaranteeing dividend growth consistency.

- Get an in-depth perspective on BRC Asia's performance by reading our dividend report here.

- Our valuation report here indicates BRC Asia may be undervalued.

Turning Ideas Into Actions

- Access the full spectrum of 1189 Top Asian Dividend Stocks by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bumrungrad Hospital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:BH

Bumrungrad Hospital

Owns and operates hospitals in Thailand and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives