- Philippines

- /

- Real Estate

- /

- PSE:ROCK

3 Asian Dividend Stocks To Consider With Up To 8.1% Yield

Reviewed by Simply Wall St

As Asian markets navigate a complex landscape of economic challenges and opportunities, investors are increasingly looking towards dividend stocks as a potential source of stable income amidst fluctuating market conditions. In this environment, identifying stocks with strong fundamentals and attractive yields can be particularly appealing for those seeking to balance risk with the potential for regular returns.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 3.80% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.24% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 3.70% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.93% | ★★★★★★ |

| NCD (TSE:4783) | 4.33% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.49% | ★★★★★★ |

| Daicel (TSE:4202) | 4.52% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.48% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.70% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.12% | ★★★★★★ |

Click here to see the full list of 1080 stocks from our Top Asian Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

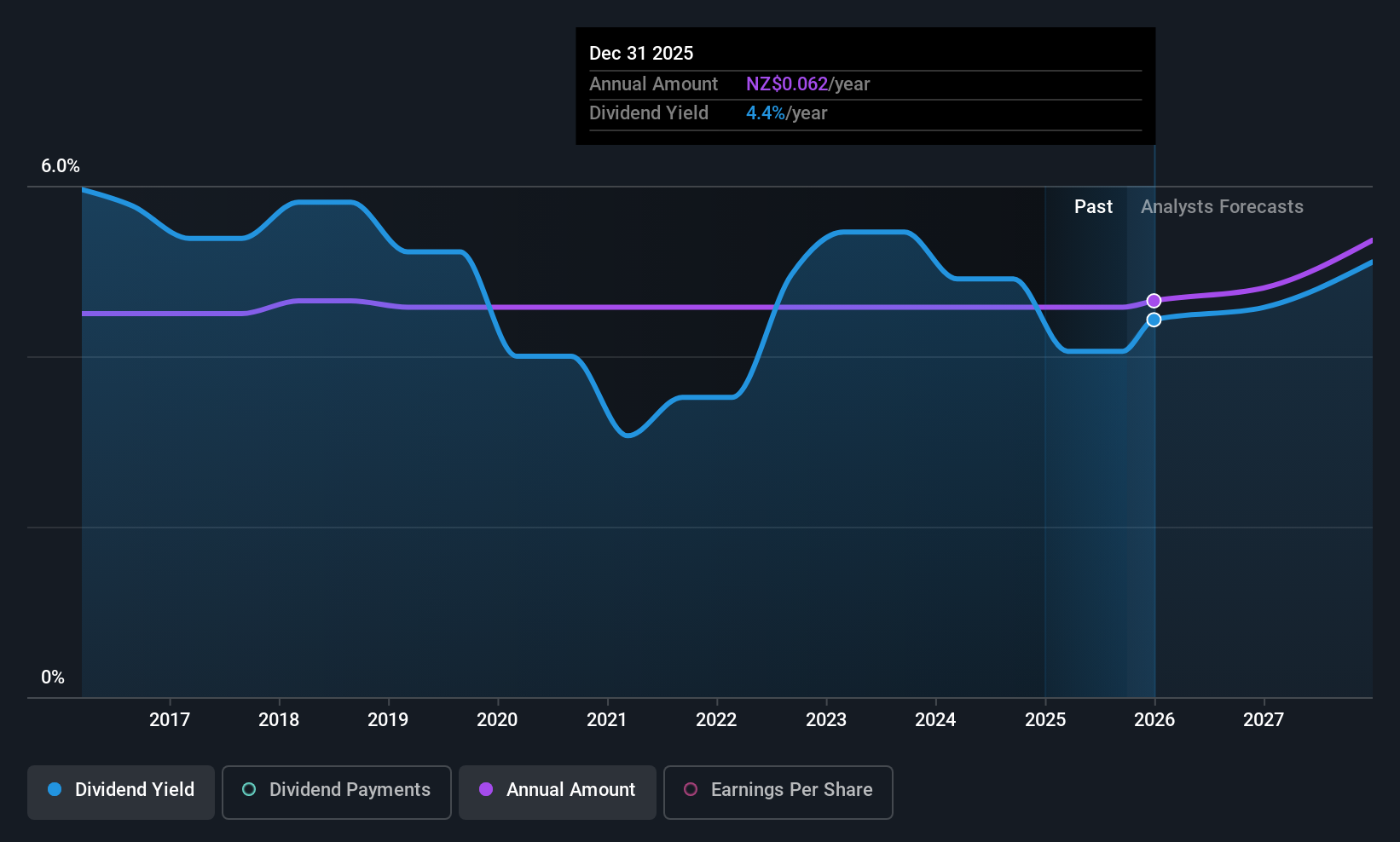

NZX (NZSE:NZX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NZX Limited operates a stock exchange in New Zealand and has a market cap of NZ$464.88 million.

Operations: NZX Limited generates revenue from several segments, including Regulation (NZ$3.86 million), Wealth Technology (NZ$11.09 million), Funds Services (NZ$46.96 million), Secondary Markets (NZ$25.62 million), Corporate Services (NZ$0.09 million), Information Services (NZ$19.67 million), and Capital Markets Origination (NZ$16.94 million).

Dividend Yield: 4.3%

NZX offers a stable dividend history with payments growing over the past decade, but its current payout ratio of 108.2% suggests dividends are not well covered by earnings. Despite covering dividends with a cash payout ratio of 81.1%, high debt levels and declining net income to NZ$8.34 million in H1 2025 raise sustainability concerns. The dividend yield of 4.31% is below the top quartile in New Zealand, highlighting potential limitations for investors seeking high yields in Asia's dividend landscape.

- Dive into the specifics of NZX here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that NZX is priced higher than what may be justified by its financials.

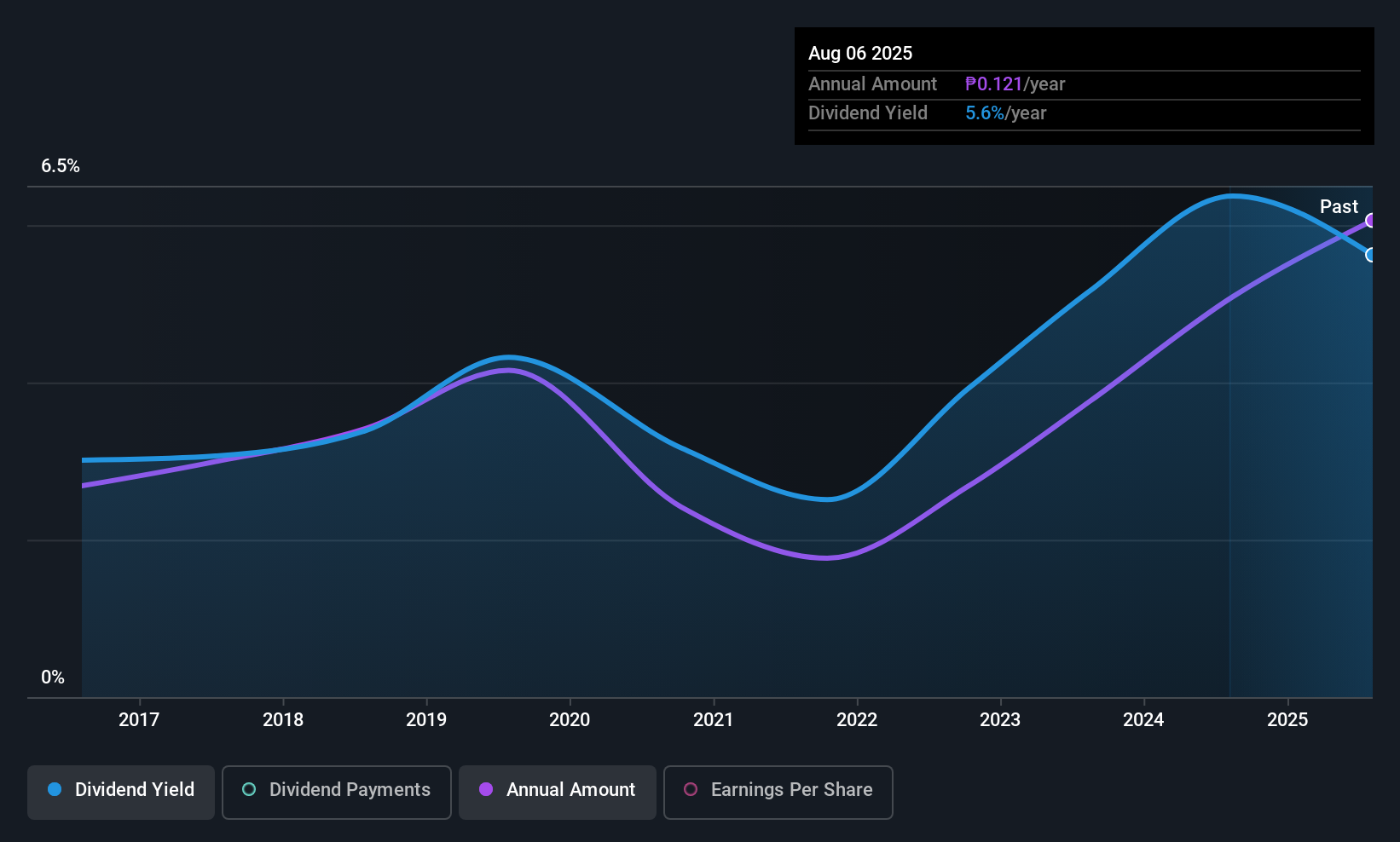

Rockwell Land (PSE:ROCK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Rockwell Land Corporation is a property developer focusing on high-end and upper-mid markets primarily in Metro Manila, the Philippines, with a market cap of approximately ₱12.05 billion.

Operations: Rockwell Land Corporation generates its revenue from two main segments: Commercial Development, contributing ₱4.23 billion, and Residential Development, which accounts for ₱16.61 billion.

Dividend Yield: 6.2%

Rockwell Land's dividend yield of 6.15% places it among the top 25% of Philippine dividend payers, though its history has been volatile with significant annual drops. Despite this, dividends are well covered by earnings and cash flows, with payout ratios at 20.2% and 33.2%, respectively. Recent earnings reports show modest growth in revenue but a slight decline in net income, indicating potential challenges in sustaining dividend stability amidst fluctuating financial performance.

- Delve into the full analysis dividend report here for a deeper understanding of Rockwell Land.

- Our valuation report unveils the possibility Rockwell Land's shares may be trading at a premium.

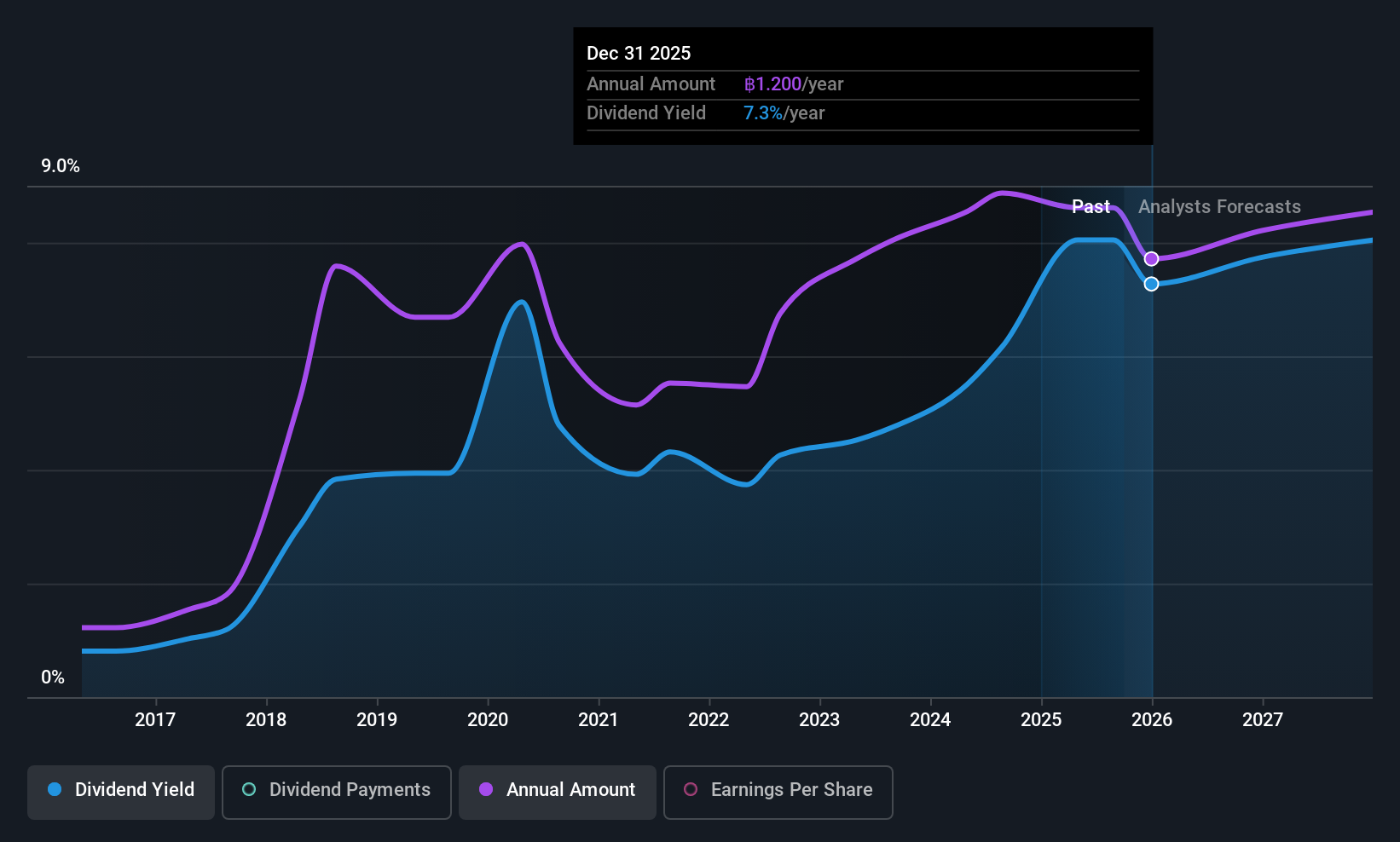

Sabina (SET:SABINA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sabina Public Company Limited, with a market cap of THB5.70 billion, manufactures and sells ready-made clothes, primarily focusing on ladies' underwear in Thailand and internationally.

Operations: Sabina Public Company Limited generates its revenue primarily from the apparel segment, amounting to THB3.47 billion.

Dividend Yield: 8.2%

Sabina's dividend yield of 8.17% ranks it in the top 25% of Thai dividend payers, yet its dividends are not well covered by earnings due to a high payout ratio of 109.1%. While cash flows reasonably cover dividends with a cash payout ratio of 50.8%, the company's history shows volatility and unreliability in payouts over the past decade. Recent financials reveal declining revenue and net income, raising concerns about future dividend sustainability despite historical increases.

- Unlock comprehensive insights into our analysis of Sabina stock in this dividend report.

- According our valuation report, there's an indication that Sabina's share price might be on the expensive side.

Summing It All Up

- Unlock more gems! Our Top Asian Dividend Stocks screener has unearthed 1077 more companies for you to explore.Click here to unveil our expertly curated list of 1080 Top Asian Dividend Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:ROCK

Rockwell Land

Operates as a property developer in high-end and upper-mid markets primarily in Metro Manila, the Philippines.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives