Narratives are currently in beta

Key Takeaways

- Strategic expansions and acquisitions, along with R&D investments, aim to drive long-term growth and revenue through product innovation and enhanced manufacturing.

- Strong demand for key products and pipeline milestones are positioned to enhance revenue and expand the company's therapeutic offerings, boosting future earnings potential.

- Manufacturing capacity challenges and regulatory uncertainties pose risks to revenue growth, market share, and pricing power for Eli Lilly.

Catalysts

About Eli Lilly- Eli Lilly and Company discovers, develops, and markets human pharmaceuticals worldwide.

- Lilly is significantly expanding its manufacturing capabilities with investments exceeding $20 billion since 2020 and an additional $4.5 billion dedicated to research and development through the Lilly Medicine Foundry. This expansion is expected to support increased production capacity for their growing portfolio, notably contributing to future revenue growth.

- The company is seeing strong demand and growth for products like Mounjaro and Zepbound, with U.S. prescription volume growth of 25% in Q3. The initiatives to expand access and increase supply are likely to drive continued revenue growth in the coming quarters.

- Lilly achieved several key pipeline milestones, including approvals for new therapeutic indications, which are building a stronger product portfolio in areas like Alzheimer’s and atopic dermatitis. These approvals are expected to enhance future earnings by broadening revenue streams.

- The ongoing investments in R&D, with a 13% increase in expenses to support both early and late-stage portfolio projects, are aimed at fueling long-term growth. Successful outcomes from these investments could significantly impact future earnings.

- The acquisition of Morphic Therapeutic and continued strategic investments in the pipeline, including promising late-phase studies, indicate potential future revenue streams through innovative products and treatment options, which can improve long-term financial performance.

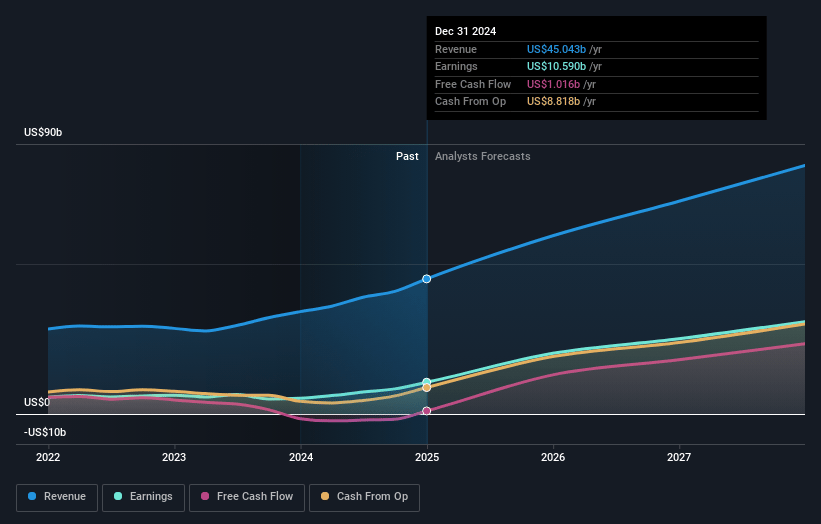

Eli Lilly Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Eli Lilly's revenue will grow by 23.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 20.5% today to 37.8% in 3 years time.

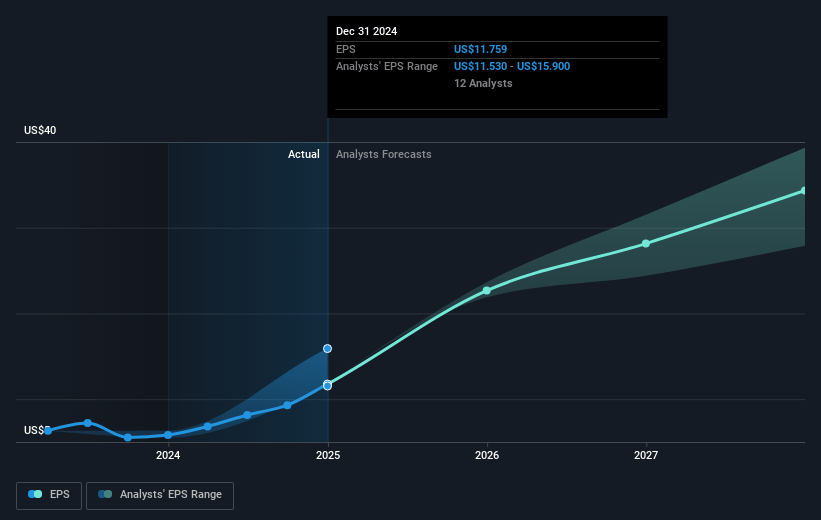

- Analysts expect earnings to reach $29.0 billion (and earnings per share of $32.67) by about January 2028, up from $8.4 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 35.8x on those 2028 earnings, down from 83.2x today. This future PE is greater than the current PE for the US Pharmaceuticals industry at 18.3x.

- Analysts expect the number of shares outstanding to decline by 0.42% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.92%, as per the Simply Wall St company report.

Eli Lilly Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The drawdown in channel inventory decreased Q3 sales of Mounjaro and Zepbound by a mid-single-digit percentage, highlighting potential volatility that can impact quarterly revenue.

- Lilly faces manufacturing capacity challenges and is carefully balancing demand creation with production, which could impact earnings growth if demand outpaces supply capabilities.

- The ongoing issues with compounding, particularly related to compounded tirzepatide, pose a competitive risk and potential erosion of market share, which could negatively affect revenue.

- Regulatory uncertainties concerning FDA actions on compounding and potential generic equivalents might impact pricing power and net margins.

- The impact of the Inflation Reduction Act (IRA) and future negotiations on drug pricing, particularly for drugs like Verzenio, can introduce pricing pressures that may affect long-term revenue and profit margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $984.05 for Eli Lilly based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $1250.0, and the most bearish reporting a price target of just $580.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $76.9 billion, earnings will come to $29.0 billion, and it would be trading on a PE ratio of 35.8x, assuming you use a discount rate of 5.9%.

- Given the current share price of $773.29, the analyst's price target of $984.05 is 21.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives