Last Update 02 Nov 25

Fair value Increased 7.88%Analysts have modestly raised their price target for Coeur Mining from approximately $20 to nearly $21.70 per share. They cite improved valuation multiples and solid operational performance, even though revenue growth forecasts remain slow.

Analyst Commentary

Recent street research on Coeur Mining reflects a mix of positive developments and tempered expectations regarding the company’s valuation, growth prospects, and operational execution.

Bullish Takeaways

- Bullish analysts have raised price targets, reflecting improving valuation multiples and confidence in the company’s operational performance.

- Coeur Mining remains recognized as one of the world’s largest primary silver producers and an important gold producer, highlighting the company’s strong market position.

- Analysts point to the company’s aggressive exploration budget as a strategy to enhance reserve life and fuel longer-term growth.

- Recent quarterly results have surpassed some expectations, further strengthening the company’s balance sheet and paving the way for anticipated production growth in the latter part of the year.

Bearish Takeaways

- Some bearish analysts have downgraded their ratings on Coeur Mining, shifting to a more neutral stance due to the significant rally in the company’s share price this year.

- There is a consensus that, following the substantial appreciation in value, the shares now reflect fair valuation, limiting near-term upside potential.

- While operational execution is strong, projected revenue growth remains sluggish, which tempers enthusiasm for aggressive upside revisions.

- Periodic downward revision of price targets signals cautiousness around current market conditions and the pace of the company’s future growth.

What's in the News

- Coeur Mining repurchased a total of 668,200 shares for $7.33 million under its buyback program announced in May 2025. This reflects ongoing capital returns to shareholders (Buyback Tranche Update).

- Third quarter 2025 unaudited production results showed gold output increased to 111,364 ounces from 94,993 ounces a year prior. Silver production rose to 4.8 million ounces compared to 3.0 million the previous year (Announcement of Operating Results).

- Updated 2025 full-year production guidance raised the expected midpoint for gold output to 415,250 ounces. Silver guidance was narrowed to a midpoint of 18.1 million ounces (Corporate Guidance, New/Confirmed).

- Exploration updates from Las Chispas and Kensington mines reported high-grade gold and silver drill intercepts. Expanded drilling is planned to support further resource growth (Product-Related Announcements).

Valuation Changes

- Consensus Analyst Price Target has increased modestly from approximately $20.08 to $21.67 per share.

- Discount Rate has edged up slightly from about 7.52% to 7.59%.

- Revenue Growth estimates have decreased notably from 23.85% to 14.44%.

- Net Profit Margin is projected to improve slightly, rising from 37.69% to 38.22%.

- Future P/E Ratio forecasts have risen from 18.8x to 21.8x. This indicates expectations of higher share valuation relative to earnings.

Key Takeaways

- Rising industrial and investor demand for silver and gold, along with operational improvements, position the company for strong revenue growth and margin expansion.

- Exploration and asset integration efforts are set to extend mine life and underpin stable long-term production.

- Greater regulatory, operational, and financial risks may constrain growth, pressure margins, and jeopardize long-term profitability and cash flow stability.

Catalysts

About Coeur Mining- Operates as a gold and silver producer in the United States, Canada, and Mexico.

- The company is set to benefit from anticipated sustained demand growth for silver, underpinning future topline revenue expansion, as global electrification and clean energy adoption drive higher usage of silver in solar panels, batteries, and EVs.

- Persistent inflationary pressures and ongoing geopolitical uncertainty continue to bolster investor demand for gold and silver as safe-haven assets, which could lead to higher realized prices and expanded net margins for Coeur.

- The successful ramp-up and integration of the Rochester expansion and Las Chispas asset are driving significant increases in silver and gold production, positioning Coeur for robust revenue and earnings growth in the near to medium term.

- Strengthened operational efficiencies-reflected in declining cost applicable to sales per ounce and process improvements at key mines-are improving operating leverage and could further support margin expansion and cash generation.

- Aggressive brownfield exploration and land package expansion at existing sites are likely to extend mine life and expand reserves, supporting sustained long-term production and reducing future earnings volatility.

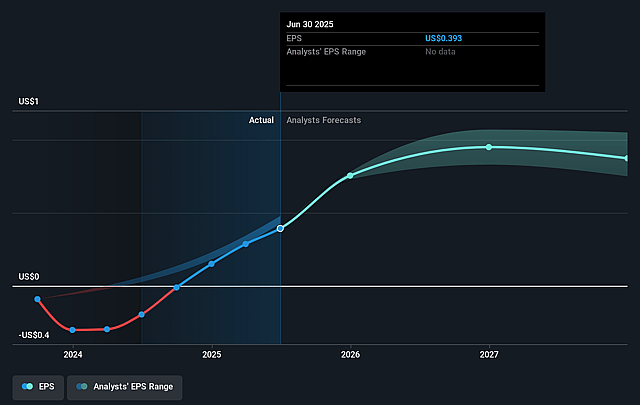

Coeur Mining Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Coeur Mining's revenue will grow by 12.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 13.1% today to 32.3% in 3 years time.

- Analysts expect earnings to reach $676.1 million (and earnings per share of $0.69) by about September 2028, up from $190.7 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $1.1 billion in earnings, and the most bearish expecting $485 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.8x on those 2028 earnings, down from 47.1x today. This future PE is lower than the current PE for the US Metals and Mining industry at 22.7x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.37%, as per the Simply Wall St company report.

Coeur Mining Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Expectations for higher regulatory and permitting hurdles, especially highlighted by the multi-year Silvertip development process and emphasis on not cutting corners, may extend lead times for new asset development and expansion, potentially delaying growth projects and revenue realization.

- The company's reliance on existing reserves and need for ongoing infill and expansion drilling to maintain or extend mine life, especially at Las Chispas and other key assets, presents a risk of production declines should exploration fail to replace depletion, which could negatively impact long-term revenue and earnings stability.

- Exposure to currency fluctuations (e.g., significant impact of the strong Mexican peso on costs and taxation) introduces cost volatility and could erode net margins if adverse foreign exchange moves persist.

- Coeur's high capital intensity, as seen in substantial investments at Rochester and Las Chispas as well as legacy acquisition-related amortization and deferred tax liabilities, may pressure cash flows and lead to higher non-cash expenses, reducing reported net income over time.

- Regional and jurisdictional risks, including potential resource nationalism, changing tax regimes, and environmental permitting delays in the U.S., Mexico, and Canada, could increase operating costs, cause project delays, or disrupt production, all of which would impact long-term profitability and cash flow.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $13.083 for Coeur Mining based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $14.5, and the most bearish reporting a price target of just $12.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.1 billion, earnings will come to $676.1 million, and it would be trading on a PE ratio of 18.8x, assuming you use a discount rate of 7.4%.

- Given the current share price of $13.97, the analyst price target of $13.08 is 6.8% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives