Bath and Body Works is an interesting company to try and project for since it has so many irregular attributes that make it trickier to predict future growth because of. The biggest reason it becomes hard to value is because of the spin off from L brands back in 2021 when Bath and Body works and Victoria Secret went ahead in becoming two separate companies. Initially a large part for it was because of the fact that Bath and Body works was being dragged down by Victoria Secret; which is kind of ironic because what is holding them down now is the debt that a large part came from splitting from Victoria Secret. This is one of the things that makes it so hard to evaluate. Past that we can really only take into consideration numbers that are after 2021 since that is when BBWI was solely on their own. I have a ton of different ways I ran the numbers for this company so I will break them all down. First off here is some of the data.

Price: $33.65

PE: 9.05

ROTA: 19.56%

ROE: -57.62%

Current Ratio: 148.09%

Gross Profit Ratio: 44.26%

Net Income Ratio: 10.92%

ROIC: 25.64%

Revenue/Share: $33.21

Net Income/Share: $3.63

Cash/Share: $3.06

FCF/Share: $3.00

FCF Yield: 7.98%

Dividend Yield: 2.38%

Dividend Ratio: 22.18%

EPS: $3.75

Here are my first bits I am going to be considering in my future projections for the company. From this We get a rough idea that the Intrinsic value of the company at this moment is roughly around $37 which is roughly a 12% difference in actual price. However a big thing that is holding the stock back when we look at it like this is the dividend discount model valuation hold the companies value back in both of the scenarios. This is mainly in part because the company is maintaining their current dividend of $0.80 and are planning on holding it there. However it does not show the fact of how they are also using a large amount of cash they are instead continuing to use for share repurchases and for repayment of debt; which mainly comes from when they split from Victoria Secret. If we take out the dividend discount model price projection out of the picture we actually come to an amount closer to $42.66. Which would be around 29% higher then the current share price; which I feel is a much more fair price for the company.

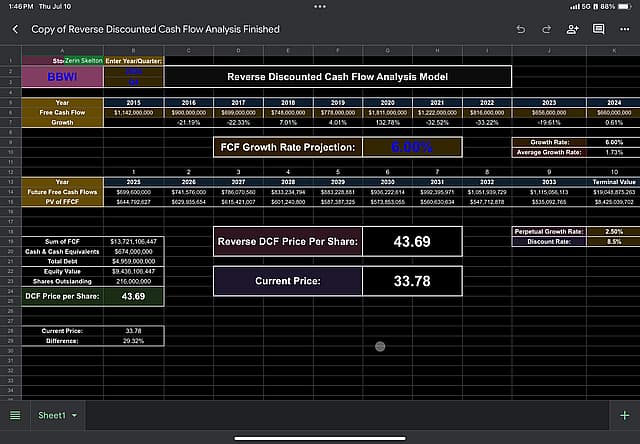

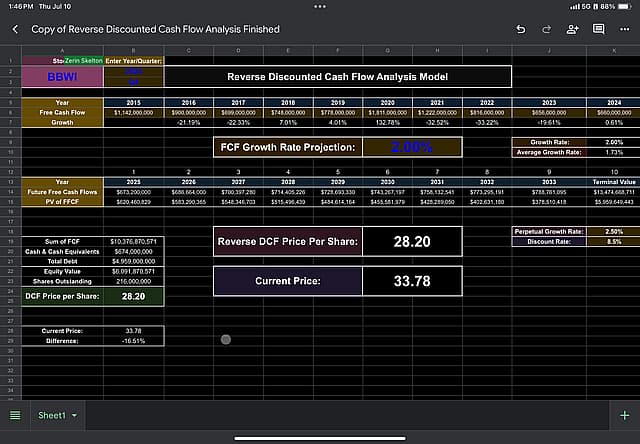

Next we will look at some projections based off of FCF Growth.

I have for this my Bull case of a 10% FCF Growth Projection, 6% for my mid and then 2% for my bear.

Then finally here is my Bogle sheet and Profitability + Income sheet.

Overall if you did not know the story behind the numbers then it would 100% look like a terrible company to own. However a big reason the companies numbers are not as good as they should be is because of the fact of how much debt they took from that split off from Victoria Secret. I ran a projection based off of equity per share if we were able to take away some of the debt from that split off. In so doing it left their a share holder equity of $10/share. I felt like this was definitely too high so I only used it to project a rough rate of return on equity. In so doing I was able to come up with an annual return of 37.5%; then if we take out the dividend aspect we are left with a return of 29.625%. I then took the TTM PE and used that to come to a share holder equity per share closer to $4; which I felt was much more appropriate to run with. From that I ran 10 years into the future and figured out the amount with a 29.625% return. After I had come up with that I came up with the priced based upon historical PE's. I ran a forward PE at roughly 8; a TTM one at 9.3 and then an 10 year average of 12.91.

Then based off of this I ran a Bear, Base and Bull case for each year.

This is what I came up with after running those numbers. However I do not believe that BBWI will start to take off for a couple more years however; but if they are able to I believe they will become very hot. In order for them to hit this there are going to have to be 2 things to happen. The first thing is they need to get through their mountain of debt. Once they can get through this debt then their earnings growth is going to start growing like crazy and become more productive. This will not help with their low revenue growth; but it will show a significant amount of more FCF and just make the company more sound. Especially with how much revenue they are already bringing in.

The second thing is if the new CEO is able to follow through with what he was saying. During the Q1 2025 conference call I became very impressed and excited about what he had to say and the passion he held through the call in his hopes and goals for the company in the growing years. Not only do I think he will help the company improve in the field they are already in; BUT help to improve in 2 markets which there is a large amount of money to be made. These two markets are firstly international, and second towards the male gender as a whole. BBWI mainly tailors to women; even though BBWI has and carries men products. However the main issue is that firstly most men do not care as much as woman to spend as much money on smelling good; and more importantly most men are not even aware of the fact that BBWI has men's products. If they are able to jump on this in just NA then they will already see a significant improvement on their revenue. And with Daniel Heaf's background at Nike I feel like he will do a good job at helping to appeal to that market.

Heaf also brings a great background to improve BBWI's international presence. At Nike in the past he had worked internationally and was born overseas as well, being I feel the perfect person to help BBWI to break into both of those categories.

I do not think BBWI is a stock that will blow up like crazy in the next 1 to 2 years. But I do think it will make some modest improvements through the next couple of years; especially because in their guidance that they provided, it was included that numbers were anticipating tariffs, so I believe that the numbers that they priced in might actually be lower then what will actually happen. However I think that until we see them start to really get rid of that debt and expand their reach into the market internationally and with men and in expanding other products like laundry........they will not improve significantly. But I am still bullish on the company.

My current projection for the stock within the next year is $40.73 which I feel is a very fair price.

My 5 year base price projection is at $131.86 which is a 290% roughly.

Then my 10 year projection base is at $481.47 which is roughly 1,235% above where it is currently.

This obviously all is assuming that they are able to continually hit what they are aiming for and able to continue to knock off their debt without letting it get bigger. If they can hit these new target markets that I definitely believe they can hit these numbers.

As of this moment I am willing to pay up to $33.95 assuming that they can hit my current 1 year projection and a 20% ROR.

Have other thoughts on Bath & Body Works?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

The user Zwfis has a position in NYSE:BBWI. Simply Wall St has no position in any of the companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The author of this narrative is not affiliated with, nor authorised by Simply Wall St as a sub-authorised representative. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimates are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.