Last Update 11 Jan 26

Fair value Decreased 2.76%OVH: New Leadership And AI Cloud Expansion Will Support Future Upside

Analysts have trimmed their fair value estimate for OVH Groupe from €9.06 to €8.81, citing slightly softer assumptions on revenue growth, profit margins and future P/E, alongside the application of a marginally lower discount rate.

What's in the News

- OVHcloud signed a cloud hosting agreement with LCH SA, aiming to support LCH SA's operational resilience, security, scalability, and faster deployment, including migration of some services to a SecNumCloud qualified environment that complies with applicable regulations for the clearing house's activities (Key Developments).

- At the OVHcloud Summit in Paris, the company announced several AI and quantum related offerings, including a solution for professional digital twins via OmisimO AI chat with the SHAI coding agent, expanded AI infrastructure with SambaNova for large scale inference, a program to help SaaS vendors integrate agentic AI, and its first Quantum as a Service platform with access to Pasqal's 100 qubit Orion Beta QPU and plans to add eight more systems by the end of 2027 (Key Developments).

- OVHcloud is reinforcing international growth plans, highlighting 3 availability zone regions in Paris and Milan and announcing a new 3 availability zone region in Berlin to address resilience needs for German customers, alongside themes of AI, cloud security, sovereignty, and customer experience at the 2025 OVHcloud Summit (Key Developments).

- The group strengthened its presence in Germany with the deployment of a 3 availability zone region in Berlin, designed for critical applications that require high availability and resilience, and intends to continue rolling out highly redundant 3 availability zone regions in other European cities in the future (Key Developments).

- OVH Groupe was removed from the Euronext 150 Index, and the company scheduled a Board meeting for October 20, 2025 to consider changes to its governance structure. This resulted in the appointment of founder Octave Klaba as Chairman and CEO and the end of the separation between the Chairman and CEO roles (Key Developments).

Valuation Changes

- Fair Value Estimate, trimmed slightly from €9.06 to €8.81 per share, reflecting modestly softer assumptions in the model.

- Discount Rate, adjusted marginally from 12.30% to about 12.16%, indicating a very small change in the required return used in the valuation.

- Revenue Growth, assumption eased slightly from about 7.30% to about 7.21%, pointing to a minor recalibration of top line expectations in the forecast period.

- Net Profit Margin, assumption reduced modestly from about 4.19% to about 4.13%, implying a small tweak to projected profitability.

- Future P/E, target multiple lowered slightly from about 29.9x to about 29.5x, signalling a very small adjustment to the valuation multiple applied to future earnings.

Key Takeaways

- OVHcloud's focus on data sovereignty and strategic autonomy could capture growth due to increased demand for secure data solutions amid geopolitical tensions.

- Innovation with new products like the Bare Metal Pod and public cloud enhancements could drive higher revenue per customer and support earnings growth.

- OVHcloud's strong revenue growth, strategic product rollouts, and solid financial positioning suggest sustained profitability and potential future revenue growth amid shifting geopolitical demands.

Catalysts

About OVH Groupe- Provides public and private cloud, shared hosting, and dedicated server products and solutions worldwide.

- OVHcloud's commitment to data sovereignty and strategic autonomy positions it to capture growth opportunities as geopolitical tensions increase demand for secure and local data solutions, potentially driving future revenue growth.

- The continued development of Public Cloud offerings, including enhancements in artificial intelligence solutions and new product rollouts in their Availability Zones, could support future revenue growth by meeting growing customer demands.

- OVHcloud's investment in setting up infrastructure, like their upcoming data center in Milan and expansion into new Local Zones, implies plans for future growth, suggesting potential revenue expansion as these come online.

- The shift towards longer-term customer engagements through the success of their Savings Plan offers can enhance predictability and stability in revenues, potentially supporting future margin and earnings growth.

- The introduction of new products such as the ultra-secure Bare Metal Pod signals an ongoing innovation strategy, which could lead to higher ARPAC (Average Revenue Per Active Customer) and subsequently bolster earnings and margins.

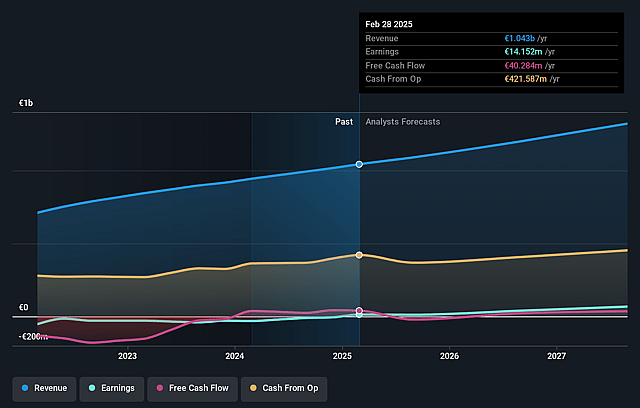

OVH Groupe Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming OVH Groupe's revenue will grow by 10.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.4% today to 7.8% in 3 years time.

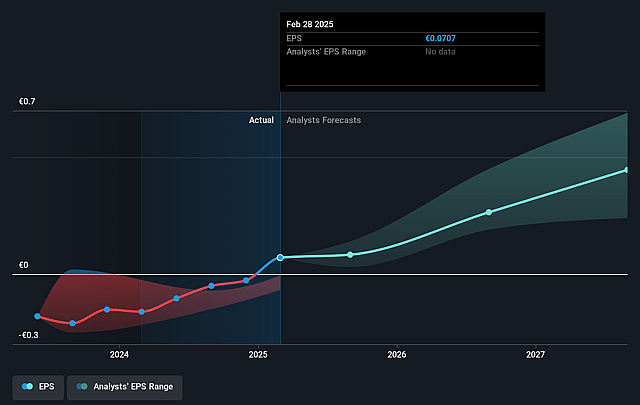

- Analysts expect earnings to reach €110.9 million (and earnings per share of €0.51) by about June 2028, up from €14.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 25.6x on those 2028 earnings, down from 152.4x today. This future PE is greater than the current PE for the FR IT industry at 15.4x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.69%, as per the Simply Wall St company report.

OVH Groupe Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- OVHcloud experienced a solid revenue growth of 10.2% like-for-like, fueled by continued demand for Public Cloud and data sovereignty offers, suggesting that their revenue might remain strong.

- The company achieved an adjusted EBITDA margin of 40%, demonstrating strong operating leverage, which could sustain their profit margins.

- Successful refinancing with a €500 million bond and a €450 million green loan suggests a stable financial position, which may secure long-term earnings.

- OVHcloud continues to strengthen its market position by rolling out new Public Cloud and AI products, potentially leading to increased revenues from these innovative offerings.

- Demand for data sovereignty and strategic autonomy solutions positions OVHcloud well in a shifting geopolitical environment, offering potential for future revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €11.617 for OVH Groupe based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €16.0, and the most bearish reporting a price target of just €6.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €1.4 billion, earnings will come to €110.9 million, and it would be trading on a PE ratio of 25.6x, assuming you use a discount rate of 9.7%.

- Given the current share price of €14.22, the analyst price target of €11.62 is 22.4% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on OVH Groupe?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.