Key Takeaways

- Strengthened European positioning and regulatory tailwinds are expected to drive sustained market share gains, above-industry revenue growth, and expanding net margins for OVHcloud.

- Rapid international expansion and energy-efficient infrastructure bolster long-term growth prospects, operational leverage, and customer retention through deeper marketplace partnerships.

- Strong competition from major cloud providers, rising costs, and high investment demands may hamper OVH Groupe's scalability, profitability, and capacity to grow globally.

Catalysts

About OVH Groupe- Provides public and private cloud, shared hosting, and dedicated server products and solutions worldwide.

- Analyst consensus recognizes that geopolitical tensions and rising demand for data sovereignty benefit OVHcloud, but this may vastly understate the scale; OVHcloud's 25-year head start and deep-rooted position as the natural European provider could see it emerge as the default choice for public and private organizations, potentially driving a multi-year market share gain and outsized, above-industry revenue growth.

- While analyst consensus highlights the ramp-up of Public Cloud and AI-driven offerings, this likely underestimates OVHcloud's rapid international product rollout and its ability to capture share from hyperscalers due to growing regulatory pressures, leading not only to sustained double-digit revenue growth but also superior pricing power and expanding net margins as regulatory tailwinds intensify.

- OVHcloud's recent acceleration in expanding Local Zones and new data center infrastructure, particularly in underpenetrated international markets, sets the stage for a step-change in its addressable customer base, supporting a structurally higher long-term growth rate and driving both revenue and margin expansion as operational leverage increases.

- Leveraging its proprietary, energy-efficient data center design alongside its 40% adjusted EBITDA margin allows OVHcloud to convert top-line growth into disproportionately stronger earnings and free cash flow generation, positioning it as an outlier for long-term net margin accretion as the shift toward sustainable cloud intensifies.

- OVHcloud's evolving marketplace ecosystem and deepening partnerships in regional markets will foster greater cross-sell and upsell opportunities, increasing customer stickiness and recurring revenue share, ultimately providing greater revenue predictability and compounding cumulative lifetime value per customer.

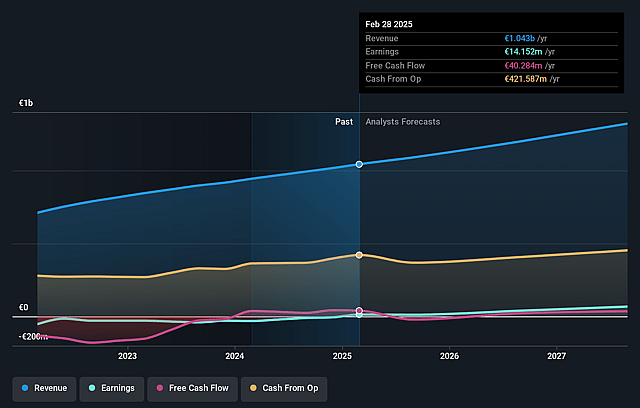

OVH Groupe Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on OVH Groupe compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming OVH Groupe's revenue will grow by 12.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 1.4% today to 11.7% in 3 years time.

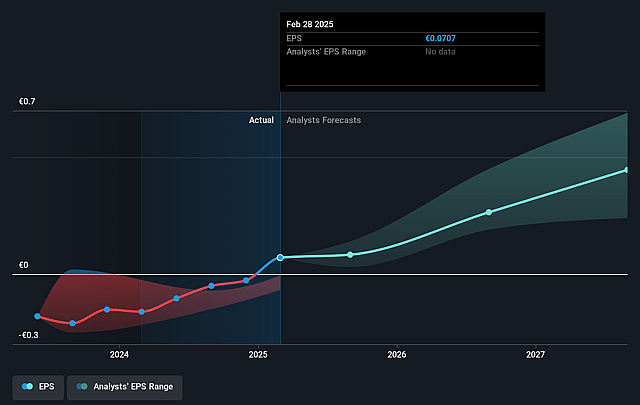

- The bullish analysts expect earnings to reach €174.6 million (and earnings per share of €0.49) by about September 2028, up from €14.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 23.0x on those 2028 earnings, down from 109.8x today. This future PE is greater than the current PE for the FR IT industry at 14.5x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.93%, as per the Simply Wall St company report.

OVH Groupe Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating dominance of hyperscale cloud providers such as AWS, Microsoft Azure, and Google Cloud continues to deepen competitive barriers; OVH Groupe's acknowledged positioning in niche segments like data sovereignty and inference AI may not be sufficient to gain significant market share, which could restrict revenue growth and place sustained pressure on overall profitability.

- High and increasing capital expenditure requirements for expansion, modernization, and hardware procurement were highlighted by OVH's 36% CapEx-to-revenue ratio in H1 2025; this recurring need to invest nearly one-third of revenues into CapEx risks outpacing internal cash generation and could eventually lead to higher debt, reduced free cash flow, and potential dilution of earnings.

- Rising energy costs and tightening environmental regulations globally can materially impact operational expenses for data centers, especially as OVH Groupe repeatedly emphasizes sustainability investments; if these cost increase trends accelerate, they may significantly erode net margins and diminish the expected benefit from recent ESG improvements.

- The persistent commoditization of core cloud and hosting infrastructure, combined with OVH Groupe's lack of deep proprietary ecosystem services and platform stickiness compared to hyperscalers, could increase client churn and keep customer acquisition costs elevated, ultimately pressuring revenues and lowering customer lifetime value.

- Escalating data sovereignty and localization requirements, along with supply chain risks mentioned in proactive component procurement, could hinder OVH Groupe's capacity to scale efficiently and respond to global demand, raising compliance and operational costs and threatening the company's ability to sustain international top-line growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for OVH Groupe is €15.9, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of OVH Groupe's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €15.9, and the most bearish reporting a price target of just €7.4.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €1.5 billion, earnings will come to €174.6 million, and it would be trading on a PE ratio of 23.0x, assuming you use a discount rate of 10.9%.

- Given the current share price of €10.25, the bullish analyst price target of €15.9 is 35.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.