Last Update 29 Nov 25

OVH: Leadership Changes And Cloud Expansion Will Shape Resilient Outlook

Analysts have revised their price target for OVH Groupe to €9.11. They are maintaining their prior fair value estimate as updates to the discount rate and modest adjustments in profitability expectations support this stance.

What's in the News

- OVHcloud signed a cloud hosting agreement with LCH SA, enabling migration to a SecNumCloud qualified environment for increased operational resilience and regulatory compliance. (Client Announcements)

- The OVHcloud Summit in Paris featured key announcements including a Quantum-as-a-Service offering, expanded AI solutions, and an initiative to help software vendors integrate agentic AI. (Product-Related Announcements)

- OVHcloud expanded in Germany with the deployment of a 3-AZ region in Berlin, strengthening high-availability services for clients in regulated sectors. (Business Expansions)

- Founder Octave Klaba has been appointed as Chairman and CEO, following board-driven governance changes. (Executive Changes: CEO)

- OVHcloud launched Managed Kubernetes Service (MKS) Standard, providing a secure, highly available platform for critical business applications in multi-cloud environments. (Product-Related Announcements)

Valuation Changes

- Consensus Analyst Price Target: Kept steady at €9.11, reflecting a stable fair value estimate.

- Discount Rate: Declined modestly from 12.18% to 11.80%, indicating a slightly lower required rate of return.

- Revenue Growth: Unchanged at 7.38%, suggesting analysts expect a consistent growth outlook.

- Net Profit Margin: Remains stable at 4.91%, supporting the prior profitability expectations.

- Future P/E: Edged down slightly from 25.54x to 25.28x, reflecting a marginal adjustment in forecasted valuation multiples.

Key Takeaways

- OVHcloud's focus on data sovereignty and strategic autonomy could capture growth due to increased demand for secure data solutions amid geopolitical tensions.

- Innovation with new products like the Bare Metal Pod and public cloud enhancements could drive higher revenue per customer and support earnings growth.

- OVHcloud's strong revenue growth, strategic product rollouts, and solid financial positioning suggest sustained profitability and potential future revenue growth amid shifting geopolitical demands.

Catalysts

About OVH Groupe- Provides public and private cloud, shared hosting, and dedicated server products and solutions worldwide.

- OVHcloud's commitment to data sovereignty and strategic autonomy positions it to capture growth opportunities as geopolitical tensions increase demand for secure and local data solutions, potentially driving future revenue growth.

- The continued development of Public Cloud offerings, including enhancements in artificial intelligence solutions and new product rollouts in their Availability Zones, could support future revenue growth by meeting growing customer demands.

- OVHcloud's investment in setting up infrastructure, like their upcoming data center in Milan and expansion into new Local Zones, implies plans for future growth, suggesting potential revenue expansion as these come online.

- The shift towards longer-term customer engagements through the success of their Savings Plan offers can enhance predictability and stability in revenues, potentially supporting future margin and earnings growth.

- The introduction of new products such as the ultra-secure Bare Metal Pod signals an ongoing innovation strategy, which could lead to higher ARPAC (Average Revenue Per Active Customer) and subsequently bolster earnings and margins.

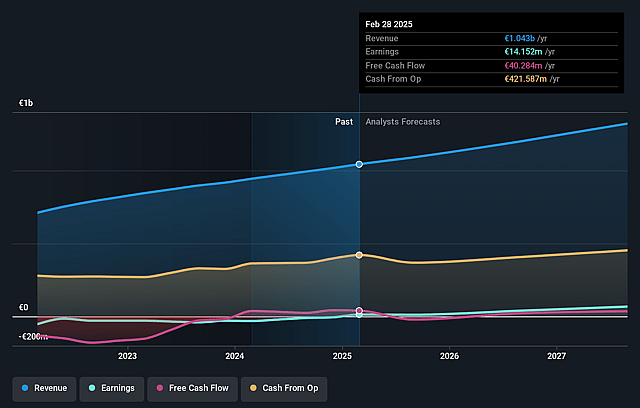

OVH Groupe Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming OVH Groupe's revenue will grow by 10.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.4% today to 7.8% in 3 years time.

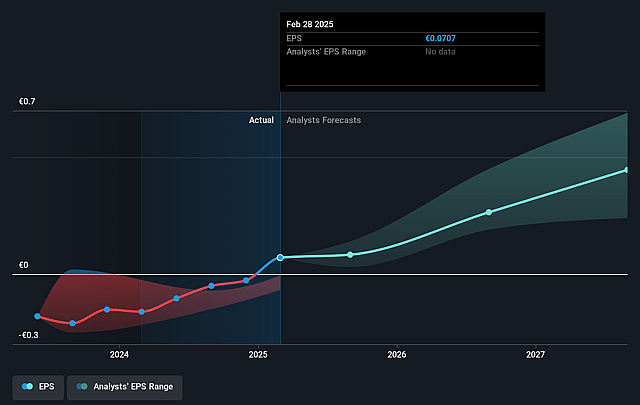

- Analysts expect earnings to reach €110.9 million (and earnings per share of €0.51) by about June 2028, up from €14.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 25.6x on those 2028 earnings, down from 152.4x today. This future PE is greater than the current PE for the FR IT industry at 15.4x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.69%, as per the Simply Wall St company report.

OVH Groupe Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- OVHcloud experienced a solid revenue growth of 10.2% like-for-like, fueled by continued demand for Public Cloud and data sovereignty offers, suggesting that their revenue might remain strong.

- The company achieved an adjusted EBITDA margin of 40%, demonstrating strong operating leverage, which could sustain their profit margins.

- Successful refinancing with a €500 million bond and a €450 million green loan suggests a stable financial position, which may secure long-term earnings.

- OVHcloud continues to strengthen its market position by rolling out new Public Cloud and AI products, potentially leading to increased revenues from these innovative offerings.

- Demand for data sovereignty and strategic autonomy solutions positions OVHcloud well in a shifting geopolitical environment, offering potential for future revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €11.617 for OVH Groupe based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €16.0, and the most bearish reporting a price target of just €6.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €1.4 billion, earnings will come to €110.9 million, and it would be trading on a PE ratio of 25.6x, assuming you use a discount rate of 9.7%.

- Given the current share price of €14.22, the analyst price target of €11.62 is 22.4% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on OVH Groupe?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.