Narratives are currently in beta

Key Takeaways

- Expansion of partnerships and AI solutions are poised to increase market reach and enhance net margins through improved design productivity.

- Growth in cloud platforms and hyperscaler demand indicate strong potential for recurring revenue and earnings increases.

- Geopolitical and regulatory uncertainties, increased competition, and financial risks could negatively affect Cadence’s revenue, profit margins, and market stability.

Catalysts

About Cadence Design Systems- Provides software, hardware, services, and reusable integrated circuit (IC) design blocks worldwide.

- The partnership with NVIDIA and use of their NeMo and NIM microservices for AI-enhanced products could drive future revenue growth as AI innovation continues to accelerate.

- Significant growth in Cadence's AI-driven portfolio and strong adoption of their AI solutions could enhance net margins by improving design productivity and performance for customers.

- Expansion of partnerships with leading players like Arm and TSMC to develop next-generation technologies suggests an increased total addressable market that could boost revenue.

- The Cadence on Cloud platform and OnCloud Marketplace are experiencing substantial customer growth, potentially contributing to a steady increase in recurring revenue and earnings.

- The robust demand and expanding footprint at several marquee hyperscalers with hardware and software portfolios, including growth in their IP business, suggest strong tailwinds for future earnings growth.

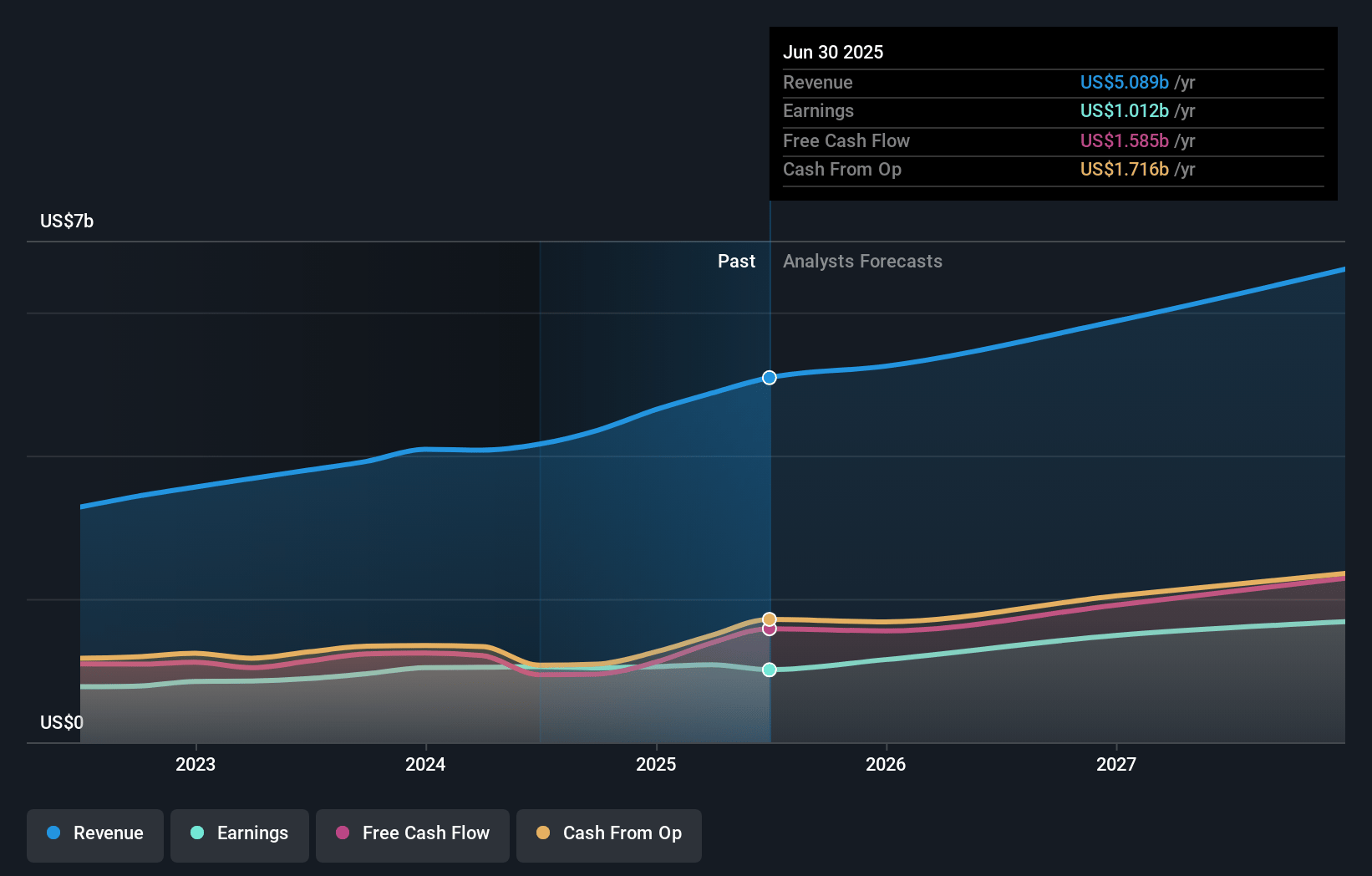

Cadence Design Systems Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Cadence Design Systems's revenue will grow by 14.1% annually over the next 3 years.

- Analysts are assuming Cadence Design Systems's profit margins will remain the same at 23.9% over the next 3 years.

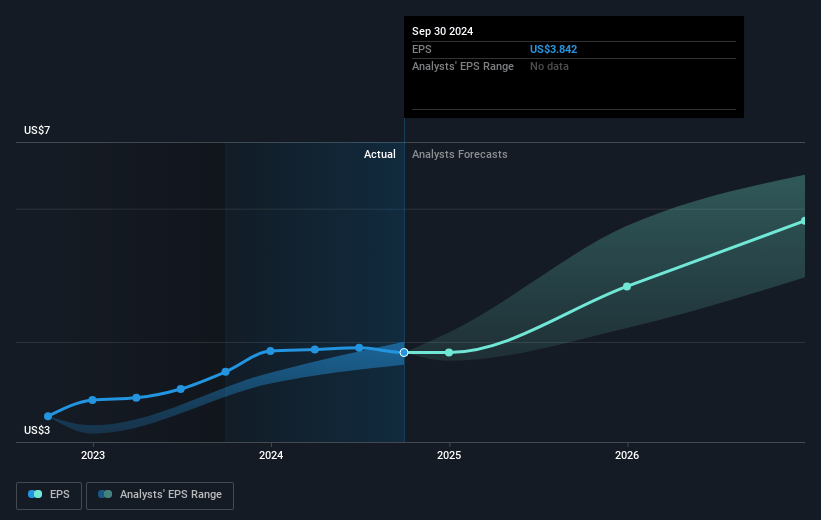

- Analysts expect earnings to reach $1.5 billion (and earnings per share of $6.32) by about January 2028, up from $1.0 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $1.1 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 62.1x on those 2028 earnings, down from 79.6x today. This future PE is greater than the current PE for the US Software industry at 38.4x.

- Analysts expect the number of shares outstanding to decline by 3.75% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.04%, as per the Simply Wall St company report.

Cadence Design Systems Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Geopolitical and regulatory uncertainties, particularly related to China, might impact revenue and growth prospects negatively, given the company's exposure to this market.

- Increased competition in the AI and semiconductor design space might pressure Cadence’s profit margins if it has to lower prices to maintain market share.

- Potential execution risks in successfully expanding partnerships with Intel and Samsung, where Cadence has historically been underrepresented, could affect projected revenue growth.

- Heavy reliance on the cyclical semiconductor and electronics markets could introduce volatility in revenue, impacting financial stability during downturns.

- Rising debt levels, as indicated by significant senior notes offering, could lead to increased financial risk and impact net earnings if economic conditions worsen.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $320.54 for Cadence Design Systems based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $365.0, and the most bearish reporting a price target of just $225.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $6.5 billion, earnings will come to $1.5 billion, and it would be trading on a PE ratio of 62.1x, assuming you use a discount rate of 7.0%.

- Given the current share price of $301.67, the analyst's price target of $320.54 is 5.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives