Last Update 02 Dec 25

Fair value Decreased 5.42%WOOF: Profit-Enhancing Measures Will Drive Improved Margins Amid Competitive Pressure

Analysts have adjusted their price target for Petco Health and Wellness Company downward, from approximately $3.91 to $3.69. They cite competitive pressures and macroeconomic uncertainty as factors affecting the company’s growth outlook and profitability trajectory.

Analyst Commentary

Recent Street research on Petco Health and Wellness Company reflects a nuanced outlook from Wall Street, shaped by the company’s latest quarterly performance and evolving industry conditions.

Bullish Takeaways

- Bullish analysts have raised future earnings estimates, citing upside performance in the most recent quarter.

- There is recognition of incremental EBITDA growth potential as profit-enhancing initiatives begin to take effect.

- Upward adjustments to the price target in some cases signal confidence that operational improvements could eventually support higher valuations.

Bearish Takeaways

- Persistent same-store sales weakness and declining traffic remain concerns that weigh on near-term growth prospects.

- Competitive market pressures and overall economic uncertainty continue to challenge profitability and dampen the company’s revenue outlook.

- Visibility around achieving a sustainable inflection in the topline and further profitability gains is currently limited.

- Longer-term risks include the potential for ongoing market share erosion, creating caution around future execution and valuation.

What's in the News

- Petco Health and Wellness Company plans to close approximately 20 stores during fiscal year 2025 (Key Developments).

- The company has provided earnings outlook for the fourth quarter and full year 2025, projecting fourth quarter net sales to decline by low single digits year over year (Key Developments).

- For the full year 2025, Petco expects its net sales to decrease by 2.5% to 2.8% (Key Developments).

Valuation Changes

- Consensus Analyst Price Target has decreased from approximately $3.91 to $3.69. This reflects a modest reduction in expected fair value.

- Discount Rate has risen slightly, moving from 12.32% to 12.5%. This suggests increased perceived risk.

- Revenue Growth forecast has increased from 0.52% to 0.74%. This indicates a more optimistic view on top-line expansion.

- Net Profit Margin estimate has improved from 0.82% to 1.17%. This reflects anticipated enhancements in operational efficiency.

- Future P/E ratio has declined significantly, from 32.8x to 21.8x. This indicates the stock is now expected to trade at a lower multiple against projected earnings.

Key Takeaways

- Expanding in-store experiences and wellness services aims to drive customer engagement, higher margins, and recurring revenue through premium offerings and service integration.

- Enhanced omnichannel strategy, loyalty programs, and differentiated merchandising seek to boost retention, operational efficiency, and brand exclusivity for long-term profitability.

- Ongoing sales declines, weak e-commerce performance, industry stagnation, rising costs, and high debt together threaten Petco's revenue growth, competitiveness, and financial flexibility.

Catalysts

About Petco Health and Wellness Company- Operates as a health and wellness company, focuses on enhancing the lives of pets, pet parents, and its Petco partners in the United States, Mexico, and Puerto Rico.

- Petco's focus on in-store experiences-including unique events, revamped merchandising, and enhanced customer-facing services-leverages the ongoing shift toward pet humanization and the desire for premium, experiential pet care, which is expected to drive higher customer engagement, increase foot traffic, and support revenue growth as these initiatives scale.

- Investments in personalized loyalty programs and data-driven marketing (including the upcoming relaunch of Vital Care in 2026) are designed to better capture the full customer lifecycle and expand share of wallet, with the potential to boost retention, average basket size, and long-term earnings consistency.

- Ongoing expansion and integration of high-margin pet wellness services (grooming, veterinary, pharmacy) within stores improves customer stickiness and creates recurring, higher-margin revenue streams, supporting net margin expansion and stronger bottom-line performance.

- Accelerated efforts to modernize and optimize the omnichannel experience-with new leadership, technology upgrades, and focus on seamless cross-channel execution-position Petco to participate in the continued migration to e-commerce and harness operational efficiencies, which should drive incremental revenue and profitability as digital rebounds.

- Company-wide focus on merchandising differentiation, faster product refreshes, and the introduction of owned brands and new pet-related categories aims to capitalize on long-term demand for innovation in pet products and nutrition, which can support both revenue growth and higher gross margins through enhanced exclusivity and reduced reliance on third-party brands.

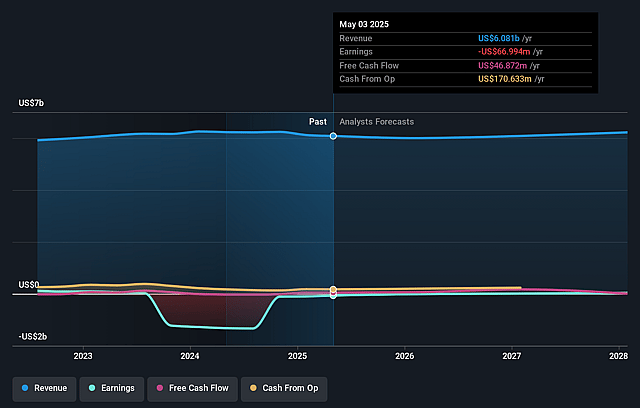

Petco Health and Wellness Company Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Petco Health and Wellness Company's revenue will decrease by 0.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from -0.5% today to 0.8% in 3 years time.

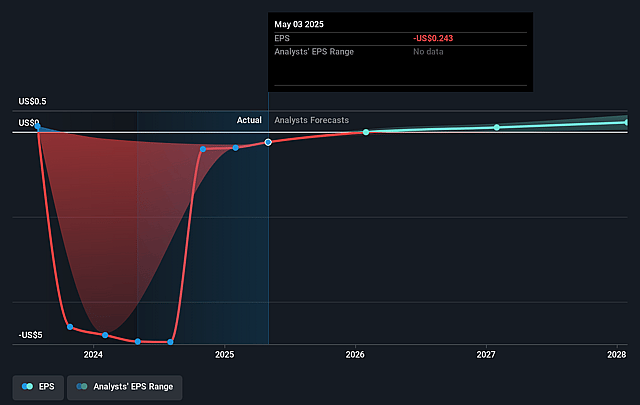

- Analysts expect earnings to reach $50.2 million (and earnings per share of $0.33) by about September 2028, up from $-28.2 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $78.0 million in earnings, and the most bearish expecting $-5 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 32.8x on those 2028 earnings, up from -32.9x today. This future PE is greater than the current PE for the US Specialty Retail industry at 19.2x.

- Analysts expect the number of shares outstanding to grow by 2.15% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.32%, as per the Simply Wall St company report.

Petco Health and Wellness Company Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Net sales continue to decline (down 2.3% year-over-year with comparable sales down 1.4%), largely attributed to intentional moves away from unprofitable sales and store closures; while margins have improved, sustained top-line contraction puts long-term revenue growth at risk.

- The company's current turnaround is heavily dependent on in-store operations and events, but they acknowledged ongoing underperformance in e-commerce and are only in early stages of omnichannel improvements; this lag leaves Petco vulnerable to continued share loss to digital-native competitors like Chewy and Amazon, negatively impacting revenue and customer retention.

- Tariff impacts were minimal in the first half but are expected to become significant in the back half of the year, with the most meaningful headwinds in Q4; this could compress gross margins and limit the ability to reinvest, affecting profitability and earnings.

- The pet industry overall is described as relatively flat right now, with no meaningful growth in the number of pet-owning families; this stagnation in the core market, coupled with increasing competition and consumer price sensitivity, threatens Petco's addressable market and future sales growth.

- High leverage from past expansion (including significant net interest expense guidance and restrained capital expenditures) reduces financial flexibility, making it harder for Petco to weather economic volatility or invest sufficiently in innovation and growth, with direct implications for earnings and long-term viability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $3.905 for Petco Health and Wellness Company based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $5.14, and the most bearish reporting a price target of just $2.72.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $6.1 billion, earnings will come to $50.2 million, and it would be trading on a PE ratio of 32.8x, assuming you use a discount rate of 12.3%.

- Given the current share price of $3.31, the analyst price target of $3.91 is 15.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Petco Health and Wellness Company?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.