Key Takeaways

- Weakness in digital capabilities and sustained sales declines expose risks from e-commerce competitors and shifting consumer preferences toward omni-channel convenience.

- Rising costs, debt pressures, and capital-heavy initiatives could erode margins and limit financial flexibility if investments fail to attract or retain customers.

- Strategic cost controls, enhanced customer engagement, and growth in high-margin services and private labels position Petco for sustainable earnings amid evolving retail dynamics.

Catalysts

About Petco Health and Wellness Company- Operates as a health and wellness company, focuses on enhancing the lives of pets, pet parents, and its Petco partners in the United States, Mexico, and Puerto Rico.

- Despite some improvement in profitability, Petco continues to experience declining net sales and negative comparable sales growth, with management guiding for overall net sales to be down low single digits for the year. In an environment where e-commerce continues to capture market share from brick-and-mortar retail, foot traffic may remain under sustained pressure, limiting future revenue growth prospects.

- The intentional pullback and ongoing retooling of the e-commerce channel signals ongoing operational weakness in Petco's ability to compete with digital-first competitors like Chewy and Amazon. If Petco fails to catch up in digital convenience or fulfillment speed, it risks persistent erosion of online revenue and margin compression due to higher costs and lost conversion opportunities.

- Management's plan to reinvest in stores and brand experience relies heavily on driving in-store traffic through events and new merchandising initiatives. As consumers become increasingly price-sensitive and prefer omni-channel options, these efforts may fail to reverse declining transaction volumes, resulting in stagnant or shrinking revenues and lower customer lifetime value.

- Petco faces escalating input costs from tariffs, which are expected to become much more meaningful in the back half of the year and could materially reduce gross margins. Management's mitigation by adjusting pricing and inventory carries risk in a highly price-competitive sector, potentially leading to further margin compression or loss of market share as mass retailers and online players undercut on price.

- The company's capital-intensive expansion into veterinary clinics and store experience overhauls, combined with an elevated debt load and ongoing store closures, constrain financial flexibility. Should the return on these investments fall short in the face of slowing pet ownership rates and increased competitive fragmentation, pressure on net earnings and returns on invested capital is likely to intensify over the long term.

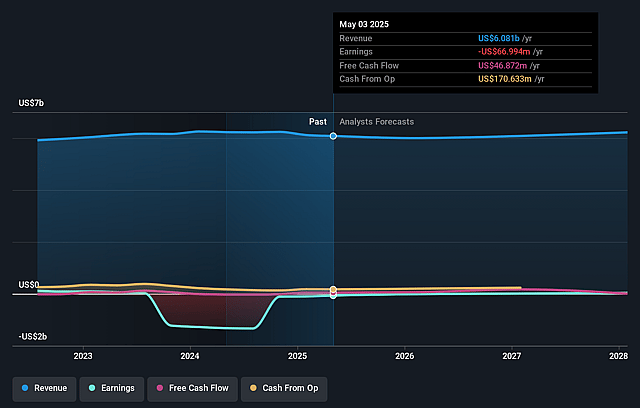

Petco Health and Wellness Company Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Petco Health and Wellness Company compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Petco Health and Wellness Company's revenue will decrease by 0.1% annually over the next 3 years.

- The bearish analysts are not forecasting that Petco Health and Wellness Company will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Petco Health and Wellness Company's profit margin will increase from -0.5% to the average US Specialty Retail industry of 4.7% in 3 years.

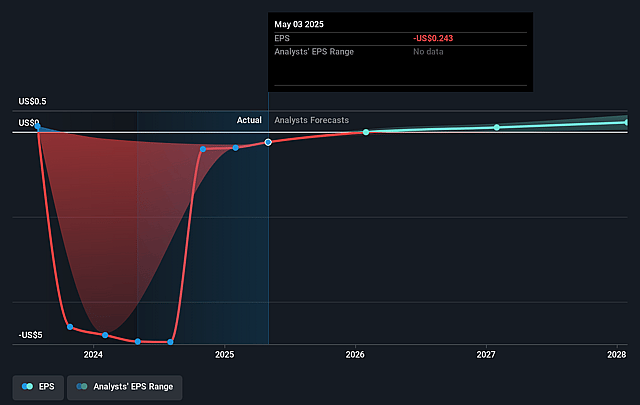

- If Petco Health and Wellness Company's profit margin were to converge on the industry average, you could expect earnings to reach $285.8 million (and earnings per share of $0.96) by about September 2028, up from $-28.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 4.0x on those 2028 earnings, up from -36.5x today. This future PE is lower than the current PE for the US Specialty Retail industry at 18.8x.

- Analysts expect the number of shares outstanding to grow by 2.15% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.32%, as per the Simply Wall St company report.

Petco Health and Wellness Company Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Petco's significant progress in gross margin expansion, disciplined expense management, and recent improvement in operating profit demonstrate that strategic initiatives are already positively impacting net margins and earnings-even in a challenging sales environment.

- The company is seeing positive early results from customer engagement initiatives, such as in-store events and revamped marketing campaigns, resulting in increased net promoter scores and improved customer sentiment, which could support a future rebound in transaction volume and revenue.

- Ongoing investment and successful execution in differentiated services, particularly scaling in veterinary clinics, pharmacy, and grooming, position Petco to capitalize on higher-margin service revenue and recurring customer purchases, which can underpin sustainable long-term earnings growth.

- Store performance trends are already showing sequential improvements in key metrics such as sales per square foot and inventory turn, while a methodical approach to merchandise overhaul and private label expansion offers runway for further margin expansion and revenue resiliency.

- The company's enhanced focus on an omnichannel strategy, including improvements in the e-commerce experience and integrated loyalty program relaunch in 2026, could better position Petco to capture greater customer lifetime value, stabilize revenue streams, and drive future growth even as consumer shopping patterns evolve.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Petco Health and Wellness Company is $2.72, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Petco Health and Wellness Company's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $5.14, and the most bearish reporting a price target of just $2.72.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $6.0 billion, earnings will come to $285.8 million, and it would be trading on a PE ratio of 4.0x, assuming you use a discount rate of 12.3%.

- Given the current share price of $3.67, the bearish analyst price target of $2.72 is 34.9% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.