Last Update 09 Jan 26

SMHN: AI Exposure And Order Inflection Will Shape Balanced Future Prospects

Our analyst price target for SUSS MicroTec is maintained, but the narrative tilts slightly more constructive as analysts highlight higher Street price targets in the €36 to €42 range, supported by improving artificial intelligence exposure, expectations for an order inflection and what they see as an undemanding valuation, even as one house turns more cautious with a €22 target.

Analyst Commentary

Recent Street research on SUSS MicroTec shows a mix of optimism and caution, with several upgrades and higher price targets set against one clear downgrade and a reduced target from another house. Here is how that split looks when you focus on growth expectations, execution risks and valuation.

Bullish Takeaways

- Bullish analysts highlight the company’s artificial intelligence exposure as a key growth driver, seeing this as an area that could support stronger demand over time.

- Some expect an order inflection, arguing that current consensus already reflects weakness in orders and backlog, especially looking out to fiscal 2026.

- Price targets in the €36 to €42 range are framed as consistent with what bullish analysts see as a low valuation relative to the company’s potential earnings power.

- Even where targets have been reduced, these analysts maintain positive ratings. This suggests they still see room for upside if execution on orders and AI related opportunities goes to plan.

Bearish Takeaways

- Bearish analysts point to execution risk around the order book, with at least one taking a more cautious stance and moving to a Sell rating despite the broader positive commentary.

- The €22 price target from the cautious camp implies concern that the current share price already discounts much of the upside that more optimistic analysts are expecting.

- Target cuts such as the move from €50 to €37 and from €41 to €36 signal that some on the Street see less headroom than before for valuation expansion, even if they are not outright negative.

- Overall, the split in ratings underlines that investors need to weigh the AI and order inflection story against the risk that orders, backlog and earnings may not track the more optimistic scenarios.

What's in the News

- SUSS MicroTec set new 2030 ambitions, with sales targeted in a range of €750 million to €900 million and an EBIT margin goal of 20 to 22%, based on 2025 guidance as the reference point (Corporate guidance).

- The company outlined an average annual sales growth ambition of 9 to 13% between 2025 and 2030, referencing experts’ expectations of around 7% annual growth in the semiconductor industry as a backdrop (Corporate guidance).

- Management adjusted 2025 guidance, keeping the consolidated sales range at €470 million to €510 million while indicating a gross profit margin range of 35 to 37% and an EBIT margin range of 11 to 13% (Corporate guidance).

- SUSS MicroTec opened a new production site in Zhubei, Taiwan, with capacity to double cleanroom space to 6,300 square meters and consolidate more than 400 employees into a single 18,000 square meter facility, following an investment of around €15 million (Business expansion).

- The Zhubei site is positioned as the largest international infrastructure project in the company’s history, with the first tools from this facility scheduled for delivery in early 2026 (Business expansion).

Valuation Changes

- Fair Value: Our fair value estimate remains unchanged at €47.16, with no adjustment in the latest update.

- Discount Rate: The discount rate is effectively stable, moving only marginally from 8.39% to 8.39% in the updated model.

- Revenue Growth: The long term revenue growth input is unchanged in practical terms, holding at around 113.68% in both the previous and updated assumptions, which is a very large rate and should be treated with care by investors.

- Net Profit Margin: The net profit margin assumption remains steady at about 12.72%, with no meaningful shift between the old and new figures.

- Future P/E: The future P/E multiple used in the model is unchanged in practical terms, staying at roughly 16.21x between the previous and updated settings.

Key Takeaways

- Expansion in products, technology, and regional manufacturing strengthens SUSS MicroTec's market position, supports innovation, and mitigates customer concentration risk.

- Strong industry demand and diversified customer base underpin recurring revenue, stable margins, and future growth despite temporary fluctuations in order intake.

- Declining order intake, weak China demand, margin compression, and heavy use of temporary labor signal heightened risks to revenue, profitability, and operational stability amid ongoing market uncertainty.

Catalysts

About SUSS MicroTec- Develops, manufactures, markets, and maintains systems to produce microelectronics, microelectromechanical systems, and related applications.

- Upcoming launches of next-generation tools (e.g., MaskTrack Smart for mid-end markets and new UV projection scanners) are expected to expand SUSS MicroTec's addressable market, particularly as demand for AI chips, IoT devices, and advanced packaging solutions accelerates worldwide. This can drive revenue growth and support premium pricing, especially as customers express preorder interest before official product release.

- Expansion in Taiwan with a new production site increases local manufacturing capacity and positions SUSS MicroTec favorably to benefit from the ongoing regionalization and reshoring of semiconductor supply chains in Asia and the US. This reduces customer concentration risk, increases throughput, and supports future sales, positively impacting revenue visibility and margin stability.

- SUSS MicroTec's strategic focus on R&D and heterogeneous integration (such as wafer and hybrid bonding) aligns with the semiconductor industry's move toward miniaturization and 3D integration, supporting long-term innovation cycles in automotive, AI, and consumer electronics. This drives recurring equipment orders and aftermarket maintenance revenues, underpinning future revenue and margin expansion.

- The transition to energy-efficient technologies and power semiconductors (driven by electrification trends like EVs and renewables) sustains robust demand for advanced backend lithography, coating, and packaging equipment. SUSS MicroTec's strong position with process-of-record tools in these niches can boost order intake and improve earnings quality over the longer term.

- Despite a temporary decline in order intake (notably from China), SUSS MicroTec retains a solid backlog, diversified regional customer base, and strong balance sheet with improving operational performance. As macro uncertainty recedes and postponed capex spending returns, accelerated customer investment for digitalization and edge applications is likely to enhance revenue momentum and support a rebound in profitability and free cash flow.

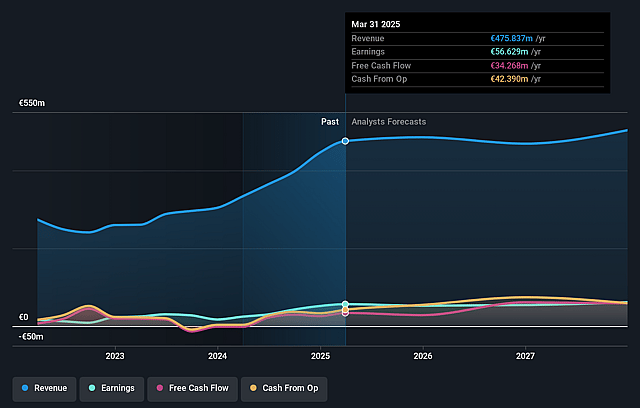

SUSS MicroTec Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming SUSS MicroTec's revenue will grow by 1.2% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 11.6% today to 9.4% in 3 years time.

- Analysts expect earnings to reach €50.7 million (and earnings per share of €2.88) by about September 2028, down from €60.2 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €67.2 million in earnings, and the most bearish expecting €39.5 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.3x on those 2028 earnings, up from 7.7x today. This future PE is greater than the current PE for the GB Semiconductor industry at 19.5x.

- Analysts expect the number of shares outstanding to grow by 0.67% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.16%, as per the Simply Wall St company report.

SUSS MicroTec Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Significant year-on-year decline in order intake (-13.2%) and a low book-to-bill ratio (0.48), combined with saturation in the AI and HBM-related markets, indicate reduced forward revenue visibility and could pressure sales and earnings in late 2025 and into 2026.

- Weak demand from China, especially in Photomask Solutions with no orders from Chinese customers for new tools in Q2, and a sharp drop in advance customer payments, increases regional concentration risks and may result in unpredictable revenue streams and cash flow volatility.

- Decreasing gross profit margins-down to 36.5% in Q2 and requiring downward revision of full-year guidance-highlight ongoing margin compression from ramp-up costs, inventory write-offs, and unfavorable product/customer mix, which could negatively affect profitability and net margins if these trends persist.

- Heavy reliance on temporary and contract labor to manage operational flexibility may reduce costs short-term but introduces execution and continuity risks if volumes shift or demand recovers unevenly, potentially increasing OpEx or affecting order fulfillment and thereby impacting margins.

- Market uncertainty due to trade tariffs, delayed customer capex, and lack of visibility into 2026 order pipelines combine with continued high R&D and strategic CapEx outlays (e.g., Taiwan expansion), posing risks of underutilization, earnings volatility, and downward pressure on cash flow and return on invested capital if order momentum does not return.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €44.912 for SUSS MicroTec based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €60.0, and the most bearish reporting a price target of just €30.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €538.6 million, earnings will come to €50.7 million, and it would be trading on a PE ratio of 21.3x, assuming you use a discount rate of 8.2%.

- Given the current share price of €24.2, the analyst price target of €44.91 is 46.1% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on SUSS MicroTec?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.