Last Update 22 Jan 26

ROIV: 2026 Trial Readouts And IP Litigation Are Expected To Drive Upside

Narrative Update: Roivant Sciences (ROIV)

Analysts have modestly raised their average price target on Roivant Sciences to about $27, citing updated assumptions around batoclimab trial timelines into 2026 and Roivant's role in ongoing Moderna IP litigation as key factors behind the revised outlook.

Analyst Commentary

Recent research points to a mixed but generally constructive view on Roivant Sciences, with attention on batoclimab timing and the evolving relationship with Moderna as key inputs into valuation and execution risk.

Bullish Takeaways

- Bullish analysts are lifting their price targets into the low to high $20s, which signals confidence that Roivant’s current pipeline and asset mix can support higher equity value if execution goes as planned.

- The decision to present data from both Phase 3 thyroid eye disease trials of batoclimab in 2026 is seen as a way to deliver a more complete data set at once, which some investors may prefer when assessing long term commercial potential.

- Roivant’s upcoming investor day in December is viewed as a chance to outline a clearer catalyst path for 2026, giving investors more visibility on how pipeline milestones could tie into future valuation scenarios.

- Moderna’s new 5 year term loan facility of up to US$1.5b, with an initial US$600m draw and higher FY25 cash guidance, is framed by bullish analysts as reinforcing Moderna’s ability to be a solvent counterparty in the ongoing IP litigation with Roivant. This is seen as helping reduce perceived collection risk around any potential royalty award or settlement.

Bearish Takeaways

- Some cautious analysts point out that pushing topline readouts for the two Phase 3 batoclimab trials from 2H25 into 1H26 extends the period of clinical and regulatory uncertainty, which can weigh on near term sentiment and delay clarity on commercial prospects.

- The reliance on a single high profile asset like batoclimab for major upcoming catalysts increases execution risk, since any trial or regulatory setbacks could have an outsized impact on growth expectations and valuation.

- The ongoing IP litigation with Moderna, while potentially favorable to Roivant, also introduces legal and timing uncertainty, which can complicate scenario analysis around future cash flows and royalty structures.

- Even with raised targets, some bearish analysts remain cautious on how quickly Roivant can convert its clinical and legal milestones into durable earnings power. This can limit how much multiple expansion they are willing to ascribe in their models.

What's in the News

- Roivant outlined updated timelines for brepocitinib, with an NDA filing in dermatomyositis expected in early calendar year 2026 and commercial launch preparations targeting early calendar year 2027 (Key Developments).

- The brepocitinib Phase 3 trial in non infectious uveitis is fully enrolled, with topline data expected in the second half of calendar year 2026 and commercial launch preparations targeting early fiscal year 2027 (Key Developments).

- Enrollment in the Phase 2 trial of mosliciguat in pulmonary hypertension associated with interstitial lung disease remains on track, and Pulmovant plans to report topline data in the second half of calendar year 2026 (Key Developments).

- Pulmovant expects to initiate a Phase 2 study of mosliciguat in combination with inhaled treprostinil in patients with pulmonary hypertension associated with interstitial lung disease, with a planned sample size of 20 patients (Key Developments).

- In the Genevant and Moderna US litigation, a jury trial has been scheduled for March 2026, with additional hearings and rulings in ex US Moderna litigation and Pfizer/BioNTech litigation expected in calendar year 2026 (Key Developments).

Valuation Changes

- Fair Value: The model fair value estimate is unchanged at US$27.0 per share.

- Discount Rate: The discount rate has risen slightly from 7.42% to 7.46%, which implies a modestly higher required return in the updated model.

- Revenue Growth: The revenue growth assumption is very large in both cases and edges higher in the update, from 325.34% to 328.79%.

- Net Profit Margin: The net profit margin input eases from 3.46% to 3.38%, which reflects a slightly more conservative profitability assumption.

- Future P/E: The future P/E multiple remains very elevated, with a small move from 398.20x to 398.66x in the revised model.

Key Takeaways

- Successful clinical trials and strategic deals may improve revenue and net margins by focusing on high-value areas.

- Potential in-licensing and late-stage pipeline approvals could significantly enhance earnings and portfolio sales impact.

- Execution risks and competitive pressures could delay Roivant's earnings growth and profitability amidst high R&D costs and legal uncertainties.

Catalysts

About Roivant Sciences- A commercial-stage biopharmaceutical company, engages in the development and commercialization of medicines for inflammation and immunology areas.

- Roivant Sciences is focused on clinical trial execution with multiple ongoing trials, including late-stage programs like brepocitinib and batoclimab, which are expected to generate significant data readouts in the near future. Successful trial outcomes may positively impact future revenue streams.

- The company has completed the Dermavant deal, potentially allowing a greater focus on clinical execution and the upside of VTAMA. This could improve net margins by refocusing capital and operational efforts on higher-value areas.

- Roivant's late-stage pipeline, with potential approvals expected in the next couple of years, could lead to a projected $10 billion+ peak sales portfolio, significantly impacting earnings as these therapies are commercialized.

- Business development activities with negotiations for potential in-licensing of new programs are ongoing, representing opportunities for revenue growth through the expansion of their development-stage clinical pipeline.

- Roivant's commitment to returning capital to shareholders, including significant stock repurchases, is a catalyst for EPS growth, reflecting a potential undervaluation of current share prices if business fundamentals improve.

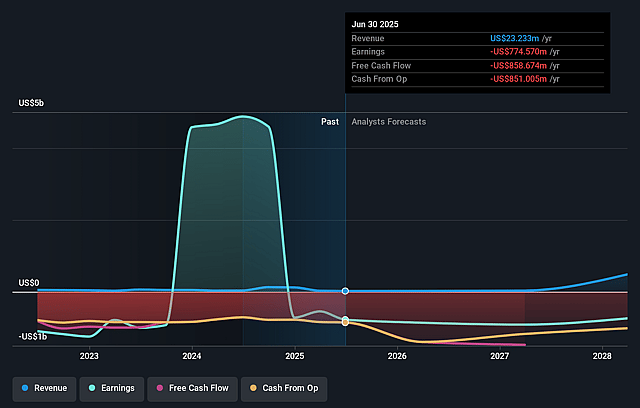

Roivant Sciences Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Roivant Sciences's revenue will grow by 59.2% annually over the next 3 years.

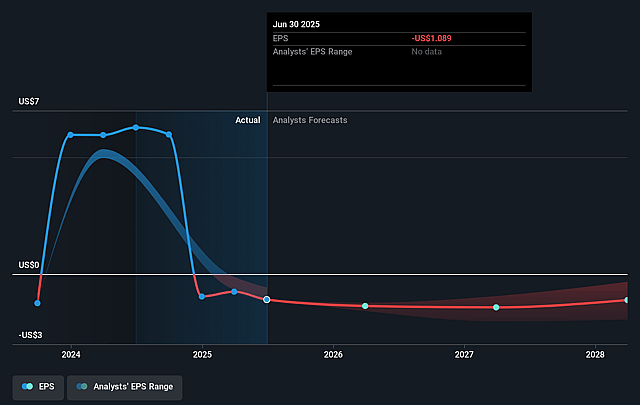

- Analysts are not forecasting that Roivant Sciences will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Roivant Sciences's profit margin will increase from 3558.5% to the average US Biotechs industry of 16.1% in 3 years.

- If Roivant Sciences's profit margin were to converge on the industry average, you could exepct earnigns to reach $83.8 million (and earnings per share of $0.16) by about January 2028, down from $4.6 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 126.9x on those 2028 earnings, up from 1.8x today. This future PE is greater than the current PE for the US Biotechs industry at 17.5x.

- Analysts expect the number of shares outstanding to decline by 9.45% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.85%, as per the Simply Wall St company report.

Roivant Sciences Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Roivant Sciences faces execution risks in clinical trial management across multiple ongoing trials, which could negatively affect their revenue and delay potential earnings growth.

- The competitive landscape, especially from well-established treatments like Humira, may limit Roivant's ability to capture market share quickly, impacting their expected revenue and potential profitability.

- There are legal uncertainties with ongoing LNP litigation, which could result in financial liabilities or distract management, thereby affecting net margins.

- Given the early development stage of many of Roivant’s drugs, there is a risk of clinical trial failures or delays, potentially impacting potential future revenues and profitability.

- The projected high R&D expenses and ongoing share repurchase program could strain Roivant’s financial resources, potentially impacting their cash flow and net income.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $16.14 for Roivant Sciences based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $18.0, and the most bearish reporting a price target of just $13.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $520.7 million, earnings will come to $83.8 million, and it would be trading on a PE ratio of 126.9x, assuming you use a discount rate of 6.8%.

- Given the current share price of $11.15, the analyst's price target of $16.14 is 30.9% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Roivant Sciences?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.